Electric Vehicle Battery Coolant Market Size, Share, Trends, Industry Analysis Report: By Battery (Lead Acid Battery, Lithium Ion Battery, and Others); Coolant; Vehicle Type; and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Dec-2024

- Pages: 123

- Format: PDF

- Report ID: PM5127

- Base Year: 2024

- Historical Data: 2020-2023

Electric Vehicle Battery Coolant Market Overview

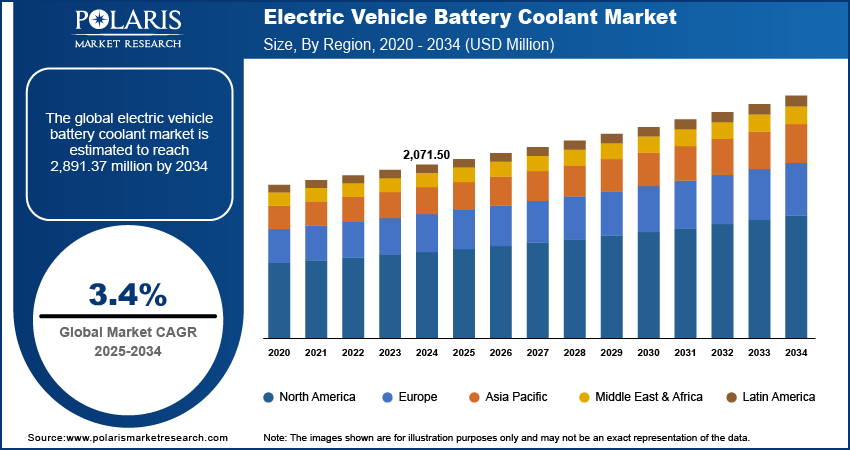

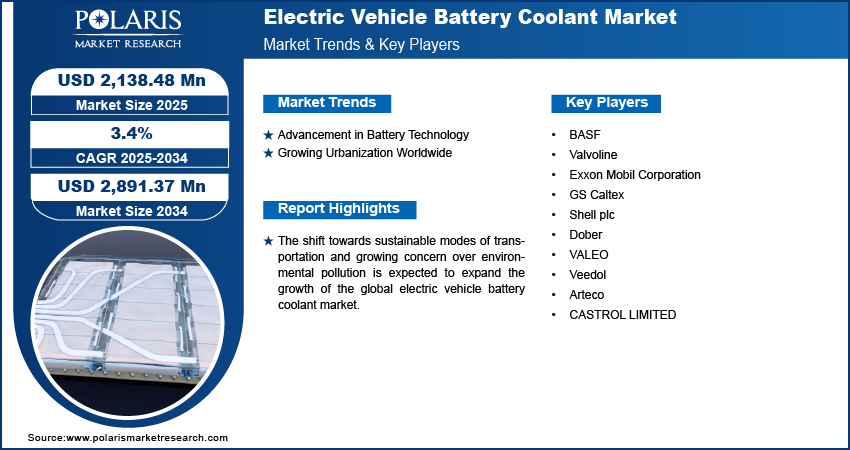

Electric vehicle battery coolant market size was valued at USD 2,071.50 million in 2024. It is projected to grow from USD 2,138.48 million in 2025 to USD 2,891.37 million by 2034, exhibiting a CAGR of 3.4% during 2025 - 2034.

Electric vehicles (EVs) rely heavily on effective battery cooling systems to maintain optimal performance, safety, and longevity. The primary function of these cooling systems is to regulate the temperature of the battery packs.

The growing concern over environmental pollution is driving the electric vehicle battery coolant market demand. As both consumers and governments push for reduced emissions, the demand for EVs continues to rise. This, in turn, drives the need for effective battery cooling solutions to ensure optimal performance and safety in EVs.

