Drug Discovery Services Market Share, Size, Trends, Industry Analysis Report, By Type (Small molecules, Large Molecules) By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM3920

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

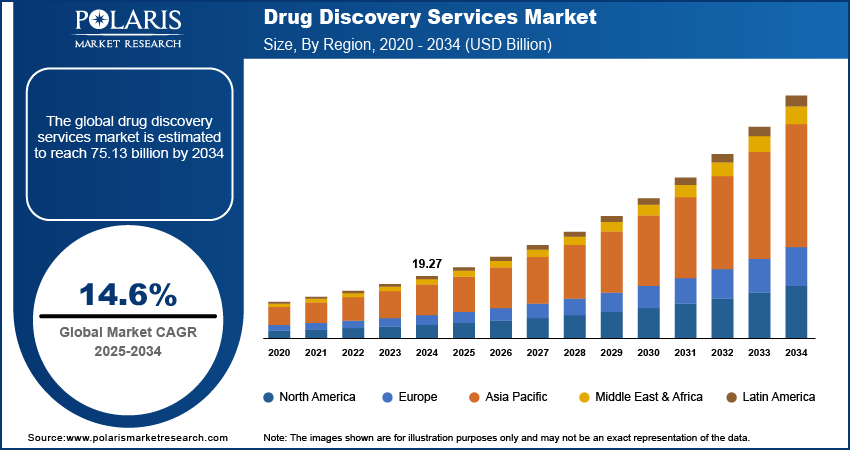

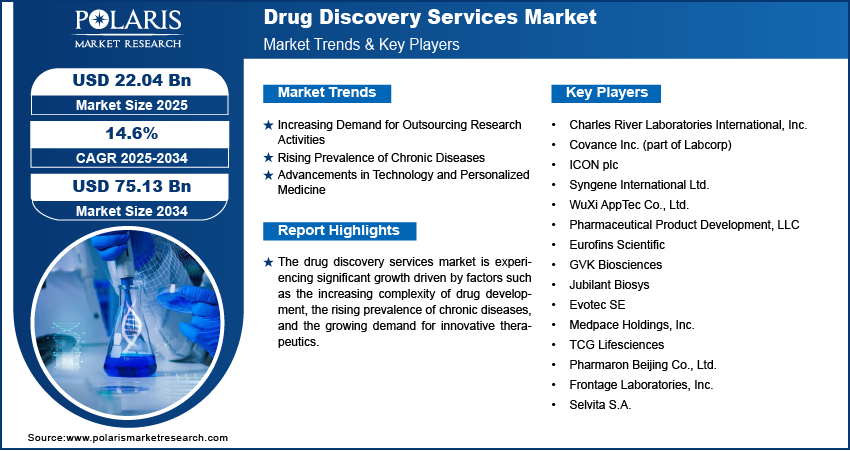

The global drug discovery services market was valued at USD 19.11 Billion in 2023 and is expected to grow at a CAGR of 14.40 % during the forecast period.

The process of finding a substance that can be employed to heal and manage illnesses is referred to as drug discovery. Typically, the journey to identify a drug begins with a molecule exhibiting intriguing biological properties or interacting with a biological target known to be involved in disease progression. Recent advancements in technology have revolutionized drug discovery, making it a more sophisticated, accurate, and time-intensive process. Historically, drugs were discovered by identifying the active components in traditional remedies, as seen with the discovery of penicillin.

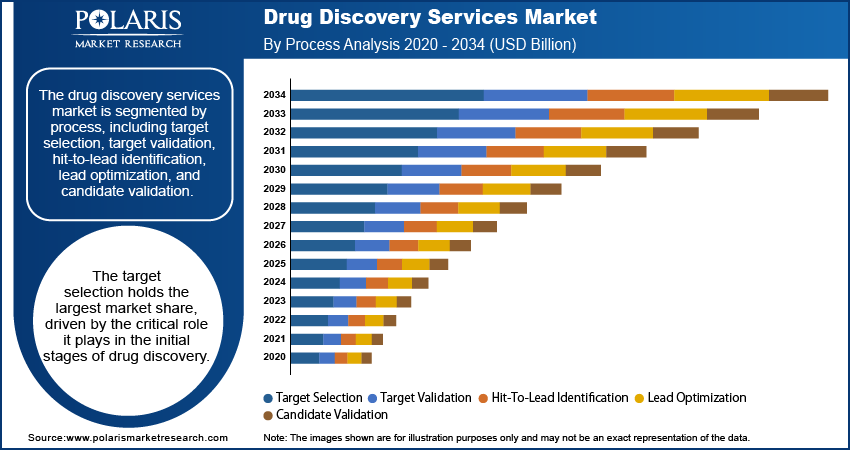

In the fields of medicine, pharmacology, and biotechnology, the term drug discovery refers to the method by which new candidate medications are found. In the past, the way drugs were found was by spotting the active ingredient from traditional remedies or by unplanned fortunate discovery. Today, drug discovery involves several steps, including the identification of screening hits and medicinal chemistry. The hits are then optimized to increase affinity, selectivity, efficacy, and bioavailability. Once the compound satisfies all the requirements, the process of drug discovery can continue. If successful, clinical trials for the same are developed.

