Drone Sensor Market Share, Size, Trends, Industry Analysis Report – By Sensor Type (Inertial Sensors, Image Sensors, Speed and Distance Sensors, Position Sensors, Pressure Sensors, Current Sensors, Ultrasonic Sensors, Light Sensors, Altimeter Sensors, Flow Sensors, and Other Sensors), Platform, Application, End-User Industry, and Region; Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 118

- Format: PDF

- Report ID: PM5166

- Base Year: 2024

- Historical Data: 2020-2023

Market Outlook

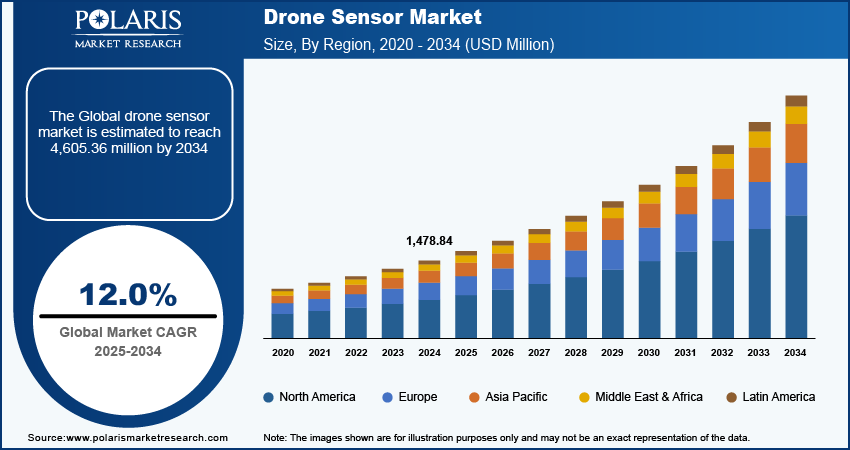

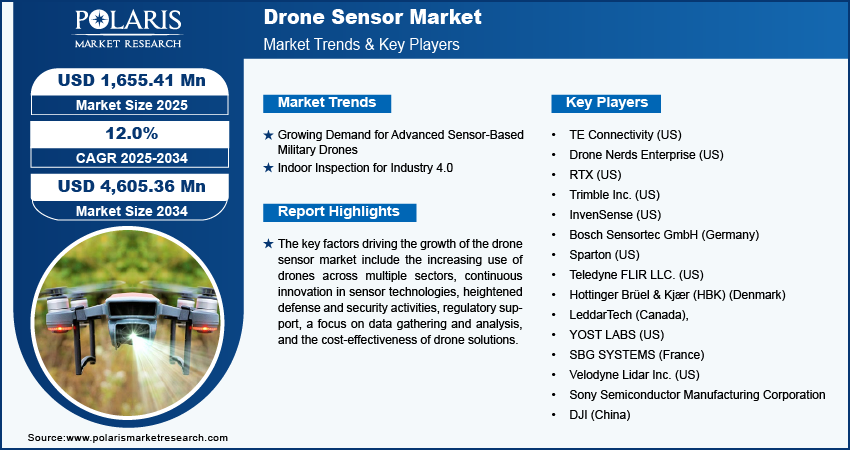

The drone sensor market size was valued at USD 1,478.84 million in 2024. The market is anticipated to grow from USD 1,655.41 million in 2025 to USD 4,605.36 million by 2034 exhibiting a CAGR of 12.0% during the forecast period.

Market Overview

The drone sensor market encompasses the development and application of advanced sensors integrated into drones for various purposes, including agriculture, defense, and public safety. The key factors driving the growth of the drone sensor market include the increasing use of drones across multiple sectors, continuous innovation in sensor technologies, heightened defense and security activities, regulatory support, a focus on data gathering and analysis, and the cost-effectiveness of drone solutions.

