Electric Powertrain Market Size, Share, Trends, Industry Analysis Report: By Product Type, Vehicle Type (Light Vehicles, Cars, and Light Trucks), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 125

- Format: PDF

- Report ID: PM1380

- Base Year: 2024

- Historical Data: 2020-2023

Electric Powertrain Market Overview

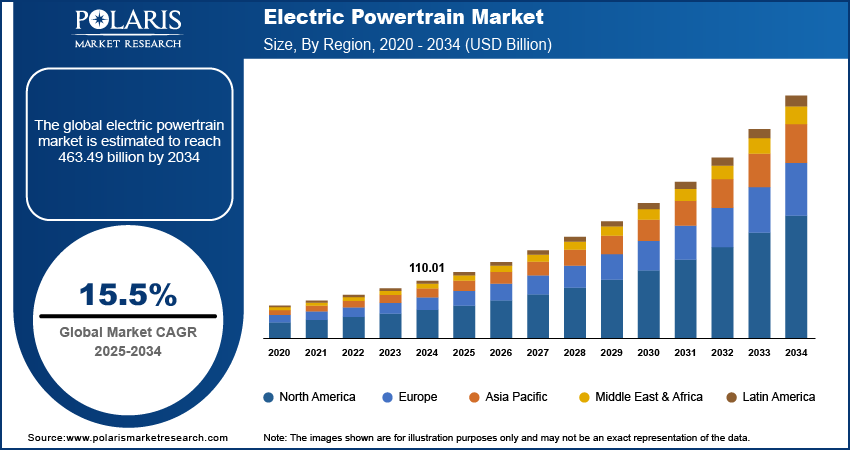

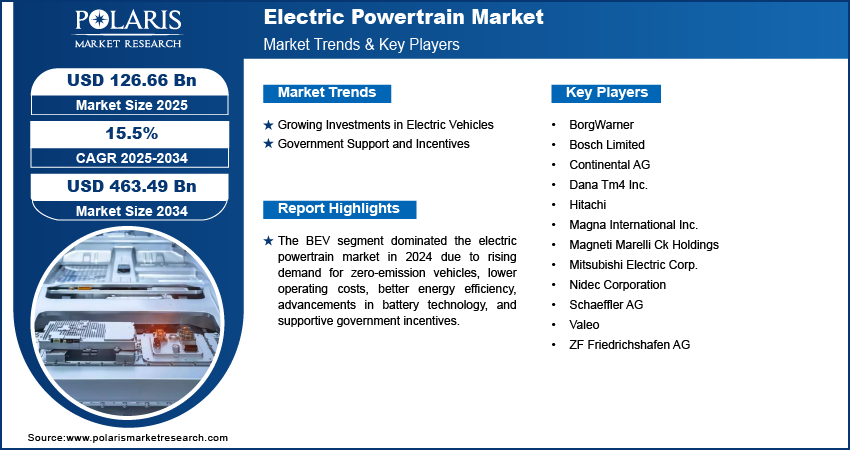

The electric powertrain market size was valued at USD 110.01 billion in 2024. The market is projected to grow from USD 126.66 billion in 2025 to USD 463.49 billion by 2034, exhibiting a CAGR of 15.5% during the forecast period.

An electric powertrain system uses electric motors, batteries, and electronic controllers to propel a vehicle or machinery. Unlike traditional internal combustion engines, the system relies on electricity stored in batteries to drive the wheels or other moving parts without fuel or exhaust systems. Governments across the world are implementing stringent environmental regulations to reduce emissions, responding to the growing concerns over climate change. These regulations encourage automakers to transition from traditional internal combustion engines to electric powertrains, which produce zero tailpipe emissions. This shift of global push for sustainability is driving the interest in electric vehicles, which propels the electric powertrains market demand.

To Understand More About this Research: Request a Free Sample Report

The ongoing development of battery technology is driving the electric powertrain market development. Improvements in battery efficiency, energy storage, and charging speed are making electric vehicles more practical and attractive to consumers. Lighter, more energy-dense, and cost-effective batteries improve the performance of electric powertrains, offering longer driving ranges and faster charging times. These advancements address previous challenges such as long charging durations, making electric vehicles a more feasible choice for daily use. This progress is boosting consumer confidence and contributing to the accelerated growth and adoption of electric vehicles, thereby boosting the electric powertrain market demand.

Electric Powertrain Market Driver Analysis

Growing Investments in Electric Vehicles

Automakers and tech companies are increasing their investments in EV development to meet the rising demand for clean, sustainable transportation. These investments are being used to improve electric powertrain technology, enhance battery efficiency, and reduce production costs. For instance, in January 2024, BMW Group invested USD 695.5 million in the production of electric vehicles in the Munich facility. This surge in investments helps accelerate the transition to electric mobility, driving the growth of the electric powertrain market revenue.

Government Support and Incentives

Governments worldwide are offering various incentives, such as tax credits, subsidies, and rebates, to accelerate the adoption of electric vehicles. These financial benefits make electric powertrains more affordable for consumers and encourage manufacturers to invest in electric vehicle production. For instance, the government in India launched a FAME subsidy for faster adoption of electric vehicles, under which various tax incentives and subsidies are covered. This government support, combined with commitments to achieving carbon reduction targets, is driving the electric powertrain market growth.

