Electric Truck Market Share, Size, Trends, Industry Analysis Report, By Application (Logistics, Municipal, Construction, Mining, Others); By Vehicle (Battery Electric, Hybrid), By Truck; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 113

- Format: PDF

- Report ID: PM2040

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

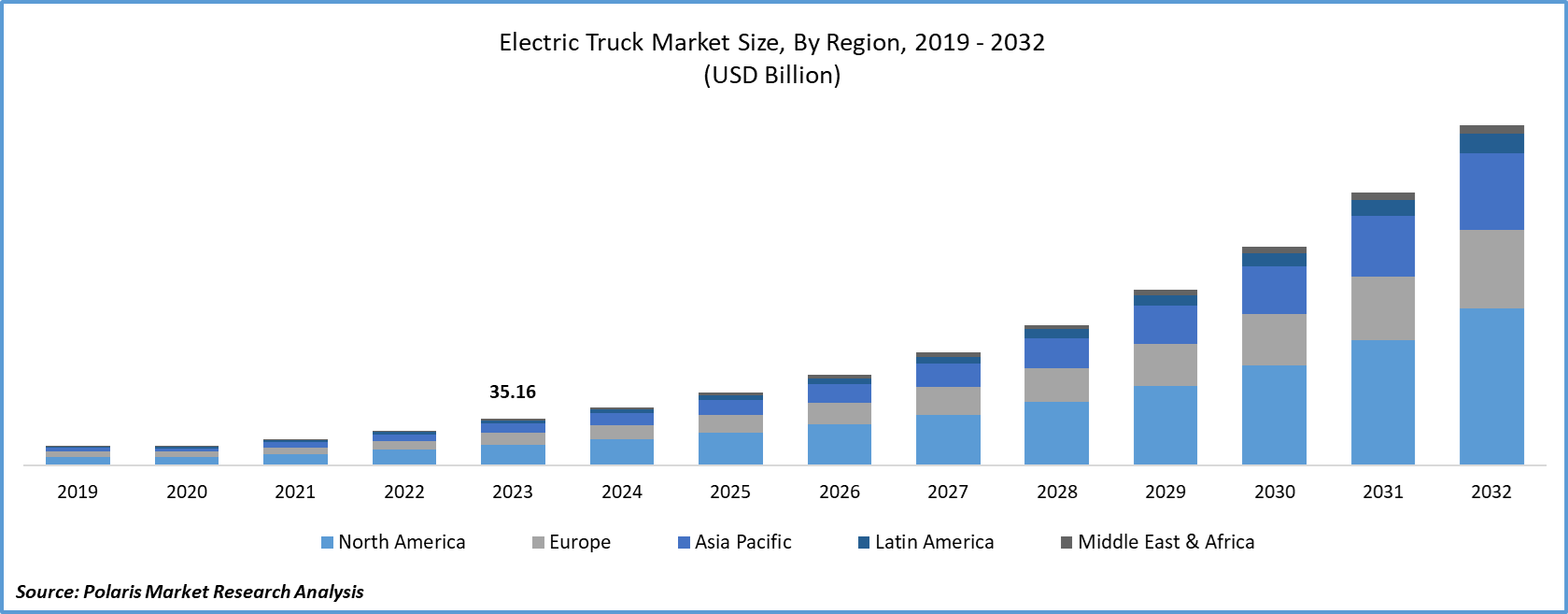

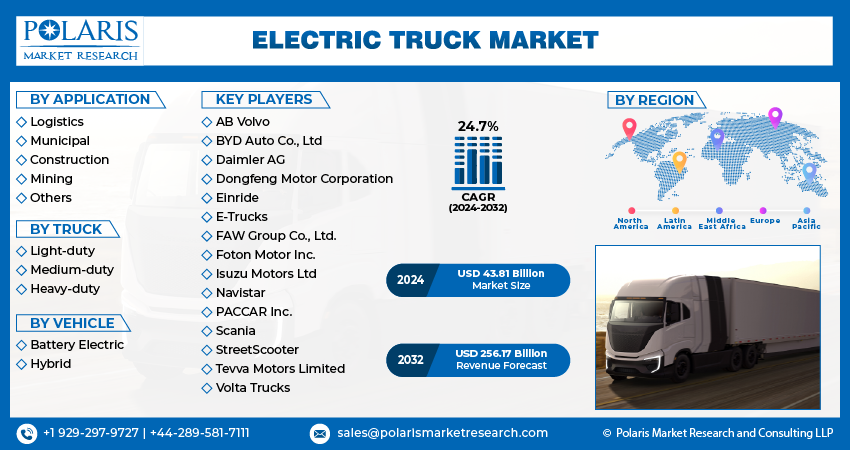

The global electric truck market size was valued at USD 35.16 billion in 2023. The market is anticipated to grow from USD 43.81 billion in 2024 to USD 256.17 billion by 2032, exhibiting the CAGR of 24.7% during the forecast period.

The continual rise in the business operations of transportation and logistics as well as construction industries, coupled with the increasing incentives and government schemes regarding environment emission control, are the few prominent factors expected to accelerate the market growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

For instance, the “Paris agreement” was signed by 175 countries in December 2015, aimed at reducing global CO2 emissions by 28% by 2025. Moreover, the robust growth in adoption for fuel-efficient or zero-emission vehicles and escalating initiatives for the promotion of e-mobility by public-private companies is further boosting the preference for electric truck market.