To Understand More About this Research: Request a Free Sample Report

The rising adoption of EVs worldwide is projected to propel the global electric vehicle battery coolant market. As per data published by the International Energy Agency, almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. EV batteries generate heat during charging and discharging. Efficient battery coolants are essential for managing this heat, preventing overheating, and maintaining battery efficiency. Thus, as the adoption of EVs increases, the demand for advanced cooling devices also spurs.

The market for electric vehicle battery coolant is driven by the growing shift towards sustainable modes of transportation. Sustainable transportation emphasizes zero emissions, which leads to increased demand for EVs. This increases the adoption of coolant as effective battery cooling is essential in EVs for optimizing battery performance, enhancing range, and reducing energy waste.

Electric Vehicle Battery Coolant Market Dynamics

Growing Urbanization Worldwide

The electric vehicle battery coolant market CAGR is being driven by growing urbanization across the globe. According to the United Nations, 68% of the world population is projected to live in urban areas by 2050. Urban environments typically experience frequent stop-and-go traffic, which leads to increased heat generation in EV batteries. Efficient battery coolants are essential for managing this heat and ensuring optimal performance under such conditions. Additionally, the development of charging infrastructure in urban areas supports the increasing number of EVs. This boosts demand for advanced battery cooling systems, driving further demand for coolants.

Increasing Advancement in Technology

The increasing advancement in technology is estimated to propel the global electric vehicle battery coolant market growth. Advancements in battery technology are enabling the development of larger batteries with greater energy storage capacity. These larger battery packs, often found in higher-performance EVs and commercial electric vehicles, generate more heat during use. Managing the thermal output of these larger battery systems requires advanced coolants with enhanced thermal conductivity and stability.

Electric Vehicle Battery Coolant Market Segment Insights

Electric Vehicle Battery Coolant Market Assessment By Battery

Based on battery, the global electric vehicle battery coolant market is divided into lead acid batteries, lithium-ion batteries, and others. The lithium-ion batteries segment dominated the market in 2024 due to its superior energy density, lightweight characteristics, and longer lifespan compared to other battery types. This segment's dominance stems from the widespread adoption of electric vehicles (EVs) that rely on lithium-ion technology, which offers higher efficiency and rapid charging capabilities. Major automotive manufacturers have increasingly prioritized lithium-ion batteries due to their performance advantages, making them the preferred choice for both electric and hybrid vehicles. Additionally, advancements in battery chemistry and manufacturing processes have further reduced costs, enhancing the overall appeal of lithium-ion batteries.

The lead acid batteries segment is also expected to grow at a robust pace in the coming years, owing to its cost-effectiveness and established infrastructure. Advancements in lead-acid technology, such as enhanced deep-cycle capabilities and improvements in energy recovery, are making them increasingly competitive. Many manufacturers are exploring lead-acid batteries for applications in electric vehicles where lower initial costs and recyclability are critical factors. The rise of budget-friendly electric models also plays a crucial role in this growth, as consumers seeking affordable options often gravitate towards vehicles that utilize lead-acid batteries.

