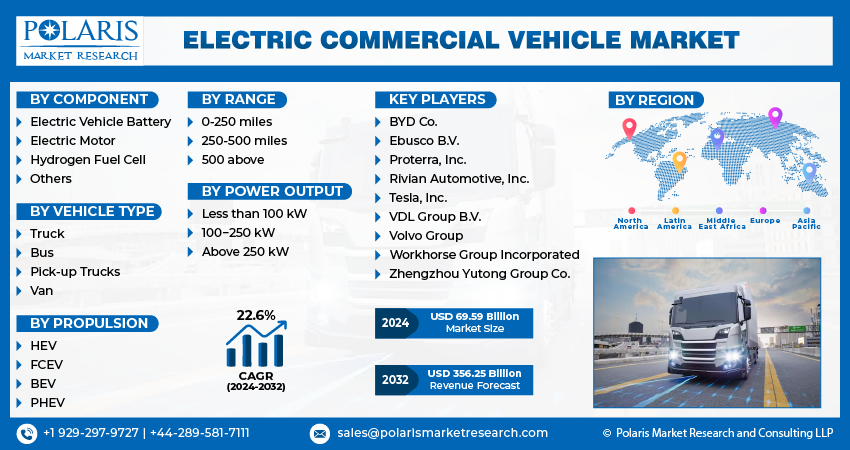

Electric Commercial Vehicle Market Share, Size, Trends, Industry Analysis Report, By Component (Electric Vehicle Battery, Electric Motor, Hydrogen Fuel Cell, Others); By Vehicle Type; By Propulsion; By Range; By Power Output; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4736

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

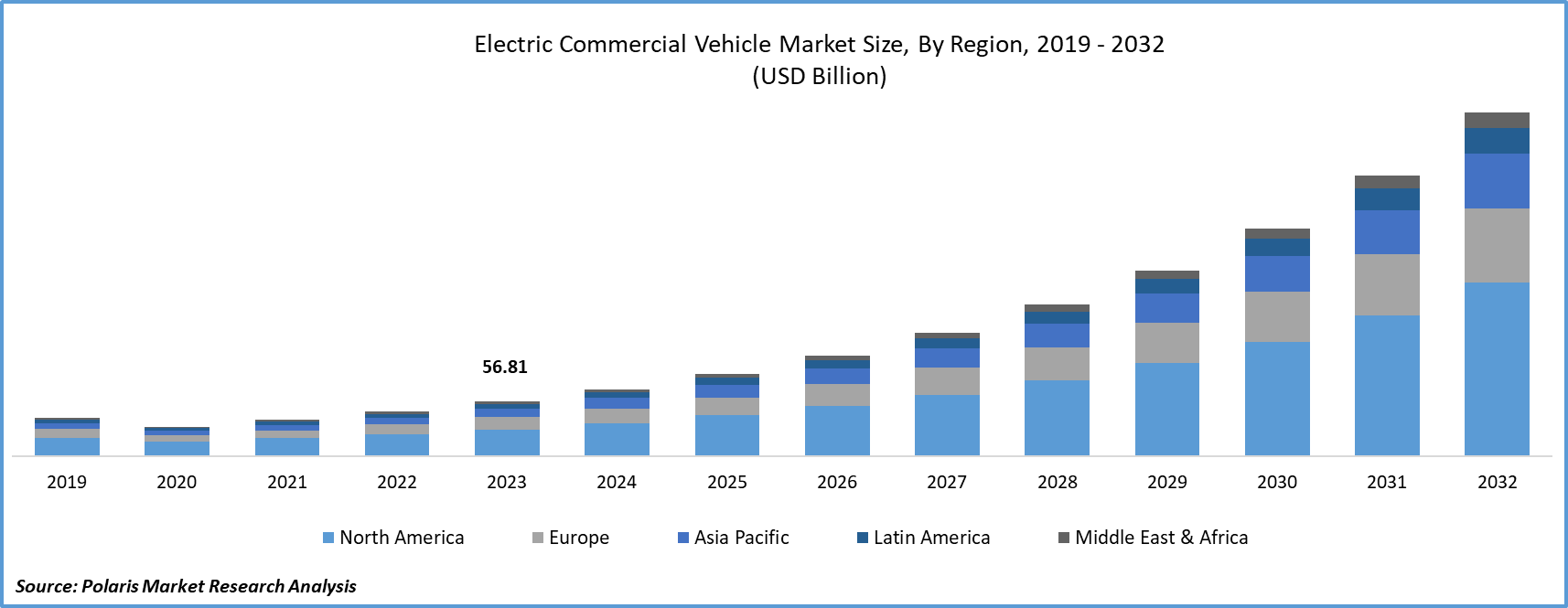

Global electric commercial vehicle market size was valued at USD 56.81 billion in 2023. The market is anticipated to grow from USD 69.59 billion in 2024 to USD 356.25 billion by 2032, exhibiting a CAGR of 22.6% during the forecast period.

