Electric AC Motors Market Size, Share, Trends, Industry Analysis Report: By Motor Type (Induction Motors, Synchronous Motors, and Others), Power Output, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 128

- Format: PDF

- Report ID: PM1605

- Base Year: 2024

- Historical Data: 2020-2023

Electric AC Motors Market Overview

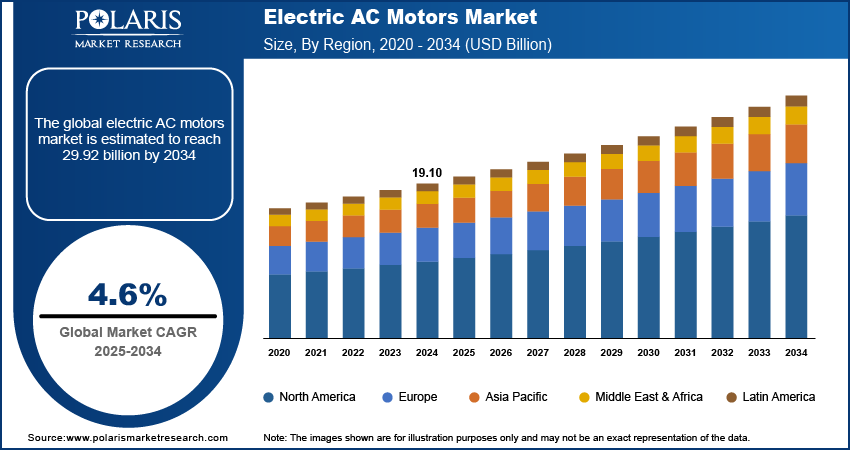

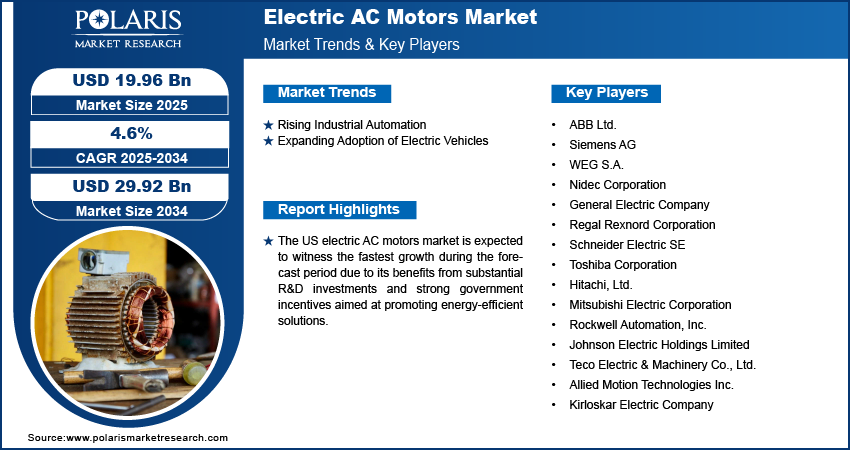

The electric AC motors market size was valued at USD 19.10 billion in 2024. The market is projected to grow from USD 19.96 billion in 2025 to USD 29.92 billion by 2034, exhibiting a CAGR of 4.6% during 2025–2034.

The electric AC motors market refers to the global industry focused on the production, distribution, and adoption of alternating current (AC) electric motors, which are widely used in industrial, commercial, and residential applications. The global electric AC motors market focuses on motors that utilize alternating current (AC) to convert electrical energy into mechanical energy. These motors are integral to numerous sectors, including industrial machinery, HVAC systems, residential appliances, and electric vehicles (EVs). The electric AC motors market growth is driven by the increasing adoption of energy-efficient systems and the ongoing shift toward industrial automation.

To Understand More About this Research: Request a Free Sample Report

Technological advancements in materials and motor designs, such as improved insulation and permanent magnet technologies, are enhancing performance while reducing energy consumption. This ensures that AC motors remain pivotal in applications requiring reliable and cost-effective mechanical energy conversion. Furthermore, the surge in renewable energy projects and the integration of AC motors with digital technologies such as IoT and AI are driving electric AC motors market expansion. These innovations enable smarter motor management, such as predictive maintenance and real-time performance monitoring, making AC motors more sustainable and efficient for modern applications.

