Electric Commercial Vehicle Traction Motor Market Size, Share, Trends, Industry Analysis Report – By Vehicle Type (Pickup Trucks, Trucks, Buses & Coaches, and Vans), Power Output, Motor Type, Design, Transmission, Axle Architecture, and Region – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5079

- Base Year: 2023

- Historical Data: 2019-2022

Electric Commercial Vehicle Traction Motor Market Outlook

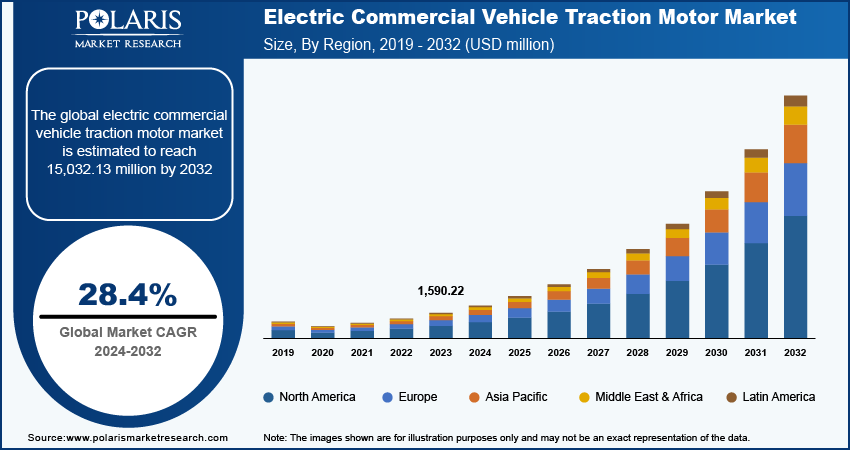

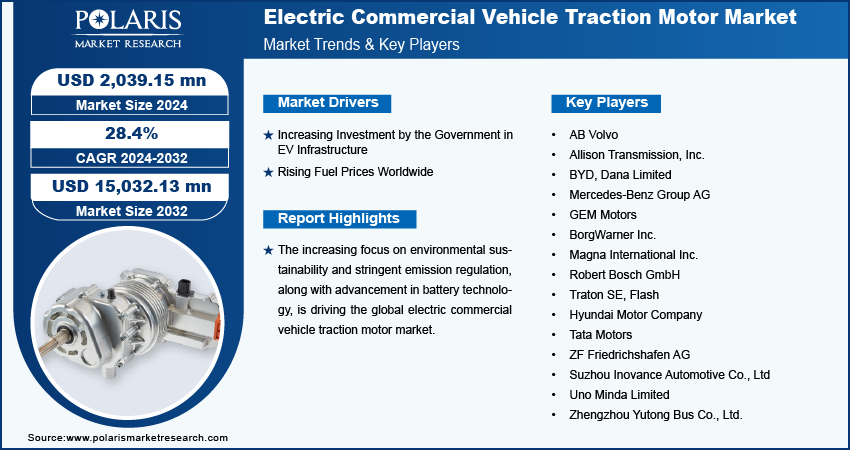

The electric commercial vehicle traction motor market size was valued at USD 1,590.22 million in 2023. The market is anticipated to grow from USD 2,039.15 million in 2024 to USD 15,032.13 million by 2032, exhibiting a CAGR of 28.4% during 2024–2032.

Electric Commercial Vehicle Traction Motor Market Overview

The increasing focus on environmental sustainability and stringent emission regulation is driving the electric commercial vehicle traction motor market growth. For instance, the transport sector in the European Union is obligated to reduce its emissions by 90% by 2050. Electric commercial vehicles do not produce tailpipe emissions, which helps companies reduce their overall carbon footprint. This aligns with global sustainability goals and corporate responsibility initiatives, which ultimately boost demand for electric commercial vehicles. Rising demand for these vehicles propels the requirement for their traction motor, as these motors are integral components in EVs. Thus, the increasing focus on emission regulation is propelling the market.

To Understand More About this Research: Request a Free Sample Report

The global electric commercial vehicle traction motor market is witnessing significant growth due to the rising advancements in battery technology. Innovations such as higher energy-density batteries are extending the range of electric vehicles, making them more suitable for commercial applications. This increased viability is driving the demand for traction motors, which are crucial components in these vehicles.