Modern drug discovery necessitates a higher level of specialized support and expertise. And this is where drug discovery services come in. By outsourcing drug discovery, companies can free up their valuable resources and accomplish their project goals. Drug discovery services have end-uses in several sectors, including pharmaceutical, biotechnology, and academics, amongst others. The growing demand for novel therapies for various therapeutic purposes is anticipated to be the primary driver of the drug discovery services market growth.

To Understand More About this Research: Request a Free Sample Report

The drug discovery services market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Pharmaceutical companies are currently focusing their efforts on addressing major health conditions and diseases such as cardiology, oncology, and infectious diseases. These particular areas have become a source of concern for many due to the increasing prevalence of conditions such as cardiac arrest and various forms of cancer. As a result, these companies are deploying resources and research efforts towards drug discovery and development in these fields to prepare for the anticipated rise in the number of cases.

Research and development play a crucial role in the success of pharmaceutical companies. With the rise of diseases and health challenges, as well as increasing competition, innovation is necessary to stay ahead in the market. In addition to promoting and marketing current medications, companies must prioritize the ongoing exploration of new drugs that can provide better efficacy than existing solutions.

The COVID-19 pandemic has significantly impacted the drug discovery services market. Initially, there was a necessary shift in priorities, focusing on the development of treatments and vaccines for the virus. However, this shift also caused disruptions in global supply chains, which affected the availability of crucial laboratory materials and equipment. Furthermore, the implementation of remote work measures led to a slowdown in laboratory research, resulting in delays in clinical trials for non-COVID drugs.

Nevertheless, the pandemic catalyzed the adoption of computational approaches such as virtual screening and molecular modeling. Additionally, there was an increase in government funding for research and development. These transformative changes, combined with expedited regulatory pathways, have the potential to fundamentally alter the drug discovery landscape in the long run, fostering greater efficiency and a stronger focus on innovation.

Industry Dynamics

Market Growth Drivers

Increasing Demand for a Novel Therapies for Numerous Therapeutic Purposes

The growing need for innovative treatments for chronic illnesses and ongoing advancements in the global healthcare sector are expected to be the primary catalysts for the expansion of the drug discovery services market. Pharmaceutical and biopharmaceutical companies continue to outsource their research and development (R&D) operations to Contract Research Organizations (CROs), which provide R&D services and employ engagement strategies to optimize R&D productivity. In response to the escalating burden of chronic diseases, pharmaceutical companies are compelled to seek solutions and increase their investments in clinical trials. This leads to a heightened demand for drug discovery services.

Chronic health conditions such as diabetes, dementia, and cardiovascular disease impose significant socioeconomic burdens and place a growing strain on patients. These ailments are responsible for seven out of every ten deaths worldwide, causing more than 40 million fatalities each year. In the United States, chronic diseases stand as the primary contributors to both mortality and disability, constituting the majority of healthcare expenditures. Consequently, the global market for drug discovery services is projected to thrive, propelled by the pervasive prevalence of chronic diseases. This surge in chronic conditions is anticipated to drive up research and development investments and foster increased exploration into innovative pharmaceuticals. The heightened demand for medications, driven by the expanding prevalence of these persistent illnesses, presents fresh economic prospects for companies specializing in drug discovery services.

Report Segmentation

The market is primarily segmented based on type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Small Molecule Segment Dominated the Market in 2022

In 2022, the small molecule segment held the largest revenue share. Small molecules are known for their low molecular weight, which makes them capable of easily passing through cell membranes, enabling them to efficiently target intracellular pathways. This group of molecules represents a significant majority, with a market share exceeding 77%. The preeminence of small molecules in drug discovery is due to several factors. For a long time now, the pharmaceutical industry has been proficient in creating small molecule-based drugs, and these compounds have consistently shown their effectiveness in treating a wide range of medical conditions.

On the other hand, the large molecule segment is witness to fastest growth in the forecast period. Large molecules originate from living organisms and encompass a wide range of substances, including peptides, proteins, antibodies, nucleic acids, and macromolecules. The surge in the prominence of large molecules can be attributed to various factors. Progress in genetic engineering and biotechnology has greatly streamlined the process of creating and manufacturing these substantial compounds. Innovative techniques like recombinant DNA technology and monoclonal antibody production have brought about a transformative shift in the biologics domain, resulting in the creation of exceptionally precise treatments.

By End-Use Analysis

The Pharmaceutical Segment Accounted for the Largest Revenue Share in the Forecast Period

The pharmaceutical segment accounted for the largest market share during the forecast period, companies allocate significant resources to research and development, facilitating investments in drug discovery services for the creation of innovative treatments. Their commitment to innovation and the pursuit of novel drug candidates fuels the demand for drug discovery services. Furthermore, pharmaceutical and biotechnology firms possess substantial expertise in drug development and maintain strategic partnerships with contract research organizations and service providers. These collaborations enable them to harness the specialized capabilities and resources of drug discovery service providers, ultimately leading to more efficient and streamlined drug discovery procedures.

