Electric Power Distribution Automation Systems Market Size, Share, Trends, Industry Analysis Report: By Component (Field Devices, Software, Services, and Communication Technology), Implementation, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 113

- Format: PDF

- Report ID: PM1430

- Base Year: 2024

- Historical Data: 2020-2023

Electric Power Distribution Automation Systems Market Overview

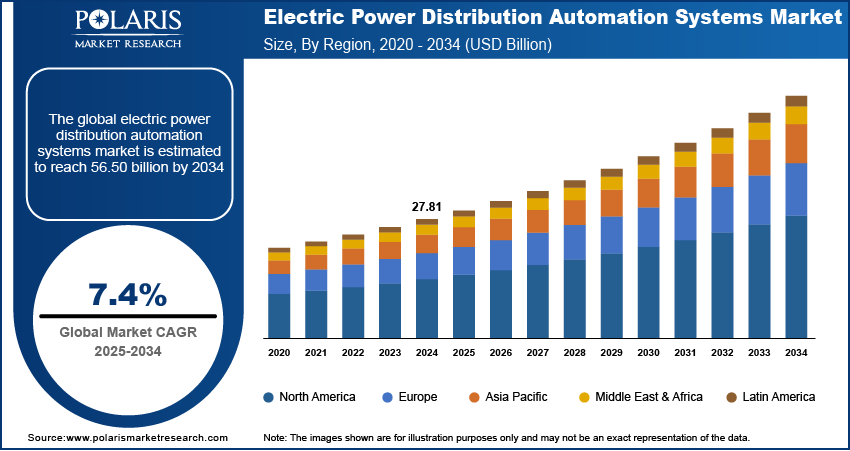

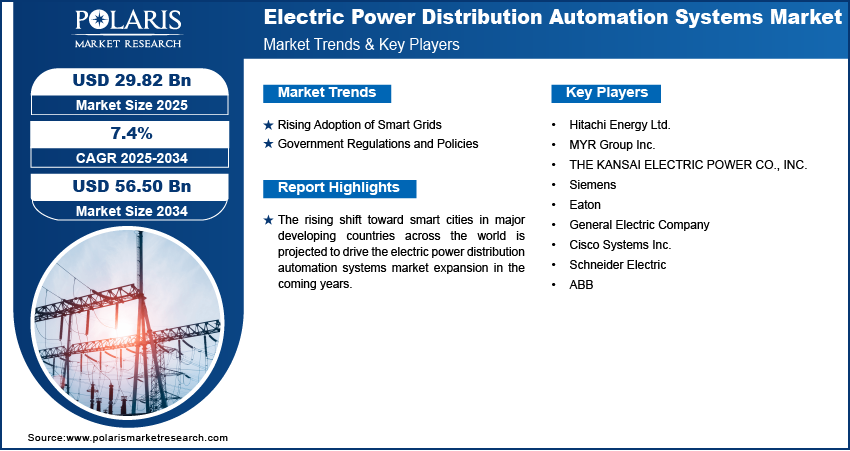

The global electric power distribution automation systems market size was valued at USD 27.81 billion in 2024. The market is projected to grow from USD 29.82 billion in 2025 to USD 56.50 billion by 2034. It is projected to exhibit a CAGR of 7.4% from 2025 to 2034.

Electric power distribution automation systems are composed of various components that facilitate the monitoring and safe distribution of electricity. A typical system includes a distribution substation that receives power from the main station and distributor transformers that step down the high voltage to distribution levels. Additional components such as switches, feeders, protection devices, and measurement equipment work together to ensure the secure and organized distribution of power.

The rising demand for electricity, coupled with the increasing need for smart grids, primarily drives the electric power distribution automation systems market growth. The increasing investments in transmission and distribution infrastructure further support the market growth. Other factors driving the adoption of electric power distribution automation systems include continuous technological advancements in power distribution systems, increasing aging infrastructure, and the growing need to update existing infrastructure.

The increasing shift toward smart cities in major developing countries worldwide is a key trend anticipated to drive electric power distribution automation systems market expansion in the upcoming years. The rising emphasis on using renewable energy sources such as solar and wind is projected to provide numerous market opportunities during the forecast period.

