e-KYC Market Share, Size, Trends, Industry Analysis Report, By Product (Identity Authentication and Matching, Video Verification, Digital ID Schemes, Enhanced vs Simplified Due Diligence); By Deployment Mode (Cloud-Based, On-Premise); By End-Use; By Region; Segment Forecast, 2022 - 2029

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2142

- Base Year: 2021

- Historical Data: 2017 - 2020

Report Outlook

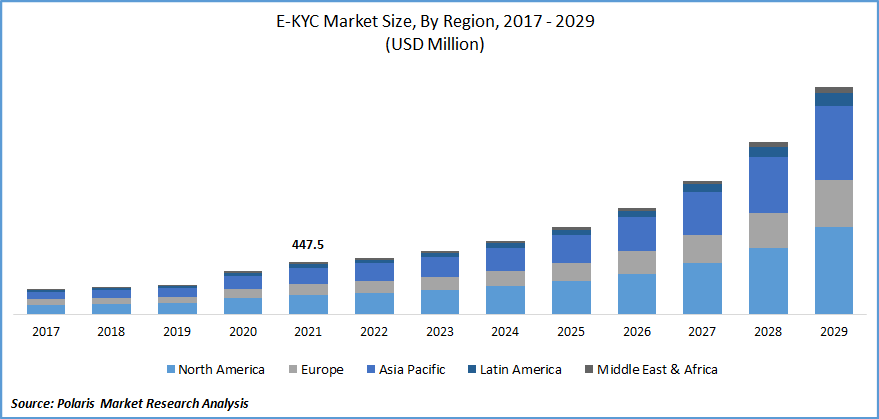

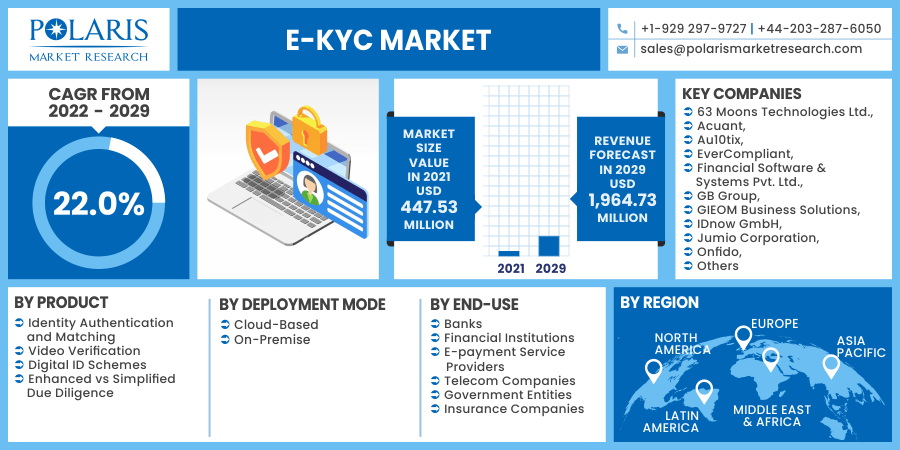

The global e-KYC market was valued at USD 447.53 Million in 2021 and is expected to grow at a CAGR of 22.0% during the forecast period.

Increasing terrorist funding activity, rising identity-related frauds, and consumer purchasing habits boost the market demand for e-KYC, driving the market growth during the forecast period. Terrorist funding and massive monetary losses in the Banking, Financial Services, and Insurance (BFSI) sector are expected to boost target market growth for e-KYC over the projection period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Terrorist organizations typically rely on money to survive and carry out terrorist operations. Terrorist funding refers to the means and methods employed by terrorist organizations to fund actions that endanger national and international security. Money gives terrorist organizations the ability to carry out terrorist operations, and it can come from a variety of sources, such as legitimate and illegal sources. Furthermore, the increasing necessity of compliance management and the rising number of identity-related frauds are likely to drive target market expansion for e-KYC. Identity fraud will cost Americans over USD 56 billion in 2020, with approximately 49 million people becoming victims.

As per the study done by the Identity Fraud Study, in 2021, almost $13 billion in damages were attributed to what Javelin refers to as "conventional identity fraud," thieves take personal identifying information and utilize it for their gain, including through data theft. Also, consumers' purchasing habits worldwide are influenced by changing fashion trends and haircuts. Product sales heavily determine the market share, heavily influenced by religious views and ethnic communities. Apparently, convenient access to clips, embellished pins, and bands on the e-commerce web platform will speed up the sector increase over the anticipated timeframe. Thus, all major factors are propelling the e-KYC market growth.

