Earphones and Headphones Market Size, Share, Trends, Industry Analysis Report: By Product (Headphones and Earphones); Technology; Price Band; Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1027

- Base Year: 2024

- Historical Data: 2020-2023

Earphones and Headphones Market Overview

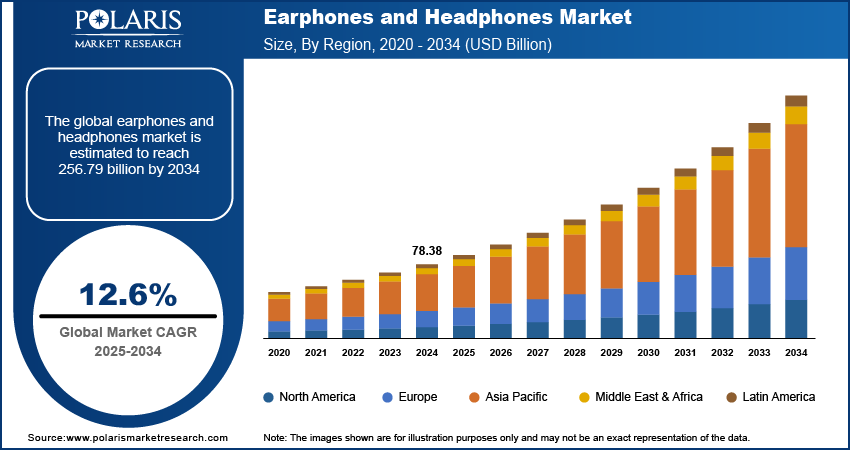

The earphones and headphones market size was valued at USD 78.38 billion in 2024. The market is projected to grow from USD 88.18 billion in 2025 to USD 256.79 billion by 2034, exhibiting a CAGR of 12.6% during the forecast period.

Earphones and headphones are essential audio devices that enhance people listening experience by providing private sound delivery. Headphones typically consist of two speakers connected by a band that rests over the head, allowing for immersive audio experiences. They come in various styles, including over-ear, on-ear, and in-ear designs. Earphones, usually referred to as earbuds, are smaller and designed to fit directly into the ear canal, making them highly portable and ideal for on-the-go use.

The increasing fitness activities globally is propelling the earphones and headphones market growth. 2023 Tracking the Fitness Movement Report by the Sports & Fitness Industry Association (SFIA) stated that participation in fitness activities has grown an impressive 5.3 percent, or by 10.4 million people, since 2017 in the US. The number of total fitness participants rose by 800,000 year-over-year in 2022 to 205.8 million in the country. Fitness enthusiasts rely on audio devices to enhance their workout experience, using music and podcasts as motivational tools during exercise. This encourages them to invest in wireless earbuds and noise-canceling headphones that provide freedom of movement, superior sound quality, and comfort during high-intensity workouts.

To Understand More About this Research: Request a Free Sample Report

Earphones and Headphones Market Dynamics

Integration of Voice Assistants and Smart Features

The integration of voice assistants such as Alexa and Google assistant into earphones and headphones has become a prominent trend, offering users hands-free control and seamless interaction with their devices. Users effortlessly control playback, adjust volume, check notifications, or even manage smart home devices, all through simple voice commands with voice assistants. This hands-free convenience enhances the user experience, particularly for individuals who engage in fitness or multitasking, where manual interaction is not ideal.

Smart features such as touch controls have gained popularity, providing intuitive ways to manage audio playback, answer calls, and activate voice assistants without the need for physical buttons. These controls are typically responsive and enable users to swipe or tap on the earphones for tasks such as skipping tracks or adjusting the volume, adding to the ease of use. Another notable trend is the incorporation of adaptive sound technology, which adjusts the audio output based on the surrounding environment. For instance, when in a noisy area, the earphones increase the volume automatically or activate noise-canceling features to enhance the hearables experience.

Growing Gen Z Population Globally

The growing Gen Z population globally is propelling the earphones and headphones market expansion. World Economic Forum published a report stating that there are more than 2 billion people in the Generation Z age range globally. This demographic represents a tech-savvy generation that values high-quality audio experiences across multiple platforms, including music streaming, gaming, content creation, and social media. Gen Z consumers prioritize wireless, stylish, and technologically advanced audio devices that seamlessly integrate with their digital-first lifestyles, pushing manufacturers to innovate continuously, thereby fueling market growth.

