Edge Computing Infrastructure Security Solutions Market Size, Share, Trends, Industry Analysis Report: By Product Type (Network Security, Cloud Security, Data Security, and Others), Component, Deployment Model, Vertical, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 128

- Format: PDF

- Report ID: PM5548

- Base Year: 2024

- Historical Data: 2020-2023

Edge Computing Infrastructure Security Solutions Market Overview

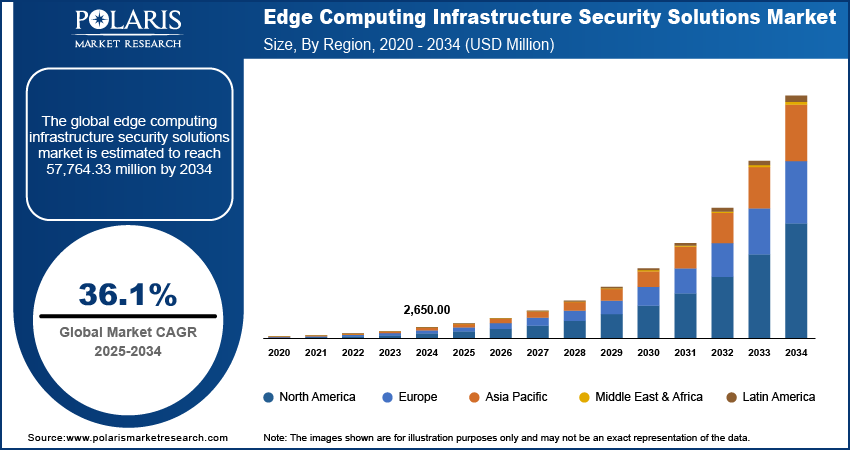

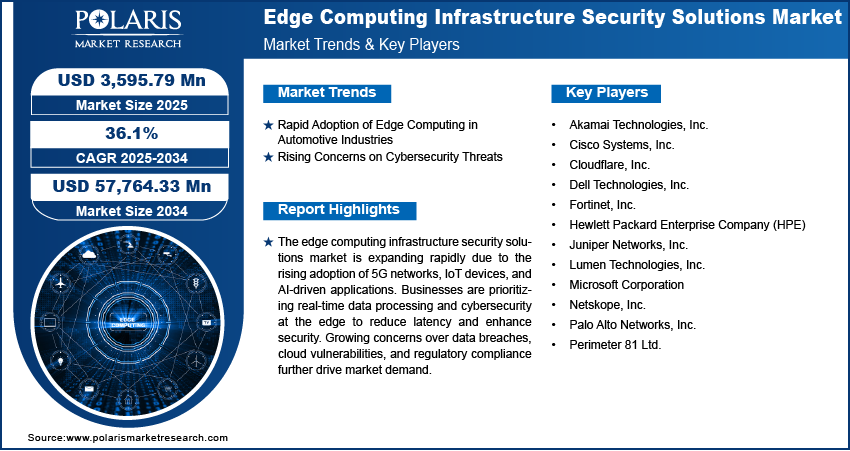

The edge computing infrastructure security solutions market size was valued at USD 2,650.00 million in 2024. The market is projected to grow from USD 3,595.79 million in 2025 to USD 57,764.33 million by 2034, exhibiting a CAGR of 36.1% during 2024–2034.

Edge computing infrastructure security solutions refer to a set of technologies and frameworks designed to protect edge computing environments from cyber threats, unauthorized access, data breaches, and other security risks. The edge computing infrastructure security solutions market demand is growing rapidly as businesses increasingly adopt edge computing to process data closer to the source, reducing latency and enhancing efficiency. Additionally, the market growth is fueled by rising IoT deployments, 5G expansion, and regulatory compliance requirements.

Leading players focus on innovation, integration, and scalability to address evolving cybersecurity threats. Edera, founded in April 2024, developed a technology for cloud workload isolation. This solution enhances cloud infrastructure security by isolating devices into their own cloud spaces, particularly for AI workloads relying on GPUs. Edera's innovative approach has attracted significant investment. For instance, in February 2025, the company secured US$15 million in Series A funding led by M12, Microsoft's Venture Fund. This new fund will accelerate the development of Edera Protect, a solution that embeds security at the architectural level, enabling developers to maintain existing workflows while ensuring automatic workload isolation. Edera is driving the evolution of secure edge computing infrastructures, thereby fueling the overall edge computing infrastructure security solutions market development.