Electric Commercial Vehicle Traction Motor Market Drivers

Increasing Investment by Government in EV Infrastructure

Governments of countries across the world are increasingly investing in EV infrastructure. Government funding often goes toward expanding the network of public and private charging stations. For instance, the government of the US awarded USD 521 million in grants to continue building out a national electric vehicle charging network. A more extensive and accessible charging infrastructure reduces range anxiety and increases the feasibility of operating electric commercial vehicles. As the investment by governments in EV infrastructure increases, the demand for electric commercial vehicles spurs, which drives the electric commercial vehicle traction motor market growth.

Rising Fuel Prices Worldwide

The rising fuel prices worldwide are creating a favorable outlook for the electric commercial vehicle traction motor market. High fuel prices make electric commercial vehicles more economically attractive to potential consumers as these vehicles operate on batteries instead of fuel. This increases the demand for electric commercial vehicles and their traction motors, as these motors are the key components in EVs.

Electric Commercial Vehicle Traction Motor Market Restraint

Limited Range and Lesser Availability of Charging Stations

The fewer availability of charging stations and the limited range of electric commercial vehicles hinder the adoption of electric commercial vehicles traction motors. Businesses may be hesitant to invest in electric commercial vehicles if they feel that current battery ranges do not meet their operational needs. This cautious approach may reduce the demand for electric traction motors.

Electric Commercial Vehicle Traction Motor Market Segment Analysis

Electric Commercial Vehicle Traction Motor Market Breakdown – Vehicle Type Analysis

Truck Segment Dominated the Market in 2023

The truck segment dominated the electric commercial vehicle traction motor market in 2023 due to the shift toward electrification in logistics and freight transportation. Trucks, especially long-haul and medium-duty variants, represent a wide portion of commercial fleets and incur high fuel and maintenance costs, making them prime candidates for electrification. The lower operating costs, driven by reduced fuel expenses and minimal maintenance requirements, have accelerated the adoption of electric trucks. Furthermore, advancements in battery technology have extended the range of electric trucks, addressing one of the primary concerns of fleet operators regarding the feasibility of electric solutions for long-distance travel. The introduction of government incentives and stricter emission regulations has also played a crucial role in encouraging businesses to adopt electric trucks.

The buses and coaches segment is projected to register a significant CAGR during the forecast period, owing to the rising urbanization and increasing public transportation needs. Governments across the world are investing in electric buses to improve air quality and meet environmental targets, leading to substantial growth in this segment. Additionally, the implementation of dedicated bus lanes and charging infrastructure in urban areas enhances the practicality and efficiency of electric buses, further boosting their market share. The combination of supportive policies, environmental benefits, and advancements in charging technology would position electric buses to hold a dominant market share in the coming years.

Electric Commercial Vehicle Traction Motor Market Breakdown – Power Output Analysis

100–200kW Segment Accounted for Largest Market Share in 2023

The 100–200kW segment accounted for the largest market share in 2023 due to its suitability for a broad range of applications, including light to medium-duty trucks, delivery vans, and urban buses. Vehicles in this power range offer a compelling balance of performance, cost, and efficiency. They provide adequate power for urban and short-haul operations while maintaining energy efficiency and reasonable battery size. The expansion of e-commerce and last-mile delivery services has driven demand for electric vans and smaller trucks, which frequently fall into this power output category. Additionally, advancements in battery technology have improved the performance and affordability of vehicles within this range, further supporting their widespread adoption.

The 200–400kw segment is estimated to grow at a rapid pace during the forecast period, owing to the increasing demands for higher performance in medium and heavy-duty applications. Larger trucks and buses that need to handle heavy loads and longer distances require 200–400kw power. The enhancements in battery energy density and power electronics now enable these higher-output systems to offer extended range and efficiency, making them more practical for commercial use. Additionally, investments in high-capacity charging infrastructure and advancements in power management technology support the adoption of vehicles in this power range, driving future market dominance.

