Elastomer Gel in Personal Care Market Size, Share, Trends, Industry Analysis Report: By Product Type, Application (Skin Care Cosmetics, Hair Care, Oral Care, and Other Sources), End User, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5306

- Base Year: 2024

- Historical Data: 2020-2023

Elastomer Gel in Personal Care Market Overview

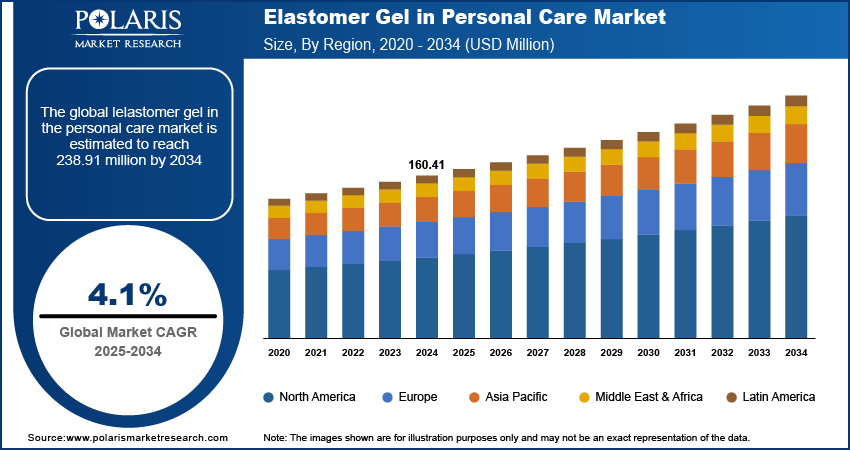

The elastomer gel in personal care market size was valued at USD 160.41 million in 2024. The market is projected to grow from USD 166.79 million in 2025 to USD 238.91 million by 2034, exhibiting a CAGR of 4.1% during the forecast period.

Elastomer gels in personal care are flexible, silicone-based materials used in cosmetic formulations to improve texture, spreadability, and sensory feel. These gels provide a smooth, lightweight finish, making them ideal for products such as skin and hair care lotions and creams.

The elastomer gel in personal care market has been experiencing steady growth, driven by the increasing demand for high-performance, innovative ingredients in skincare, haircare, and cosmetic products. Growing consumer preference for products that offer lightweight, non-greasy, and long-lasting effects has led to elastomer gels becoming a major ingredient in premium personal care formulations, as they provide enhanced sensory experiences, smooth application, and improved product stability.

For instance, in March 2023, Momentive Performance Materials Inc. introduced its HARMONIE line, a new range of natural and high-performance ingredients for the beauty and personal care sector. This launch includes HARMONIE Soft Fluid, an emollient for improved spreadability; HARMONIE Silken Gum, a naturalized silicone gum; and HARMONIE Luxe-4 Powder, a natural silica microsphere. Moreover, the rise in demand for clean beauty products and sustainable ingredients has also fueled market growth, as elastomer gels are often featured in formulations that meet consumer preferences. Additionally, advancements in gel formulations that focus on improved performance and stability are expected to drive further adoption across various personal care categories.

To Understand More About this Research: Request a Free Sample Report

Elastomer Gel in Personal Care Market Dynamics

Rising Demand for Personal Care Products

The rising demand for personal care products is driving the elastomer gel market as consumers increasingly seek lightweight, high performance, and non-greasy formulations. Elastomer gels offer improved texture, long-lasting effects, and smooth application, making them ideal for skincare, haircare, and cosmetic products. For instance, in April 2020, Elkem Silicones launched the PURESIL series of elastomer gels, offering superior beauty enhancement with smaller particle sizes for improved skin sensorial effects and wrinkle blurring. The products are derived from sugar cane, and suitable for various personal care applications, including skin care, color cosmetics, and sun care, with benefits such as anti-aging, UV protection, and texture modification.

Consumers become more conscious of ingredient quality, as elastomer gel's ability to provide clean, sustainable, and stable solutions further aligns with the growing preference for premium, eco-friendly beauty products. Thus, this shift towards advanced formulations fuels the adoption of elastomer gels in personal care products.

Rising Regulatory Standards on Growth of Elastomer Gels in Personal Care

Regulatory standards play a crucial role in driving the elastomer gel in personal care market growth by ensuring product safety and quality. Stricter regulations around ingredient transparency, safety protocols, and sustainability are pushing manufacturers to adopt high-quality elastomer gels that meet these standards. For instance, a report from the California Legislative Counsel in September 2022 announced new legislation effective January 1, 2025, banning the manufacture, sale, and distribution of cosmetics with intentionally added perfluoroalkyl and polyfluoroalkyl substances (PFAS). This measure aims to reduce hazardous chemicals in personal care products and enhance consumer safety.

The growing consumer focus on clean beauty and safe ingredients creates an increasing demand for elastomer gels that comply with regulatory standards and are environmentally friendly. As a result, brands are prioritizing the use of such gels in their formulations to meet consumer expectations and strengthen their credibility in the market. Thus, these regulations protect consumers and encourage innovation, leading to the development of advanced and sustainable elastomer gel products.

