Electric Two-Wheeler Market Size, Share, Trends, Industry Analysis Report: By Vehicle Type (Electric Scooters, Electric Motorcycles, and Electric Mopeds), Application, Battery Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM1356

- Base Year: 2024

- Historical Data: 2020-2023

Electric Two-Wheeler Market Overview

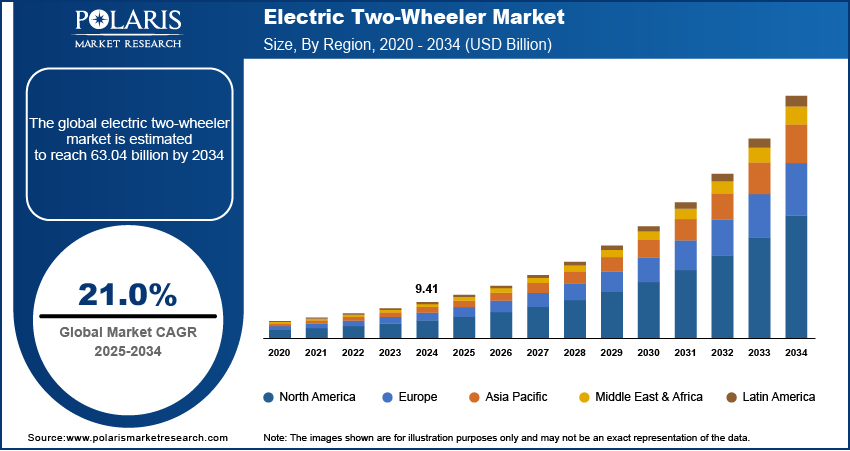

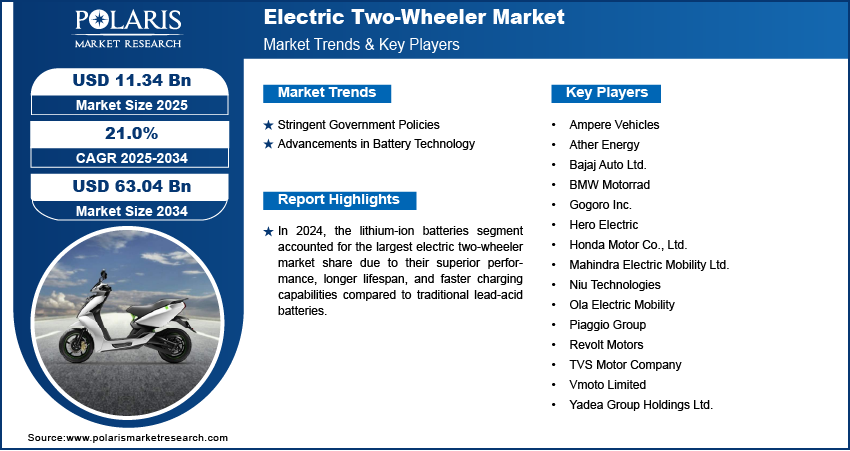

The global electric two-wheeler market size was valued at USD 9.41 billion in 2024 and is expected to reach USD 11.34 billion by 2025 and 63.04 billion by 2034, exhibiting a CAGR of 21.0% during 2025–2034.

The global electric two-wheeler market represents a pivotal segment of the automotive industry, characterized by the production and adoption of electric-powered motorcycles, scooters, and mopeds. Owing to the rising shift toward sustainable and eco-friendly transportation solutions, the market has witnessed significant growth driven by advancements in battery technology and rising awareness of environmental preservation. The market’s robust expansion aligns with the increasing demand for zero-emission vehicles, targeting both urban and rural mobility needs. One major driver is the implementation of stringent emission norms worldwide, compelling manufacturers to transition to electric solutions and consumers to embrace cleaner alternatives. European nations and China have established ambitious targets for electric vehicle (EV) penetration, further boosting the global electric two-wheeler market growth.

