E-pharmacy Market Size, Share, Trends, Industry Analysis Report: By Drug Type (Prescription Drugs and OTC Drugs), Product Type, Payment Method, Platform, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM1012

- Base Year: 2024

- Historical Data: 2020-2023

E-pharmacy Market Overview

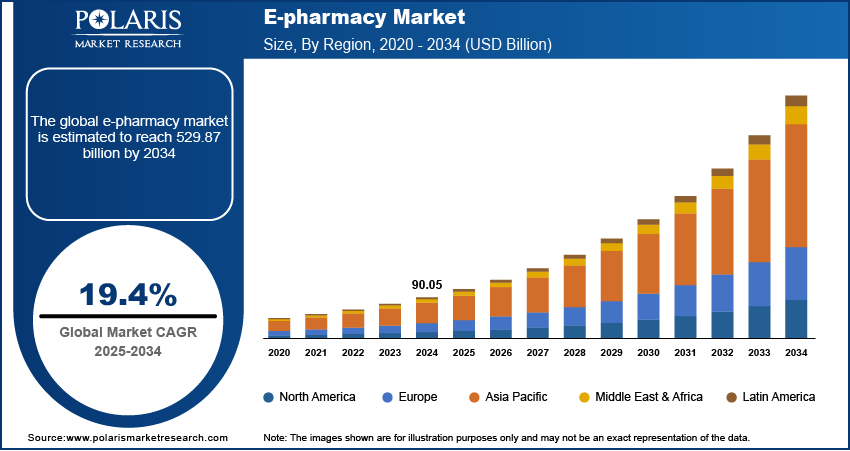

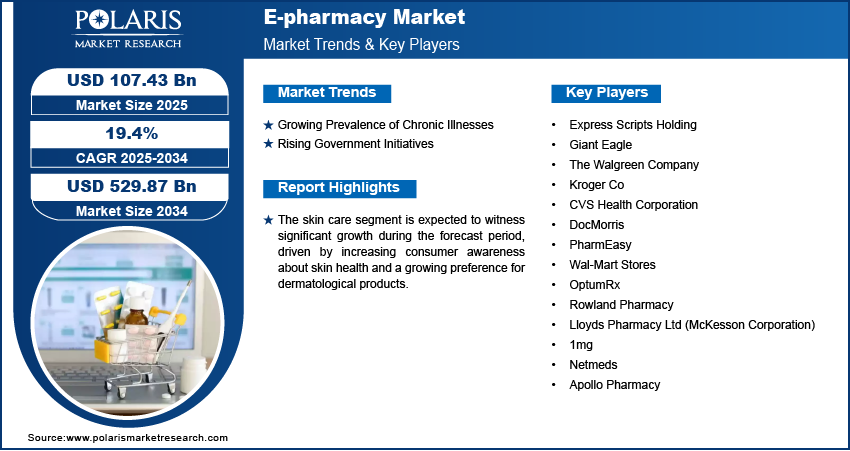

The global e-pharmacy market size was valued at USD 90.05 billion in 2024. The market is projected to grow from USD 107.43 billion in 2025 to USD 529.87 billion by 2034, exhibiting a CAGR of 19.4% from 2025 to 2034.

The e-pharmacy market refers to the online marketplace for purchasing medications, healthcare products, and pharmacy-related services. E-pharmacy involves platforms and apps where customers can browse, order, and receive medicines and other health-related items delivered to their doorstep. E-pharmacy solutions are becoming essential to reduce operating costs in the expanding healthcare sector and its high operating expenses.

The market has grown significantly due to advancements in digital technologies, evolving consumer preferences, and increased internet penetration. Other key factors driving the e-pharmacy market expansion include the digitization of healthcare services and the growing number of tech-savvy consumers. In addition, rising healthcare mobile application adoption and convenience-driven consumer preferences for online shopping are fueling the growth of the market. The increasing reliance of the healthcare sector on e-commerce is expected to further accelerate market development.

To Understand More About this Research: Request a Free Sample Report

E-pharmacy Market Dynamics

Growing Prevalence of Chronic Illnesses

The growing prevalence of chronic illnesses, such as diabetes, hypertension, and cardiovascular diseases, has significantly increased the demand for healthcare products, especially pharmaceuticals. For instance, according to the Centers for Disease Control and Prevention, the prevalence of diabetes in US adults was 15.8%, with 11.3% diagnosed and 4.5% undiagnosed, from August 2021 to August 2023. Patients with chronic conditions often require long-term medication management, which drives the need for convenient and reliable access to medicines. E-pharmacies cater to this demand by offering online platforms for easy ordering and doorstep delivery of essential medications. This trend highlights the growing acceptance and reliance on online drug shopping globally, as consumers prioritize convenience and accessibility for managing their ongoing health needs, thereby fueling the e-pharmacy market demand.

Rising Government Initiatives

Both Central and State Governments have recognized the importance of e-pharmacies, designating them as essential services and actively promoting them on platforms like the Aarogya Setu App. To further support the market, the government has launched several initiatives, including Ayushman Bharat, National Digital Health Mission (NDHM), Startup India, Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP), and Digital India. These initiatives aim to simplify business operations while ensuring better accessibility to authentic and affordable medications. Thus, rising government initiatives are boosting the e-pharmacy market revenue.

E-pharmacy Market Segment Insights

E-pharmacy Market Assessment Based on Drug Type

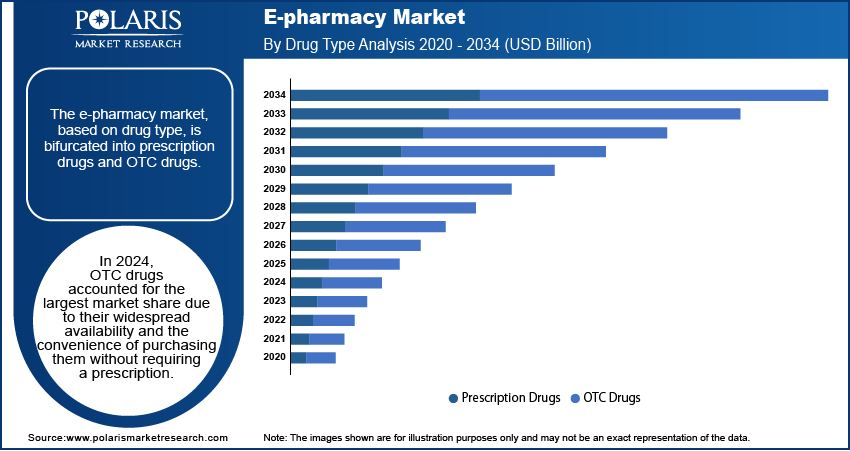

The global e-pharmacy market, based on drug type, is bifurcated into prescription drugs and OTC drugs. In 2024, the OTC drugs segment accounted for the largest e-pharmacy market share due to their widespread availability and the convenience of purchasing them without a prescription. Consumers increasingly prefer OTC drugs for minor health concerns, such as colds, allergies, pain relief, and digestive issues, owing to their easy accessibility and affordability. The rising trend of self-medication, coupled with the growing awareness of health and wellness, has further boosted the demand for OTC drugs. E-pharmacies have capitalized on this trend by offering a wide range of OTC products with quick delivery, competitive pricing, and user-friendly platforms, making them a popular choice among consumers globally.

E-pharmacy Market Evaluation Based on Product Type

The global e-pharmacy market, based on product type, is segmented into skin care, dental, cold and flu, vitamins, weight loss, and other product types. The skin care segment is expected to witness significant growth from 2025 to 2034, driven by increasing consumer awareness about skin health and a growing preference for dermatological products. Factors such as rising disposable income, evolving beauty standards, and heightened interest in preventive skincare are fueling this expansion. E-pharmacies provide easy access to a wide range of skincare products, including moisturizers, sunscreens, anti-aging treatments, and acne solutions, often accompanied by attractive discounts and doorstep delivery. Additionally, the growing trend of personalized skincare recommendations and the integration of telepharmacy for dermatologist with dermatologists on these platforms support the segment's robust growth trajectory.

E-pharmacy Market Regional Analysis

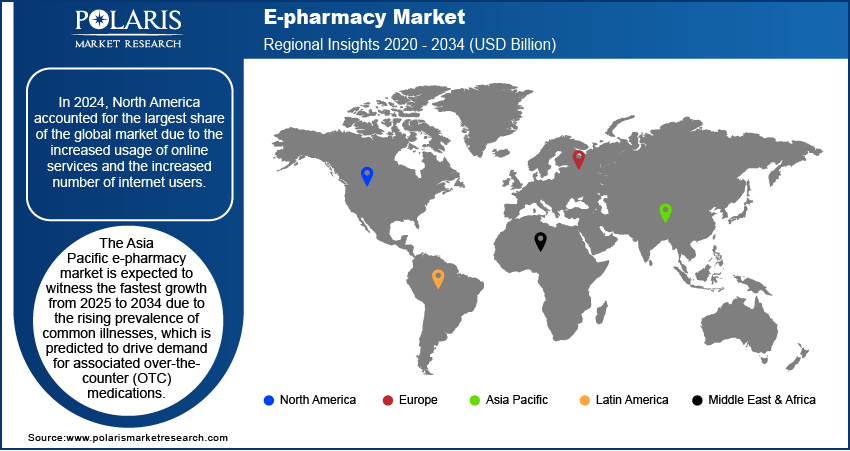

By region, the study provides the e-pharmacy market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the global market due to the increased usage of online services and the growing number of internet users. For instance, in February 2022, Medicure Inc.'s subsidiary, Marley Drug Pharmacy, introduced its nationwide direct-to-consumer e-commerce pharmacy platform in the US. Americans can purchase affordable, FDA-approved medications from Marley Drug through its new e-commerce website, which offers home delivery across all 50 states. The demand for over-the-counter pharmaceuticals has risen as the frequency of minor illnesses, such as the flu, fever, backaches, coughs, and colds, increases. As a result, more people are turning to Internet pharmacies to get those medications. Additionally, the convenience of ordering medications from the comfort of home is expected to further drive the growth of the market in North America, particularly in the US.

The Asia Pacific e-pharmacy market is expected to witness the fastest growth during the forecast period, driven by the rising prevalence of common illnesses, which is anticipated to increase the demand for associated over-the-counter (OTC) medications. Additionally, the e-pharmacy market in Asia Pacific is expanding due to government initiatives aimed at improving the quality of healthcare services. The growing popularity of the direct-to-patient approach is further expected to drive the regional market demand.

E-pharmacy Market – Key Players and Competitive Insights

The e-pharmacy market is characterized by intense competition, driven by the presence of both established players and emerging startups aiming to capitalize on the growing demand for online healthcare services. Key players in the market are continually enhancing their platforms by integrating advanced technologies such as AI-driven recommendations, seamless payment gateways, and teleconsultation services to gain a competitive edge. Moreover, partnerships with pharmaceutical companies, healthcare providers, and logistics firms are becoming common strategies to strengthen market positioning. The e-pharmacy market is also seeing significant investments and acquisitions, enabling companies to expand their geographical reach, diversify product portfolios, and offer more personalized services to meet evolving consumer needs. A few key major players in the market are Express Scripts Holding, Giant Eagle, The Walgreen Company, Kroger Co, CVS Health Corporation, DocMorris, PharmEasy, Wal-Mart Stores, OptumRx, Rowland Pharmacy, Lloyds Pharmacy Ltd (McKesson Corporation), 1mg, Netmeds, and Apollo Pharmacy.

Apollo Pharmacy, part of the Apollo Hospitals Group, is a leading retail pharmacy chain based in India. The company was established in 1987 and operates a network of over 4,000 pharmacies across the country. The company provides a broad range of pharmaceutical products, including prescription medications, over-the-counter drugs, and health and wellness items. Apollo Pharmacy offers services such as online ordering and home delivery to enhance accessibility and convenience for its customers. The company plays a significant role in India's healthcare sector, contributing to the overall accessibility of pharmaceutical products and services throughout the region. In 2024, Apollo Pharmacy touched revenue of 120 million USD through online sales of medicines.

Netmeds.com is an online pharmacy company based in India, established to provide a convenient platform for purchasing pharmaceutical products. The company offers a wide range of medications, including prescription drugs, over-the-counter medicines, and health and wellness products. Through its user-friendly website and mobile app, Netmeds.com facilitates online ordering and home delivery services, catering to the needs of customers across the country. Netmeds.com also provides additional services such as medication reminders and health information resources to support its customers' healthcare needs. The company's focus on accessibility and efficiency aims to simplify the process of obtaining essential medications and health products, contributing to the broader landscape of online healthcare services in India.

List of Key Companies in E-pharmacy Market

- Express Scripts Holding

- Giant Eagle

- The Walgreen Company

- Kroger Co

- CVS Health Corporation

- DocMorris

- PharmEasy

- Wal-Mart Stores

- OptumRx

- Rowland Pharmacy

- Lloyds Pharmacy Ltd (McKesson Corporation)

- 1mg

- Netmeds

- Apollo Pharmacy

E-pharmacy Industry Developments

In May 2024, Bond Vet announced the launch of an online pharmacy to service all bond vet positions. The company stated that the online pharmacy follows a simplified approach to enable users to get medications for their pet’s requirements. It improves ease and obtainability while sustaining the standard of care.

In January 2024, Lilly launched an end-to-end digital healthcare experience through LillyDirect. This service aims to offer a new digital pharmacy experience for patients in the US living with obesity, migraine, and diabetes.

In September 2022, Amazon announced its plans to start selling prescription drugs online in Japan. It seeks to work in partnership with small and medium-sized pharmacies to develop a platform where patients obtain online drug directions. Customers can order their medications online and get them delivered to their homes without having to visit a drugstore.

E-pharmacy Market Segmentation

By Drug Type Outlook (Revenue – USD Billion, 2020–2034)

- Prescription Drug

- OTC Drug

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Skin Care

- Dental

- Cold and Flu

- Vitamins

- Weight Loss

- Other Product Types

By Payment Method Outlook (Revenue – USD Billion, 2020–2034)

- Cash On Delivery

- Online Payment

By Platform Outlook (Revenue – USD Billion, 2020–2034)

- App Based

- Web Based

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

E-pharmacy Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 90.05 billion |

|

Market Size Value in 2025 |

USD 107.43 billion |

|

Revenue Forecast by 2034 |

USD 529.87 billion |

|

CAGR |

19.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market was valued at USD 90.05 billion in 2024 and is projected to grow to USD 529.87 billion by 2034.

The global market is projected to register a CAGR of 19.4% from 2025 to 2034.

In 2024, North America accounted for the largest market share due to the increased usage of online services and the growing number of internet users.

A few of the key players in the market are Express Scripts Holding, Giant Eagle, The Walgreen Company, Kroger Co, CVS Health Corporation, DocMorris, PharmEasy, Wal-Mart Stores, OptumRx, Rowland Pharmacy, Lloyds Pharmacy Ltd (McKesson Corporation), 1mg, Netmeds, and Apollo Pharmacy.

In 2024, the OTC drugs segment accounted for the largest market share due to their widespread availability and the convenience of purchasing them without requiring a prescription.

The skin care segment is expected to witness significant growth during the forecast period, driven by increasing consumer awareness about skin health and a growing preference for dermatological products.