Electric Powertrain Market Segment Analysis

Electric Powertrain Market Assessment by Product Type Outlook

The electric powertrain market segmentation, based on product type, includes BEV, mild hybrid, series hybrid, parallel hybrid, and series-parallel hybrid. The BEV segment accounted for the largest share in 2024. This is primarily due to the increasing demand for zero-emission vehicles and the global shift toward sustainable transportation. Battery electric vehicles (BEVs) offer lower operating costs, fewer maintenance needs, and better energy efficiency compared to traditional vehicles. Additionally, advancements in battery technology and supportive government incentives are boosting the demand for BEVs, driving their dominance in the electric powertrain market.

Electric Powertrain Market Evaluation by Vehicle Type Outlook

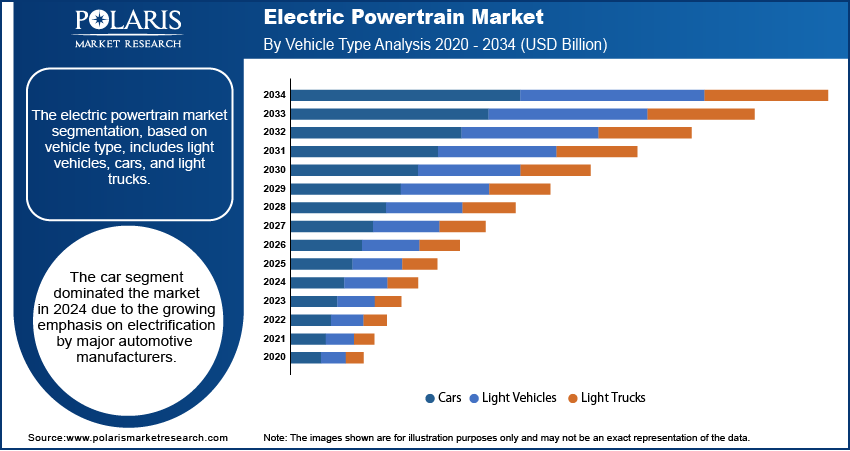

The electric powertrain market segmentation, based on vehicle type, includes light vehicles, cars, and light trucks. The car segment dominated the market in 2024 due to the growing emphasis on electrification by major automotive manufacturers. Automakers are shifting focus toward electric vehicles and investing heavily in the development of advanced electric powertrains for cars. This transition is driven by stricter environmental regulations, increased consumer demand for greener transportation, and technological advancements that make electric cars more affordable and efficient, thereby driving segmental growth in the global market.

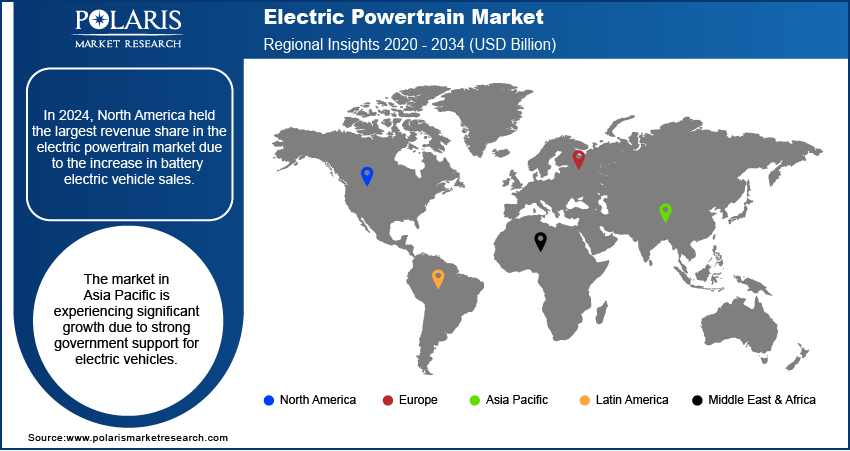

Electric Powertrain Market Regional Analysis

By region, the study provides the electric powertrain market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share in the market due to the increase in battery electric vehicle sales. Consumers are becoming more interested in electric cars as they offer lower operating costs and contribute to environmental sustainability. According to the US Energy Information Administration, battery electric vehicle sales increased by 21.2% in 2023 from last year sales. Major automakers are investing heavily in electric vehicle production, further boosting the electric powertrain market in North America.

The electric powertrain market in Asia Pacific is experiencing significant growth due to strong government support for electric vehicles. Many countries, including China, Japan, and India, have introduced various incentives such as subsidies, tax rebates, and infrastructure development to encourage the adoption of electric vehicles. These government initiatives are aimed at reducing pollution, improving energy efficiency, and supporting the transition to clean energy. Consequently, consumers are increasingly adopting electric vehicles, and automakers are ramping up the production of electric vehicles. The government-driven push is accelerating the electric powertrain market expansion in Asia Pacific.