To Understand More About this Research: Request a Free Sample Report

Electric two-wheelers are economical, offering lower operational costs compared to their internal combustion engine counterparts due to reduced fuel and maintenance expenses. This affordability attracts cost-conscious consumers, particularly in emerging markets. Increasing urbanization has amplified traffic congestion issues, making compact and efficient electric two-wheelers a practical alternative. Additionally, volatile global fuel prices have pushed consumers toward energy-efficient transportation options. These dynamics collectively contribute to the widespread adoption of electric two-wheelers across developed and developing economies.

Electric Two-Wheeler Market Dynamics

Stringent Government Policies

Stringent government regulations on vehicular emissions and renewable energy adoption are key factors propelling the electric two-wheeler market demand. Governments worldwide are providing substantial financial incentives, such as subsidies, tax rebates, and grants, to encourage the production and adoption of electric vehicles. For instance, in 2024, the Biden-Harris Administration allocated USD 54 million to enhance clean transportation initiatives within American communities. This funding aims to advance the deployment of sustainable transportation options, supporting efforts to reduce greenhouse gas emissions and promote environmental equity. Investing in innovative technologies and infrastructure, the administration seeks to facilitate the transition to cleaner transport systems across diverse regions. Similarly, China’s EV-friendly policies, including subsidies for electric two-wheelers and the establishment of battery-swapping networks, have significantly boosted market expansion. These regulations aim to reduce carbon footprints, improve air quality, and align with global climate change mitigation goals. Moreover, the imposition of bans on internal combustion engine vehicles in several countries by 2030 has accelerated investments in electric mobility, creating vast opportunities for manufacturers.

Advancements in Battery Technology

The electric two-wheeler market is witnessing rapid advancements in battery technology. Innovations such as lithium-ion batteries with enhanced energy density, durability, and faster charging capabilities have addressed consumer concerns about range anxiety and charging time. Solid-state batteries are emerging as a revolutionary technology, offering improved safety, higher energy capacity, and extended life cycles. Furthermore, the development of battery-swapping stations is gaining traction, particularly in densely populated urban areas, ensuring convenience and minimizing downtime for users. Companies are increasingly investing in research and development to introduce cost-effective and sustainable battery solutions. Also, leading players in the market are exploring second-life applications of batteries, contributing to a circular economy. These advancements have significantly enhanced the performance and affordability of electric two-wheelers, making them a viable option for diverse consumer segments. Hence, the rising advancements in battery technology drive the electric two-wheeler market development.

Electric Two-Wheeler Market Segment Insights

Electric Two-Wheeler Market Assessment by Vehicle Type Outlook

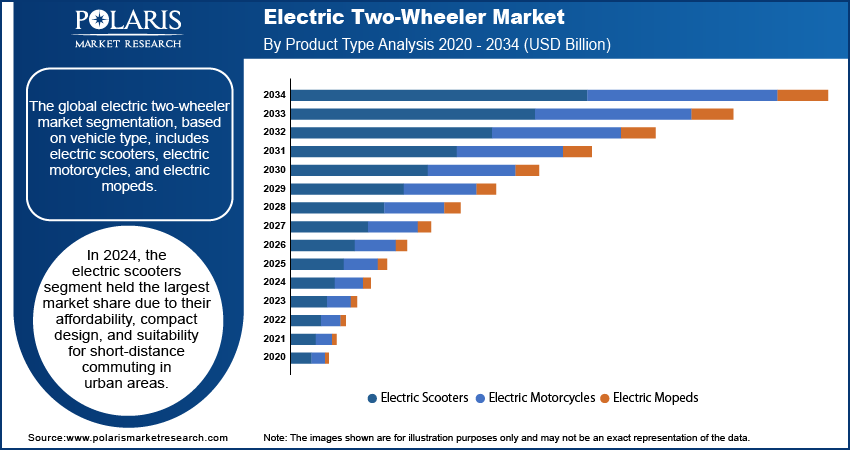

The global electric two-wheeler market segmentation, based on vehicle type, includes electric scooters, electric motorcycles, and electric mopeds. In 2024, the electric scooters segment held the largest market share due to their affordability, compact design, and suitability for short-distance commuting in urban areas. Ola Electric, an Indian EV manufacturer, launched a new range of affordable electric scooters with swappable battery technology, offering prices well below those of conventional e-bikes. Electric scooters are widely favored for their ease of use, low maintenance costs, and diverse model availability. Additionally, their extensive adoption in ride-sharing and food delivery services has further propelled segment growth.