To Understand More About this Research: Request a Free Sample Report

In October 2023, Drone Shield Limited introduced Sensor Fusion AI (SFAI), a 3-D data fusion engine designed for complex environments like airspace security. This technology combines various sensor modalities, including radiofrequency, radar, acoustics, and cameras, to improve accuracy and reduce false positives and negatives.

Additionally, growing investments from key market players are fueling market expansion. In March 2024, Terra Drone, a leading drone provider from Japan, invested in Aloft Technologies, marking its official entry into the U.S. market—the largest market for drones and advanced air mobility (AAM). This partnership allows Terra Drone to leverage Aloft's top-tier unmanned traffic management (UTM) platform and fleet management system, facilitating the development of UTM technology and the integration of new technologies in sensor-based drones across various industries. This strategic move further enhances the potential for market growth.

Growth Drivers

Growing Demand for Advanced Sensor-Based Military Drones

There is a rising requirement for drones for the military or security departments' tasks such as surveillance, reconnaissance, or even attacks. These drones require sophisticated sensors that operate in highly tight environments. Such mechanisms will require sophisticated devices on board such as IR devices, electro-optical sensors, and radar installations if they must be helpful during operations. Thus, the growing demand for advanced sensor-based military drones drives the drone sensor market growth significantly.

In February 2024, at the World Defense Show, the Global Industrial Defence Solutions (GIDS) launched the Ranger drone, a strip autonomous small UAV meant for different roles such as reconnaissance, surveillance, target detection, and adjustment of the artillery fire.

Indoor Inspection for Industry 4.0

Drones improve inspection efficiency, accuracy, and safety within industrial contexts with the use of sophisticated sensors such as LiDAR and infrared. To ensure real-time data collection, analysis, and decision-making in indoor inspection drones, one must integrate cutting-edge sensor technologies. This further expands the use of drone sensors for Industry 4.0 applications, which propels the drone sensor market.

In May 2022, Flyability launched the world's first obstacle-resistant drone with a LiDAR sensor for indoor 3D mapping named the Elios 3, which employs a brand-new SLAM engine known as FlyAware to make 3D models while flying.

Restraining Factors

Regulatory Hurdles

Regulatory hurdles are a key restraining factor in the drone sensor market. The rapid advancement of drone technology often leads to regulatory frameworks that lag behind, causing uncertainty for manufacturers and operators. Stricter regulations on airspace usage, safety, and data privacy can restrict the deployment of drone sensors, particularly in urban areas. Additionally, inconsistent regulations across regions complicate global expansion, hindering innovation and slowing the adoption of advanced sensor technologies in various applications.

Report Segmentation

The market is primarily segmented on the basis of sensor type, platform, application, end-user industry, and region.

By Sensor Type Analysis

Image Sensors Segment Accounted for Largest Market Share in 2024

The image sensors segment held the largest revenue share in the drone sensor market in 2024. Image sensors are used for various applications such as navigation, surveillance, and data acquisition, making them crucial for commercial and military drone operations.

In August 2023, GalaxEye released its high-resolution aerial drone-based synthetic aperture radar (SAR) system. It provides detailed imaging in all weather conditions, even during rain or fog. The latest technology leverages proprietary data fusion techniques to provide unrivaled insights and information from space.