Earphones and Headphones Market Segment Insights

Earphones and Headphones Market Assessment by Product Outlook

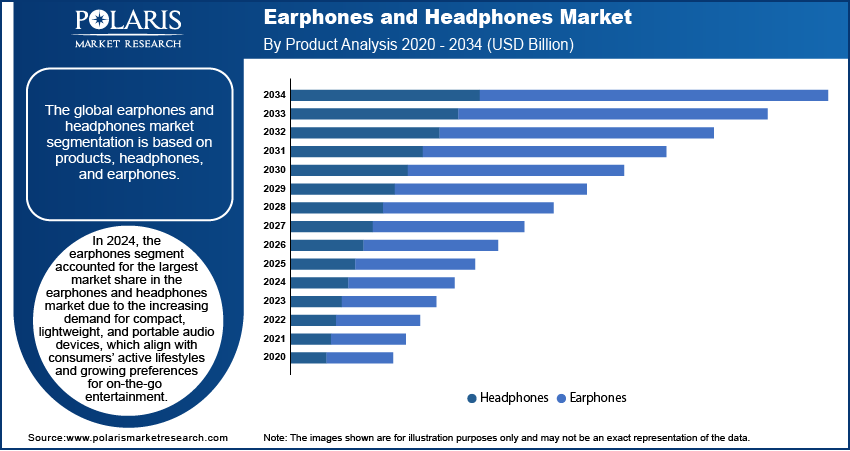

The global earphones and headphones market segmentation, based on products, includes headphones and earphones. In 2024, the earphones segment accounted for the largest earphones and headphones market share due to the increasing demand for compact, lightweight, and portable audio devices, which align with consumers’ active lifestyles and growing preferences for on-the-go entertainment. The rise in wireless and true wireless stereo (T3WS) earphones, driven by advancements in Bluetooth technology and the phasing out of traditional audio jacks in smartphones, has further fueled the earphones segment growth. Additionally, the popularity of earphones has been boosted by their versatility for activities such as commuting, exercising, and remote working, as well as improvements in sound quality and battery life.

Earphones and Headphones Market Evaluation by Application Outlook

The global earphones and headphones market segmentation, based on application, includes fitness, virtual reality, gaming, and music & entertainment. The fitness segment is projected to experience the fastest growth during the forecast period due to the rising adoption of wireless and sweat-resistant earphones designed for active lifestyles. The increasing health consciousness among consumers and the growing popularity of fitness activities such as running, gym workouts, and yoga are further propelling the growth of the segment. Additionally, the integration of advanced features such as heart rate monitoring, voice assistant applications, and AI-powered coaching in earphones has further driven their appeal among fitness enthusiasts.

Earphones and Headphones Market Share Regional Insights

By region, the study provides earphones and headphones market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share due to the region's large and growing consumer base, rapid urbanization, and increasing disposable income levels. The widespread adoption of smartphones and other portable devices, along with a growing preference for wireless audio solutions, has significantly driven demand. Additionally, the presence of key manufacturers, advancements in technology, and the popularity of e-commerce platforms offering a wide range of affordable and premium products have further boosted the market in this region. For instance, in April 2024, a Shenzhen-based company Shenzhen Grandsun Electronic Co., Ltd launched the world’s first zero-carbon open-ear earbuds, marking a key advancement in audio technology in line with China’s "dual carbon goals" and highlighting the industry's shift toward sustainable innovation.

The earphones and headphones market in North America is expected to witness the fastest growth over the forecast period due to the increasing adoption of advanced audio technologies, rising demand for wireless and noise-canceling headphones, and a growing consumer base with higher disposable incomes. The popularity of fitness and gaming applications, coupled with the integration of smart features such as voice assistants and augmented reality capabilities, has further driven demand in the region. Additionally, the strong presence of leading industry players and rapid advancements in product innovation contribute significantly to market growth in North America. For instance, Silynxcom Ltd. has received a new order from the United States Air Force for its tactical communication headsets designed for demanding military applications.

Earphones and Headphones Market – Key Players and Competitive Analysis Report

The earphones and headphones market is highly competitive, with both global and regional players. The competitive landscape of the earphones and headphones market is characterized by intense competition among key players, driven by rapid technological advancements and evolving consumer preferences. Major companies focus on innovation, offering features such as noise cancellation, wireless connectivity, and enhanced sound quality to capture market share. Prominent players include Apple Inc.; Sony Corporation; Bose Corporation; Samsung Electronics Co., Ltd.; and Sennheiser Electronic GmbH & Co. KG, among others. These companies leverage strategies such as mergers and acquisitions, partnerships, and product launches to strengthen their positions.