Edge Computing Infrastructure Security Solutions Market Dynamics

Rapid Adoption of Edge Computing in Automotive Industries

The edge computing infrastructure security solutions market growth is driven by the increasing adoption of edge computing for real-time data processing across various industries such as healthcare, automotive, manufacturing, and telecommunications. In July 2024, during the Wimbledon tennis tournament, Jaguar and Vodafone showcased their collaboration by transforming Jaguar I-Pace vehicles into high-speed Wi-Fi hotspots. This was achieved using a Vodafone "smart hub" that provided a robust Wi-Fi service, allowing passengers to use real-time GPS, access data, and stay connected on the go. By enabling real-time GPS tracking and data analytics, connected vehicles generate vast amounts of data that need to be processed quickly and securely. As more automotive companies are adopting similar technologies to enhance navigation, driver assistance, and in-car entertainment, the market is expanding.

As more automakers integrate AI-driven safety features such as collision detection and smart traffic management, edge computing security solutions become essential. With the global shift toward autonomous and connected vehicles, the edge computing infrastructure security solutions market value is expected to grow rapidly during the forecast period.

Rising Concerns on Cybersecurity Threats

The surge in cyberattacks targeting edge devices, IoT networks, and cloud-edge systems has increased the demand for robust security solutions, which is driving the edge computing infrastructure security solution market growth. According to published data by Edge Delta, a log management and analytics platform, approximately 45% of data breaches in 2023 were cloud-based, with 69% of organizations experiencing incidents due to multi-cloud security misconfigurations. This highlights the vulnerabilities inherent in distributed computing systems.

In September 2024, Asimily, a leading risk management platform, published a report stating that by the end of 2023, there were 16.6 billion IoT devices worldwide, with this number projected to increase by 13% to 18.8 billion by the end of 2024. This rapid expansion significantly increases the attack surface, making IoT networks more susceptible to cyber threats.

As a result, the rising incidents of cyber threats and the exponential growth of IoT devices are expected to offer lucrative edge computing infrastructure security solutions market opportunities during the forecast period.

Edge Computing Infrastructure Security Solutions Market Segment Insights

Edge Computing Infrastructure Security Solutions Market Assessment by Vertical Insights

On the basis of vertical, the edge computing infrastructure security solutions market has been segmented into IT & telecom, energy & utilities, BFSI (Banking, Financial Services, and Insurance), government & defense, and others. In 2024, the IT & telecom sector held the largest share of the global edge computing infrastructure security solutions market revenue. This dominance is attributed to the sector's increasing reliance on edge computing to manage vast amounts of data generated by IoT devices and the expansion of 5G networks. The need for real-time data processing and low-latency communication has increased the demand for robust security solutions to protect decentralized networks and data integrity.

Leading telecom operators such as Verizon, AT&T, Deutsche Telekom, Vodafone, and others actively implemented edge computing deployments to enhance network capabilities and service offerings. For instance, in February 2024, T-Mobile US collaborated with AI leaders such as NVIDIA Corporation and OpenAI to develop AI-RAN, a network optimization technology that leverages edge computing to enhance connectivity and reduce latency. As IT & telecom companies deploy more edge devices and services, the edge computing infrastructure security solutions market is growing.

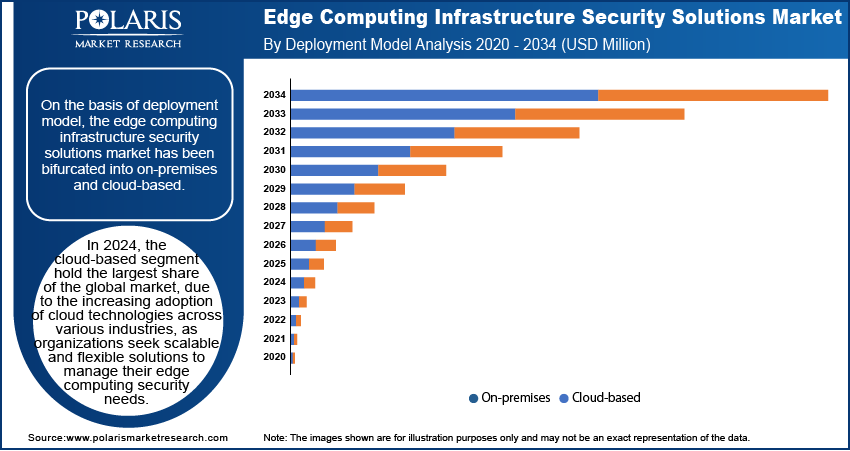

Edge Computing Infrastructure Security Solutions Market Outlook by Deployment Model Insights