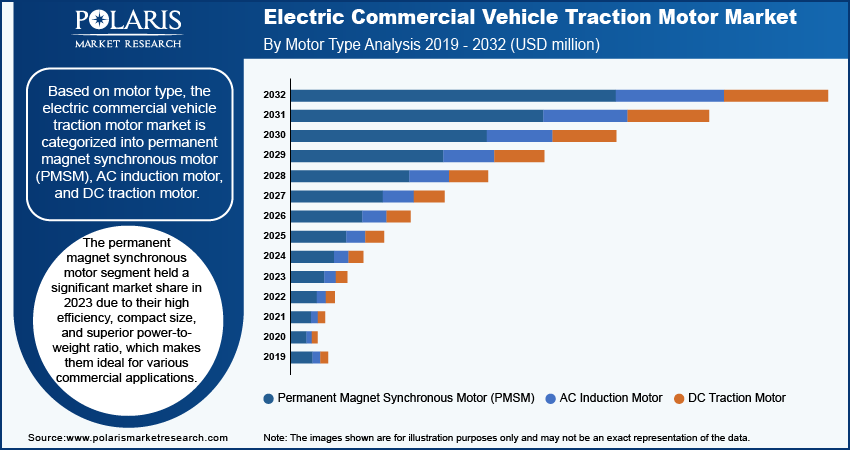

Electric Commercial Vehicle Traction Motor Market Breakdown – Motor Type Analysis

Permanent Magnet Synchronous Motor (PMSM) Segment Held Significant Market Revenue Share in 2023

The permanent magnet synchronous motor segment held a significant market share in 2023 due to their high efficiency, compact size, and superior power-to-weight ratio, which makes them ideal for various commercial applications. Advances in permanent magnet materials and motor design have enhanced the efficiency and reliability of PMSMs, driving their widespread adoption. Additionally, the higher torque and responsiveness of PMSMs contribute to better acceleration and overall vehicle performance, which appeals to fleet operators seeking efficiency and robust operational capabilities.

The AC induction motor segment is expected to register a considerable CAGR during the forecast period owing to its ability to offer a high level of robustness and durability, making it suitable for heavy-duty applications such as long-haul trucks and large buses. Additionally, as the industry continues to focus on reducing costs and improving scalability, the cost-effectiveness and ease of integration of AC induction motors position them well to capture a dominant share of the market. The growing investments in charging infrastructure and the increasing emphasis on reducing operational costs for fleet operators are expected to support the shift toward AC induction motors in the coming years.

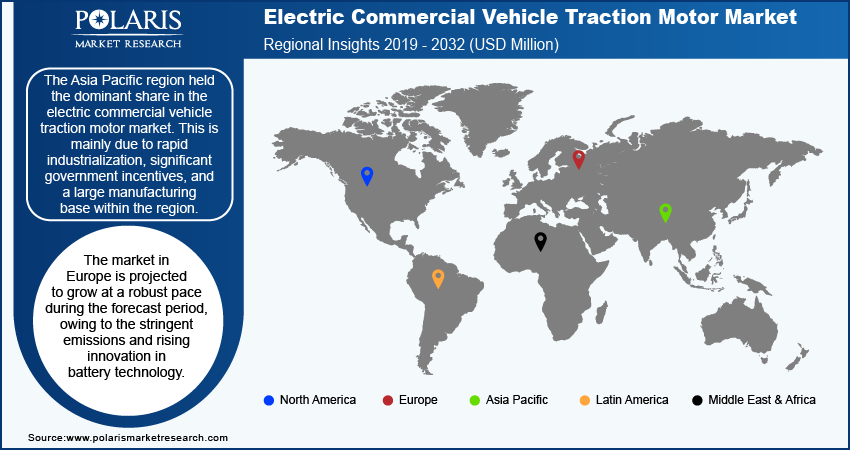

Electric Commercial Vehicle Traction Motor Market Breakdown – Regional Insights

Asia Pacific Held Largest Share of Global Market in 2023

Asia Pacific held the largest share of the electric commercial vehicle traction motor market in 2023. This is mainly due to rapid industrialization, significant government incentives, and a large manufacturing base within the region. Countries such as China and India played crucial roles, with China being the leading country in the region due to its robust investments in electric vehicle technology and infrastructure. China's extensive charging station network, substantial subsidies for electric vehicles, and supportive environmental policies have spurred the widespread adoption of electric commercial vehicles. Additionally, the presence of major automotive manufacturers in Asia Pacific, coupled with the region's growing focus on reducing urban pollution, has significantly contributed to the market’s expansion.