Electric Power Distribution Automation Systems Market Dynamics

Rising Adoption of Smart Grids

Smart grids are electricity networks that rely on advanced technologies to monitor and manage the flow of electricity. These networks use digital communication and automation to optimize electricity generation, transmission, and distribution. They enable real-time monitoring of the power distribution network and provide automated responses to faults. Also, smart grids facilitate better integration of renewable energy sources. Governments worldwide are increasingly adopting smart grids due to the many benefits they offer. As a result, the transition from traditional grids to smart grids is one of the most significant contributors to the electric power distribution automation systems market demand.

Government Regulations and Policies

Government regulations and policies aimed at reducing carbon emissions and enhancing energy efficiency are strong drivers of the electric power distribution automation systems market development. Several major economies globally have set ambitious targets for reducing greenhouse gas emissions, promoting renewable energy, and enhancing grid resilience. To achieve these goals, they are offering financial incentives, subsidies, and favorable policies to encourage the deployment of advanced power equipment, including electric power distribution automation systems.

Electric Power Distribution Automation Systems Market Segment Insights

Electric Power Distribution Automation Systems Market Outlook Based on Implementation

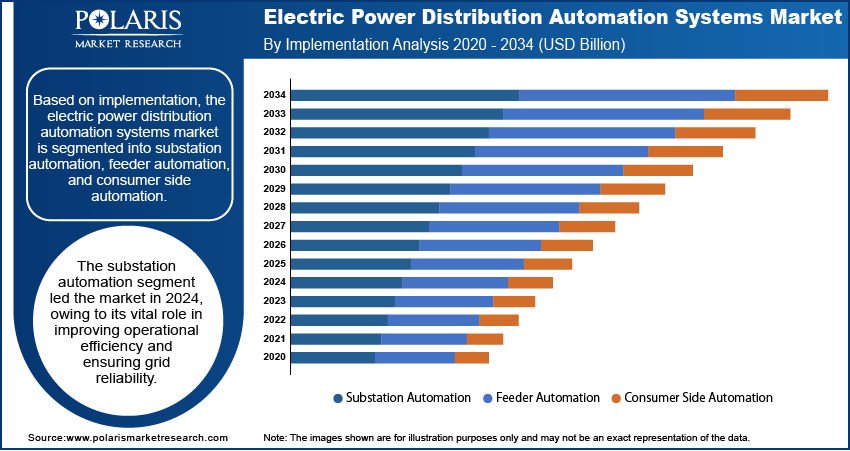

The electric power distribution automation systems market, based on implementation, is segmented into substation automation, feeder automation, and consumer side automation. The substation automation segment led the market with a revenue share of 58.8% in 2024, owing to its vital role in improving operational efficiency and ensuring grid reliability. Substation automation encompasses several hardware and software components used to remotely monitor and control an electrical system. With substation automation, utilities can gain real-time insights into grid operations and performance. Also, it helps streamline grid operations, which lowers costs and reduces the need for onsite service calls.

Electric Power Distribution Automation Systems Market Assessment Based on Application

The electric power distribution automation systems market, based on application, is segmented into residential, commercial, and industrial. The commercial segment is anticipated to register the highest CAGR of 5.9% from 2025 to 2034. The commercial sector is rapidly adopting automation solutions for electric power distribution to ensure a reliable power supply for businesses such as data centers, hospitals, and hotels. The use of these systems enhances efficiency by facilitating real-time monitoring and control and lowering costs and outages. The implementation of smart grid initiatives and regulatory pressures for energy efficiency and sustainability further drive the adoption of electric power distribution automation systems in the commercial sector.