Electric Commercial Vehicle Market Overview

Electric commercial vehicles encompass a diverse range of vehicles, from low- to heavy-duty automobiles powered by battery-based electric engines. This category includes tractors, harvesters, loaders, vans, buses, excavators, trucks, and more. The popularity of electric commercial vehicles has grown as an environmentally friendly substitute for gasoline-powered counterparts due to their emission-free operation. Additionally, these vehicles present advantages such as reduced maintenance costs and various operational benefits in commercial sectors. Consequently, electric commercial vehicles have found widespread adoption across diverse industries, including mining, construction, transportation, logistics, and others.

To Understand More About this Research:Request a Free Sample Report

In the automotive industry of late, there is an observed laudable commitment towards manufacturing a cost-effective and road-worthy electric vehicle for public transport. The electric commercial vehicle market is currently in the middle of a growth stage, which is considered to be fueled by the low maintenance and economic stimulation resulting from the use of these vehicles, driving consumer awareness and electric commercial vehicle market size.

The rise of regulations that are positive and reduce the use of vehicles propelled by fuel has eventually contributed to the high demand for electric-powered commercial vehicles. In order to attract more and more enterprises to adopt such passenger cars, the governments keep giving out different incentives in the form of subsidies or tax exemptions. Such initiatives as the electrification of public transport personnel and the increasing popularity of electric vehicles in different commercial deliveries remain the other forces that affect electric commercial vehicle market sales positively.

Battery suppliers are busily taking care of the testing of batteries that are long-lived, safe, and environmentally friendly so as to power energy consumption heavy electric vehicles. The fall in Li-ion batteries with high storage features presents the opportunity for reducing the overall vehicle cost and, hence, the vehicle demand on a global scale. Furthermore, drawdowns on the spending for the revival of electric vehicles' charging stations' networks and integrating smart vehicle technologies, e.g., wireless connectivity, telematics devices, Advanced Driver-Assistance Systems (ADAS), GPS, touch sensors, and others, are deepening the electric commercial vehicle market growth.

Electric Commercial Vehicle Market Dynamics

Market Drivers

Increasing Costs of Fossil Fuels Bolstering the Growth of the Electric Commercial Vehicle Market

Rising expense of traditional fuel, such as gasoline and diesel, is on the constant rise, the transport and logistics firms with large vehicle fleets for commuting will be borne by further increments of operational expenses. The rising trend of fuel prices shows the financial attractiveness of changing to electric vehicles (cars), which possess much lower operational costs and maintenance during their lifespan compared to those of conventional cars. The ECV completely runs on electricity, and thus, electricity becomes the primary source of power, unlike fossil fuels, whose prices are quite erratic in terms of supply and demand. In light of this, the companies whose finances are seriously affected by the high level of fuel prices often choose ECVs to solve their problems. ECV is a very cheap solution for them.

Also, on top of the pollutant’s emission uncertainty driving companies to come up with ECV initiative as a long-term cost reduction strategy and secured financing, the global political tensions, as well as the supply chain disruptions, fuel the unpredictability of future fossil fuel prices, which adds up on companies’ list of objectives of switching to ECVs. As it is, traditional vehicles require their fuel costs to be continuously adjusted to the differences in the electric commercial vehicle market and political situation. The ECVs, on the other hand, provide a stable and predictable solution for the use of transportation expenses. Fossil fuel dependency can be reduced by shaping the business; this can further protect them from the risk of fuel fluctuations. With the enhanced ability to have control over their operating cost, the demand for commercial fleets to shift to ECVs might also grow.

Market Restraints

High Development Costs are Likely to Hamper the Growth of the Market

The progress of electric vehicle technology involves a versatile but extensive investment in research, development, and manufacturing plants. So, electric vehicle funding was meant to be for new technologies like batteries, electric drivetrains, and also electric-specific components such as engines. The capital-intensive front-end expenses act as a pit-trap for the small-scale manufacturers who lack the financial patent the advanced research and development projects. This factor actually leads to the case of Electric Commercial Vehicles (ECVs) being much more expensive than the newer model of conventional commercial vehicles in the beginning, which cannot be easily accessible for companies with a stricter budget.

Moreover, high research and development expenditures for electric vehicles introduce a barrier for the ingenious investors who want to inject capital into the production of electric cars, which ultimately leads to a scarcity of these vehicles on the market. Product innovators are forced to pay their R&D expenditures, which, in turn, extends the time needed for new models to catch the price advantage that conventional vehicles have. This tariff may become an obstacle for enterprises to make the move to electric fleets, especially if the delay in a return is too big or there is too much uncertainty over the payback period. Therefore, cheap long-term vehicle maintenance is a predicted advantage of ECVs during use. However, the high start-up cost needed for development and production discourages the rapid spread of electric commercial vehicles, a major hurdle.

Report Segmentation

The market is primarily segmented based on component, vehicle type, propulsion, range, power output, and region.

|

By Component |

By Vehicle Type |

By Propulsion |

By Range |

By Power Output |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Electric Commercial Vehicle Market Segmental Analysis

By Component Analysis

The electric vehicle battery category is anticipated to experience a higher CAGR over the forecasted period, primarily fueled by the escalating demand for Electric Vehicles (EVs) and emission control systems. The surge in EV popularity is a response to increasing environmental awareness and the pressing need to address pollution concerns. Governments across numerous nations have responded to this by enacting regulations that incentivize and promote the development and adoption of EVs.

