Electric Bikes/E-Bikes Market Size, Share, Trends, Industry Analysis Report: By Product, Battery Type (Lead Acid Batteries, Lithium-ion (Li-ion) Batteries, and Others), Usage, Drive Mechanism, Application, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 121

- Format: PDF

- Report ID: PM1357

- Base Year: 2024

- Historical Data: 2020-2023

Electric Bikes/E-Bikes Market Overview

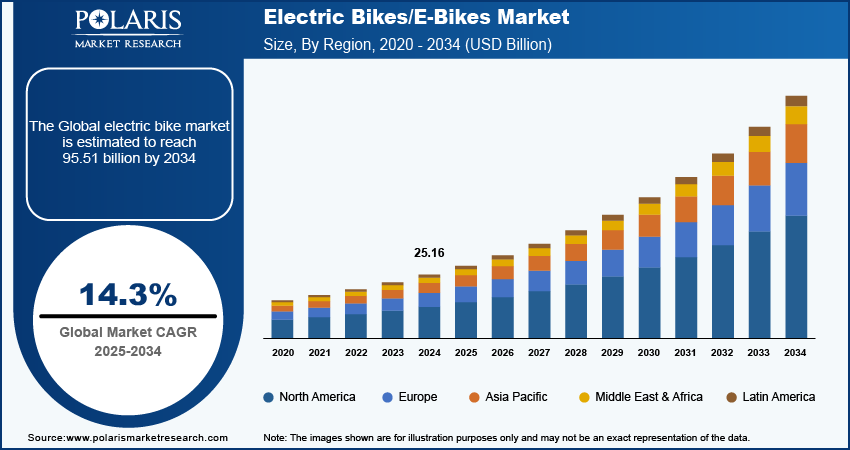

The e-bikes market size was valued at USD 25.16 billion in 2024. The market is projected to grow from USD 28.67 billion in 2025 to USD 95.51 billion by 2034, exhibiting a CAGR of 14.3% from 2025 to 2034.

An electric bike (e-bike) is a bicycle equipped with an electric motor and battery to assist with pedaling, allowing riders to pedal with less effort. These bikes offer various modes, including pedal-assist and full electric.

The electric bike (e-bike) market is rapidly expanding, driven by growing demand for eco-friendly transportation and advancements in battery technology. E-bikes offer a convenient, energy-efficient alternative to traditional bicycles and motor vehicles, appealing to commuters, recreational riders, and delivery services. Additionally, governments worldwide are promoting e-bike adoption through incentives and infrastructure development to reduce carbon emissions. For instance, a 2023 report by the European Commission highlighted the launch of a subsidy program in France offering up to €4,000 approx (USD 4,350.28) for citizens trading in their old cars for electric bicycles. This initiative aims to reduce carbon emissions by encouraging the switch from motor vehicles to more sustainable transportation.

To Understand More About this Research: Request a Free Sample Report

The market benefits from innovations such as lightweight frames, improved motor efficiency, and extended battery life. Furthermore, increasing urbanization and the popularity of cycling for health and fitness fuel the demand for e-bikes, making the sector a key player in the future of sustainable mobility.

Electric Bikes/E-Bikes Market Driver Analysis

Growing Demand for Sustainable and Smart E-Bike Solutions

Growing environmental awareness and concerns about climate change are driving consumers to seek sustainable transportation solutions, with e-bikes emerging as a popular zero-emission option. The increasing urbanization and traffic congestion in cities further support e-bike adoption, offering a practical way to navigate busy streets and avoid parking problems. Additionally, advancements in battery and motor technology, combined with smart features, are improving the appeal and functionality of e-bikes, making them a more viable and attractive choice for modern commuters. For instance, Royal Dutch Gazelle, a bicycle manufacturer in the Netherlands, introduced the "Gazelle Eclipse Series," featuring advanced smart features designed for rider convenience. The new series includes built-in GPS tracking, compact folding designs, and ABS braking, offering a combination of innovation and practicality for cyclists.

Government Support and Cost Advantages

Government incentives and supportive policies, such as subsidies and tax benefits, are playing a significant role in promoting e-bike use. For instance, the government of Canada has introduced a 15% tax credit for the purchase of e-bikes, with a maximum credit of $1000. The development of cycling infrastructure further facilitates the integration of e-bikes into urban transport networks. E-bikes offer a cost-effective alternative to traditional vehicles with lower operating costs and reduced maintenance. As consumer preferences shift towards convenience, flexibility, and an active lifestyle, coupled with rising fuel costs and increased public awareness, the e-bike market is well-positioned for continued expansion.