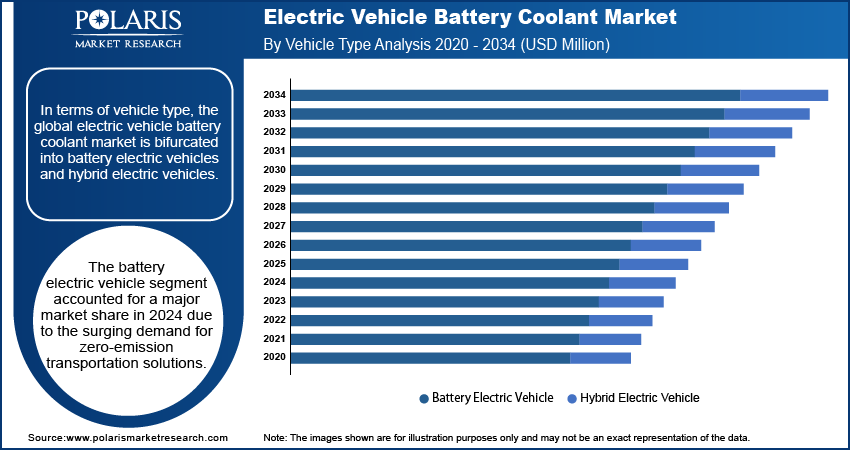

Electric Vehicle Battery Coolant Market Assessment By Vehicle Type

In terms of vehicle type, the global electric vehicle battery coolant market is bifurcated into battery electric vehicles and hybrid electric vehicles. The battery electric vehicle segment accounted for a major electric vehicle battery coolant market share in 2024 due to the surging demand for zero-emission transportation solutions. The increasing focus on sustainability and stringent regulations aimed at reducing carbon emissions have prompted both consumers and manufacturers to pivot towards fully electric vehicles. Technological advancements in battery efficiency and performance have further accelerated this shift. Manufacturers have invested in developing advanced coolant formulations that enhance thermal management, as BEVs require specialized cooling solutions to maintain optimal battery temperature and ensure longevity.

The hybrid electric vehicles segment is also expected to grow rapidly during the forecast period. This segment offers a compelling alternative for consumers who seek greater fuel efficiency without fully committing to battery electric vehicles. The flexibility of combining an internal combustion engine with an electric powertrain allows these vehicles to address range anxiety, a common concern among potential EV buyers. Additionally, the expanding infrastructure for HEVs, including charging stations and maintenance facilities, enhances their appeal.

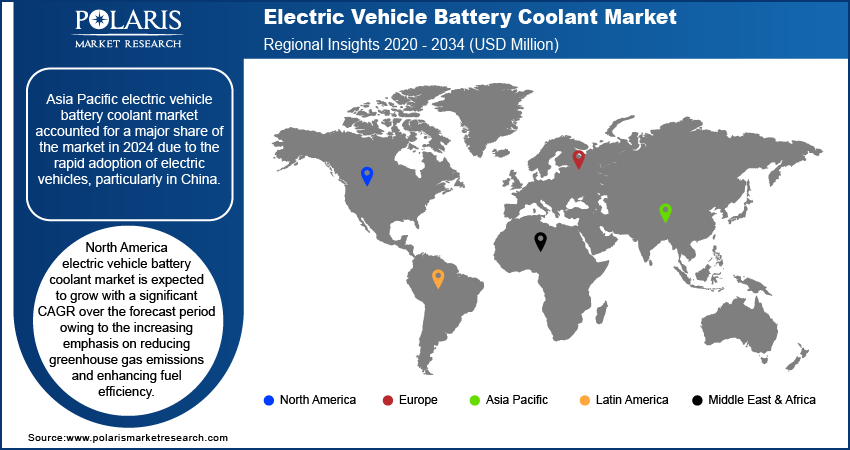

Electric Vehicle Battery Coolant Regional Insights

By region, the study provides the electric vehicle battery coolant market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major share of the market in 2024 due to the rapid adoption of electric vehicles, particularly in China. The country’s aggressive initiatives to promote electric mobility, including substantial government incentives and investments in charging infrastructure, significantly boosted the demand for advanced thermal management solutions. China's extensive manufacturing capabilities and its position as a global hub for electric vehicle production further solidified its dominance in this sector. The need for efficient cooling solutions has spurred as automakers ramp up production of battery electric vehicles (BEVs) to meet both domestic and international demand, contributing to the region’s substantial market share.

The North America electric vehicle battery coolant market is expected to grow with a significant CAGR over the forecast period owing to the increasing emphasis on reducing greenhouse gas emissions and enhancing fuel efficiency. Countries such as the US and Canada are witnessing a surge in HEV adoption, supported by federal incentives and growing environmental awareness among consumers. The robust automotive infrastructure and an increasing number of manufacturers entering the HEV space in North America are estimated to support this growth further, making the region a critical continent in the evolving landscape of thermal management for vehicle batteries.

Electric Vehicle Battery Coolant Key Market Players & Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the electric vehicle battery coolant market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the electric vehicle battery coolant industry must offer innovative solutions.

