EV Battery Market Size, Share, Trends, Industry Analysis Report

By Battery (Lead-Acid, Lithium-Ion, Nickel-Metal Hydride, Sodium-Ion, Solid-State); By Propulsion; By Vehicle; By Method; By Capacity; By Form; By Material; By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM1623

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

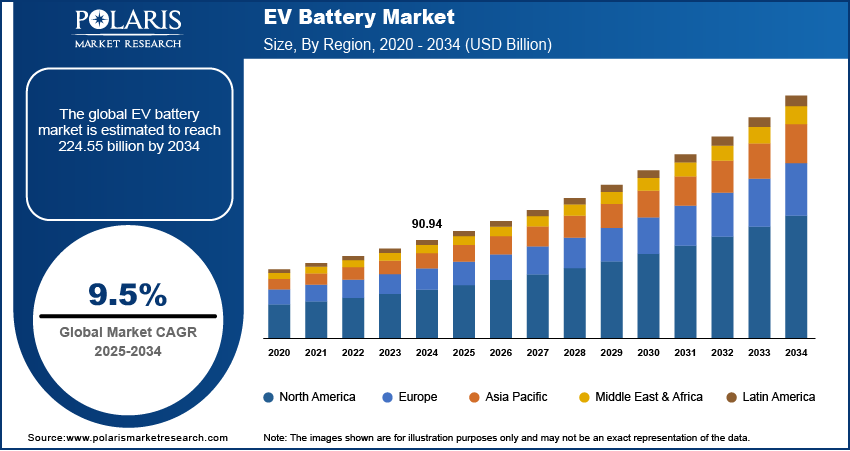

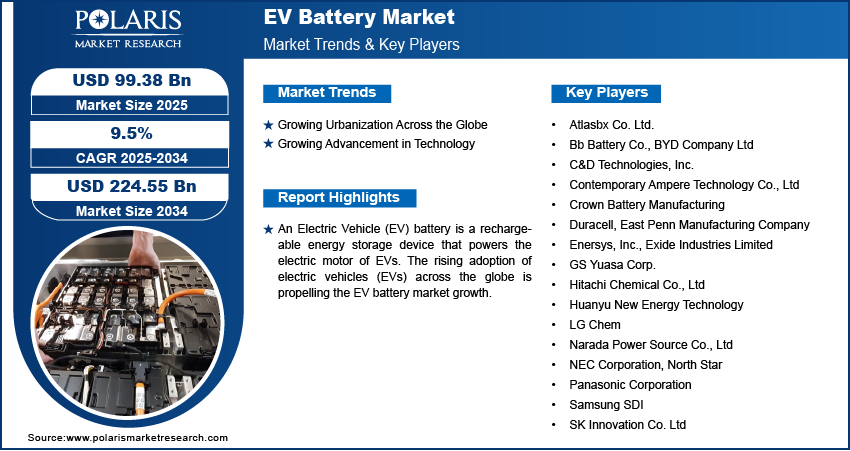

The global electric vehicles (EV) battery market size was USD 90.94 billion in 2024. The market is expected to record a CAGR of 9.5% from 2025 to 2034. The increasing adoption of electric vehicles worldwide is driving the EV battery market growth. The ongoing development of charging infrastructure in various countries would further continue to drive EV battery demand in the near future.

Key Insights

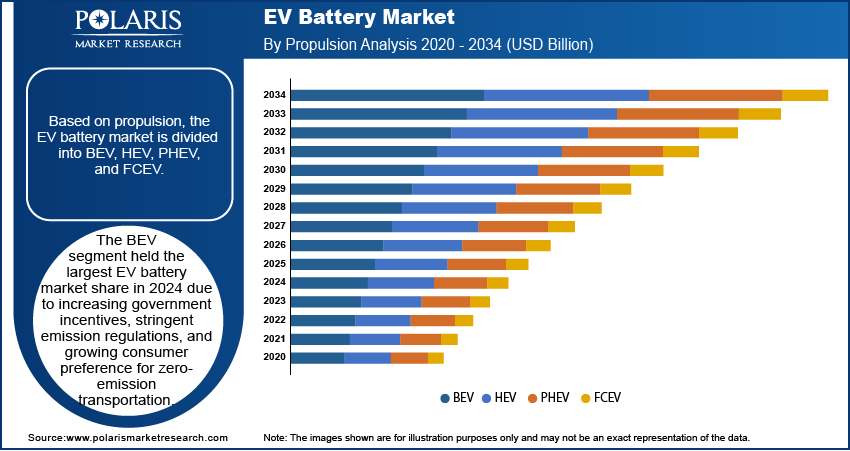

- Based on propulsion, the BEV segment dominated the EV battery market share in 2024. The dominance of this segment is attributed to burgeoning government incentives, stringent emission regulations, and a surging consumer inclination toward zero-emission commute.