The electric commercial vehicle traction motor market in Europe is projected to grow at a robust pace during the forecast period owing to the stringent regulations focusing on reducing emissions. The European Union’s Green Deal and various national policies provide strong incentives for fleet electrification and charging infrastructure development. Countries such as Germany and the Netherlands are leading this transformation. Additionally, Europe’s emphasis on sustainability and innovation, coupled with investments in advanced charging networks, is likely to accelerate the adoption of electric commercial vehicles and their traction motors. For instance, the EU and its stakeholders have developed a plan to invest ∼ €280 billion in charging points by 2030. This plan includes an estimate of the number of public fast chargers needed for trucks and buses.

Electric Commercial Vehicle Traction Motor Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will drive the electric commercial vehicle traction motor market growth. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. A few major players in the electric commercial vehicle traction motor market include AB Volvo, BYD, Daimler AG, GE Motor, BorgWarner Inc., Robert Bosch GmbH, and Tata Motors.

List of Key Players in Electric Commercial Vehicle Traction Motor Market

- AB Volvo

- Allison Transmission, Inc.

- BYD

- Dana Limited

- Mercedes-Benz Group AG

- GEM Motors

- BorgWarner Inc.

- Magna International Inc.

- Robert Bosch GmbH

- Traton SE

- Flash

- Hyundai Motor Company

- Tata Motors

- ZF Friedrichshafen AG

- Suzhou Inovance Automotive Co., Ltd

- Uno Minda Limited

- Zhengzhou Yutong Bus Co., Ltd.

Recent Developments in Industry

- In June 2024, Uno Minda Limited, a global manufacturer of proprietary automotive solutions and systems, announced that it has signed a Technical License Agreement (TLA) with Suzhou Inovance Automotive Co., Ltd., China, for the production and distribution of specific high voltage category electric vehicle products for passenger and commercial vehicles in India.

- In February 2023, Flash, an electronic component maker, entered into a partnership agreement with Slovenia-based GE Motors to boost hub motors production for electric vehicles in the range from 1kw to 15kw.

Report Coverage

The electric commercial vehicle traction motor market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, it covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, vehicle type, power output, motor type, design, transmission, axle architecture, and their futuristic opportunities.

Report Segmentation

The electric commercial vehicle traction motor market is primarily segmented on the basis of vehicle type, power output, motor type, design, transmission, axle architecture, and region.

By Vehicle Type Outlook (Revenue, USD million, 2019–2032)

- Pickup Trucks

- Trucks

- Buses & Coaches

- Vans

By Power Output Outlook (Revenue, USD million, 2019–2032)

- Less than 100 kW

- 100–200 kw

- 200–400 kw

- Above 400 kw

By Motor Type Outlook (Revenue, USD million, 2019–2032)

- Permanent Magnet Synchronous Motor (PMSM)

- AC Induction Motor

- DC Traction Motor

By Design Outlook (Revenue, USD million, 2019–2032)

- Radial Flux

- Axial Flux

By Transmission Outlook (Revenue, USD million, 2019–2032)

- Single-Speed Drive

- Multi-Speed Drive

By Axle Architecture Outlook (Revenue, USD million, 2019–2032)

- Integrated Axle

- Central Drive Unit

By Regional Outlook (Revenue, USD million, 2019–2032)

-

North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Latin America

- Argentina

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

Electric Commercial Vehicle Traction Motor Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,039.15 million |

|

Revenue Forecast in 2032 |

USD 15,032.13 million |

|

CAGR |

28.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Electric Commercial Vehicle Traction Motor Industry Trend Analysis (2023) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global electric vehicle commercial traction motor market size was valued at USD 1,590.22 million in 2023 and is projected to grow to USD 15,032.13 million by 2032.

The global market is projected to register a CAGR of 28.4% during the forecast period.

Asia Pacific accounted for the largest share of the global market.

A few key players in the market are AB Volvo; Allison Transmission, Inc.; BYD; Dana Limited; Mercedes-Benz Group AG; GEM Motors; BorgWarner Inc.; Magna International Inc.; Robert Bosch GmbH; Traton SE; Flash; Hyundai Motor Company; Tata Motors; ZF Friedrichshafen AG; Suzhou Inovance Automotive Co., Ltd; Uno Minda Limited; and Zhengzhou Yutong Bus Co., Ltd.

The buses & coaches segment is projected for significant growth in the global market during 2024–2032.

The 100–200 kW segment dominated the market in 2023.