Electric AC Motors Market Dynamics

Rising Industrial Automation

Owing to the rise of Industry 4.0, industries across the globe are adopting advanced automation technologies to enhance productivity, reduce human error, and improve operational efficiency. Electric AC motors, which are key components in automated systems, are being extensively used in various industrial applications, such as conveyors, pumps, robotics, and manufacturing equipment. These motors offer high efficiency, durability, and reliability, making them essential for powering automated machinery. As industries such as manufacturing, automotive, and consumer electronics continue to embrace automation, the demand for electric AC motors is projected to rise during the forecast period. Additionally, advancements in motor control systems, such as variable frequency drives (VFDs), further support the increased utilization of electric AC motors in automation applications. Thus, the increasing demand for industrial automation drives the electric AC motors market growth.

Expanding Adoption of Electric Vehicles

This growing trend toward sustainable transportation contributes to the rising demand for electric vehicles (EVs). According to the International Energy Agency, in 2023, the automotive sector witnessed over 250,000 new vehicle registrations weekly, exceeding the total for 2013. Electric vehicles accounted for about 18% of sales, up from 14% in 2022 and just 2% in 2018, highlighting the rapid growth of electric mobility. As governments worldwide continue to implement stricter emissions regulations and offer incentives for EV adoption, the automotive industry is witnessing a significant shift toward electrification. Electric AC motors, especially induction motors, play a crucial role in the propulsion systems of EVs due to their efficiency, longevity, and performance characteristics. With the increasing number of EVs being produced, demand for electric AC motors is expected to surge in the coming years, particularly in the commercial and passenger vehicle segments. Furthermore, advancements in motor technology and energy management systems are enhancing the overall performance and range of EVs, further accelerating the transition from internal combustion engine vehicles to electric vehicles. Therefore, the expanding adoption of electric vehicles (EVs) is another significant factor that will fuel the electric AC motors market value during the forecast period.

Electric AC Motors Market Segment Insights

Electric AC Motors Assessment by Motor Type Outlook

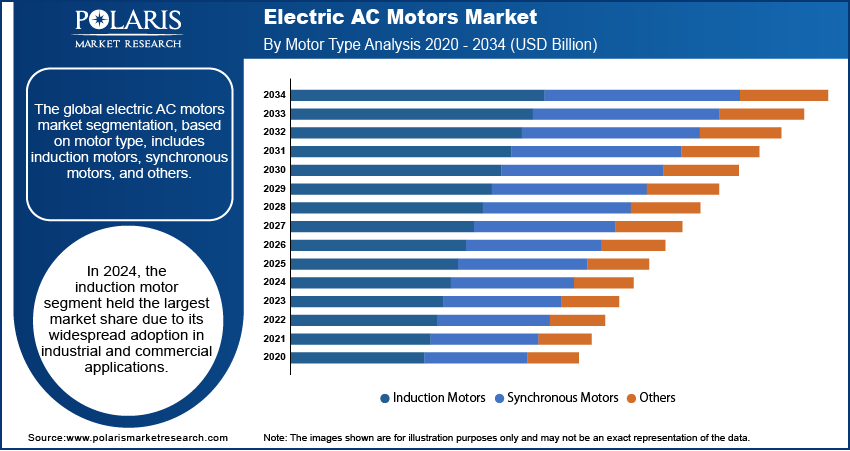

The global electric AC motors market segmentation, based on motor type, includes induction motors, synchronous motors, and others. In 2024, the induction motor segment held the largest market share due to its widespread adoption in industrial and commercial applications. These motors are highly durable, cost-effective, and capable of handling high loads, making them suitable for heavy machinery in manufacturing and construction. Their reliability in harsh operational conditions further solidifies their preference across industries.

Electric AC Motors Assessment by Application Outlook

The global electric AC motors market, based on application, is segmented into industrial machinery, HVAC equipment, electric vehicles (EVs), home appliances, and others. In 2024, the electric vehicles (EVs) segment held the largest market share due to the rising global demand for EVs and the associated need for efficient motor systems. Automakers increasingly invest in AC motors that provide high torque, superior performance, and energy efficiency, ensuring optimal battery usage. These characteristics align with the sustainability goals of major EV manufacturers, boosting their market share significantly.

