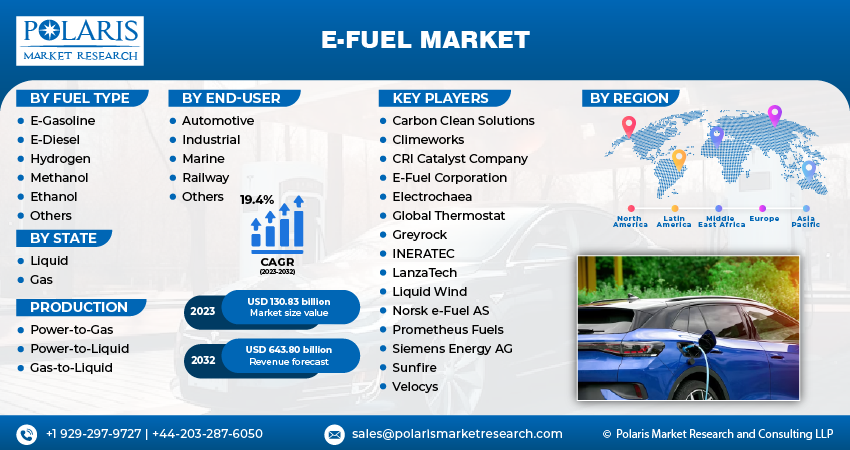

E-Fuel Market Share, Size, Trends, Industry Analysis Report, By Fuel Type (E-Gasoline, E-Diesel, Hydrogen, Methanol, Ethanol, and Others); By State; By Production; By End-User; By Region; Segment Forecast, 2023- 2032