Electric Bikes Market Segment Analysis

E-Bikes Market Breakdown by Product Outlook

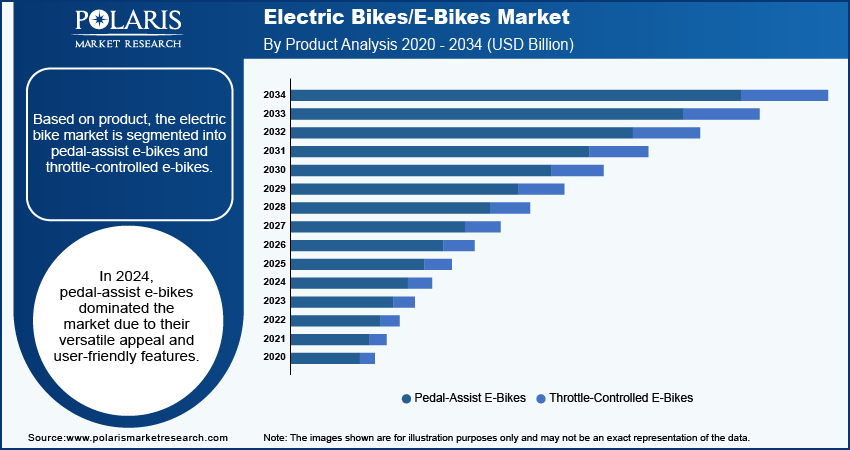

The electric bikes/e-bikes market segmentation, based on product, includes pedal-assist e-bikes and throttle-controlled e-bikes. In 2024, pedal-assist e-bikes dominated the market due to their versatile appeal and user-friendly features. These e-bikes provide a natural cycling experience while giving riders the option of electric assistance when needed, making them suitable for a wide range of users, from commuters to recreational cyclists. Pedal-assist models are also favored for their ability to extend the range and reduce rider tiredness, making longer trips more effortless and enjoyable. Additionally, their regulatory acceptance in many regions, where they are classified similarly to traditional bicycles, has facilitated widespread adoption. Thus, the combination of convenience, health benefits, and adaptability has made pedal-assist e-bikes the preferred choice for many consumers.

Electric Bikes Market Breakdown By Battery Type Analysis

The e-bikes market segmentation, based on battery type, includes lead acid batteries, lithium-ion (Li-ion) batteries, and others. The lithium-ion (Li-ion) batteries segment is expected to grow at a significant CAGR during the forecast period due to the superior performance characteristics of Li-ion batteries as compared to other battery types. Li-ion batteries are known for their high energy density, which enables longer ranges on a single charge, making them ideal for urban commuting and recreational cycling. Also, they are lighter and more compact than lead-acid batteries, contributing to the overall weight reduction of electric bikes and improving their maneuverability. The growing availability of cost-effective lithium-ion solutions has facilitated their widespread adoption among manufacturers, who increasingly favor them for new e-bike models. Thus, this combination of performance, efficiency, and affordability has solidified lithium-ion batteries as the preferred choice in the electric bike market.

Electric Bikes/E-Bikes Market Breakdown by Regional Outlook

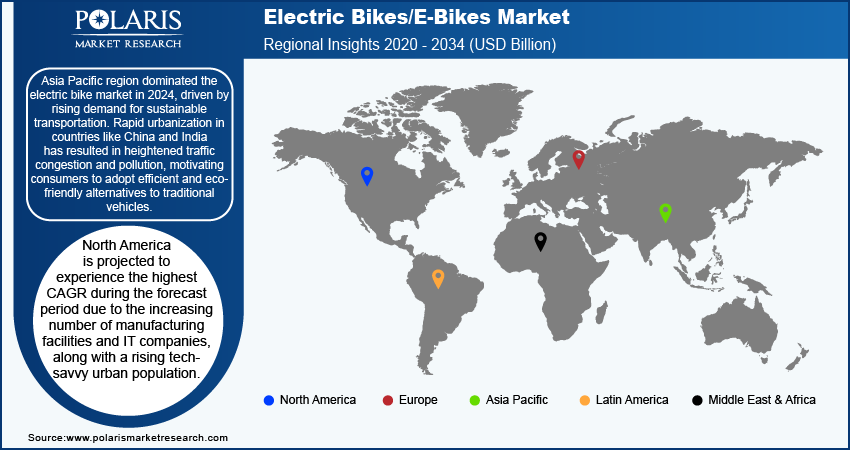

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the electric bikes/e-bikes market in 2024 due to the growing demand for sustainable transportation solutions. Rapid urbanization in countries like China and India has led to increased traffic congestion and pollution, prompting consumers to seek efficient and eco-friendly alternatives to traditional vehicles. Additionally, government initiatives in the region are actively promoting e-bike adoption through subsidies, tax incentives, and investments in cycling infrastructure. The region is also home to a significant number of manufacturers, including industry leaders such as Yamaha and Giant, which contribute to lower production costs and a wider availability of e-bikes in various models and price ranges. As a result, the Asia Pacific market has seen substantial growth, with China being the largest contributor, boasting millions of e-bikes on the road.

North America is projected to experience the highest CAGR during the forecast period. This growth can be attributed to the increasing number of manufacturing facilities and IT companies, along with a rising tech-savvy urban population. Additionally, the region benefits from lower raw material costs, which is expected to create significant opportunities for market expansion.

Electric Bikes Market – Key Players & Competitive Insights

The competitive landscape of the electric bike market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic partnerships, and geographic expansion. Major companies in the market, such as Accell Group, River, Hornback, and others, leverage their robust research and development capabilities along with extensive distribution networks to deliver advanced e-bike solutions tailored to diverse applications, including urban commuting, recreational use, and delivery services. These leading manufacturers focus on product innovation, improving battery efficiency and motor performance, and integrating smart technology to meet the evolving demands of consumers seeking sustainable transportation options.