- In terms of material, the natural graphite segment is expected to record significant growth in the coming years. Natural graphite is used as an essential component in anode production due to its excellent conductivity and stability, as well as its ability to enhance battery performance.

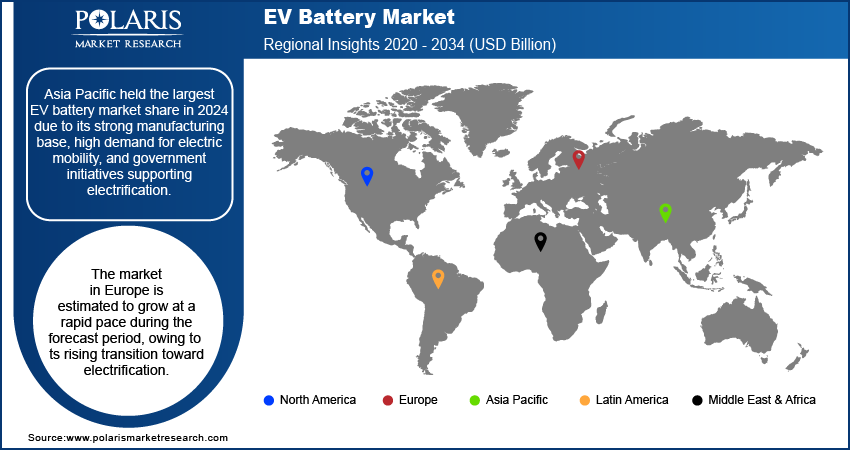

- In 2024, Asia Pacific dominated the market revenue share driven by strong manufacturing bases, high electric mobility demands, and government initiatives supporting electrification.

- The Europe EV battery industry is expected to register the highest CAGR from 2025 to 2034. The growth in the region can be associated with the continuous transition of prominent countries in this region toward electrification in response to stringent carbon reduction targets.

Industry Dynamics

- An upsurge in the number of on-road electric cars is a prime enabler of EV battery demand. As per the International Energy Agency data, nearly 14 million new electric cars were registered globally in 2023, bringing the total number of on-road EVs to 40 million.

- Initiatives taken by governments and regulatory bodies to promote EV adoption through incentives and stricter emission standards encourage the development and production of EV batteries.

- Heavy investments by EV automakers in battery technology to improve range, reduce charging times, and lower costs serve as growth opportunities in the EV battery market.

- Ongoing developments and upgrades in charging infrastructure are expected to generate significant growth opportunities during the forecast period. A robust charging infrastructure has the potential to address the concern of range anxiety, one of the primary concerns of EV users. Fast-charging stations and electric road systems, which mark further advancements in charging technologies, offer quicker and more convenient charging facilities.

- High costs of battery development and manufacturing, and disposal pose a major hindrance to the EV battery market growth.

Market Statistics

2024 Market Size: USD 90.94 billion

2034 Projected Market Size: USD 224.55 billion

CAGR (2025–2034): 9.5%

Asia Pacific: Largest market in 2024

AI Impact on EV Battery Market

- Artificial intelligence (AI) has shortened R&D timelines in various industries, including the EV industry. Searching for attractive battery materials has been a slow and expensive process for long, associated with uncertain outcomes, as scientists relied on trial-and-error work models, testing each material individually. AI and machine learning models, capable of analyzing numerous potential materials in mere days, have allowed companies to identify revolutionary battery components in a duration five times less than the manual processes.

- The technology is expected to make EV manufacturing and assembly processes more foolproof as AI-driven algorithms can detect battery defects with 99% accuracy, improving quality control in manufacturing.

