Global Drug Discovery Informatics Market Size, Share, Trends, Industry Analysis Report: By Application (Drug Discovery, Drug Development), By Mode, By Services, By End-User, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 118

- Format: PDF

- Report ID: PM1870

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

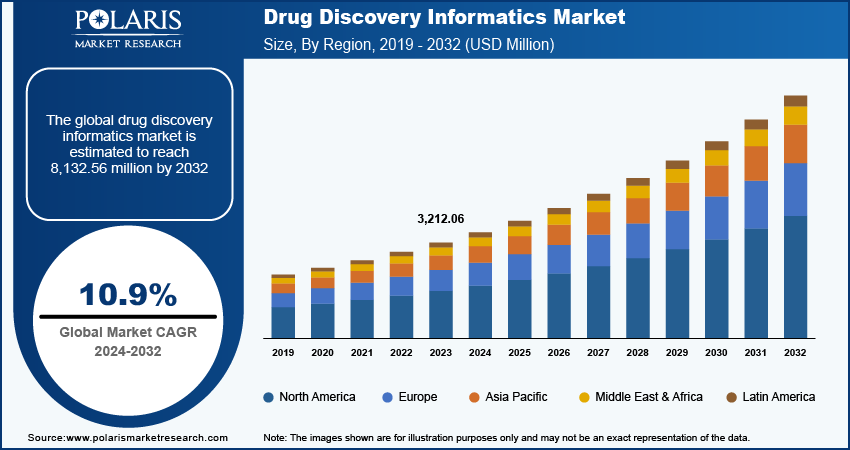

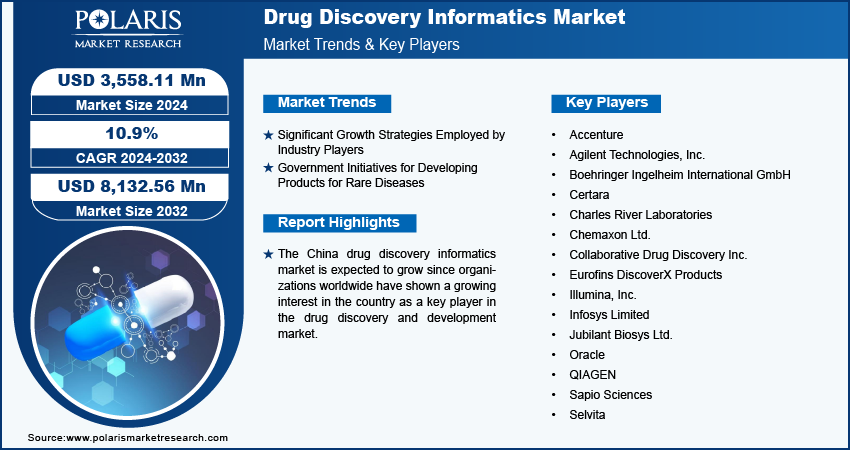

Global drug discovery informatics market size was valued at USD 3,212.06 million in 2023. The drug discovery informatics market industry is projected to grow from USD 3,558.11 million in 2024 to USD 8,132.56 million by 2032, exhibiting a compound annual growth rate (CAGR) of 10.9% during the forecast period (2024 - 2032).

Drug discovery informatics involves the use of computational tools and techniques to analyze and interpret biological and chemical data to identify potential new drug prospects. The drug discovery informatics market growth is driven by technological advancements such as integration with artificial intelligence and cloud computing.

Further, several tech companies are introducing innovative drug discovery solutions to meet the demand from the healthcare industry. For instance, in May 2023, Google Cloud introduced two advanced AI-driven solutions for the life sciences industry, including the Target and Lead Identification Suite and Multiomics Suite. The solutions were designed to accelerate the process of drug discovery and precision medicine for pharmaceutical firms, biotech companies, and public sector organizations. The Target and Lead Identification Suite enabled researchers to identify the function of amino acids and make predictions about protein structures.

Additionally, the Multiomics Suite accelerated the analysis and interpretation of genomic data, facilitating the development of tailored treatments by companies. These AI-powered advancements in the market are transforming the drug discovery process by making it more efficient to handle the complexity of biomedical data. Thus, innovative technological enhancements are driving the drug discovery informatics market.