On the basis of deployment model, the market has been bifurcated into on-premises and cloud-based. In 2024, the cloud-based segment led the edge computing infrastructure security solutions market share. This dominance is driven by the increasing adoption of cloud technologies across various industries as organizations seek scalable and flexible solutions to manage edge computing security needs. Also, the cloud-based model offers advantages such as reduced upfront costs, ease of integration, and the ability to quickly adapt to evolving security threats, making it a preferred choice for many enterprises. As more businesses adopt cloud-based security solutions, the edge computing infrastructure security solutions market demand for the segment will grow rapidly during the forecast period.

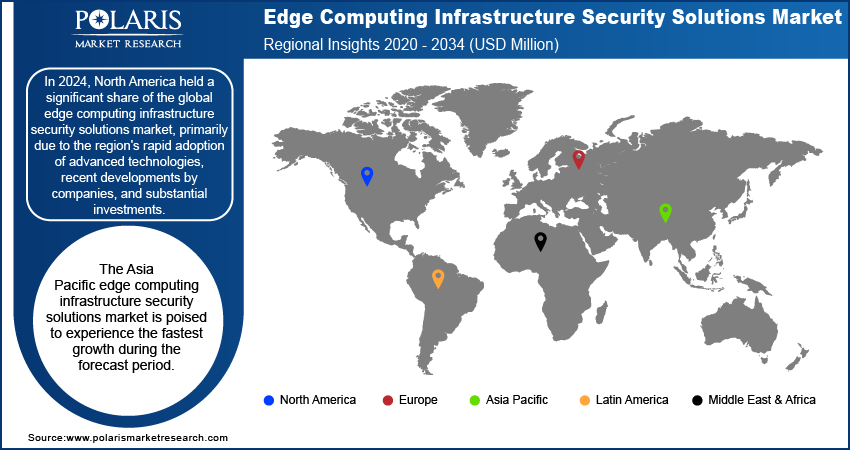

Edge Computing Infrastructure Security Solutions Market Regional Insights

By region, the study provides edge computing infrastructure security solutions market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In 2024, North America held a significant share of the market, primarily due to its region's rapid adoption of advanced technologies, recent developments by companies, and substantial investments in the market. In October 2024, Maris-Tech expanded into the US market by launching Maris North America, focusing on video and AI-based edge computing solutions. This move aims to strengthen local data processing capabilities, thereby improving efficiency and security in sectors that rely on real-time data analysis. Additionally, partnerships and collaborations between hardware and software providers are shaping edge computing infrastructure security solutions market trends. For example, in October 2024, US-based ZEDEDA partnered with OnLogic to introduce a solution that combines rugged industrial hardware with cloud-native edge orchestration software. Such advancements are accelerating the adoption of edge technologies in various industries, consequently driving the edge computing infrastructure security solutions market expansion in North America.

The Asia Pacific edge computing infrastructure security solutions market is poised to experience the fastest growth during the forecast period. This surge is driven by rapid digital transformation, increased adoption of Internet of Things (IoT) devices, and the expansion of 5G networks across the region. The rise of 5G services has increased the edge computing infrastructure security solutions market demand, as industries require robust security measures to protect data processed at the network's edge. According to the Ministry of Industry and Information Technology (MIIT), by November 2024, China's 5G mobile phone subscriptions have surpassed 1.002 billion, accounting for 56% of all mobile users in the country. This makes a 9.4% increase from the previous year and indicates a major milestone in the world's leading telecom market. With this rapid 5G expansion, the Asia Pacific edge computing infrastructure security solutions market growth is accelerating.

Edge Computing Infrastructure Security Solutions Market Players & Competitive Insights

The edge computing infrastructure security solutions market is highly competitive, driven by rising cyber threats and increased adoption of IoT, AI, and 5G networks. Key players focus on network security, threat detection, and compliance solutions to protect data processed at the edge. Companies invest in advanced encryption, zero-trust architectures, and AI-driven security analytics to enhance protection. Increasing market demand and emerging threats drive companies to innovate, while partnerships and acquisitions influence market share. Major players in the market include Akamai Technologies, Inc.; Cloudflare, Inc.; Palo Alto Networks, Inc.; Cisco Systems, Inc.; Juniper Networks, Inc.; Perimeter 81 Ltd.; Netskope, Inc.; Fortinet, Inc.; Lumen Technologies, Inc.; Hewlett Packard Enterprise Company (HPE); Dell Technologies, Inc.; Microsoft Corporation, and others.