On the other hand, Academic institutes is the fastest growing segment in the forecast period. Academic institutions play a pivotal role in the field of drug discovery research thanks to their emphasis on innovation, scientific inquiry, and cooperative efforts. Within these institutions, there exists a wealth of highly proficient researchers and scientists who make significant contributions to the progress of drug discovery and its subsequent development. These academic entities frequently engage in partnerships with governmental agencies, pharmaceutical corporations, and various other stakeholders to conduct research and development initiatives. Their research is further amplified by their access to cutting-edge technologies and financial support from government sources, which enhances their research capabilities.

Regional Insights

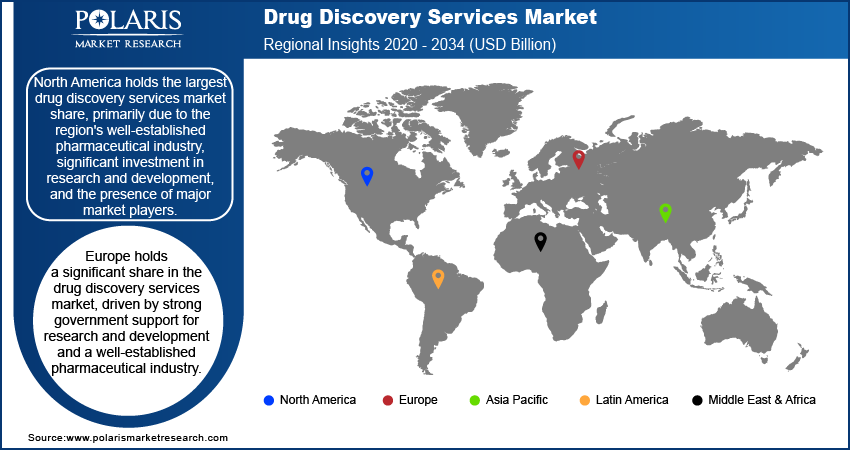

North America Dominated the Largest Market in 2022

In 2022, North America dominated the largest market contributor in the drug discovery services market. North America boasts a significant presence of leading pharmaceutical companies and biotechnology firms, which serve as catalysts for the demand for drug discovery services. The continent also possesses a firmly established and resilient research ecosystem, encompassing research centers, prestigious academic institutions, and governmental backing to foster scientific progress.

The presence of highly skilled researchers and scientists, along with cutting-edge technological capabilities, serves to enhance the region's market dominance even further.

Asia-Pacific is the fastest growing market in the forecast period. The growth in the pharmaceutical industry can be attributed to several factors. Firstly, the increasing prevalence of chronic lifestyle disorders in the region has compelled companies to develop therapeutics in these areas. Secondly, the growing number of biopharmaceutical businesses in the region has led to more opportunities for drug discovery services, thus contributing to the market growth. Lastly, the implementation of effective business strategies and regional collaboration is expected to have a significant positive impact on the market.

Furthermore, governmental efforts to encourage research and development, along with favorable regulatory frameworks and tax incentives, have contributed to the accelerated growth of the market in this region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Aurigene Discovery Technologies

- Charles River Laboratories International Inc.

- Eurofins Scientific

- Evotec

- Frontage Labs

- Galapagos NV

- General Electric

- Genscript

- Laboratory Corporations of America Holdings

- PPD Inc.

- Syngene International Limited

- Thermo Fisher Scientific Inc.

- WuXi AppTec

Recent Developments

- In February 2023, Charles River Laboratories, a company based in the United States, announced a comprehensive partnership with Pioneering Medicines, an initiative under Flagship Pioneering (also based in the United States). This partnership includes providing access to the Logica AI platform for the purpose of advancing small-molecule drug discovery.

- In October 2022, Exemplify Bio-Pharma, a company headquartered in the United States, offered comprehensive drug development services encompassing process and analytical chemistry, along with advanced formulation technologies.

- In January 2022, Evotec and Boehringer Ingelheim established a collaborative initiative focused on utilizing iPSC-based disease modeling to advance the development of medications for ophthalmologic disorders.

Global Drug Discovery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21.79 Billion |

|

Revenue forecast in 2032 |

USD 64.08 Billion |

|

CAGR |

14.40 % from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2024 Scooters Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Drug Discovery Services Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse for Our Top Selling Reports

AI in oncology Market Size & Share

Smart Pills Market Size & Share

In-Vehicle Payment Services Market Size & Share

Audience Analytics Market Size & Share

Delve into the intricacies of the drug discovery services market landscape with the latest statistical insights for 2024, meticulously crafted by Polaris Market Research Industry Reports. Uncover the market's share, size, and revenue growth rate, supplemented by a forward-looking market forecast until 2032 and a retrospective glance at its history. Elevate your understanding of this dynamic industry by securing a complimentary PDF download of the sample report and staying ahead in the ever-evolving realm of drug discovery services.