Electric Power Distribution Automation Systems Market Regional Analysis

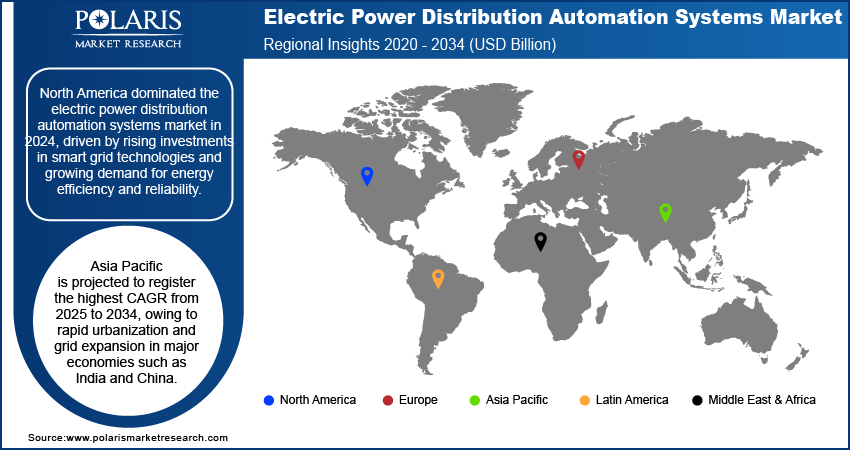

By region, the market report offers electric power distribution automation systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market and accounted for 34.2% revenue share in 2024. The market growth in the region is primarily fueled by rising investments in smart grid technologies, growing demand for energy efficiency and reliability, and infrastructure modernization. Further, the presence of several leading market participants and regulatory support for sustainability initiatives contributes to the regional market dominance.

The Asia Pacific electric power distribution automation systems market is projected to register the highest CAGR of 7.9% from 2025 to 2034, driven by rapid urbanization and grid expansion in major economies such as India and China. The introduction of smart city initiatives, rising emphasis on the integration of clean energy, and rapid growth of the industrial sector further contribute to the market landscape in the region.

Electric Power Distribution Automation Systems Market – Key Players and Competitive Insights

The electric power distribution automation systems market has the presence of both established players and new entrants. The leading market players focus on offering advanced products to improve their offerings. Also, they are undertaking various strategic initiatives such as collaborations, mergers, and partnerships to expand their market share. To expand and survive in a more competitive and rising market environment, market participants must offer innovative solutions.

Manufacturing locally is one of the key business strategies used by manufacturers to benefit clients and increase the market sector. In recent years, the market has witnessed several technological and innovation breakthroughs. The electric power distribution automation systems market report offers a market assessment of all the leading players, including Hitachi Energy Ltd.; MYR Group Inc.; THE KANSAI ELECTRIC POWER CO., INC.; Siemens; Eaton; General Electric Company; Cisco Systems Inc.; Schneider Electric; and ABB.

List of Key Players in Electric Power Distribution Automation Systems Market

- Hitachi Energy Ltd.

- MYR Group Inc.

- THE KANSAI ELECTRIC POWER CO., INC.

- Siemens

- Eaton

- General Electric Company

- Cisco Systems Inc.

- Schneider Electric

- ABB

Electric Power Distribution Automation Systems Industry Developments

August 2024: Hitachi Energy announced the launch of Relion REF650, an advanced multi-application protection and control relay. The company stated that the new relay offers enhanced flexibility and reliability and is specifically designed to meet the evolving power quality needs across both industrial and utility operations.

May 2024: ABB signed an agreement with Siemens to acquire its Wiring Accessories business in China. With the acquisition, ABB aims to improve its reach and customer offerings in the smart buildings sector in China.

Electric Power Distribution Automation Systems Market Segmentation

- Field Devices

- Software

- Services

- Communication Technology

By Implementation Outlook

- Substation Automation

- Feeder Automation

- Consumer Side Automation

By Application Outlook

- Residential

- Commercial

- Industrial

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electric Power Distribution Automation Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 27.81 billion |

|

Market Size Value in 2025 |

USD 29.82 billion |

|

Revenue Forecast by 2034 |

USD 56.50 billion |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 27.81 billion in 2024 and is projected to grow to USD 56.50 billion by 2034.

The market is projected to register a CAGR of 7.4% from 2025 to 2034.

North America accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Hitachi Energy Ltd.; MYR Group Inc.; THE KANSAI ELECTRIC POWER CO., INC.; Siemens; Eaton; General Electric Company; Cisco Systems Inc.; Schneider Electric; and ABB.

The substation automation segment accounted for the largest market share in 2024.

The commercial segment is anticipated to register the highest CAGR during the forecast period.