Elastomer Gel in Personal Care Market Segment Analysis

Elastomer Gel in Personal Care Market Assessment by Product Type Outlook

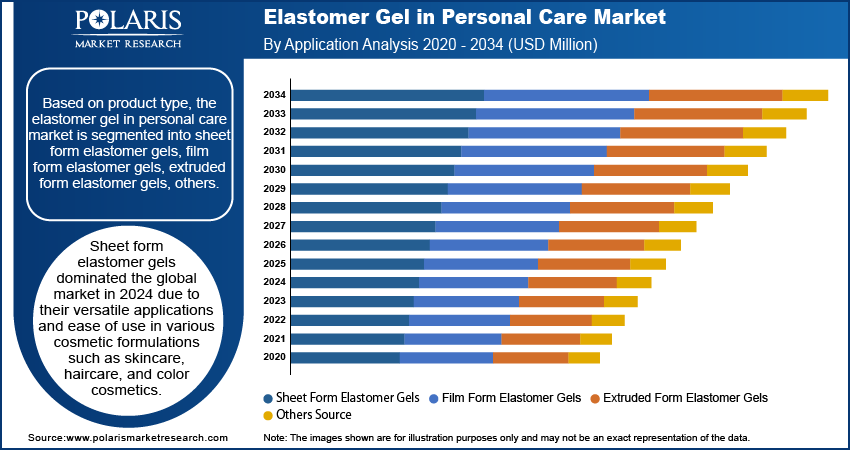

The global elastomer gel in personal care market segmentation, based on product type, includes sheet form elastomer gels, film form elastomer gels, extruded form elastomer gels, other sources. The sheet form elastomer gels sector dominated the global market in 2024 due to their versatile applications and ease of use in various cosmetic formulations such as skincare, haircare, and color cosmetics. Their ability to provide long-lasting, non-greasy effects aligns with consumer preferences for lightweight and high-performance formulations. Additionally, sheet elastomer gels are increasingly used in clean beauty products due to their compatibility with natural and sustainable ingredients, further driving their demand in the market.

Elastomer Gel in Personal Care Market Evaluation by Application Outlook

The global elastomer gel in personal care market segmentation, based on application, includes skin care cosmetics, hair care, oral care, and other sources. The oral care segment of the elastomer gel in personal care market is expected to grow due to increasing consumer demand for advanced, effective, and aesthetically pleasing oral care products. Elastomer gels are being incorporated into toothpaste, mouthwashes, and other oral care products to improve texture improve spreadability, and provide a smoother application experience. Additionally, these gels offer benefits such as controlled release of active ingredients and long-lasting freshness, which align with the growing focus on oral health and hygiene. The rise in consumer interest in premium oral care products, combined with innovations in formulation, is driving the growth of elastomer gels in this segment.

Elastomer Gel in Personal Care Market Regional Insights

By region, the study provides elastomer gel in personal care market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market in 2024 due to a large consumer base, rising disposable income, and increasing demand for high-quality personal care products. The region has seen growth in the beauty and skincare industries, driven by changing consumer preferences towards premium and innovative formulations such as anti-aging skin care products and clean beauty formulations. Additionally, the growing awareness of clean beauty, coupled with the rising demand for eco-friendly and sustainable ingredients, has further accelerated the adoption of elastomer gels. Strong manufacturing capabilities and the presence of major cosmetic companies in countries such as China, Japan, and South Korea also contribute to the region's dominance. Furthermore, the rapid expansion of e-commerce platforms and distribution channels has supported the widespread availability of these products, driving elastomer gel in personal care market growth in the region.

For instance, in December 2023, JD Worldwide introduced new cross-border e-commerce solutions aimed at boosting beauty retail, focusing on integrated supply chain capabilities and offering various incentives for new merchants joining the platform. This move was designed to streamline operations and expand market access for beauty brands, reinforcing JD's position in the growing e-commerce sector.

The North American elastomer gel market in personal care is experiencing rapid growth due to increasing consumer demand for premium, clean beauty products. This growth is driven by the region's strong focus on product safety, sustainability, and the use of high-quality ingredients. North American consumers are increasingly seeking eco-friendly, cruelty-free, and innovative formulations, pushing brands to adopt elastomer gels in their products. Furthermore, the region's well-established infrastructure for research and development, along with a growing trend towards personalized skincare, is contributing to the elastomer gel in personal care market expansion.

