Drug Device Combination Products Market Size, Share, Trends, Industry Analysis Report, By Type (Drug Eluting Stents, Infusion Pumps, Inhalers, Orthopedic Combination Products, Wound Care Combination Products, Photodynamic Therapy Devices, Transdermal Patches, Antimicrobial Catheters, and Others), Application, End user, and Region- Market Forecast, 2025 - 2034

- Published Date:Nov-2024

- Pages: 118

- Format: PDF

- Report ID: PM5167

- Base Year: 2024

- Historical Data: 2020-2023

Drug Device Combination Products Market Outlook

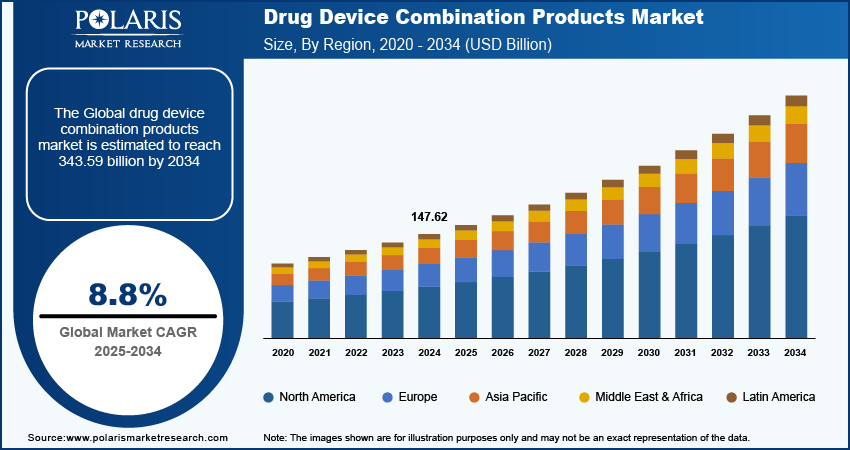

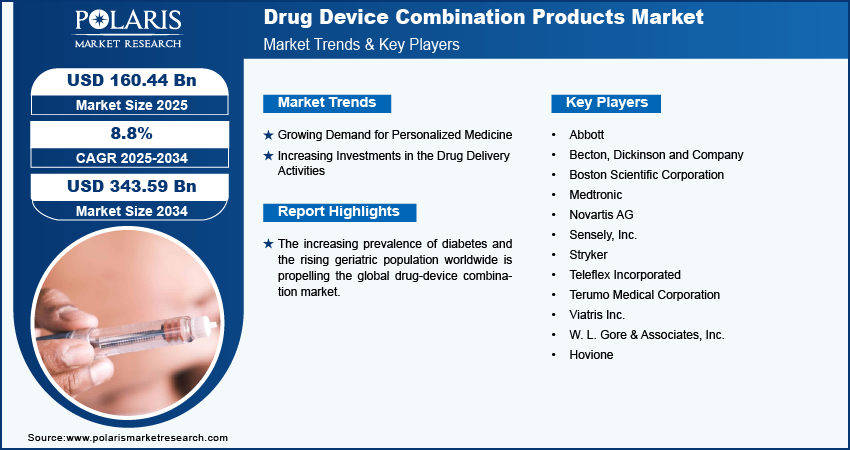

Drug Device Combination Products Market size was valued at USD 147.62 billion in 2024. The market is anticipated to grow from USD 160.44 billion in 2025 to USD 343.59 billion by 2034, exhibiting the CAGR of 8.8% during the forecast period.

Drug Device Combination Products Market Overview

The increasing prevalence of diabetes is driving the global drug-device combination products market. Diabetes requires ongoing management involving both medication and monitoring. Drug-device combination products, such as insulin pumps or continuous glucose monitors (CGMs) that also administer medication provide a more integrated approach to treatment. These products simplify the management of diabetes by combining drug delivery with monitoring in a single device, making them more convenient for patients. Therefore, as the prevalence of diabetes increases, the demand for drug-device combination products also spurs. For instance,

The International Diabetes Federation (IDF) projects that the number of people with diabetes will increase to 643 million by 2030 and 783 million by 2045.

To Understand More About this Research: Request a Free Sample Report

The rising geriatric population worldwide is propelling the drug-deice combination products market. Older adults often have multiple chronic conditions, such as diabetes, hypertension, and arthritis. Drug-device combination products that integrate medication delivery with monitoring or other supportive functions are particularly beneficial for managing these complex health needs, thereby boosting demand. Thus, the growing geriatric population is expanding the market. For instance,

According to a report published by the United Nations, the number of people aged 65 years or older worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion in 2050.