Electric Two-Wheeler Market Evaluation by Battery Type Outlook

The global electric two-wheeler market segmentation, based on battery type, includes lithium-ion batteries and lead-acid batteries. In 2024, the lithium-ion batteries segment accounted for the largest share of the market revenue due to their superior performance, longer lifespan, and faster charging capabilities compared to traditional lead-acid batteries. The declining cost of lithium-ion technology, coupled with its high energy density, has made it the preferred choice for manufacturers and consumers alike. Furthermore, lithium-ion batteries are lightweight, enhancing vehicle efficiency and driving electric two-wheeler market trends.

Electric Two-Wheeler Market Regional Analysis

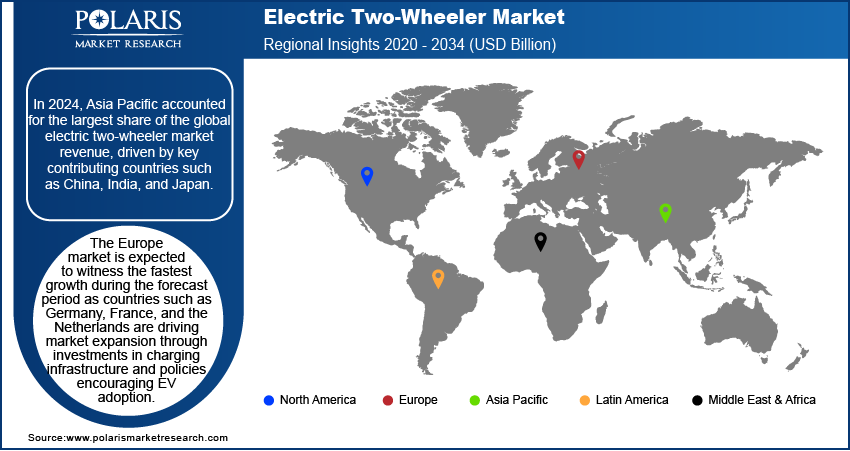

By region, the study provides electric two-wheeler market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share, key contributors such as China, India, and Japan. China leads the electric two-wheeler market share due to its well-established manufacturing base, government subsidies, and robust EV infrastructure. China’s dominance is attributed to its large-scale production capabilities, innovation in battery technology, and high domestic demand driven by urbanization and environmental policies. For instance, the Center for Strategic and International Studies estimates that between 2009 and 2023, the Chinese government invested about USD 230 billion in subsidies for the battery and electric vehicle sectors, significantly enhancing their growth and global competitiveness.

The Europe electric two-wheeler market is expected to witness the fastest growth during the forecast period. Countries such as Germany, France, and the Netherlands are driving the electric two-wheeler market expansion through investments in charging infrastructure and policies encouraging EV adoption. Germany, in particular, stands out as a leading country due to its focus on technological innovation and the presence of prominent manufacturers investing in electric mobility. The European Union’s Green Deal and carbon-neutral goals have further spurred regional growth, positioning Europe as a hub for electric vehicle innovation and adoption.

Electric Two-Wheeler Market – Key Players & Competitive Analysis Report

The competitive landscape of the electric two-wheeler market is rapidly evolving, marked by strategic partnerships and collaborations among key players aiming to enhance their market presence. Consumer demand for sustainable transportation solutions is growing; thus, companies are increasingly merging resources to innovate and expand their product offerings. This trend reflects a collective effort to leverage technological advancements, particularly in battery efficiency and smart connectivity features, which are becoming essential in attracting tech-savvy consumers. Additionally, players are focusing on optimizing supply chains to improve efficiency and reduce costs, which is critical in a market characterized by fluctuating demand and supply challenges.

