Electric Tile Cutter Market Share, Size, Trends, Industry Analysis Report

Electric, By Type (Wet Tile Cutter, and Dry Tile Cutter); By Application; By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 115

- Format: PDF

- Report ID: PM2884

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

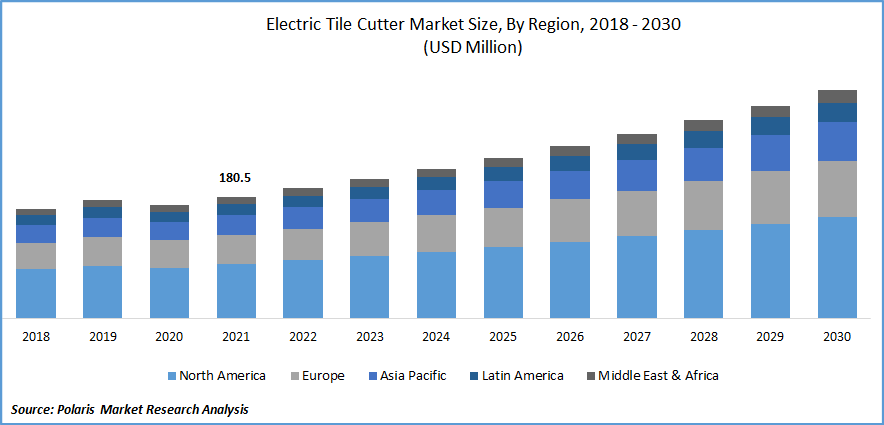

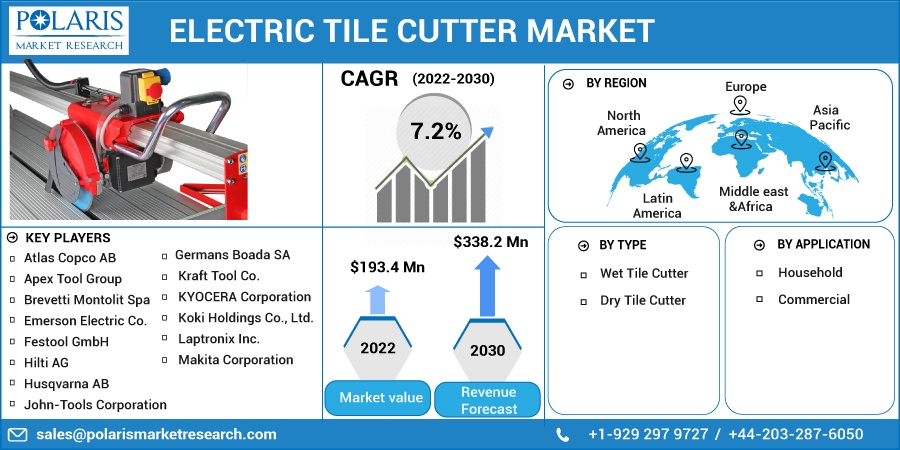

The global electric tile cutter market was valued at USD 180.5 million in 2021 and is expected to grow at a CAGR of 7.2% during the forecast period.

Electric tile cutter demand has expanded globally as a result of the expanding demand for tiles and the quickening pace of technological development in the building industry. Ceramic tiles are in high demand among consumers since they are generally accessible and come in various shapes, forms, colors, and sizes. Ceramic tiles can also be used in place of many different types of flooring, including concrete, marble, carpet, wood, rugs, and more. The expanding custom and personalized trends are predicted to increase demand for ceramic tile in the region.

Know more about this report: Request for sample pages

Electric tile cutters are employed to shape and size cut tiles to fit a specific need. They are electric-operated tools that make it easier to precisely cut ceramic and other kinds of tile. These electric cutters are offered in a range of forms and dimensions to meet various needs. Electric tile cutters are becoming more and more well-liked all over the world since they are more convenient, more exact, and less expensive to use than manual cutters.

In addition, rising urbanization in emerging economies is anticipated to increase spending on critical infrastructure, including power, building, and transportation. As per the World Bank, by 2025, India will have 46% of Indians living in urban spaces. In Brazil, 89% of the entire population lives in urban areas. The urban population in Brazil is growing by 1.1 % each year.

The COVID-19 epidemic harms people's economic well-being. Lockdowns enacted to stop the spread of the coronavirus hurt international trade because all companies were forced to close their doors or operate with fewer employees. This affected people's jobs and salaries, leading to salary reductions and several job losses that reduced living standards.

People made fewer investments in upgrading their homes, businesses, and other commercial spaces, which reduced the demand for electric tile cutters. As a result, the worldwide electric tile cutter market grew slowly throughout the pandemic.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The expanding building and construction industry is one of the major factors propelling the market expansion. Growth in ceramic tiles & the utilization of associated power tools in implementing them, which then, in turn, had also generated the requirement for tile cutters, has been fueled by a growing construction spending along with an expansion in the number of commercial & residential buildings. According to the DPIIT, FDIs in the construction industry in India were USD 29.5 billion in April 2020 and USD 23.9 billion in December 2020, respectively.