Electric AC Motors Market Regional Analysis

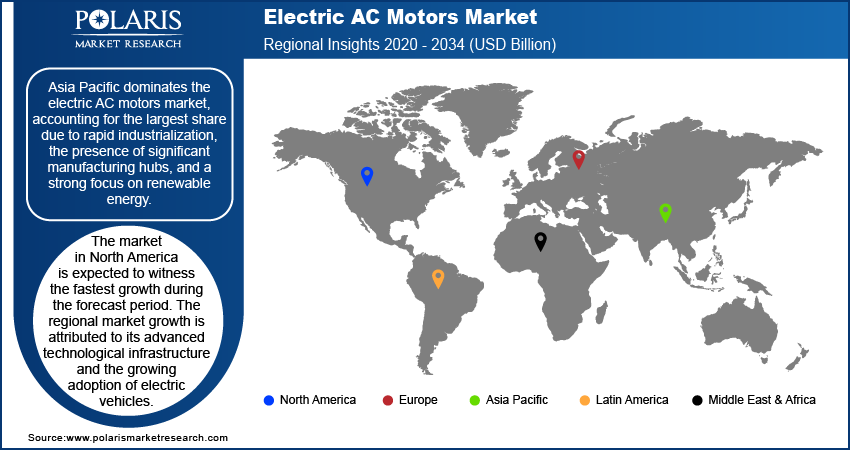

Asia Pacific dominates the electric AC motors market share in 2024 due to rapid industrialization, the presence of significant manufacturing hubs, and a strong focus on renewable energy. According to the report by Asia’s Energy Transition, in 2022, Asia accounted for around 65% of global renewable energy investment, rising 13% year-over-year to USD 532 billion. By 2030, investments in Asia Pacific are expected to double to USD 1.3 trillion, overtaking the previous decade's levels. Countries such as China and India are major contributors, with China leading the regional market. China's dominance is propelled by its leadership in electric vehicle production, backed by substantial government subsidies and policies promoting clean energy solutions. Additionally, the region's expanding infrastructure projects and investments in smart cities drive the demand for AC motors in HVAC systems and industrial machinery.

North America is expected to witness the fastest growth during the forecast period. The region's growth is attributed to its advanced technological infrastructure and the growing adoption of electric vehicles. The US electric AC motors market is expected to witness the fastest growth during the forecast period due to its benefits from substantial R&D investments and strong government incentives aimed at promoting energy-efficient solutions. These factors, coupled with increasing renewable energy installations, position North America as a rapidly growing market for electric AC motors.

Electric AC Motors Market – Key Players and Competitive Analysis Report

The competitive landscape of the Electric AC Motors Market features global leaders and regional players competing for market share through technological innovation, strategic partnerships, and regional expansion. Leading companies leverage strong R&D capabilities, advanced motor technologies, and extensive distribution networks to develop high-efficiency solutions that meet the rising demand for energy-efficient, smart, and industrial automation-driven motors. Market trends highlight the growing adoption of digitalization, IoT-enabled motor monitoring, and sustainable manufacturing practices driven by industrial automation, electrification of transportation, and regulatory energy-efficiency standards.

Global players focus on strategic investments, mergers & acquisitions, and joint ventures to strengthen their market position, while post-merger integration and strategic alliances play a crucial role in expanding regional footprints. Regional companies address localized industrial and infrastructure needs by offering cost-effective and customized solutions, leveraging regional economic landscapes and energy policies. Competitive benchmarking includes market entry strategies, expansion opportunities, and ecosystem partnerships to support the demand for next-generation, high-performance motors.

The market is experiencing technological advancements, such as sensor-equipped smart motors, variable frequency drive (VFD) integration, and AI-driven predictive maintenance, reshaping industry ecosystems. Companies are investing in supply chain resilience, procurement strategies, and sustainability transformations to align with the demand for energy-efficient and environmentally friendly electric motors. Pricing strategies, revenue growth analysis, and competitive intelligence remain critical for identifying opportunities and driving long-term market profitability.

