Global Drone Package Delivery Market Size, Share, Trends, Industry Analysis Report: By Solution, By Type, By Range, By Package Size, By Operation Mode, By Duration, By End-Use, and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 120

- Format: PDF

- Report ID: PM5012

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

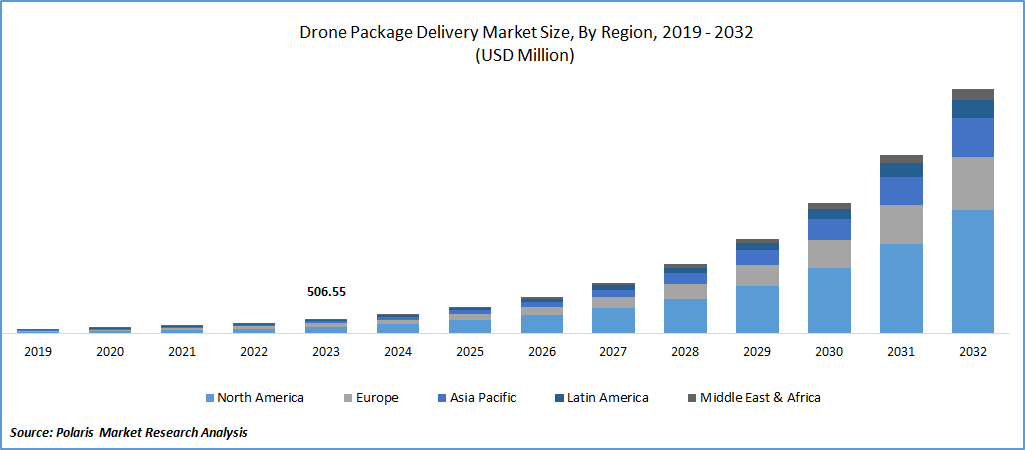

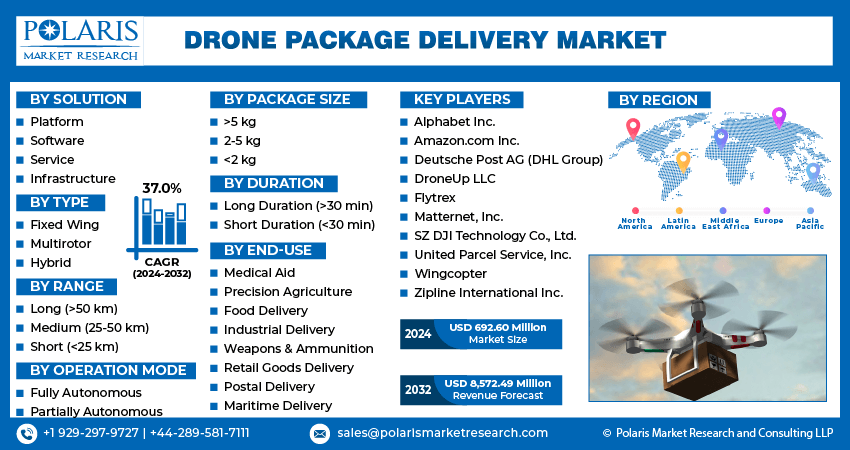

Global drone package delivery market size was valued at USD 506.55 million in 2023. The drone package delivery industry is projected to grow from USD 692.60 million in 2024 to USD 8572.49 million by 2032, exhibiting a compound annual growth rate (CAGR) of 37% during the forecast period.

The drone package delivery market involves the use of unmanned aerial vehicles (UAVs) to transport goods from one location to another, offering efficient and innovative logistics solutions. The market for drone package delivery is growing rapidly as drones offer a cost-effective delivery option compared to traditional ground-based methods, especially for last-mile deliveries. Moreover, advances in battery technology have improved the power efficiency and payload capacity of drones. Support from regulatory bodies for the approval of delivery drones is further driving growth in the drone package delivery market.

The use of drones for delivery helps minimize the need for large delivery trucks, leading to a reduction in traffic congestion and greenhouse gas emissions. Furthermore, improvements in regulatory frameworks that promote drone package delivery, with a focus on reducing carbon emissions, are contributing to the growth of the market.

To Understand More About this Research:Request a Free Sample Report

For example, according to an article published by IEEE Spectrum, regulators and retailers will have to impose restrictions on the size of drones to ensure that drone delivery remains environmentally friendly. It is anticipated that battery-powered drones will take over the role of large diesel-consuming trucks for transporting goods to the final destination from warehouses to residential and commercial locations.