The market also sees significant contributions from emerging players and regional manufacturers, particularly in Asia Pacific, offering affordable alternatives. Additionally, the increasing popularity of true wireless stereo (TWS) earbuds and smart headphones with integrated AI features further intensifies competition. A few key major players are Sennheiser Electronic GmbH & Co. KG; Sony Corporation; GN Netcom; Audio-Technica Corporation; JVC Corporation; Beats Electronics (Apple, Inc.); Harman International Industries, Inc.; Plantronics Pty Ltd.; Philips Electronics Ltd.; and Bose Corporation.

Sony Corporation is a Japanese multinational conglomerate headquartered in Minato, Tokyo. Founded in 1946 by Masaru Ibuka and Akio Morita, Sony initially focused on electronics and has since diversified into various sectors, including entertainment, gaming, and financial services. The company is widely recognized for its products, such as Walkman, PlayStation gaming consoles, and high-definition televisions. Sony operates through several business segments: Game & Network Services, Music, Pictures, Electronics Products & Solutions, Imaging & Sensing Solutions, and Financial Services. The company has over 200 subsidiaries worldwide and a workforce exceeding 100,000 employees. In September 2024, Sony Electronics Inc. launched the MDR-M1 Reference Closed Monitor Headphones, designed for music creators and sound engineers.

Koninklijke Philips N.V., commonly recognized as Philips, is a company that operates in various industries, including healthcare technology, consumer electronics, and lighting. Philips provides medical equipment, software, and services in healthcare, including imaging systems, patient monitoring systems, and clinical informatics solutions. Philips offers a diverse range of audio products, including headsets and earphones. These products are designed to deliver exceptional sound performance, comfort, and advanced features to provide various consumer needs. The company’s audio portfolio includes wired and wireless earphones, over-ear and in-ear headsets, noise-canceling options, and sport-focused designs, all integrated with the latest audio technology.

Key Companies in Earphones and Headphones Market Outlook

- Sennheiser Electronic GmbH & Co. KG

- Sony Corporation

- GN Netcom

- Audio-Technica Corporation

- JVC Corporation

- Beats Electronics (Apple, Inc.)

- Harman International Industries, Inc.

- Plantronics Pty Ltd.

- Philips Electronics Ltd.

- Bose Corporation

Earphones and Headphones Market Developments

September 2024: Apple launched the AirPods 4 and AirPods Pro 2, featuring advanced audio technology and a comprehensive hearing health solution. The Pro model offers adaptive audio, customizable sound profiles, and real-time hearing assessments, pioneering auditory health management.

November 2022: Zebronics launched a combination product called Zeb-Sound Bomb X1 3-in-1, which includes a truly wireless headset, Bluetooth speaker, and Torch. The earbuds, which come in white, blue, and black, have a battery life of up to five hours per charge, support voice assistants, and are available in three colors.

In September 2022, Sony launched the WH-1000XM5 noise-canceling headphones in India, expanding its range of wireless headphones. The WH-1000XM5 has a unique design with sliding headphones and features improved Active Noise Cancellation (ANC) with two processors and eight microphones, among other enhancements. It is the successor to the popular WH-100XM4 headphones.

Earphones and Headphones Market Segmentation

By Product Outlook (Revenue, USD Billion; 2020–2034)

- Headphones

- Earphones

By Technology Outlook (Revenue, USD Billion; 2020–2034)

- Wireless

- ANC

- Bluetooth

- NFMI

- Smart Headphones

- Others

- Wired

- ANC

- Others

By Price Band Outlook (Revenue, USD Billion; 2020–2034)

- <50

- 50-100

- >100

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Fitness

- Virtual Reality

- Gaming

- Music & Entertainment

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Earphones and Headphones Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 78.38 billion |

|

Market Size Value in 2025 |

USD 88.18 billion |

|

Revenue Forecast by 2034 |

USD 256.79 billion |

|

CAGR |

12.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global earphones and headphones market size was valued at USD 78.38 billion in 2024 and is projected to grow to USD 256.79 billion by 2034.

The global market is projected to register a CAGR of 12.6% during the forecast period.

In 2024, Asia Pacific accounted for the largest earphones and headphones market share due to the region's large and growing consumer base, rapid urbanization, and increasing disposable income levels.

A few key players in the market are Sennheiser Electronic GmbH & Co. KG; Sony Corporation; GN Netcom; Audio-Technica Corporation; JVC Corporation; Beats Electronics (Apple, Inc.); Harman International Industries, Inc.; Plantronics Pty Ltd.; Philips Electronics Ltd.; and Bose Corporation.

In 2024, the earphones segment accounted for the largest market share due to the increasing demand for compact, lightweight, and portable audio devices.

The fitness segment is projected to experience the fastest growth during the forecast period due to the rising adoption of wireless and sweat-resistant earphones designed for active lifestyles, increasing health consciousness among consumers.