However, lack of awareness and technical glitches are the factors restraining the market growth for e-KYC during the forecast period. e-KYC simplifies online transactions and aids in the management of various digital accounts securely and simply. This action is more noticeable in wealthy countries. Failure of technical infrastructure and data breaches, as well as misuse of personal information, may represent a barrier to the market of e-KYC in the coming years.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The e-KYC market has observed extensive developments in the last few decades supported by various factors such as the stringent government regulations to prevent money laundering and financial fraud and the rising adoption of digital payment modes. For instance, according to the International Monetary Fund (IMF), it has prioritized the battle against money laundering and terrorism financing. Among the objectives of this initiative are to defend the reliability and safety of the international financial system, cut off terrorists' access to resources, and make it more difficult for criminals to benefit from their illicit actions. The IMF's one-of-a-kind combination of universal membership, monitoring functions, and financial sector expertise makes it a crucial and necessary component of international attempts to prevent terrorist financing.

In addition, the Anti-Money Laundering Act of 2020 (AMLA) has been Congress's most significant anti-money laundering bill for centuries. Among it has many regulations, this law includes increased whistleblower benefits and protections, the creation of a beneficial data ownership to be incorporated by the Financial Crimes Enforcement Network (FinCEN). AMLA 2020 updated the legislation to require the "Secretary of Treasury" to "must" pay awards to the whistleblowers to have transparency in the system. Still, the legislation does not include a prize "floor," which means whistleblowers may only get a token award.

Furthermore, expanding AI and machine applications in evaluating huge amounts of data created by digital currency transactions and reducing false alerts are projected to fuel e-KYC demand in the future years. More opportunities for digital money and digital payments from the central bank have emerged due to technological improvement. With the advent of interconnected devices, cloud computing, and AI, the market for e-KYC is expected to gain traction in the next years. The growing requirement to limit illegal use of credentials and violations of conduct is projected to fuel growth in the e-KYC market throughout the forecast period.

Report Segmentation

The market is primarily segmented based on product, deployment mode, end-use, and region.

|

By Product |

By Deployment Mode |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by End-Use

Based on the end-user segment, the bank market segment is expected to be the most significant revenue contributor in the global market for e-KYC in 2021 and is expected to retain its dominance in the foreseen period. Due to the increased use of E-KYC to optimize customer onboarding by validating KYC documents online and improving efficiency payment collections, eliminating documentation in the processing of loan applications, and attempting to prevent identity fraud, the banking market segment accounted for the largest revenue share. Furthermore, most of the share is attributable to the growing adoption of the traditional KYC process for e-KYC for digital and remote exchange and lower costs optimally. The Financial Industry segment had a good market share for e-KYC in 2019. It is projected to contribute to economic growth during the forecast period due to e-KYC contributing to remote client onboarding and effectively preventing compliance and risk evaluation of anti-money laundering conformance and risk evaluation.

Geographic Overview

In terms of geography, North America had the largest revenue share, in 2021. The increased requirement for fraud detection in countries such as Canada and the United States is attributable to the market share for e-KYC. Furthermore, the rise in data theft and cyber-attack cases in small and medium-sized businesses is likely to fuel the market growth of the e-KYC over the forecast time frame. For instance, in March 2021, according to the FBI's Internet Crime Report 2020, American victims reported USD 4.2 billion in damages to the FBI last year due to cyberattacks and internet fraud. Also, the Federal Trade Commission (FTC) issued warnings regarding an e-mail fraud involving COVID-19 stimulus money. Thus, the increase in this type of threat and cyber-attack in the market is boosting the e-KYC demand in the region.

Moreover, Asia-Pacific witnessed a high CAGR in the global market for e-KYC in 2021. Growing internal and external threats, rising cloud use, and the Internet of Things (IoT) have all contributed to targeting market expansion for e-KYC in the region.

Competitive Insight

Some of the major players operating in the global market for e-KYC include 63 Moons Technologies Ltd., Acuant, Au10tix, EverCompliant, Financial Software & Systems Pvt. Ltd., GB Group, GIEOM Business Solutions, IDnow GmbH, Jumio Corporation, Onfido, Panamax Inc., Pegasystems Inc., Tata Consultancy Services (TCS), Trulioo, Trust Stamp, Wipro Technologies among others.

e-KYC Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 447.53 Million |

|

Revenue forecast in 2029 |

USD 1,964.73 Million |

|

CAGR |

22.0% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2029 |

|

Segments covered |

By Product, By Deployment Mode, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

63 Moons Technologies Ltd., Acuant, Au10tix, EverCompliant, Financial Software & Systems Pvt. Ltd., GB Group, GIEOM Business Solutions, IDnow GmbH, Jumio Corporation, Onfido, Panamax Inc., Pegasystems Inc., Tata Consultancy Services (TCS), Trulioo, Trust Stamp, Wipro Technologies |