Drug Device Combination Products Drivers

Growing Demand for Personalized Medicine

The growing demand for personalized medicine is propelling the global drug-device combination products market. Personalized medicine aims to tailor treatments to individual patients based on their unique genetic, environmental, and lifestyle factors. Drug-device combination products that offer customizable or adjustable features align with this approach by providing personalized drug delivery and monitoring, which increases their adoption among chronic patients and others.

Increasing Investments in the Drug Delivery Activities

The rising investments in drug delivery activities are projected to expand the market. Increased investment allows key companies to develop products that address specific medical needs and offer superior performance compared to existing solutions. This increases the demand for updated and advanced drug delivery devices. For instance, in November 2023, Kindeva Drug Delivery, a drug delivery device contract development and manufacturing organization, received a £33 million grant from Life Sciences Innovation Manufacturing to manufacture the next generation of green inhalers.

Drug Device Combination Products Restraints

Strict Regulations

The ongoing regulations by government agencies are projected to hamper the market growth. Compliance with strict regulatory requirements is costly as companies must invest in rigorous clinical trials, comprehensive documentation, and regulatory submissions. These high costs deter smaller companies from entering the market or developing new products, potentially limiting innovation and reducing the overall supply of drug-device combination products.

Report Segmentation

The Drug Device Combination Products Market is primarily segmented based on product type, application, End user, and region.

|

By Product Type |

By Application |

By End user |

By Region |

|

|

|

|

By Type Analysis

Transdermal Patches dominated the market in 2024

The transdermal patches segment dominated the market share in 2024 due to their non-invasive nature, which aligns with the rising demand for minimally invasive and patient-friendly drug delivery solutions. Transdermal patches offer a convenient alternative for continuous, controlled release of medication, addressing patient preferences for less discomfort and ease of use. The expansion of this market segment is also driven by advancements in drug formulation and patch technology, which enhance the efficacy and versatility of transdermal systems. These innovations enable the delivery of a wider range of medications, including those previously limited to oral or injectable forms. Moreover, the growing focus on personalized medicine supports the development of customized patches that cater to individual patient needs, further contributing to their market dominance.

The drug-eluting stents segment is estimated to grow at a robust pace in the coming years owing to their effectiveness in treating coronary artery disease by releasing medications that prevent restenosis of the artery. Drug-eluting stents combine the benefits of mechanical support with localized drug delivery, reducing the need for repeat procedures and improving long-term patient outcomes. The rise in cardiovascular diseases and the increasing prevalence of aging populations drive demand for these innovative devices. Additionally, continuous innovation and development of advanced drug-eluting stents by key players in the market are fueling the segment growth. For instance, In May 2024, Abbott introduced a new version of the drug-eluting coronary stent system, the XIENCE Sierra stent, in India.

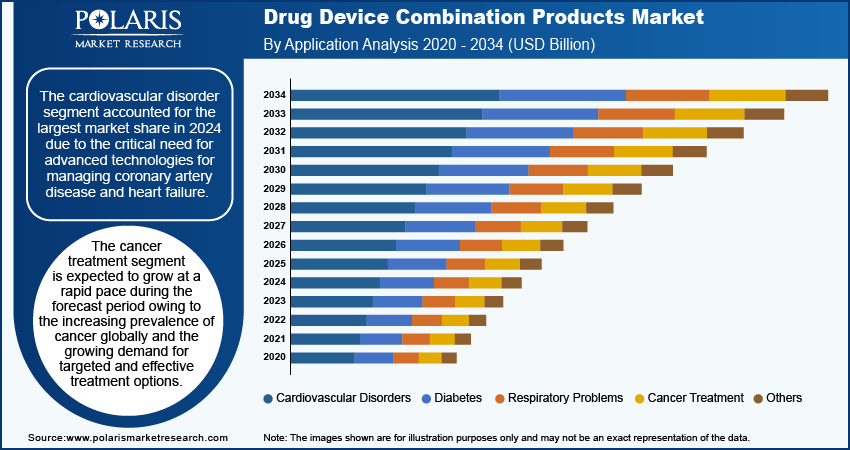

By Application Analysis

Cardiovascular Disorder Segment Accounted for the Largest Market Share in 2024.

The cardiovascular disorder segment accounted for the largest market share in 2024 due to the critical need for advanced technologies for managing coronary artery disease and heart failure. Devices like drug-eluting stents, which release medication to prevent artery re-narrowing, play a crucial role in this area. Innovations in stent technology, including improved drug formulations and biocompatible materials, have further contributed to this segment's growth. The effectiveness of these devices in enhancing patient outcomes and reducing the need for repeat interventions underscores their importance in the cardiovascular field.

The cancer treatment segment is expected to grow at a rapid pace during the forecast period owing to the increasing prevalence of cancer globally and the growing demand for targeted and effective treatment options. Drug-device combination products, such as implantable chemotherapy delivery systems and photodynamic therapy devices, offer advanced solutions for managing cancer with precision. These technologies allow for localized drug delivery directly to the tumor site, minimizing systemic side effects and improving treatment efficacy. Additionally, the rise in personalized medicine, which tailor’s treatments based on genetic and molecular profiles, also supports the growth of this segment.

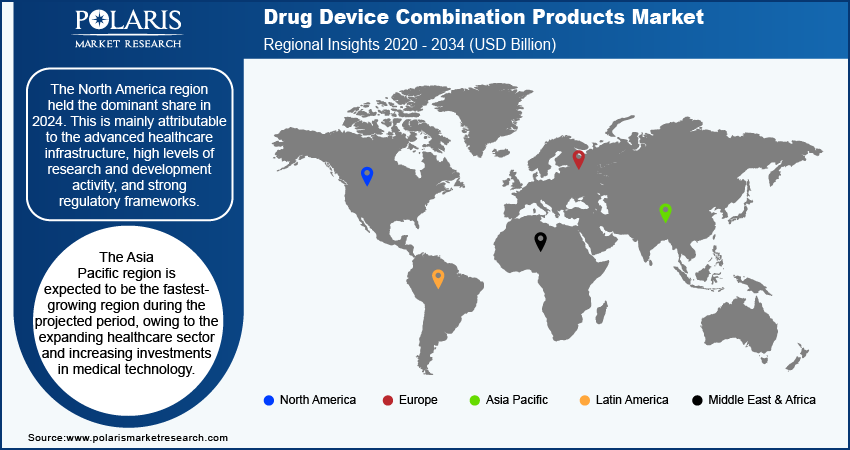

Drug Device Combination Products Market Regional Insights

North America Registered the Largest Share of the Market in 2024

The North America region held the dominant share in 2024. This is mainly attributable to the advanced healthcare infrastructure, high levels of research and development activity, and strong regulatory frameworks that support innovation and market entry. The US, in particular, led this region due to its robust healthcare system, significant investments in medical technology, and a high prevalence of chronic diseases. Additionally, the presence of numerous leading pharmaceutical and medical device companies, along with a high rate of adoption of new technologies, further contributes to North America's market leadership.

The Asia Pacific region is expected to be the fastest-growing region during the projected period, owing to the expanding healthcare sector, increasing investments in medical technology, and rising patient populations. Countries such as China and India are driving this expansion due to their large and growing patient bases and improving access to advanced medical technologies. For instance,

According to the International Diabetes Federation, more than 60% of people with diabetes live in Asia, with almost one-half in China and India combined.

Key Market Players & Competitive Insights

Key market players are investing heavily in research and development in order to expand their offerings, which will help the drug-device combination products market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. Major players in the drug-device combination products market include Abbott; Becton, Dickinson and Company; Medtronic; Novartis AG; Stryker; and others.

List of the Major Players Operating in The Global Drug Device Combination Products Market

- Abbott

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Medtronic

- Novartis AG

- Sensely, Inc.

- Stryker

- Teleflex Incorporated

- Terumo Medical Corporation

- Viatris Inc.

- Hovione

Recent Developments in the Industry

- December 2022, Terumo Corporation, a Japan-based medical device company, announced the launch of G-Lasta Subcutaneous Injection 3.6 mg BodyPod”, a drug-device combination product co-developed with Kyowa Kirin Co., Ltd.

- November 2023, Hovione, the specialist integrated CDMO, announced an expansion of its nasal drug delivery capabilities with the addition of a family of innovative nasal powder delivery devices developed in partnership with IDC.

Report Coverage

The drug-device combination products market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, application, End user, and their futuristic growth opportunities.

Drug Device Combination Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 160.44 billion |

|

Revenue Forecast in 2034 |

USD 343.59 billion |

|

CAGR |

8.8% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

Drug Device Combination Products Industry Trend Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global drug-device combination products market size was valued at USD 147.62 billion in 2024 and is projected to grow to USD 343.59 billion by 2034.

The global market is projected to grow at a CAGR of 8.8% during the forecast period.

North America had the largest share of the global market.

The key players in the market are Abbott; Becton, Dickinson and Company; Boston Scientific Corporation; Medtronic; Novartis AG; Sensely, Inc.; Stryker; Teleflex Incorporated; Terumo Medical Corporation; Viatris Inc.; and Hovione.

The drug-eluting stents type segment is projected for significant growth in the global market.

The cardiovascular disorder segment dominated the drug-device combination products market in 2024.