This regulatory push, coupled with the broader societal shift towards sustainability, is driving the expansion of the EV battery market as manufacturers strive to meet the rising demand for electric vehicles and contribute to emissions reduction efforts. The convergence of consumer demand, regulatory support, and environmental consciousness is propelling the growth trajectory of the EV battery category, making it a pivotal element in the broader shift towards a greener and more sustainable automotive landscape.

By Vehicle Type Analysis

The Bus segment accounted for the largest share of the electric commercial vehicle market in 2023. The increasing focus on sustainable and eco-friendly urban mobility solutions has positioned electric buses as a vital component of public transportation systems. Cities globally are adopting electric buses to reduce emissions, improve air quality, and address urban congestion. Government incentives, subsidies, and regulations promoting the adoption of electric vehicles, especially in public transportation fleets, play a crucial role. Many governments worldwide are incentivizing the transition to electric buses to achieve emission reduction targets and combat climate change.

Electric buses offer long-term cost savings in terms of operational and maintenance expenses compared to traditional diesel or gasoline-powered buses. Lower fuel and maintenance costs contribute to a favorable Total Cost of Ownership, making electric buses an attractive option for fleet operators. Technological advancements in battery technology, including improved energy density and charging infrastructure, have addressed historical limitations. These developments enable electric buses to cover longer distances on a single charge, making them more viable for public transportation routes.

Electric Commercial Vehicle Market Regional Insights

The Asia Pacific Region Dominated the Global Market with the Largest Share in 2023

In 2023, the Asia Pacific region dominated the largest market share in electric commercial vehicles, attributed primarily to the flourishing Chinese electric bus industry. Many countries in the Asia Pacific region have implemented robust government initiatives and policies to promote electric vehicles (EVs), including commercial vehicles. Subsidies, incentives, and favorable regulations have accelerated the adoption of electric commercial vehicles.

Rapid urbanization in Asia Pacific cities has led to increased pollution and environmental concerns. Governments and municipalities are actively promoting electric commercial vehicles to address air quality issues and reduce the environmental impact of transportation. Economic growth in the Asia Pacific region has resulted in increased demand for transportation services. As countries invest in infrastructure development, there is a simultaneous push toward sustainable and electric modes of transportation, including commercial vehicles.

Furthermore, owing to innovations, substantial research and development efforts, and technological advancements in Electric Vehicles (EVs) within the region, the North American region is projected to witness significant revenue growth over the forecast period. The United States stands out as one of the primary hotspots for EVs in the region, contributing significantly to the market's stability and development. Furthermore, the increasing consumer demand for electric commercial vehicles and a growing public awareness regarding the environmental risks associated with fossil fuels are anticipated to act as driving factors, fostering market growth in this sector.

Competitive Landscape

The competitive landscape in the Electric Commercial Vehicle (ECV) market is dynamic and evolving, reflecting the transformative shift towards sustainable transportation solutions. As governments worldwide emphasize decarbonization and stringent emission regulations, key players in the industry are engaged in intense competition to establish market dominance. Established automotive manufacturers, emerging electric vehicle (EV) startups, and technology giants are all vying for a strategic position in this burgeoning market.

Some of the major players operating in the global market include:

- BYD Co.

- Ebusco B.V.

- Proterra, Inc.

- Rivian Automotive, Inc.

- Tesla, Inc.

- VDL Group B.V.

- Volvo Group

- Workhorse Group Incorporated

- Zhengzhou Yutong Group Co.

Recent Developments

- In February 2024, EKA Mobility introduced the Revolutionary 1.5-tonne ELCV (Electric Light Commercial Vehicles) at the Bharat Mobility Global Expo. This launch represents a major achievement in the company's endeavor to reshape the electric commercial vehicle sector with sustainable transportation solutions.

- In April 2023, a cloud-based EV fleet charging software platform was introduced by Proterra Valence, in collaboration with Delaware Transit Corporation. Valence, a software-as-a-service platform, is tailored to enhance the efficiency of commercial electric vehicle fleets. It offers a comprehensive set of solutions featuring data analytics, charger, and vehicle diagnostics, along with energy management and charger optimization tools.

Report Coverage

The electric commercial vehicle market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive components, vehicle type, propulsion, range, power output and futuristic growth opportunities.

Electric Commercial Vehicle Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 69.59 billion |

|

Revenue Forecast in 2032 |

USD 356.25 billion |

|

CAGR |

22.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Vehicle Type, By Propulsion, By Propulsion, By Power Output, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

Electric Commercial Vehicle Market Size Worth $356.25 Billion By 2032

Key players in the market are BYD Co., Ebusco B.V., Proterra, Inc., Rivian Automotive, Inc., Tesla, Inc

Asia Pacific contribute notably towards the global Electric Commercial Vehicle Market

Electric Commercial Vehicle Market exhibiting a CAGR of 22.6% during the forecast period.

The Electric Commercial Vehicle Market report covering key segments are component, vehicle type, propulsion, range, power output, and region.