- Published Date:Oct-2023

- Pages: 114

- Format: PDF

- Report ID: PM3873

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

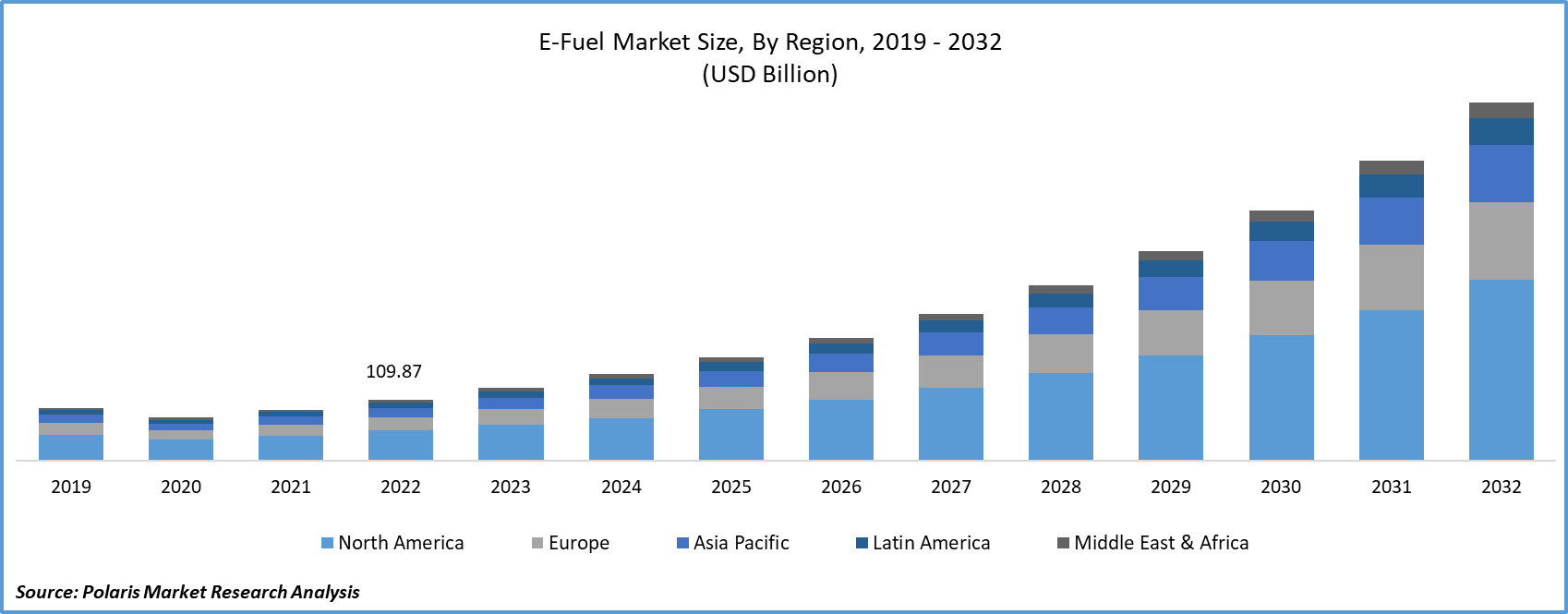

The global e-fuel market was valued at USD 109.87 billion in 2022 and is expected to grow at a CAGR of 19.4% during the forecast period.

In recent times, a noticeable shift towards sustainability has taken place in the worldwide energy landscape, driven by the urgent imperative to combat climate change. Leading this evolution is the rapidly growing e-fuel market. E-fuels, commonly known as synthetic fuels, present a hopeful path toward reducing carbon emissions across various sectors such as transportation, aviation, and heavy industry. This article aims to assess the importance of e-fuels, delve into the factors propelling market growth, pinpoint obstacles to advancement, and highlight the ample opportunities that await in the future.

To Understand More About this Research: Request a Free Sample Report

E-fuels are created through the synthesis of carbon dioxide (CO2) captured from the atmosphere and hydrogen generated from renewable energy sources. This method not only provides a practical means to mitigate greenhouse gas emissions but also tackles the complexities associated with electrifying sectors less amenable to battery technologies. These sectors notably encompass aviation, maritime shipping, and heavy-duty transportation.

Moreover, e-fuels can serve as a bridge between conventional fossil fuels and a sustainable energy future. By leveraging existing infrastructure and engines, they provide a practical and efficient means to decarbonize without necessitating a complete overhaul of existing systems.

- For instance, in December 2022, Porsche invested in e-fuel and started its production in Chile. This was undertaken in Punta Arenas because of its windy climate.

The adaptability of e-fuels to existing infrastructure, including pipelines, storage facilities, and engines, presents a significant opportunity for rapid market penetration. This minimizes the need for costly infrastructure overhauls.

Furthermore, International cooperation and investment in e-fuel production facilities can accelerate the development and deployment of this technology. Collaborative efforts drive down production costs and establish a robust market for e-fuels on a global scale.

For Specific Research Requirements: Request for Customized Report

However, higher production costs. Limited production capacity and technological challenges are the factors restraining the growth of the e-fuel market. Currently, the production of e-fuels remains more expensive compared to conventional fossil fuels. The energy-intensive processes involved in capturing CO2 and producing hydrogen, coupled with the capital-intensive infrastructure required, contribute to this cost disparity.

Similarly, there are various technical hurdles that need to be overcome, particularly in optimizing the efficiency of e-fuel production processes. Innovations in catalysts, electrolyzers, and reactors are essential for scaling up production while maintaining economic viability.

Growth Drivers

Advancements in renewable energy technologies is projected to spur the product demand.

The maturation and widespread adoption of renewable energy technologies, such as solar and wind, have significantly reduced the cost of electricity production. This, in turn, has made the production of green hydrogen, a key component of e-fuels, more economically viable.

Also, stringent environmental regulations and carbon pricing mechanisms are incentivizing industries to seek cleaner alternatives. Governments and international bodies are implementing policies to encourage the adoption of low-carbon technologies, which is driving the demand for the e-fuel market.

Report Segmentation

The market is primarily segmented based on fuel type, state, production, end-user, and region.

|

By Fuel Type |

By State |

Production |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Fuel Type Analysis

Ethanol segment accounted for the largest market share in 2022

The ethanol segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. This can be attributed to a multitude of government policies and investments occurring worldwide aimed at ramping up e-fuel production. For example, in the U.S., the Renewable Fuel Standard Program enforces fuel blending requirements that encourage the utilization and production of renewable ethanol within the country.