A few key major players are ABB Ltd.; Siemens AG; WEG S.A.; Nidec Corporation; General Electric Company; Regal Rexnord Corporation; Schneider Electric SE; Toshiba Corporation; Hitachi, Ltd.; Mitsubishi Electric Corporation; Rockwell Automation, Inc.; Johnson Electric Holdings Limited; Teco Electric & Machinery Co., Ltd.; Allied Motion Technologies Inc.; and Kirloskar Electric Company.

ABB Group is a global technology and automation company, providing solutions across industries like power generation, electrification, automation, and robotics. ABB has grown into a multinational corporation with a presence in over 100 countries. The company's mission is to deliver advanced technology that enables sustainable growth while addressing the world's energy and industrial challenges. ABB plays a significant role in the ocean economy through its wide array of technologies that support the maritime industry, offshore energy production, and renewable energy projects. The company's expertise spans automation, electrical systems, and digitalization, which are critical for improving efficiency, sustainability, and safety in ocean-based industries.

General Electric is a global industrial company that operates in China, Europe, the Americas, the Middle East, Asia, and Africa. The compnay has four segments: Renewable Energy, Aviation, Power, and Healthcare. The Power segment offers gas and steam turbines, as well as software solutions for power generation, industrial, government, and other customers. It also provides upgrade and service solutions. The Aviation segment produces and designs military and commercial aircraft engines, electric power, integrated engine components, and mechanical aircraft systems; and provides aftermarket services.

Key Companies in Electric AC Motors Market Outlook

- ABB Ltd.

- Siemens AG

- WEG S.A.

- Nidec Corporation

- General Electric Company

- Regal Rexnord Corporation

- Schneider Electric SE

- Toshiba Corporation

- Hitachi, Ltd.

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Johnson Electric Holdings Limited

- Teco Electric & Machinery Co., Ltd.

- Allied Motion Technologies Inc.

- Kirloskar Electric Company

Electric AC Motors Market Developments

In September 2024, WEG, one of the largest manufacturers of electric motors, announced the signing of agreements to acquire Volt Electric Motors, a Turky-based manufacturer of industrial and commercial electric motors that is currently a subsidiary of the Saya Group. The acquisition will help Weg expand its presence in the region of Turkey and all of Europe.

In May 2024, ABB, a global engineering company that focuses on electrification and automation, announced the launch of an innovative new package consisting of an electric AC motor AMXE250 and HES580 inverter tailored for electric buses.

In March 2023, Siemens completed the acquisition of C&S Electric in India for USD 245.86 million to strengthen its motor portfolio and presence in India.

Electric AC Motors Market Segmentation

By Motor Type Outlook (Revenue, USD Billion, 2020–2034)

- Induction Motors

- Synchronous Motors

- Others

By Power Output Outlook (Revenue, USD Billion, 2020–2034)

- Less than 1 HP

- 1 HP to 10 HP

- More than 10 HP

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Industrial Machinery

- HVAC Equipment

- Electric Vehicles (EVs)

- Home Appliances

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electric AC Motors Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 19.10 Billion |

|

Market Size Value in 2025 |

USD 19.96 Billion |

|

Revenue Forecast by 2034 |

USD 29.92 Billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion; 2020–2034 and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global electric AC motors market size was valued at USD 19.10 billion in 2024 and is projected to grow to USD 29.92 billion by 2034.

The global market is projected to register a CAGR of 4.6% during 2025–2034.

In 2024, Asia Pacific dominated the electric AC motors market, accounting for the largest share due to rapid industrialization, the presence of significant manufacturing hubs, and a strong focus on renewable energy.

A few key players in the market are ABB Ltd.; Siemens AG; WEG S.A.; Nidec Corporation; General Electric Company; Regal Rexnord Corporation; Schneider Electric SE; Toshiba Corporation; Hitachi, Ltd.; Mitsubishi Electric Corporation; Rockwell Automation, Inc.; Johnson Electric Holdings Limited; Teco Electric & Machinery Co., Ltd.; Allied Motion Technologies Inc.; and Kirloskar Electric Company.

In 2024, the induction motor segment accounted for the largest market share due to its widespread adoption in industrial and commercial applications.

In 2024, the electric vehicles (EVs) segment held the dominant market share due to the rising global demand for EVs and the associated need for efficient motor systems.