- It can improve vehicle range efficiency by 10–20% through smart energy management and optimization, thereby maximizing battery utilization.

- AI-powered automation plays a crucial role in enhancing the eco-friendliness of EVs by improving material recovery rates in battery recycling processes by 90%, thereby reducing waste and resource dependency. AI can also support fast charging, minimize battery replacement rates, and reduce fire risks through effective anomaly detection in battery packs, among others.

To Understand More About this Research: Request a Free Sample Report

An electric vehicle (EV) battery is a rechargeable energy storage device that powers the electric motor of EVs. It replaces internal combustion engines by converting chemical energy into electrical energy to propel vehicles and operate onboard systems. EV batteries consist of multiple electrochemical cells with electrodes (anode and cathode) and an electrolyte facilitating ion exchange. These batteries vary in size and capacity, directly influencing the vehicle's range, charging time, and cost. EV batteries power diverse vehicles, including cars, buses, trucks, motorcycles, and scooters.

The rising adoption of electric vehicles (EVs) across the globe is propelling the EV battery market growth. International Energy Agency published a data stating that almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. EV batteries are the primary component of EVs as they store and supply the energy required to propel these vehicles. EV automakers are investing heavily in battery technology to improve range, reduce charging times, and lower costs, further driving the demand for advanced battery solutions. Governments and regulatory bodies are also promoting EV adoption through incentives and stricter emission standards, which encourage the development and production of EV batteries. Therefore, the demand for EV batteries is rising with the growing adoption of electric vehicles.

The EV battery market demand is driven by the increasing development of charging infrastructure. Charging infrastructure addresses one of the primary concerns of EV owners, which is range anxiety. This reassurance encourages more people to adopt electric vehicles, driving up the need for EV batteries to power these vehicles. Furthermore, the advancement of charging technologies, such as fast-charging stations and electric road systems (ERS), allows for quicker and more convenient charging options. These innovations make EVs more practical for long-distance travel and daily use, further increasing the overall demand for EV batteries. As per the data published by the International Energy Agency, at the end of 2022, there were 2.7 million public charging points worldwide, more than 900,000 of which were installed in 2022, about a 55% increase from 2021. Hence, as the development of charging infrastructure increases, the demand for EV batterie also spurs.

Market Dynamics

Growing Urbanization Across the Globe

Urban people prefer EVs over ICE vehicles due to their shorter driving distances and denser populations, which drives demand for EV batteries. Urbanization often comes with infrastructure developments that support EV charging networks, further encouraging EV use and battery demand. Governments and policymakers in urban areas also tend to implement stricter emission standards and incentives for EV adoption, which fuels the EV battery market growth. Moreover, the concentration of people and services in urban areas creates a robust market for EVs, as residents seek to reduce their carbon footprint and contribute to cleaner, more sustainable cities. This urban dynamic boosts the immediate need for EV batteries and drives innovation in battery technology to meet the specific requirements of urban transportation. United Nations published a report stating that, the total urban population is estimated to double by 2050. Thus, increasing urbanization across the world propels the EV battery market demand.

Growing Advancement in Technology

Innovations in battery chemistry, such as the development of solid-state batteries or improvements in lithium-ion technology, increase energy density, allowing EVs to travel longer distances on a single charge. This drives demand for electric vehicles and their components such as electric battery among consumers who prioritize range and convenience. Additionally, advancements in manufacturing processes reduce production costs, making EVs and their batteries more accessible to a broader market. Smart battery management systems and faster charging technologies further propel the demand for advanced EV batteries among automakers to improve user experience, addressing concerns about charging times and battery longevity. Thus, growing advancements in technology boost the EV battery market development.

Market Assessment by Segment

Market Evaluation by Propulsion

Based on propulsion, the EV battery market is divided into BEV, HEV, PHEV, and FCEV. The BEV segment held the largest EV battery market share in 2024 due to increasing government incentives, stricter emission regulations, and growing consumer preference for zero-emission transportation. Companies expanded their BEV offerings as advancements in lithium-ion technology improved energy density, reduced costs, and extended driving ranges. The rapid expansion of charging infrastructure worldwide further strengthened BEV adoption, addressing range anxiety concerns and making these vehicles more practical for everyday use. Major manufacturers, including Tesla, BYD, and Volkswagen, prioritized BEV development, pushing the dominance of the segment.

Market Outlook by Material

In terms of material, the EV battery market is segregated into lithium, cobalt, manganese, and natural graphite. The natural graphite segment is expected to grow at a robust pace in the coming years, owing to its essential function in anode production. Manufacturers favor graphite owing to its excellent conductivity, stability, and ability to enhance battery performance. The shift toward synthetic alternatives remains limited due to higher production costs, making natural graphite the preferred choice for large-scale applications. Expanding mining operations and advancements in anode technology further strengthen graphite’s position in the market, ensuring continued growth in the evolving EV battery market demand.

Regional Analysis

By region, the report provides EV battery market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest EV battery market revenue share in 2024 due to its strong manufacturing base, high demand for electric mobility, and government initiatives supporting electrification. China dominated the regional market, leading global production and consumption, driven by its advanced supply chain, vast raw material reserves, and aggressive policies promoting sustainable transportation. Major manufacturers, including CATL, BYD, and LG Energy Solution, expanded production capacity in the region to meet the growing demand, while extensive investments in research and development pushed technological advancements. Subsidies, tax incentives, and stringent emission regulations encouraged faster adoption of electric vehicles, contributing to the dominance of Asia Pacific EV battery market. Countries such as Japan and South Korea also contributed significantly by innovating in battery chemistry and energy storage solutions, further strengthening the region’s dominance.

The Europe EV battery market is estimated to grow at a rapid pace during the forecast period, owing to its transition toward electrification. The European Union enforces strict carbon reduction targets, pushing automakers to scale up electric vehicle production and invest in localized supply chains, which propels demand for EV batteries. Germany is projected to lead the region with its strong automotive industry, housing major companies such as Volkswagen, BMW, and Mercedes-Benz, all heavily investing in battery technology. Gigafactories continue to emerge across the region, reducing dependency on Asian imports and ensuring a stable supply of advanced EV battery solutions. Government funding and strategic partnerships drive innovation, while a growing network of charging infrastructure enhances consumer confidence toward EVs and its component including EV battery. Europe is set to become a key region in the market expansion, with increasing consumer preference for sustainable mobility and ambitious climate policies.

Key Players & Competitive Analysis Report

The EV battery market is highly competitive, driven by continuous advancements in battery chemistry, manufacturing efficiency, and energy density improvements. Key players are investing heavily in research and development to enhance battery performance, lifespan, and charging speed while reducing costs to maintain a competitive edge. Solid-state battery technology, improved lithium-ion formulations, and recycling innovations are emerging as major focus areas. The market is also witnessing strategic partnerships between automakers and battery manufacturers to secure long-term supply agreements and drive economies of scale. Additionally, government incentives, stringent emission regulations, and the rising demand for sustainable energy solutions are further intensifying competition. Companies are expanding production capacities and establishing gigafactories to meet the growing demand for electric vehicles worldwide. Supply chain security, especially for critical raw materials such as lithium, cobalt, and nickel, remains a crucial competitive factor, compelling companies to explore alternative chemistries and localize sourcing strategies.

The EV battery market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Atlasbx Co. Ltd.; Bb Battery Co.; BYD Company Ltd.; C&D Technologies, Inc.; Contemporary Ampere Technology Co., Ltd; Crown Battery Manufacturing; Duracell; East Penn Manufacturing Company; Enersys, Inc.; Exide Industries Limited; GS Yuasa Corp.; Hitachi Chemical Co., Ltd; Huanyu New Energy Technology; LG Energy Solution; Narada Power Source Co., Ltd; NEC Corporation; North Star; Panasonic Corporation; Samsung SDI; SK Innovation Co. Ltd; and TCL Corporation.

BYD Company Ltd is a major China-based multinational conglomerate specializing in green technology and innovation. Founded in 1995 by Wang Chuanfu, the company initially focused on battery manufacturing before expanding into electric vehicles (EVs), electronics, and rail transit. Headquartered in Shenzhen, Guangdong, BYD operates globally with over 30 industrial parks and 40 branches worldwide, employing nearly 900,000 people as of 2024. BYD Auto, the company’s automotive subsidiary established in 2003, has emerged as a global company in new energy vehicles (NEVs), including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

SK Group, is an integrated energy and materials company headquartered in Seoul. Established in 2011 following a restructuring of SK Energy, the company operates through eight key subsidiaries, including SK Energy, SK Geo Centric, SK On, and SK IE Technology. Its diverse portfolio spans oil exploration, petrochemical production, and advanced materials, with a strong focus on eco-friendly initiatives. SK Innovation is a global player in petroleum refining and chemical products and is actively expanding its footprint in the electric vehicle (EV) battery sector to align with the growing demand for sustainable energy solutions. The company’s EV battery division, managed by its subsidiary SK On, specializes in high-energy-density lithium-ion batteries for global automakers.

Key Companies

- Atlasbx Co. Ltd.

- Bb Battery Co.

- BYD Company Ltd

- C&D Technologies, Inc.

- Contemporary Ampere Technology Co., Ltd

- Crown Battery Manufacturing

- Duracell

- East Penn Manufacturing Company

- Enersys, Inc.

- Exide Industries Limited

- GS Yuasa Corp.

- Hitachi Chemical Co., Ltd

- Huanyu New Energy Technology

- LG Energy Solution

- Narada Power Source Co., Ltd

- NEC Corporation

- North Star

- Panasonic Corporation

- Samsung SDI

- SK Innovation Co. Ltd

- TCL Corporation

EV Battery Industry Developments

March 2025: SK On and Nissan announced a battery supply agreement to support Nissan's electric vehicle (EV) production in North America. Under the agreement, SK On is to supply nearly 100GWh of US-made batteries from 2028 to 2033.

February 2025: Hyundai, a South Korea-based multinational automotive manufacturer, announced to reveal its all-solid-state EV battery pilot line to the public for the first time.

April 2024: CATL, a major EV battery maker, released its new battery pack with up to a nearly 1 million miles (1.5 million km) or 15-year warranty.

EV Battery Market Segmentation

By Battery Outlook (Revenue, USD Billion, 2020–2034)

- Lead-Acid

- Lithium-Ion

- Positive Electrode

- Negative Electrode

- Electrolyte

- Separator

- Nickel-Metal Hydride

- Sodium-Ion

- Solid-State

By Propulsion Outlook (Revenue, USD Billion, 2020–2034)

- BEV

- HEV

- PHEV

- FCEV

By Vehicle Outlook (Revenue, USD Billion, 2020–2034)

- Passenger Cars

- Vans/Light Trucks

- Medium & Heavy Trucks

- Buses

- Off-Highway Vehicles

By Method Outlook (Revenue, USD Billion, 2020–2034)

- Wire Bonding

- Laser Bonding

By Capacity Outlook (Revenue, USD Billion, 2020–2034)

- 5o kWh

- 50-11o kWh

- 11-200 kWh

- 201-300 kWh

- >300 kW

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Prismatic

- Cylindrical

- Pouch

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Lithium

- Cobalt

- Manganese

- Natural Graphite

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 90.94 Billion |

|

Market Forecast in 2025 |

USD 99.38 Billion |

|

Revenue Forecast in 2034 |

USD 224.55 Billion |

|

CAGR |

9.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global EV battery market size was valued at USD 90.94 billion in 2024 and is projected to grow to USD 224.55 billion by 2034.

The global market is projected to register a CAGR of 9.5% during the forecast period.

Asia Pacific held the largest share of the global market in 2024

A few of the key players in the market are Atlasbx Co. Ltd.; Bb Battery Co.; BYD Company Ltd.; C&D Technologies, Inc.; Contemporary Ampere Technology Co., Ltd; Crown Battery Manufacturing; Duracell; East Penn Manufacturing Company; Enersys, Inc.; Exide Industries Limited; GS Yuasa Corp.; Hitachi Chemical Co., Ltd; Huanyu New Energy Technology; LG Energy Solution; Narada Power Source Co., Ltd; NEC Corporation; North Star; Panasonic Corporation; Samsung SDI; SK Innovation Co. Ltd; and TCL Corporation.

The BEV segment dominated the market share in 2024 due to increasing government incentives, stringent emission regulations, and growing consumer preference for zero-emission transportation.

The natural graphite segment is expected to grow at the fastest pace in the coming years, owing to its essential function in anode production.