Elastomer Gel in Personal Care Market – Key Players and Competitive Analysis Report

The competitive landscape of the elastomer gel in personal care industry is characterized by a mix of global industry leaders and emerging regional players, all vying for market share. Major companies such as Arkema S.A., 3M Company, Evonik Industries, and others leverage their robust R&D capabilities to develop advanced elastomer gel formulations that cater to growing consumer demands for high-performance, sustainable, and clean beauty products. Innovation remains a key strategy, with these companies focusing on improving product efficacy, texture, and environmental impact. In addition, regional players are gaining ground by offering specialized products tailored to local preferences and needs. Competitive strategies include forming partnerships with cosmetics brands, expanding distribution networks through e-commerce channels, and diversifying product portfolios to tap into various skincare, haircare, and cosmetic segments. This combination of global reach and localized innovation is driving market growth and shaping the competitive dynamics of the elastomer gel market. A few key major players are Momentive Performance Materials Inc.; PolyOne Corporation; Ferro Corporation; BASF SE; Eastman Chemical Company; PMC Group Inc.; Arkema S.A.; 3M Company; Evonik Industries; Dow Chemical Company; ShinEtsu Chemical Co., Ltd.

Dow is a chemical manufacturing conglomerate with a wide range of products. The company offers consumer care, construction, and industrial materials science solutions throughout the United States, Canada, Latin America, Europe, Africa, India, the Middle East, and Asia Pacific. Dow maintains 113 production facilities in 31 countries. Coatings, durable goods, home and personal care, adhesives and sealants, and food and specialized packaging are among the applications served by the company. Dow's portfolio includes six global business divisions, structured into three functioning segments, including industrial intermediates & infrastructure, packaging & specialty plastics, and performance material & coatings. The industrial intermediates & infrastructure segment offers propylene oxide, ethylene oxides, aromatic isocyanates, and polyurethane systems, propylene glycol, polyether polyols, coatings, sealants, adhesives, composites, elastomers caustic soda, vinyl chloride monomers; ethylene dichloride, cellulose ethers, silicones, acrylic emulsions, and redispersible latex powders. The packaging & specialty plastics segment offers ethylene, polyolefin elastomers, propylene and aromatics products, ethylene propylene diene monomer rubbers, polyethylene, and ethylene-vinyl acetate. The performance materials and coatings segment offers industrial coatings and architectural paints that are used in maintenance and protective industries, thermal paper, metal packaging, wood, traffic markings, leather, standalone silicones, performance monomers and silicones, and home and personal care solutions.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, Surface Technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The Nutrition and Care sector provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the Agricultural Solutions segment offers seeds and crop protection products, such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products.

Key Companies in Elastomer Gel in Personal Care Market

- Momentive Performance Materials Inc.

- PolyOne Corporation

- Ferro Corporation

- BASF SE

- Eastman Chemical Company

- PMC Group Inc.

- Arkema S.A.

- 3M Company

- Evonik Industries

- Dow Chemical Company

- ShinEtsu Chemical Co., Ltd.

Elastomer Gel in Personal Care Market Developments

April 2024: WACKER announced to showcase silicone products for cosmetics and hair care at in-cosmetics Global, featuring the BELSIL EG 3000 silicone elastomer gel, BELSIL GB 3010 gum blend, and eco-friendly options like BELSIL eco EG 3001 and eco DM 3096.

January 2023: SUNJIN introduced the SFGEL series, a silicone-free elastomer gel developed for a clean beauty approach. It provides a luxurious feel in emulsion products, enhancing skin smoothness and offering excellent spreadability.

Elastomer Gel in Personal Care Market Segmentation

By Product Type Outlook (Revenue, USD Million, Volume, Tons, 2020–2034)

- Sheet Form Elastomer Gels

- Film Form Elastomer Gels

- Extruded Form Elastomer Gels

- Other Sources

By Application Outlook (Revenue, USD Million, Volume, Tons, 2020–2034)

- Skin Care Cosmetics

- Hair Care

- Oral Care

- Other Sources

By End User Outlook (Revenue, USD Million, Volume, Tons, 2020–2034)

- Men

- Women

- Children

- Unisex

By Distribution Channel Outlook (Revenue, USD Million, Volume, Tons, 2020–2034)

- Online Retail

- Department Stores

- Mass Merchandisers

- Salons and Spas

- Other Sources

By Regional Outlook (Revenue, USD Million, Volume, Tons, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Elastomer Gel in Personal Care Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 160.41 million |

|

Market Size Value in 2025 |

USD 166.79 million |

|

Revenue Forecast by 2034 |

USD 238.91 million |

|

CAGR |

4.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Tons, Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global elastomer gel in personal care market size was valued at USD 160.41 million in 2024 and is projected to grow to USD 238.91 million by 2034.

The global market is projected to register a CAGR of 4.1% during the forecast period.

Asia Pacific dominated the elastomer gel in personal care market in 2024.

A few key players in the market are Momentive Performance Materials Inc.; PolyOne Corporation; Ferro Corporation; BASF SE; Eastman Chemical Company; PMC Group Inc.; Arkema S.A.; 3M Company; Evonik Industries; Dow Chemical Company; ShinEtsu Chemical Co., Ltd.

Sheet form elastomer gels dominated the elastomer gel in personal care market in 2024.

The oral care segment of the elastomer gel in the personal care market is expected to grow.