Drone Package Delivery Market Trends:

Rising Demand for Fast Deliveries is Driving the Market Growth

The market CAGR for drone package delivery is being driven by the increasing demand for fast delivery services. Customers are willing to pay a premium for same-day delivery, which has led to innovations in cargo transportation and a rise in investments from logistics and transportation companies. As a result, delivery drones are now being utilized in e-commerce, quick-service restaurants, convenience stores, and healthcare.

Also, retailers are working towards reducing their delivery times and improving the flexibility and speed of deliveries through the use of drones to manage stock-keeping units (SKUs).

For instance, in January 2024, Zipline unveiled a new home delivery service integrated into Walmart stores across the Dallas-Fort Worth metro area. The new service will significantly boost Zipline's customer base at Walmart by over 1,000 times in comparison to its existing operations with the retail giant.

Rising Drone Package Delivery Services in the Logistics Sector

The drone package delivery market is experiencing significant growth, driven by the expanding e-commerce industry. Drone package delivery services are poised to transform final-mile delivery by providing same-day delivery for packages, effectively cutting down delivery time and environmental footprint.

Further, the Asia-Pacific region’s logistics industry is undergoing expansion influenced by the increased buying power of consumers and the growth of Tier 2 & Tier 3 cities. This increase in demand highlights the importance of creative solutions that promote growth while also ensuring effectiveness and sustainability, driving the drone package delivery market revenue.

For instance, in September 2021, Blue Dart introduced drone delivery services in partnership with Skye Air to facilitate express package distribution in the South Asian region. This represents a major step forward in providing greener and more effective delivery options.

Drone Package Delivery Market Segment Insights:

Drone Package Delivery Range Insights:

The global drone package delivery market segmentation, based on range, includes long (>50 km), medium (25-50 km), and short (<25 km). In 2023, the short (<25 km) segment dominated the market. The segment’s growth is attributed to the growing utilization of drones for transporting food, medicine, and e-commerce products in urban and sub-urban regions, resulting in a substantial reduction in delivery time through the facilitation of instant and same-day deliveries.

For instance, Zipline initiated a short-distance service drone and collaborated with three hospitals across three states in the US, along with Sweetgreen, a chain of salad restaurants. The collaboration was done to introduce a home delivery service capable of covering a 10-mile distance in just 10 minutes, efficiently transporting food and medicine over a short distance.

Drone Package Delivery End-Use Insights:

The global drone package delivery market segmentation, based on end-use, includes food delivery, retail goods delivery, postal delivery, medical aid, precision agriculture, industrial delivery, weapons & ammunition, and maritime delivery. The medical aid segment dominated the market in 2023, mainly fueled by the necessity to transport crucial medical supplies swiftly, particularly to remote or inaccessible regions. There is a rise in the utilization of drones for delivering supplies during emergencies and disaster relief efforts, where rapid delivery is crucial.

For instance, in February 2024, TechEagle collaborated with 10 AIIMS & INI hospitals in India to introduce drone services for medicine delivery with a payload capacity of up to five kilograms. The collaboration aims at setting new range and speed records, revolutionizing the medical aid segment in the drone package delivery market.

Drone Package Delivery Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America region dominated the drone package delivery market, owing to the presence of numerous key service providers and the growing number of FAA approvals for the development and deployment of drones for package delivery.

For instance, the Federal Aviation Administration (FAA) validates the participant’s ideas of utilizing drones for package delivery under part 135 air carrier certification. Part 135 certification is the route for small drones to deliver packages.

The participants are obligated to validate their concepts by making use of the FAA's prevailing 135 certification process. For instance, in June 2022, Zipline was granted the 135 certificate, making it the fourth drone operator to receive such authorization. This certificate allows Zipline to function as an air carrier and conduct common package delivery operations.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The Asia-Pacific drone package delivery market is expected to grow at the fastest CAGR from 2024 to 2032. The expansion of the market in this region is attributed to rising e-commerce platforms and the adoption of advanced technology. The traffic congestion in countries like China, India, Japan, Malaysia, and others is driving the need for quick food and grocery deliveries.

For instance, in January 2024, SZ DJI unveiled the FlyCart 30 model, now accessible worldwide. The drone is capable of reaching heights of up to 10,000 feet. It is specifically designed to cater to China's rugged terrain with its high-definition cameras, video recording capabilities, and various other aerial imaging tools.

Certain versions of the FlyCart 30 also come equipped with infrared or temperature sensors, mapping technology, cutting-edge communication systems, and additional functionalities tailored for surveillance and inspection purposes.

Drone Package Delivery Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the drone package delivery market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the drone package delivery industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global drone package delivery industry to benefit clients and increase the market sector. In recent years, the drone package delivery industry has witnessed some technological advancements. Major players in the drone package delivery market include Amazon.com Inc., Zipline International Inc., United Parcel Service, Inc., SZ DJI Technology Co., Ltd., Deutsche Post AG (DHL Group), Alphabet Inc., Wingcopter, Matternet, Inc., DroneUp LLC, and Flytrex.

Amazon.com Inc. is an online retail company offering a vast array of products, including apparel, electronics, books, toys, and grocery items. Amazon has expanded beyond e-commerce into cloud computing, digital streaming, and artificial intelligence. Amazon offers a range of services, such as Amazon Prime, Amazon Web Services, Amazon Instant Video, and Amazon Marketplace. The company was founded in 1994 and headquartered in the United States. In May 2024, Amazon revealed that Prime Air, its drone delivery service, has been granted permission by the Federal Aviation Administration (FAA) to extend the range of its drone flights. This enables Prime Air to enhance its drone delivery services and effectively increase its operations in additional areas within the United States.

United Parcel Service, Inc. (UPS) is a company in the package delivery and supply chain management solutions. UPS offers time-definite delivery of documents, express letters, packages, and palletized freight through ground and air services in the U.S. and internationally. The company’s brands include UPS Express, UPS SurePost, UPS My Choice, and UPS Quantum View. The company was founded in 1907 and is headquartered in Atlanta. In September 2023, UPS obtained authorization from the Federal Aviation Administration (FAA) to carry out Beyond Visual Line Of Sight (BVLOS) package deliveries utilizing Matternet’s M2 Drone for drone delivery services in the United States.

Key companies in the drone package delivery market include:

- Alphabet Inc.

- Amazon.com Inc.

- Deutsche Post AG (DHL Group)

- DroneUp LLC

- Flytrex

- Matternet, Inc.

- SZ DJI Technology Co., Ltd.

- United Parcel Service, Inc.

- Wingcopter

- Zipline International Inc.

Drone Package Delivery Industry Developments

- January 2024: The DT46 drone, manufactured by the Haute-Garonne company, transported medicines and blood samples on a successful 150 km flight in south-west France as part of a test to assess its potential in aiding patients in remote and difficult-to-access areas in Quebec and Canada.

- October 2023: Emirates Post Group (EPG) entered into an agreement with SkyGo, an aerial logistics provider, to introduce drone-enabled logistics and delivery services connecting specific areas in Abu Dhabi.

- January 2023: Causey Aviation Unmanned, a partner of Flytrex, was awarded the standard 135 Air Carrier Certification. The certification allows it to conduct on-demand drone deliveries for commercial purposes within long-range, across the United States.

Drone Package Delivery Market Segmentation:

Drone Package Delivery Solution Outlook

- Platform

- Software

- Service

- Infrastructure

Drone Package Delivery Type Outlook

- Fixed Wing

- Multirotor

- Hybrid

Drone Package Delivery Range Outlook

- Long (>50 km)

- Medium (25-50 km)

- Short (<25 km)

Drone Package Delivery Package Size Outlook

- >5 kg

- 2-5 kg

- <2 kg

Drone Package Delivery Operation Mode Outlook

- Fully Autonomous

- Partially Autonomous

Drone Package Delivery Duration Outlook

- Long Duration (>30 min)

- Short Duration (<30 min)

Drone Package Delivery End-Use Outlook

- Medical Aid

- Precision Agriculture

- Food Delivery

- Industrial Delivery

- Weapons & Ammunition

- Retail Goods Delivery

- Postal Delivery

- Maritime Delivery

Drone Package Delivery Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Drone Package Delivery Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 506.55 million |

|

Market Size Value in 2024 |

USD 692.60 million |

|

Revenue Forecast in 2032 |

USD 8,572.49 million |

|

CAGR |

37.0% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global drone package delivery market size was valued at USD 506.55 million in 2023 and is projected to be valued at USD 8572.49 million in 2032.

The global drone package delivery market is projected to grow at a CAGR of 37% during the forecast period, 2024-2032

North America held the largest share of the drone package delivery market.

The key players in the drone package delivery market are Amazon.com Inc., Zipline International Inc., United Parcel Service, Inc., SZ DJI Technology Co., Ltd., Deutsche Post AG (DHL Group), Alphabet Inc., Wingcopter, Matternet, Inc., DroneUp LLC, and Flytrex

The short (<25km) range category dominated the market in 2023.

The medical aid segment held the largest share in the global market.