To Understand More About this Research: Request a Free Sample Report

Furthermore, substantial investment by companies to speed up drug discovery processes is driving market growth. For instance, in July 2023, Nvidia made a significant investment of USD 50 million in Recursion Pharmaceuticals to accelerate the advancement of artificial intelligence models specifically tailored for drug discovery. These investments enhanced the capabilities of drug discovery informatics and paved the way for innovative therapeutics. Thus, the synergy between advanced informatics models and significant financial support is fostering drug development and ultimately driving the drug discovery informatics market growth.

Drug Discovery Informatics Market Trends

Significant Growth Strategies Employed by Industry Players

The expansion and growth activities by industry participants drive the market CAGR for drug discovery informatics. Companies are acquiring, collaborating, and partnering with academic institutions, research organizations, and pharmaceutical companies to foster innovation in the market space. For instance, in May 2023, Recursion, a company specializing in clinical stage TechBio, announced the acquisition of two companies, Cyclica and Valence, that are operating in the AI-enabled drug discovery sector. The strategic acquisitions of pharma companies have enabled Recursion to expand into the field of AI and ML-based drug discovery. These types of strategic activities are collectively accelerating research and development, reducing costs, and improving the success rates of new drug development, thereby propelling the drug discovery informatics market.

Government Initiatives for Developing Products for Rare Diseases

Governments are introducing initiatives to control and promote drug development for rare diseases or conditions. These initiatives, which include increased funding, tax incentives, and streamlined regulatory processes, encourage pharmaceutical companies and research institutions to invest in the discovery and development of treatments. For instance, The Orphan Drug Act, established in the United States, provides incentives for the development of drugs to address rare diseases. It allows companies and drug developers to request orphan drug designation, enabling companies to get funding for the development of products targeted at rare diseases or conditions. Additionally, the Orphan Drug Act plays a crucial role in safeguarding public health by ensuring the efficacy and safety of drugs, biological products, and medical devices. Consequently, these government-driven efforts are expanding the demand for and the development of informatics solutions, thereby propelling the growth of the drug discovery informatics market.

Drug Discovery Informatics Market Segment Insights

Drug Discovery Informatics Application Insights

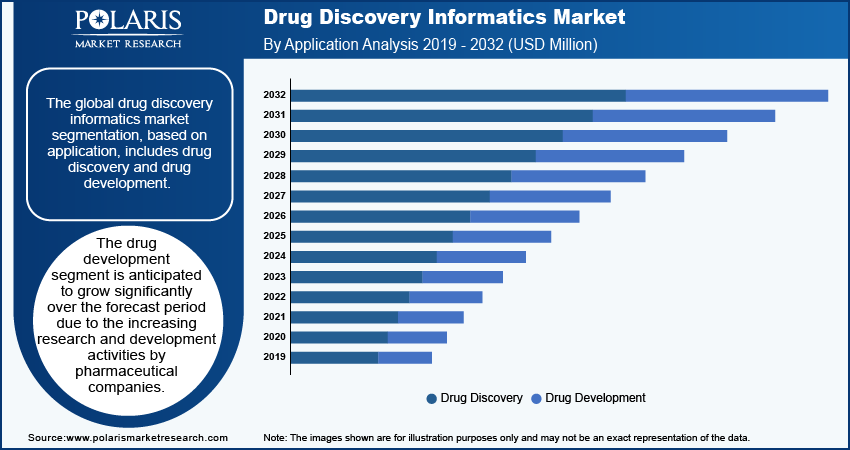

The global drug discovery informatics market segmentation, based on application, includes drug discovery and drug development. The drug development segment is anticipated to grow significantly over the forecast period due to the increasing research and development activities by pharmaceutical companies. Pharmaceutical companies and research institutions are intensifying their efforts to develop new drugs. For instance, according to the Pharmaceutical Research and Manufacturers of America 2023, more than 400 medications are under development for chronic diseases affecting Americans. The increasing emphasis on drug development creates the need for advanced informatics tools to manage and analyze the vast amounts of data generated during the drug development process. Thus, the surge in drug development activities and the need for data management tools is driving the expansion of the drug development segment within the drug discovery informatics market.