Simultaneously, smaller regional firms are emerging with specialized e-bike models designed for specific markets, offering unique features and customized solutions. Competitive strategies within this market encompass mergers and acquisitions, collaborations with technology firms, and widening product portfolios to improve their presence in key regions. Major players in the electric bikes/e-bikes market include Accell Group; River; Hornback; Fuji-ta Bicycle Co., Ltd.; Giant Bicycles; Jiangsu Xinri E-Vehicle Co. Ltd.; Mahindra & Mahindra Limited; Pedego Electric Bikes; Prodeco Technologies LLC; Robert Bosch GmbH; Shimano Inc.; Tianjin Golden Wheel Group Co., Ltd.; Trek Bicycle Corporation; VanMoof; and Yamaha Motor Co. Ltd.

River Mobility Private Limited, founded in 2021 in Bengaluru, India, is focused on the utility lifestyle segment of the electric vehicle market. Their flagship product, the Indie e-scooter, launched in October 2023 and quickly sold around 1,500 units. The company plans to expand significantly, aiming to open 50 stores by March 2025 and 100 by March 2026. In October 2023, River Mobility secured $40 million in funding from Yamaha Motor Company for their electric bike development.

Hornback is an innovative startup based in Hyderabad, specializing in the design and production of electric bikes (e-bikes) and associated technologies. The company is dedicated to integrating advanced solutions aimed at optimizing the riding experience while enhancing the accessibility of sustainable transportation alternatives. By leveraging advanced engineering and smart technology, Hornback seeks to push the boundaries of e-bike performance and user engagement. In November 2023, Mahindra & Mahindra announced its strategic investment in Hornback. This investment helps Hornback to launch innovative and portable e-bikes.

List of Key Companies in the E-Bikes Industry Outlook

- Accell Group

- River Mobility Private Limited

- Hornback

- Fuji-ta Bicycle Co., Ltd.

- Giant Bicycles

- Jiangsu Xinri E-Vehicle Co. Ltd.

- Mahindra & Mahindra Limited

- Pedego Electric Bikes

- Prodeco Technologies LLC

- Robert Bosch GmbH

- Shimano Inc.

- Tianjin Golden Wheel Group Co., Ltd.

- Trek Bicycle Corporation

- VanMoof

- Yamaha Motor Co. Ltd.

Electric Bikes Industry Developments

January 2024: The Swiss company Stormer developed solid-state batteries that offer high power output. This will help manufacturers to develop long-range electric bikes, catering to the rising demand for long-range bikes.

March 2024: San Francisco enhanced their incentives for e-bike purchases by providing subsidies and rebates. These efforts aim to promote e-bike adoption and support sustainable transportation initiatives.

April 2024: Bosch launched its latest e-bike system, which integrates advanced smart features such as real-time navigation, theft protection, and connectivity with mobile apps. The new system aims to enhance the user experience and safety.

Electric Bikes Market Segmentation

By Product Outlook (Revenue, USD Billion; 2020–2034)

- Pedal-Assist E-Bikes

- Throttle-Controlled E-Bikes

By Battery Type Outlook (Revenue, USD Billion; 2020–2034)

- Lead Acid Batteries

- Lithium-ion (Li-ion) Batteries

- Others

By Usage Outlook (Revenue, USD Billion; 2020–2034)

- Mountain/Trekking E-Bikes

- City/Urban E-Bikes

- Cargo E-Bikes

- Specialized E-Bikes

By Drive Mechanism Outlook (Revenue, USD Billion; 2020–2034)

- Hub Motor E-Bikes

- Mid-Drive E-Bikes

- All-Wheel Drive (AWD) E-Bikes

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Cargo/Utility

- City/Urban

- Trekking

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electric Bikes/E-Bikes Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 25.16 Billion |

|

Market Size Value in 2025 |

USD 28.67 Billion |

|

Revenue Forecast in 2034 |

USD 95.51 Billion |

|

CAGR |

14.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Electric Bikes/E-Bikes Industry Trends Analysis (2024) Company profiles/industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The electric bikes/e-bikes market was valued at USD 25.16 billion in 2024 and is projected to grow to USD 95.51 billion by 2034.

The market is projected to register a CAGR of 14.3% from 2025 to 2034

Asia Pacific held the largest market share in the global market.

The key players in the market are Accell Group; River; Hornback; Fuji-ta Bicycle Co., Ltd.; Giant Bicycles; Jiangsu Xinri E-Vehicle Co. Ltd.; Mahindra & Mahindra Limited; Pedego Electric Bikes; Prodeco Technologies LLC; Robert Bosch GmbH; Shimano Inc.; Tianjin Golden Wheel Group Co., Ltd.; Trek Bicycle Corporation; VanMoof; and Yamaha Motor Co. Ltd.

Lithium-ion (Li-ion) batteries are expected to register a significant CAGR during the forecast period.

Pedal-assist electric bikes dominated the electric bike market in 2024.