The electric vehicle battery coolant market is fragmented, with the presence of numerous global and regional market players. Major players include BASF, Valvoline, Exxon Mobil Corporation, GS Caltex, Shell plc, Dober, VALEO, Veedol, Arteco, and Castrol Limited.

BASF, headquartered in Ludwigshafen, Germany, is one of the largest chemical producers in the world and has a rich history dating back to its founding in 1865. It is a major global chemical company that plays a pivotal role in the electric vehicle (EV) market, particularly in the development of advanced battery materials and cooling solutions. In November 2022, BASF announced the launch of Glysantin, the battery coolant for battery electric vehicles in the Chinese automotive aftermarkets.

Exxon Mobil Corporation, commonly referred to as ExxonMobil is a major American multinational oil and gas corporation headquartered in Spring, Texas. Formed in 1999 through the merger of Exxon and Mobil, the company is one of the largest publicly traded energy providers and chemical manufacturers globally. In April 2019, ExxonMobil made a final investment decision on a multi-billion dollar expansion of its integrated manufacturing complex in Singapore to convert fuel oil and other bottom-of-the-barrel crude products into higher-value lube base stocks and distillates.

Key Companies in Electric Vehicle Battery Coolant Market

- BASF

- Valvoline

- Exxon Mobil Corporation

- GS Caltex

- Shell plc

- Dober

- VALEO

- Veedol

- Arteco

- CASTROL LIMITED.

Electric Vehicle Battery Coolant Market Developments

In January 2025: UPS expanded its pharmaceutical cold chain storage and transportation network across Europe through the acquisition of Frigo-Trans and BPL.

In November 2024: Lineage, Inc. announced the acquisition of Coldpoint, a cold storage and transportation solutions provider based in Kansas City. This strategic acquisition expands Lineage's footprint in the region, enhancing its services with Coldpoint's 621,000-square-foot facility and advanced intermodal capabilities.

April 2023: Arteco, a developer and manufacturer of quality antifreeze coolants and heat transfer fluids for automotive and industrial applications, announced the launch of Freecor EV Multi 10. It is a new EV-coolant specifically designed as a multifunctional coolant for the cooling of e-Motors, power electronics, batteries and all other components in both full electric and hybrid vehicles.

May 2022: Arteco, a dynamic chemical company, announced the launch of a new coolant, Freecor EV Milli 10. Freecor EV Milli 10 is specifically designed as a reduced electrical conductivity coolant for indirect cooling of battery electric vehicles (BEV).

June 2021: Castrol, a lubricant company, announced the launch of Castrol ON, its new range of e-fluids for electric vehicles.

Electric Vehicle Battery Coolant Market Segmentation

By Battery Outlook (Volume, Kilotons; Revenue, USD Billion, 2020 - 2034)

- Lead Acid Battery

- Lithium Ion Battery

- Other

By Coolant Outlook (Volume, Kilotons; Revenue, USD Billion, 2020 - 2034)

- Glycol-based

- Water-based

By Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2020 - 2034)

- Battery Electric Vehicles

- Hybrid Electric Vehicles

By Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electric Vehicle Battery Coolant Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,071.50 million |

|

Market Size Value in 2025 |

USD 2,138.48 million |

|

Revenue Forecast in 2034 |

USD 2,891.37 million |

|

CAGR |

3.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Volume in Kiloton, Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global electric vehicle battery coolant market size was valued at USD 2,071.50 million in 2024 and is projected to grow to USD 2,891.37 million by 2034.

The global market is projected to grow at a CAGR of 3.4% during 2025-2034.

Asia Pacific held the largest share of the global market in 2024.

The key players in the market are BASF, Valvoline, Exxon Mobil Corporation, GS Caltex, Shell plc, Dober, VALEO, Veedol, Arteco, and CASTROL LIMITED.

The lead-acid batteries segment is projected for significant growth in the global market.

The battery electric vehicle segment dominated the electric vehicle battery coolant market in 2024.