Electric Powertrain Market – Key Players and Competitive Analysis

The electric powertrain market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the electric powertrain market are BorgWarner, Bosch Limited, Continental AG, Dana Tm4 Inc., Hitachi, Magneti Marelli Ck Holdings, Valeo, Nidec Corporation, ZF Friedrichshafen AG, Schaeffler AG, Mitsubishi Electric Corp., and Magna International Inc.

Continental AG, is a technology company with a global presence, providing innovative solutions for vehicles, machines, traffic, and transportation. The company specializes in tires, global automotive suppliers, software development, driver assistance systems, automated driving, global industrial suppliers, blockchain, the Internet of Things, connectivity, vehicle networking and information, continental business consulting, continental engineering services, and autonomous mobility and safety. Continental AG has evolved into a multifaceted entity operating through four key sectors—Automotive, ContiTech, Tires, and Contract Manufacturing. The Automotive sector is focused on enhancing vehicle safety and performance through advanced technologies, including safety, chassis, brake, motion, and motion control systems. It also develops solutions for assisted and automated driving, as well as innovative display, operating, and interior systems encompassing audio and camera technologies. Additionally, the sector provides intelligent information and communication technology solutions, integrating the latest advancements in vehicle connectivity and automation. Continental AG's electric powertrain portfolio includes high-voltage e-motors, inverters, power electronics, battery management systems, thermal management solutions, and integrated axle drives, enhancing efficiency, performance, and sustainability in electric and hybrid vehicles.

Hitachi Ltd is an electric power transmission, control, and distribution company that specializes in energy, technology, utilities, transportation, renewable energy, infrastructure, semiconductors, e-mobility, transformers, industries, smart cities, and power. The company’s product portfolio is categorized into products and systems, software, and solutions. The product and systems category is further segmented into capacitors and filters, cable accessories, communication networks, disconnectors, energy storage, cooling systems, flexible AC transmission systems, high-voltage switchgear, generator circuit-breakers, breakers, instrument transformers, high-voltage direct current, semiconductors, substation automation control and protection, surge arresters, transformers, substations and electrification, and transformer components and insulation.Hitachi Ltd.'s electric powertrain portfolio includes high-performance motors, inverters, battery management systems, power electronics, and electric drive systems, providing advanced solutions for electric and hybrid vehicles to enhance efficiency and sustainability.

List of Key Companies in Electric Powertrain Market

- BorgWarner

- Bosch Limited

- Continental AG

- Dana Tm4 Inc.

- Hitachi

- Magna International Inc.

- Magneti Marelli Ck Holdings

- Mitsubishi Electric Corp.

- Nidec Corporation

- Schaeffler AG

- Valeo

- ZF Friedrichshafen AG

Electric Powertrain Industry Developments

In June 2024, Ansys announced the launch of its cloud-native SaaS offering, ConceptEV, which enabled engineers to collaboratively optimize EV powertrain designs, improving efficiency, reducing costs, and accelerating development.

In July 2021, Mercedes-Benz announced that it had acquired Yasa, a provider of advanced electric propulsion technology. The business offers the automobile sector solutions for electric and hybrid powertrains. Yasa will continue to function as a wholly-owned Mercedes-Benz subsidiary.

In July 2021, LG Electronics and Magna International announced an electric powertrain joint venture to serve the EV industry. Both firms have formally signed the transaction agreement. The new business will be situated in Incheon, South Korea, and will go by LG Magna e-powertrain.

In February 2023, Continental AG introduced a new electric motor rotor position sensor (eRPS) designed for electric vehicles. These sensors utilize inductive technology to accurately track the position of rotors in electric machines, enhancing efficiency and providing smoother operation.

In April 2023, Denso Corporation developed its first inverter that uses silicon carbide (SiC) power semiconductors. This inverter will be incorporated into BlueE Nexus Corporation's eAxle, which is set to be used in the Lexus RZ.

Electric Powertrain Market Segmentation

By Product Type Outlook (Revenue USD Billion, 2020–2034)

- BEV

- Mild Hybrid

- Series Hybrid

- Parallel Hybrid

- Series-Parallel Hybrid

By Vehicle Type Outlook (Revenue USD Billion, 2020–2034)

- Light Vehicles

- Cars

- Light Trucks

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electric Powertrain Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 110.01 billion |

|

Market size value in 2025 |

USD 126.66 billion |

|

Revenue Forecast by 2034 |

USD 463.49 billion |

|

CAGR |

15.5% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The market size was valued at USD 110.01 billion in 2024 and is projected to grow to USD 463.49 billion by 2034.

• The global market is projected to register a CAGR of 15.5% during 2025–2034.

• North America held the largest share of the global market in 2024.

• A few key players in the market are BorgWarner, Bosch Limited, Continental AG, Dana Tm4 Inc., Hitachi, Magneti Marelli Ck Holdings, Valeo; Nidec Corporation, ZF Friedrichshafen AG, Schaeffler AG, Mitsubishi Electric Corp., and Magna International Inc.

• The BEV segment accounted for the largest share in 2024 due to the increasing demand for zero-emission vehicles and the global shift toward sustainable transportation.

• The car segment dominated the electric powertrain market revenue share in 2024 due to the growing emphasis on electrification by major automotive manufacturers.