By Platform Analysis

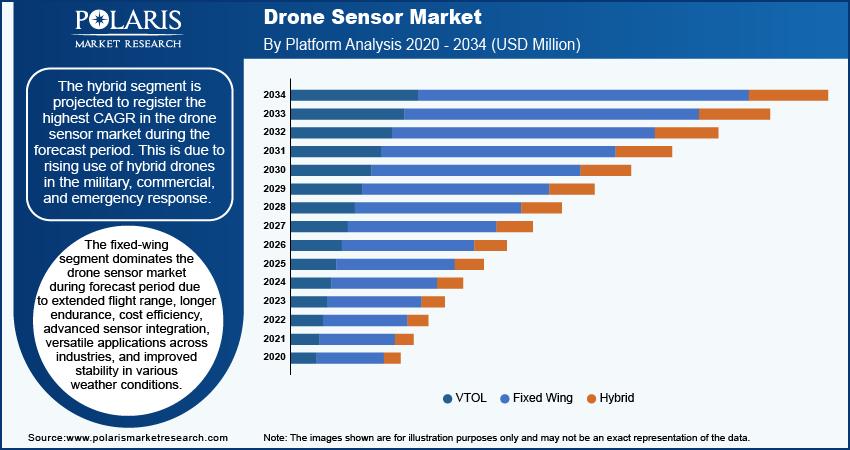

Hybrid Segment to Witness Highest Growth During Forecast Period

The hybrid segment is projected to register the highest CAGR in the drone sensor market during the forecast period. This is due to rising use of hybrid drones in the military, commercial, and emergency response. The drones are becoming popular owing to the combined vertical flight characteristics of VTOL drones with long endurance/range possessed by fixed-wing aircraft.

In May 2024, a new variant called the Hybrid October UAV was launched by Aeronautics Systems, the Israeli manufacturer of Unmanned Aerial Vehicles (UAV), utilizing a hybrid propulsion system for extended endurance.

The fixed-wing segment dominates the drone sensor market during forecast period due to extended flight range, longer endurance, cost efficiency, advanced sensor integration, versatile applications across industries, and improved stability in various weather conditions. Fixed-wing drones offer longer flight durations and greater coverage areas compared to their multirotor counterparts, making them ideal for applications like agriculture, surveying, and surveillance. Their efficiency in covering vast terrains reduces operational costs and enhances data collection capabilities. Additionally, advancements in sensor technology and integration with fixed-wing platforms improve performance and reliability. The increasing demand for aerial mapping, environmental monitoring, and military operations further propels the growth of the fixed-wing segment in the drone sensor market.

Regional Insights

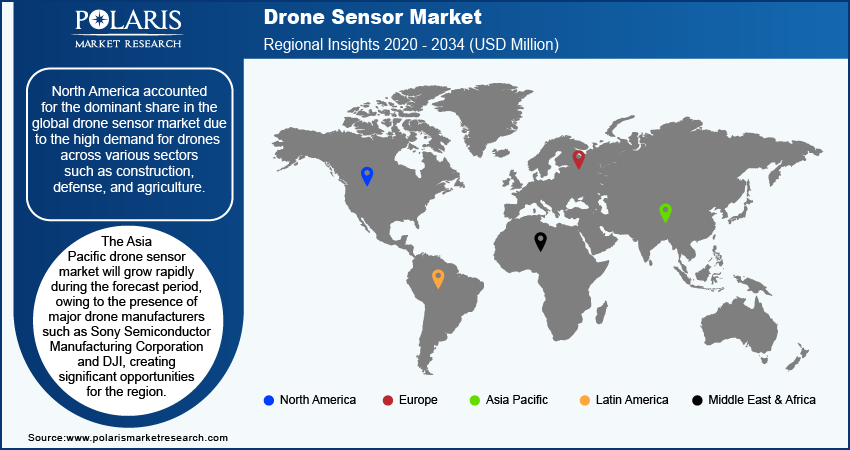

North America Held Largest Share of Global Market in 2024

North America accounted for the dominant share in the global drone sensor market due to the high demand for drones across various sectors such as construction, defense, and agriculture. Moreover, regulatory support and initiatives, advanced technological infrastructure, and the presence of key players contributed to the growth of the regional market.

The Asia Pacific drone sensor market will grow rapidly during the forecast period, owing to the presence of major drone manufacturers such as Sony Semiconductor Manufacturing Corporation and DJI, creating significant opportunities for the region. Moreover, government support and initiatives and technological advancements and innovations in emerging countries drive the regional market growth.

In July 2023, DJI launched a new drone—the DJI Air 3. The drone has a dual-camera setup and has a 4241mAh or 62.6Wh battery. The Air 3 cameras are notable because the first one has a focal length equivalent to 24mm with an f/1.7 main camera, whereas the second utilizes a telephoto lens with a 70mm focal length equivalent to f/2.4.