However, in the wake of the COVID-19 pandemic, some OEMs were affected heavily and delayed their business target for the short-term, as they conserved cash and investment projects. But these targets continue to play an important priority for OEMs in the long term, which will impact a seismic market shift and growth over the next decade.

Industry Dynamics

Growth Drivers

The market has witnessed considerable developments in the last few decades, supported by the fact that automakers are investing a substantial amount of funds in manufacturing electric vehicles with zero or low tailpipe emission, which includes the fuel economy standard. For instance, as per the Electric Vehicle Initiative, Japan’s automotive strategy as a part of the cooperative approach across industrial stakeholders aims to cut greenhouse emissions by 80% from manufacturing EV by national automakers by 2050. Thus, the huge investments from automobile manufacturers are expected to cater to raising the demand and play a significant role in driving the market.

Escalating demand for fuel-efficient vehicles in order to minimize the emission of greenhouse gases, such as CO2, compared with other gasoline or conventional vehicles is another major reason to proliferate the adoption of the product. In addition, the battery electric vehicles are often considered the cleanest and safest for the environment as it emits 144 gram of carbon dioxide per mile.

Furthermore, changing consumer preference for electric vehicles over gasoline-based vehicles and the advancement in OEM vehicle strategy further fuel the demand and adoption of commercial electric vehicles, including electric trucks in the market. In the last few years, few prominent OEMs have proclaimed strategic commitments to EVs in order to support customer sentiments regarding such vehicles.

New models have also been launched, production targets intensified, and sales targets moved forward and multiplied. For instance, in July 2021, Stellantis merged with the PSA Groupe, has planned to invest around USD 35.5 billion in electric vehicles and to aid technologies through 2025 in the global market.

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Electric Truck Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Report Segmentation

The market is primarily segmented on the basis of application, truck, vehicle, and region.

|

By Application |

By Truck |

By Vehicle |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Vehicle

Based on the vehicle type segment, the battery-electric trucks are the largest revenue contributor in the global market in 2020. They are expected to keep their dominance in the forthcoming period. The segment is further anticipated to see healthy market growth from 2021 to 2028, owing to its various factors, including the increased density and lifespan of batteries and reduction in battery prices.

This has forced truck manufacturers to deploy batteries and electrify the vehicles, which helps tackle greenhouse gas emissions, creating huge investments and demand for electric truck market. Furthermore, governments from different geographical nations are offering incentives and schemes to manufacture electric trucks integrated with batteries, which is predicted to propel the market worldwide.

Hybrid trucks accounted for a considerable share in 2020 and are likely to observe a downfall over the study period. The demand for such trucks in the global market is anticipated to decline primarily due to rising government regulations. In addition, the manufacturers and other OEMs are focused on manufacturing electric trucks integrated with fuel-cell for the long haul purpose. In July 2020, Hyundai Hydrogen Mobility shipped the 10 units of XCIENT Fuel Cell trucks to transportation and logistics companies based on pay-per-use.

Geographic Overview

Geographically, Europe is the largest revenue contributor in the global market due to the increasing popularity and adoption of these trucks for conducting commercial operations, along with the growing presence of vehicle manufacturing vendors and transportation & logistics companies to offer electric vehicles in the region. Electric trucks are extensively focusing on complying with environment-safety regulations imposed by the regulatory bodies and transport authorities in the global market. Thus, the demand for electric trucks from this region is continually growing at a rapid pace considering the global market scenario.

United Kingdom, Germany, Spain, and Italy are further estimated to register the largest number of initiatives to reduce greenhouse gas emissions. Similarly, in countries such as France, most logistics and transportation companies are using electric trucks on the back of their many tangible benefits. These take account of a much quieter ride in comparison to diesel trucks, making EVs a reduced amount of impact on a driver's hearing and indeed not emit emissions.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2020. The demand for the electric truck market in the region is anticipated to increase over the forecast period owing to favorable government initiatives concerning pollution control strategies and the significant presence of prominent vendors, including BYD Auto Co. Ltd., Dongfeng Motor Corporation, and Daimler AG.

As per the Made in China 2025 initiative, China's government focuses on selling around 1 million units of domestically produced plug-in hybrid and electric vehicles by 2020. Thus, many transportations and logistics companies have now recognized the acceptance of electric trucks, and so, the market is gaining significant prominence across the region.

Competitive Landscape

Some of the Major Players operating the global market include AB Volvo, BYD Auto Co., Ltd, Daimler AG, Dongfeng Motor Corporation, Einride, E-Trucks, FAW Group Co., Ltd., Foton Motor Inc., Isuzu Motors Ltd, Navistar, PACCAR Inc., Scania, StreetScooter, Tevva Motors Limited, and Volta Trucks.

Electric Truck Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 43.81 billion |

|

Revenue forecast in 2032 |

USD 256.17 billion |

|

CAGR |

24.7% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Application, By Truck, By Vehicle, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

AB Volvo, BYD Auto Co., Ltd, Daimler AG, Dongfeng Motor Corporation, Einride, E-Trucks, FAW Group Co., Ltd., Foton Motor Inc., Isuzu Motors Ltd, Navistar, PACCAR Inc., Scania, StreetScooter, Tevva Motors Limited, and Volta Trucks |

Uncover the dynamics of the Electric Truck Market sector in 2021 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2028, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.