Government incentives and regulations drive competition, prompting companies to align their strategies with environmental goals. The rise of electric two-wheelers in emerging markets, particularly in Asia, presents significant growth opportunities; however, firms must navigate challenges such as affordability and performance expectations from consumers accustomed to traditional vehicles. The integration of Internet of Things (IoT) technology into electric two-wheelers enhances user experience through features such as real-time monitoring and remote diagnostics, positioning these vehicles as modern transportation solutions.

Yadea is a global company engaged in the electric two-wheeler market. The company’s product portfolio includes electric scooters, motorcycles, and bicycles. Recent developments include partnerships to enhance battery-swapping networks and the introduction of next-generation lithium-ion batteries. Yadea’s commitment to sustainability and innovation has solidified its position as a market leader.

Hero Electric is India’s electric two-wheeler manufacturer, excelling in affordability and energy-efficient products tailored to the Indian market. Recent initiatives include expanding its production capacity and launching high-performance models to provide urban commuters. Hero Electric’s focus on enhancing EV infrastructure through strategic collaborations has strengthened its leadership in the market.

List of Key Companies in Electric Two-Wheeler Market

- Ampere Vehicles

- Ather Energy

- Bajaj Auto Ltd.

- BMW Motorrad

- Gogoro Inc.

- Hero Electric

- Honda Motor Co., Ltd.

- Mahindra Electric Mobility Ltd.

- Niu Technologies

- Ola Electric Mobility

- Piaggio Group

- Revolt Motors

- TVS Motor Company

- Vmoto Limited

- Yadea Group Holdings Ltd.

Electric Two-Wheeler Industry Developments

January 2025: CBAK Energy partnered with Ather Energy, a top electric two-wheeler manufacturer in India, to enhance Ather's vehicle performance using CBAK's advanced energy storage solutions. This collaboration marks a key advancement in integrating battery technology into India's electric mobility sector.

November 2024: Honda launched two electric motorcycle concepts at EICMA 2024 in Milan. The "EV Fun Concept," its first electric sports model, is set for a 2025 release, and the "EV Urban Concept" showcases Honda's vision for efficient urban mobility.

November 2024: LiveWire and KYMCO expanded their strategic partnership to develop an electric maxi-scooter for the European market. This collaboration utilizes LiveWire's advanced S2 powertrain, combining the strengths of both companies for superior performance and efficiency.

Electric Two-Wheeler Market Segmentation

By Vehicle Type Outlook (Revenue, USD Billion, 2020–2034)

- Electric Scooters

- Electric Motorcycles

- Electric Mopeds

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Personal Use

- Commercial Use (e.g., Delivery Services, Ride-Hailing)

By Battery Type Outlook (Revenue, USD Billion, 2020–2034)

- Lithium-Ion Batteries

- Lead-Acid Batteries

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electric Two-Wheeler Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.41 billion |

|

Market Size Value in 2025 |

USD 11.34 billion |

|

Revenue Forecast by 2034 |

USD 63.04 billion |

|

CAGR |

21.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global electric two-wheeler market size was valued at USD 9.41 billion in 2024 and is projected to grow to USD 63.04 billion by 2034.

The global market is projected to register a CAGR of 21.0% during the forecast period.

In 2024, Asia Pacific accounted for the largest share, driven by key contributing countries such as China, India, and Japan.

A few of the key players in the market are Yadea Group Holdings Ltd.; Hero Electric; Ather Energy; Niu Technologies; Bajaj Auto Ltd.; TVS Motor Company; Gogoro Inc.; Ampere Vehicles; Ola Electric Mobility; Vmoto Limited; Revolt Motors; Mahindra Electric Mobility Ltd.; BMW Motorrad; Honda Motor Co., Ltd.; and Piaggio Group.

In 2024, the electric scooters segment held the largest market share due to their affordability, compact design, and suitability for short-distance commuting in urban areas.

In 2024, the lithium-ion batteries segment accounted for the largest market share due to their superior performance, longer lifespan, and faster charging capabilities compared to traditional lead-acid batteries.