Drug Discovery Informatics Services Insights

The global drug discovery informatics market segmentation, based on services, includes clinical trial data management, docking, molecular modeling, sequence analysis platforms, and others. In 2023, the sequence analysis platforms segment held the largest revenue share since platforms such as FASTA, BLAST, and CLUSTALW played an essential role in modern drug discovery and development. These platforms enabled researchers to process and interpret a large volume of genomic data. Furthermore, the tools mentioned above are applied to identify genetic mutations, understand disease mechanisms, and discover new drug targets. The ability to rapidly compare and align DNA, RNA, and protein sequences allows for the efficient identification of similarities and differences that are important in biological functions. Consequently, these applications of computational tools in sequential analysis have resulted in the dominant revenue share of the sequence analysis platforms in the drug discovery informatics market.

Drug Discovery Informatics Regional Insights

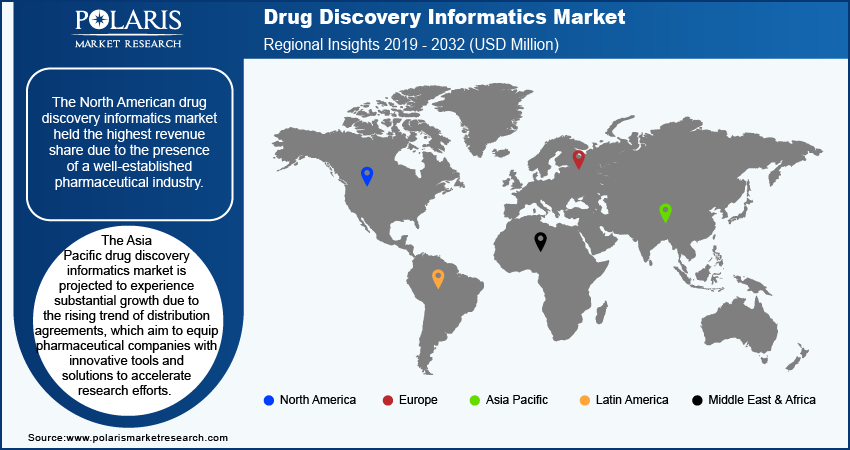

By region, the study provides the drug discovery informatics market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North American drug discovery informatics market held the highest revenue share due to the presence of a well-established pharmaceutical industry. The region's pharmaceutical industry is allocating a substantial amount of funds to research and development activities. For instance, according to the Congressional Budget Office, the U.S. pharmaceutical industry spent USD 83 billion on research and development activities in 2019. This spending on research and development fostered a facilitative environment for the adoption of informatics technologies in the region. Thus, the presence of a robust pharmaceutical industry in North America is creating a favorable environment for drug discovery informatics, contributing to the region's leading revenue share in the market.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The Asia Pacific drug discovery informatics market is projected to experience substantial growth due to the rising trend of distribution agreements, which aim to equip pharmaceutical companies with innovative tools and solutions to accelerate research efforts. For instance, in May 2024, Certara, Inc., a company in MIDD Model-Informed Drug Development, announced a new distributor agreement with Cloudscientific. The partnership enabled the distribution of Certara’s discovery informatics platform, D360, and the secure and adaptable GPT offering, Certara.AI, in China to expand the research and development community. These agreements are facilitating collaborations that combine international expertise with local market knowledge, fostering innovation and enabling the development of region-specific solutions. Consequently, the Asia Pacific drug discovery informatics market is anticipated to grow with a significant CAGR over the forecast period.

The China drug discovery informatics market is expected to grow since organizations worldwide have shown a growing interest in the country as a key player in the drug discovery and development market. China-based companies are offering contract research services in the drug discovery field to meet the increasing demand for drug development. Thus, the organizations’ growing interest, along with the increasing recognition of China's potential as a source of novel preclinical and clinical compounds, drives growth in the China drug discovery informatics market.

Drug Discovery Informatics Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the drug discovery informatics market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the drug discovery informatics industry must offer cost-effective solutions.

The drug discovery informatics market is highly competitive, with numerous global and regional players competing for market share. The global players are dominating the market with comprehensive offerings spanning data analytics, AI-driven insights, and cloud-based solutions tailored for pharmaceutical research. Major players in the drug discovery informatics market include Accenture, Agilent Technologies, Inc., Boehringer Ingelheim International GmbH, Certara, Charles River Laboratories, Chemaxon Ltd., Collaborative Drug Discovery Inc., Eurofins DiscoverX Products, Illumina, Inc., Infosys Limited, Jubilant Biosys Ltd., Oracle, QIAGEN, Sapio Sciences, and Selvita.