Cisco Systems, Inc. is a global leader in networking, cybersecurity, and IT solutions, headquartered in San Jose, California. Founded in 1984, the company revolutionized digital communication with its routers and switches, becoming a dominant force in enterprise networking. Cisco provides hardware, software, and services for networking, cloud computing, security, collaboration, and the Internet of Things (IoT). Its key products include Cisco Catalyst switches, Meraki cloud-managed solutions, and Webex collaboration tools. The company serves enterprises, governments, and service providers worldwide, highlighting innovation in AI-driven networking, automation, and security. Cisco invests heavily in research and acquisitions to stay ahead in the evolving tech landscape.

Microsoft Corporation, headquartered in Redmond, Washington, is a global technology leader specializing in software, cloud computing, AI, and hardware. Founded in 1975, Microsoft transformed personal computing with its Windows operating system and Office productivity suite. The company dominates enterprise software, cloud services through Microsoft Azure, and AI-powered solutions. Its diverse portfolio includes LinkedIn, GitHub, and gaming via Xbox. Microsoft 365 integrates productivity tools with AI-driven capabilities, while Azure competes with AWS in cloud computing. The company is a pioneer in artificial intelligence, advancing technologies such as Copilot and OpenAI integration. Microsoft also enhances edge computing infrastructure security through Azure IoT Edge, confidential computing, and zero-trust security frameworks, ensuring robust protection for distributed networks and devices. Microsoft is one of the world’s most valuable companies, continuously shaping the future of work, cloud infrastructure, and AI-driven computing.

List of Key Companies in Edge Computing Infrastructure Security Solutions Market

- Akamai Technologies, Inc.

- Cisco Systems, Inc.

- Cloudflare, Inc.

- Dell Technologies, Inc.

- Fortinet, Inc.

- Hewlett Packard Enterprise Company (HPE)

- Juniper Networks, Inc.

- Lumen Technologies, Inc.

- Microsoft Corporation

- Netskope, Inc.

- Palo Alto Networks, Inc.

- Perimeter 81 Ltd.

Edge Computing Infrastructure Security Solutions Industry Developments

December 2024: Cyderes acquired Outpost Security to enhance its cybersecurity capabilities, particularly in threat detection and response. This acquisition strengthens Cyderes' position in the edge computing infrastructure security solutions market by integrating Outpost Security's advanced security technologies, improving protection for enterprises against evolving cyber threats in edge environments.

August 2024: Cisco introduced edge computing solutions designed to transform service edge architectures using a distributed cloud model. These solutions enable real-time data processing at the network edge, reducing latency and improving efficiency. With integrated security features, they provide a trusted infrastructure for modern digital applications and services.

February 2024: Akamai revealed its plans to embed cloud computing capabilities into its extensive edge network through an initiative code-named "Gecko." This development aims to enhance edge computing infrastructure security by bringing full-stack computing closer to users, thereby reducing latency and improving security.

Edge Computing Infrastructure Security Solutions Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Network Security

- Cloud Security

- Data Security

- Others

By Component Outlook (Revenue, USD Million, 2020–2034)

- Hardware

- Software

- Services

By Vertical Outlook (Revenue, USD Million, 2020–2034)

- IT & Telecom

- Energy & Utilities

- BFSI (Banking, Financial Services, and Insurance)

- Government & Defense

- Others

By Deployment Model Outlook (Revenue, USD Million, 2020–2034)

- On-Premises

- Cloud-Based

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Edge Computing Infrastructure Security Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,650.00 Million |

|

Market Size Value in 2025 |

USD 3,595.79 Million |

|

Revenue Forecast by 2034 |

USD 57,764.33 Million |

|

CAGR |

36.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2024–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global edge computing infrastructure security solutions market size was valued at USD 2,650.00 million in 2024 and is projected to grow to USD 57,764.33 million by 2034.

The global market is expected to register a CAGR of 36.1% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Akamai Technologies, Inc.; Cloudflare, Inc.; Palo Alto Networks, Inc.; Cisco Systems, Inc.; Juniper Networks, Inc.; Perimeter 81 Ltd.; Netskope, Inc.; Fortinet, Inc.; Lumen Technologies, Inc.; Hewlett Packard Enterprise Company (HPE); Dell Technologies, Inc.; and Microsoft Corporation.

The cloud-based segment dominated the market in 2024.