Key Market Players and Competitive Insights

Strategic Initiatives by Key Market Players to Drive Competition

The drone sensor market is fragmented. The growing investments in new drone sensor technology are impacting the global market. The ongoing expansion initiatives, including partnerships and collaborations, are fueling competition in the marketplace. In May 2023, DJI showed the Matrice 350 RTK drone for industrial use with improved features. The M350 RTK drone can be in the air for a longer time (up to about 55 minutes) and can carry more weight equaling 2.7 kilograms. This model consists of latest video transmission system, batteries that serve for longer times, complete safety measures, and a large carrying weight.

Major Players Operating in Global Market

- TE Connectivity (US)

- Drone Nerds Enterprise (US)

- RTX (US)

- Trimble Inc. (US)

- InvenSense (US)

- Bosch Sensortec GmbH (Germany)

- Sparton (US)

- Teledyne FLIR LLC. (US)

- Hottinger Brüel & Kjær (HBK) (Denmark)

- LeddarTech (Canada),

- YOST LABS (US)

- SBG SYSTEMS (France)

- Velodyne Lidar Inc. (US)

- Sony Semiconductor Manufacturing Corporation (Japan)

- DJI (China)

Recent Developments in Industry

- In February 2024, Teledyne FLIR Defense announced that Canada's Department of National Defence had sold 800 Sky Ranger R70 Unmanned Aerial Systems (UAS) to Ukraine. These drones are worth around USD 70 million.

- In January 2024, Drone Nerds, a complete drone solutions provider, unveiled the DJI Inspire 3, a cinematography drone that comes in place of the Inspire 2. The improvement is marked by an enhanced quality of videos courtesy of an upgraded FPV camera sensor combined with an O3 pro video transmission system that also increases its reach.

Drone Sensor Market Segmentation

By Sensor Type Outlook (Revenue – USD Million, 2020–2034)

- Inertial Sensors

- Image Sensors

- Speed and Distance Sensors

- Position Sensors

- Pressure Sensors

- Current Sensors

- Ultrasonic Sensors

- Light Sensors

- Altimeter Sensors

- Flow Sensors

- Other Sensors

By Platform Outlook (Revenue – USD Million, 2020–2034)

- VTOL

- Fixed Wing

- Hybrid

By Application Outlook (Revenue – USD Million, 2020–2034)

- Navigation

- Collision Detection and Avoidance

- Data Acquisition

- Motion Detection

- Air Pressure Measurement

- Power Monitoring

- Other Applications

By End User Industry Outlook (Revenue – USD Million, 2020–2034)

- Energy & Utilities

- Precision Agriculture

- Media & Entertainment

- Defense

- Consumer

- Law Enforcement

- Security & Surveillance

- Other End-User Industries

By Regional Outlook (Revenue, USD billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Coverage

The drone sensor market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, sensor type, platform, application, end-user industry, and their futuristic growth opportunities.

Drone Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2025 |

USD 1,655.41 million |

|

Revenue Forecast in 2034 |

USD 4,605.36 million |

|

CAGR |

12.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global drone sensor market size was valued at USD 1,478.84 million in 2024 and is projected to grow to USD 4,605.36 million by 2034

The global market is projected to register a CAGR of 12.0% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are TE Connectivity (US), Drone Nerds Enterprise (US), RTX (US), Trimble Inc. (US), InvenSense (US), Bosch Sensortec GmbH (Germany), Sparton (US), Teledyne FLIR LLC (US), Hottinger Brüel & Kjær (HBK) (Denmark), LeddarTech (Canada), YOST LABS (US), SBG SYSTEMS (France), Velodyne Lidar Inc. (US), Sony Semiconductor Manufacturing Corporation (Japan), DJI (China).

The fixed-wing segment dominated the market in 2024.

The image sensors segment dominated the market in 2024.