Furthermore, construction companies in China signed 50 Tn yuan contracts in 2018. China Railway Construction Corporation announced in 2019 that newly signed contracts for the first three quarters of 2019 totaled 1.112 trillion yuan, up 25.07 % from 2018. According to the World Economic Forum, China is the world's largest building construction market, with up to 2 billion square meters built annually, accounting for half of all new construction globally. Thus, the rising construction industry is projected to drive the market in the extended run.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

The household segment is expected to witness the fastest growth

The rising benefits of the tile cutter and ease of use for the household industry are projected to spur segment growth. Electric tile cutters make it simpler to cut tiles into a specific size and form that work for walls and floors. Tiles significantly enhance the inside of a home, and customer preferences for various tile kinds might fluctuate based on the household space can be covered with a variety of tiles, including those made of stone, ceramic, quarry, cork, porcelain, glass, vinyl, and bamboo. The kitchen backsplash is the primary application for glass tiles. For flooring and countertops, ceramic, porcelain, and granite tiles are frequently utilized.

The dry tile cutter segment industry accounted for the highest market share in 2021

Using dry cutting eliminates the need for water to cut the tile. Dry cutting is intended for sporadic shortcutting. The most common professional tile-cutting tool is a manual tile cutter; however, individuals can also use tile pliers or a tile scriber, depending on the tile size. Tile nippers have two blades that are compressed together using handles that resemble pliers. Because they score tiles by producing a breaking point in which the tile can be snapped in half, they are perfect for smaller projects and mosaic tiles. Tile scribers have a sharpened point that produces clean, even scoring and straight cuts throughout tiles. Dry cutting is the best method for indoor projects and spaces requiring smaller tiles.

Furthermore, the major players' launch of dry electric tile cutters is the major factor boosting the market growth over the forecast period. For instance, in January 2018, "iQ Power Tools" released accessories for their dry-cut tile to cut ceramic, marble, & stone. This instrument makes it possible to cut tile indoors or outdoors without any water or dust owing to a completely integrated dust control system. Thus, this is boosting segmental growth.

The demand in North America is expected to witness significant growth.

North American region is dominating the market growth due to the rising disposable income and construction activities. The market in North America is anticipated to have considerable revenue growth during the forecast period as a result of the expanding construction of non-residential and residential structures in the region. Additionally, a lot of Italian tile producers are growing their manufacturing facilities in the region due to the accessibility of raw materials and a sizable percentage of the untapped market. Due to rising single-family home construction and rising spending on residential renovation in the country, ceramic tile demand is anticipated to rise throughout the forecast period.

Further, the Asia Pacific market is expanding rapidly due to increased infrastructure development, increase in disposable income, and expanding construction sector in nations like India, China, and Japan. For instance, the National Investment & Infrastructure Fund (NIIF) received $200 million worth from the Asian Infrastructure Investment Bank (AIIB) in June 2018.

In addition, the Indian government has implemented several significant policies and programs, such as Housing for All, Smart Cities, and "Atal Mission for Urban Rejuvenation and Transformation" (AMRUT), which all assist in the expansion of the country's building market. For instance, the National Bank for Financing Infrastructure and Development (NaBFID) was established in March 2021 by a bill passed by the Indian Parliament to finance infrastructure projects.

Europe is predicted to have significant growth due to the quickly expanding real estate sector, which comprises rising residential building construction and rising remodeling and refurbishment operations. Furthermore, the German government declared its intention to build roughly 1.5 million dwelling units by 2021. This translates to 375,000 new homes annually.

Competitive Insight

Key players include Atlas Copco AB, Apex Tool Group, Brevetti Montolit Spa, Emerson Electric Co., Festool GmbH, Hilti AG, Husqvarna AB, John-Tools Corporation, Germans Boada SA, Kraft Tool Co., KYOCERA Corporation, Koki Holdings Co., Ltd., Laptronix Inc., Makita Corporation, Norcros Corp., Panasonic Corporation, Robert Bosch GmbH, Ryan Industries Co. Ltd., Rubi Corp., Stanley Black & Decker, Inc., Vitrex Inc., Yancheng Baoding Power Tools Co. Ltd., and Zhongxing Diamond Tools Co. Ltd.

Recent Developments

In August 2022, Einhell introduced the first battery-operated tile cutter, expanding the Power X-Change product line. Workers now have greater flexibility than ever owing to the innovative TE-TC Li cordless machine.

In August 2019, a firm that creates, produces, and sells flooring and installation solutions, Q.E.P., just established a strategic alliance with the leading Spanish ceramic tile businesses. As a result, Q.E.P. Co., Inc. will be more competitive in the international floor-covering sector.

Electric Tile Cutter Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 193.4 million |

|

Revenue forecast in 2030 |

USD 338.2 million |

|

CAGR |

7.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Atlas Copco AB, Apex Tool Group, Brevetti Montolit Spa, Emerson Electric Co., Festool GmbH, Hilti AG, Husqvarna AB, John-Tools Corporation, Germans Boada SA, Kraft Tool Co., KYOCERA Corporation, Koki Holdings Co., Ltd., Laptronix Inc., Makita Corporation, Norcros Corp., Panasonic Corporation, Robert Bosch GmbH, Ryan Industries Co. Ltd., Rubi Corp., Stanley Black & Decker, Inc., Vitrex Inc., Yancheng Baoding Power Tools Co. Ltd., and Zhongxing Diamond Tools Co. Ltd. |