QIAGEN is a global company that provides biological sample technologies for molecular insights. The company offers a wide range of primary and secondary sample technology consumables, including purification and nucleic stabilization kits, automated and manual processing for various analyses, silica membranes, nucleic acid purification instruments, magnetic bead technologies, and accessories. In February 2024, QIAGEN introduced the QIAGEN Biomedical KB-AI, which is a generative AI-driven knowledge base tailored to advance drug discovery in the pharmaceutical and biotechnology sectors. This solution is specifically developed to meet the needs of data scientists and bioinformaticians seeking highly extensive knowledge graphs to power data-centric drug discovery efforts.

Eurofins Discovery is a biotechnology company specializing in providing comprehensive scientific testing and laboratory services to drive drug discovery and improve human health. The company's expertise spans molecular and functional, cellular, in vivo, in vitro pharmacology, epigenetics, immunology, oncology, cell-based services, GPCRs, ion channels, kinases, drug discovery products, enzymes, drug discovery services, integrated drug discovery, drug safety, drug efficacy, phenotypic, translational biology, and research informatics. In February 2024, Eurofins Discovery launched DiscoveryAI SAFIRE, an innovative platform harnessing proprietary datasets, artificial intelligence (AI), and machine learning (ML) capabilities to accelerate the pace of discovery.

Key companies in the drug discovery informatics market include

- Accenture

- Agilent Technologies, Inc.

- Boehringer Ingelheim International GmbH

- Certara

- Charles River Laboratories

- Chemaxon Ltd.

- Collaborative Drug Discovery Inc.

- Eurofins DiscoverX Products

- Illumina, Inc.

- Infosys Limited

- Jubilant Biosys Ltd.

- Oracle

- QIAGEN

- Sapio Sciences

- Selvita

Drug Discovery Informatics Industry Developments

April 2024: Sapio Sciences, the science-aware lab informatics platform, introduced multimodal registration capabilities. It integrates small-molecule, large-molecule, and multimodal discovery workflows, such as entity registration, into a unified platform.

July 2021: Collaborative Drug Discovery, Inc., a provider of the web-based drug discovery informatics platform CDD Vault, introduced BioHarmony. BioHarmony is a new data offering that features semantically curated live feeds of drug data sourced from diverse outlets.

June 2023: Revvity, Inc., introduced its Signals Research Suite, a cloud-native SaaS platform designed to facilitate scientific collaboration across various R&D domains, ranging from drug discovery to the development of specialty chemicals materials.

Drug Discovery Informatics Market Segmentation

Drug Discovery Informatics Application Outlook

- Drug Discovery

- Identification, Validation, & Assay Development Informatics

- Lead Generation

- Drug Development

- FHD Preparation

- Lead Optimization

- Phase IA

- Phase IB/2

Drug Discovery Informatics Mode Outlook

- Outsourced

- In-house

Drug Discovery Informatics Services Outlook

- Clinical Trial Data Management

- Docking

- Molecular Modeling

- Sequence Analysis Platforms

- Others

Drug Discovery Informatics End User Outlook

- Biotechnology Companies

- Contract Research Organization (CROs)

- Pharmaceutical Companies

- Others

Drug Discovery Informatics Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Drug Discovery Informatics Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 3,212.06 million |

|

Market Size Value in 2024 |

USD 3,558.11 million |

|

Revenue Forecast in 2032 |

USD 8,132.56 million |

|

CAGR |

10.9% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global drug discovery informatics market size was valued at USD 3,212.06 million in 2023 and is projected to grow to USD 8,132.56 million by 2032.

The global market is projected to grow at a CAGR of 10.9% during the forecast period, 2024-2032.

North America had the largest share of the global market.

The key players in the market are Accenture, Agilent Technologies, Inc., Boehringer Ingelheim International GmbH, Certara, Charles River Laboratories, Chemaxon Ltd., Collaborative Drug Discovery Inc., Eurofins DiscoverX Products, Illumina, Inc., Infosys Limited, Jubilant Biosys Ltd., Oracle, QIAGEN, Sapio Sciences, and Selvita.

The drug development segment had the highest CAGR in the global market.

The sequence analysis platforms category held the highest share of the market in 2023.