Moreover, this surge is also due to numerous initiatives launched in Europe to boost e-fuel production. By 2025, aircraft departing from European airports will be required to incorporate a greater proportion of sustainable aviation fuels (SAFs), including e-kerosene, for refueling. These enhanced blending regulations have received approval from the European Commission (EC).

By State Analysis

Liquid segment accounted for the largest market share in 2022

The liquid segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. This expansion is due to the versatile use of liquid e-fuels in propelling vehicles, energizing generators, and driving industrial processes, all achieved without the necessity for substantial modifications to current setups This expansion is due to the versatile use of liquid e-fuels in propelling vehicles, energizing generators, and driving industrial processes, all achieved without the necessity for substantial modifications to current setups.

The gas segment is expected to witness highest growth during forecast period. This is due to its extensive utilization in sectors heavily reliant on gaseous fuels, such as power generation and heating. This adaptability further extends to their seamless integration within the existing gas infrastructure.

By Production Analysis

Gas-to-liquid segment is expected to witness highest growth during forecast period

The gas-to-liquid segment is projected to grow at a CAGR during the projected period. This technology represents a revolutionary production process converting gases like natural gas or syngas into liquid hydrocarbons using Fischer-Tropsch synthesis. This technique involves leveraging the primary gas feedstock, derived from sources like natural gas or syngas obtained through processes like gasification, which significantly fuels the growth of this sector.

By End-User Analysis

Automotive segment held the significant market revenue share in 2022

The automotive segment held a significant market share in revenue share in 2022, which is primarily attributed to the fact that e-fuels like e-diesel and e-gasoline can seamlessly substitute traditional petroleum-based fuels in standard internal combustion engines, enabling automakers to adopt them with minimal adjustments.

Regional Insights

Europe region dominated the global market in 2022

The European region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to stringent environmental regulations. Europe has been at the forefront of implementing rigorous environmental regulations to combat climate change. The European Union's commitment to reduce greenhouse gas emissions has spurred investment and innovation in renewable energy technologies, including e-fuels.

Moreover, various European governments have introduced incentives, subsidies, and tax breaks to encourage the production and adoption of e-fuels. These policies provide a favorable environment for businesses to invest in e-fuel technologies.

Also, there have been various advancements in renewable energy. Europe has made significant strides in renewable energy generation, particularly in wind and solar power. The availability of abundant renewable energy sources has facilitated the production of green hydrogen, a key ingredient in e-fuel production.

The North American region is expected to witness the highest growth during the forecast period. This is due to substantial backing from the federal governments of its constituent countries. Countries such as the U.S. and Canada allocate significant resources for pilot-scale ventures, facilitating progress in research and development for renewable fuel technologies. Additionally, the escalating enforcement of rigorous regulations to curtail greenhouse gas emissions, coupled with an increasing emphasis on clean energy, is projected to propel the regional market during the forecast period.

Key Market Players & Competitive Insights

The e-fuel market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Carbon Clean Solutions

- Climeworks

- CRI Catalyst Company

- E-Fuel Corporation

- Electrochaea

- Global Thermostat

- Greyrock

- INERATEC

- LanzaTech

- Liquid Wind

- Norsk e-Fuel AS

- Prometheus Fuels

- Siemens Energy AG

- Sunfire

- Velocys

Recent Developments

- In March 2023, Norwegian Air Shuttle ASA entered into a collaboration with Norsk e-fuel for building new energy efficient plant in Norway. The facility, slated for completion by 2026, is dedicated to the sustainable production of e-fuels tailored for the aviation sector. This collaboration is poised to significantly amplify Norsk e-fuel's capacity to meet the demands of the aviation industry.

E-Fuel Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 130.83 billion |

|

Revenue forecast in 2032 |

USD 643.80 billion |

|

CAGR |

19.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Fuel Type, By State, By Production, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |