Dropshipping Market Size, Share, Trends, Industry Analysis Report: By Product (Electronics, Fashion & Apparel, Home & Kitchen, and Others), Business Model, Platform Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM2061

- Base Year: 2024

- Historical Data: 2020-2023

Dropshipping Market Overview

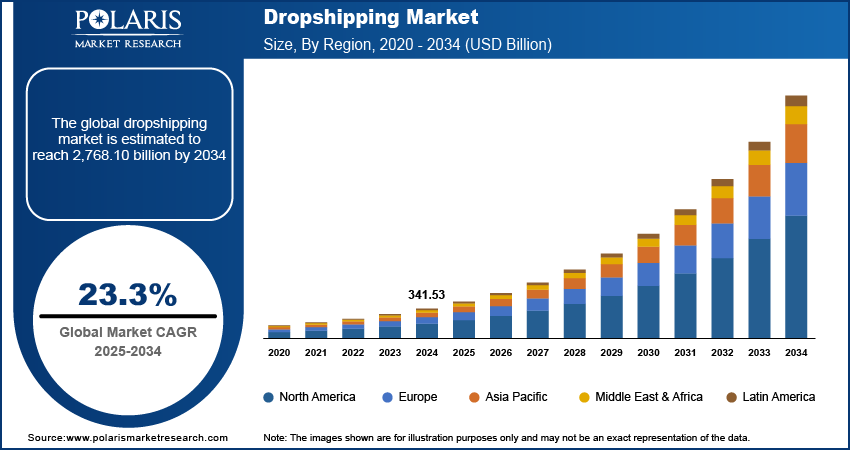

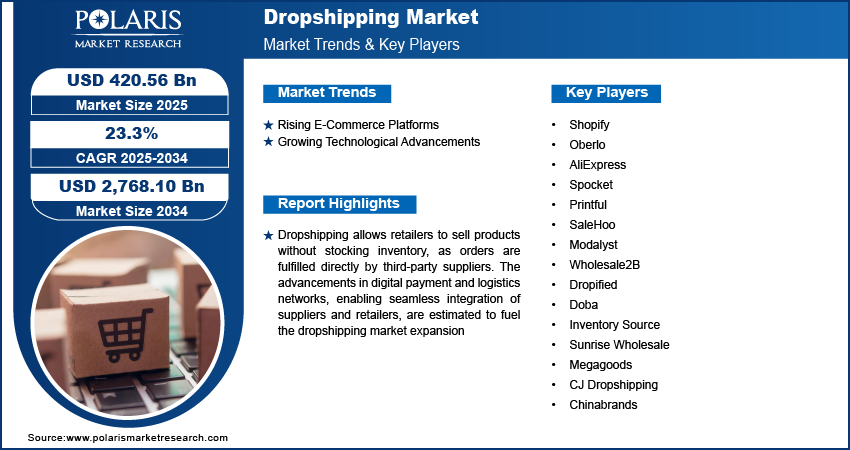

The dropshipping market size was valued at USD 341.53 billion in 2024. The market is projected to grow from USD 420.56 billion in 2025 to USD 2,768.10 billion by 2034, exhibiting a CAGR of 23.3% during 2025–2034.

Dropshipping allows retailers to sell products without stocking inventory, as orders are fulfilled directly by third-party suppliers. The increasing penetration of e-commerce platforms and the surging adoption of online shopping globally are propelling the dropshipping market growth. Growing preference for cost-efficient operational models among small and medium-sized enterprises (SMEs) is further contributing to the market growth as the dropshipping model minimizes upfront costs and offers scalability.

The advancements in digital payment and logistics networks, enabling seamless integration of suppliers and retailers, are estimated to fuel the dropshipping market expansion. Digital payment processors such as Stripe, PayPal, and Square enable suppliers and retailers to accept global payments instantly and securely, removing traditional barriers to international commerce. Thus, the rising adoption of digital payment contributes to the dropshipping market demand by allowing retailers to purchase goods directly from third-party suppliers.

To Understand More About this Research: Request a Free Sample Report

Dropshipping Market Driver Analysis

Rising Awareness Regarding Benefits of E-Commerce Platforms

E-commerce platforms such as Shopify, WooCommerce, and BigCommerce have revolutionized how dropshippers reach customers. These platforms provide retailers with ready-made infrastructure to launch online stores within hours, complete with professional designs, secure checkout systems, and automated inventory management. These platforms also allow dropshippers to simplify product sourcing and order fulfillment. Therefore, such benefits of e-commerce platforms propel the dropshipping market demand.

Growing Technological Advancements

Technological advancements have revolutionized the dropshipping industry by improving supply chain efficiency and customer engagement. Integration of AI and machine learning tools has enabled businesses to analyze consumer behavior, optimize pricing strategies, and forecast demand accurately. Additionally, advancements in logistics, such as real-time tracking and automation in order processing, have strengthened the reliability of dropshipping services. Hence, as technology continues to evolve, the dropshipping market is estimated to grow during the forecast period.

Dropshipping Market Segment Assessment

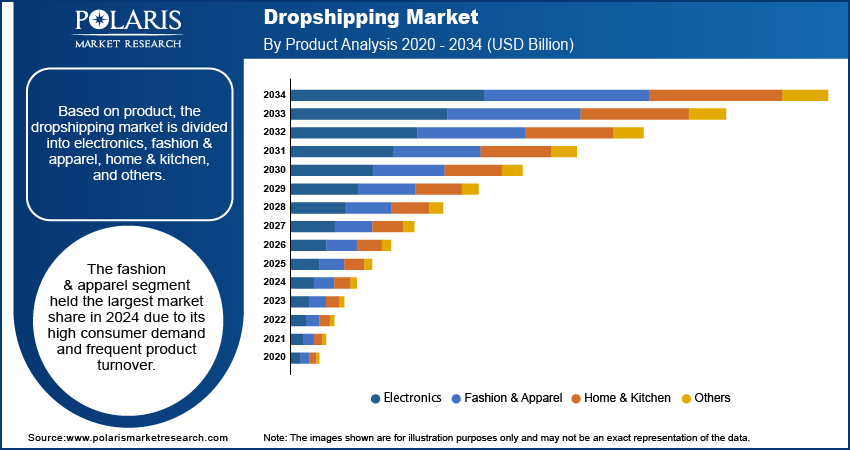

Dropshipping Market Outlook by Type

Based on Product, the dropshipping market is divided into electronics, fashion & apparel, home & kitchen, and others. The fashion & apparel segment held the largest market share in 2024 due to shifting consumer preferences toward trendy, customizable, and affordable clothing. Social media platforms and influencers have amplified the visibility of emerging brands, driving the popularity of apparel in the e-commerce space. Additionally, advancements in AI-driven analytics and automation have enabled businesses to curate personalized offerings, enhancing customer satisfaction and repeat purchases.

Dropshipping Market Evaluation by Business Model

In terms of business model, the dropshipping market is segregated into B2C (Business-to-Consumer), B2B (Business-to-Business), and C2C (Consumer-to-Consumer). The B2C model dominated the segment in 2024 due to its faster sales cycle and ability to offer lower prices. Moreover, the B2C model provides convenient purchasing experiences, which contributed to the prominent market share.

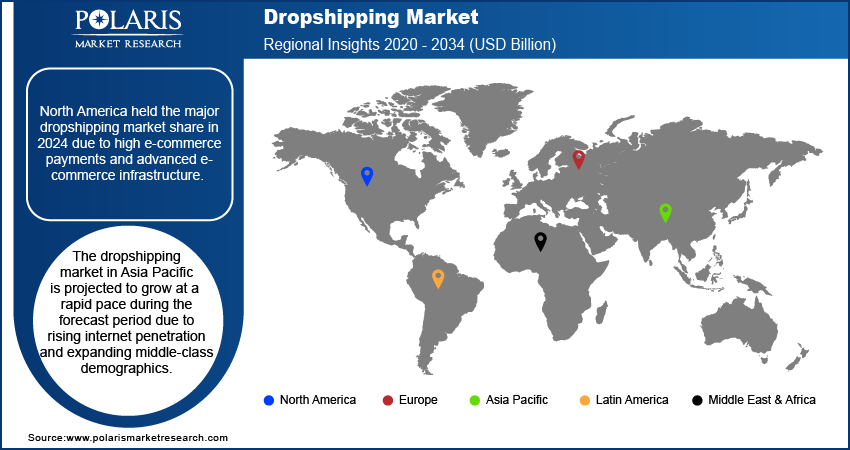

Dropshipping Market Regional Analysis

By region, the report provides the dropshipping market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the major dropshipping market share in 2024 due to high e-commerce payments and advanced e-commerce infrastructure. According to Payments Canada, in 2023, e-commerce payments totaled 546 million transactions, a 3% increase in both volume and value from 2022. Moreover, the presence of major dropshipping companies and high disposable income drives the dropshipping market expansion in the region.

The dropshipping market in Asia Pacific is projected to grow at a rapid pace during the forecast period due to rising internet penetration and expanding middle-class demographics. Countries such as China and India hold a strong market share within the region owing to their cost-efficient manufacturing and booming e-commerce sector. The rising smartphone usage, along with growing internet subscriptions in the region, is further fueling the market growth. For instance, as per the data published by the Global System for Mobile Communication, 1.8 billion people in Asia Pacific (63% of the population) subscribed to mobile services as of 2023.

Dropshipping Market – Key Players and Competitive Analysis Report

Major market players are investing heavily in research and development to expand their offerings, which will boost the dropshipping market demand during the forecast period. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

Shopify is an e-commerce platform designed to empower entrepreneurs and businesses to create and manage their online stores with ease. Launched in 2006, Shopify has evolved into a major solution for both small and large businesses, offering a wide range of features that facilitate online selling. The company provides users with the tools necessary to build an attractive and functional online storefront without requiring extensive technical knowledge. Shopify dropshipping is a popular eCommerce model that allows entrepreneurs to sell products online without the need to maintain inventory. This model operates by enabling sellers to partner with suppliers who handle the storage, packaging, and shipping of products directly to customers.

Printful is a major print-on-demand (POD) fulfillment service that enables entrepreneurs and businesses to create, sell, and ship custom merchandise without the need for inventory management. Founded in 2013, Printful operates on a made-to-order model, meaning that products are printed only after an order is placed, which reduces upfront costs and financial risks for sellers. The platform offers a diverse range of customizable products, including apparel, accessories, home goods, and more, allowing users to apply their designs using Printful’s built-in design tools.

List of Key Companies in Dropshipping Market

- Shopify

- Oberlo

- AliExpress

- Spocket

- Printful

- SaleHoo

- Modalyst

- Wholesale2B

- Dropified

- Doba

- Inventory Source

- Sunrise Wholesale

- Megagoods

- CJ Dropshipping

- Chinabrands

Dropshipping Industry Developments

February 2022: Alibaba.com, an online marketplace that connects businesses with suppliers, manufacturers, and wholesalers, entered into a partnership with Dropified for better dropshipping services.

Dropshipping Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Electronics

- Fashion & Apparel

- Home & Kitchen

- Others

By Business Model Outlook (Revenue, USD Billion, 2020–2034)

- B2C (Business-to-Consumer)

- B2B (Business-to-Business)

- C2C (Consumer-to-Consumer)

By Platform Type Outlook (Revenue, USD Billion, 2020–2034)

- Marketplace Platforms

- Standalone Websites

- Mobile Apps

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dropshipping Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 341.53 billion |

|

Revenue Forecast in 2025 |

USD 420.56 billion |

|

Revenue Forecast by 2034 |

USD 2,768.10 billion |

|

CAGR |

23.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global dropshipping market size was valued at USD 341.53 billion in 2024 and is projected to grow to USD 2,768.10 billion by 2034.

The global market is projected to register a CAGR of 23.3% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are Shopify, Oberlo, AliExpress, Spocket, Printful, SaleHoo, Modalyst, Wholesale2B, Dropified, Doba, Inventory Source, Sunrise Wholesale, Megagoods, CJ Dropshipping, and Chinabrands.

The fashion & apparel apps segment dominated the dropshipping market in 2024.