Drone Logistics and Transportation Market Share, Size, Trends, Industry Analysis Report

By Application (Logistics, and Transportation); User; By Product; By Range; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 114

- Format: PDF

- Report ID: PM2767

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

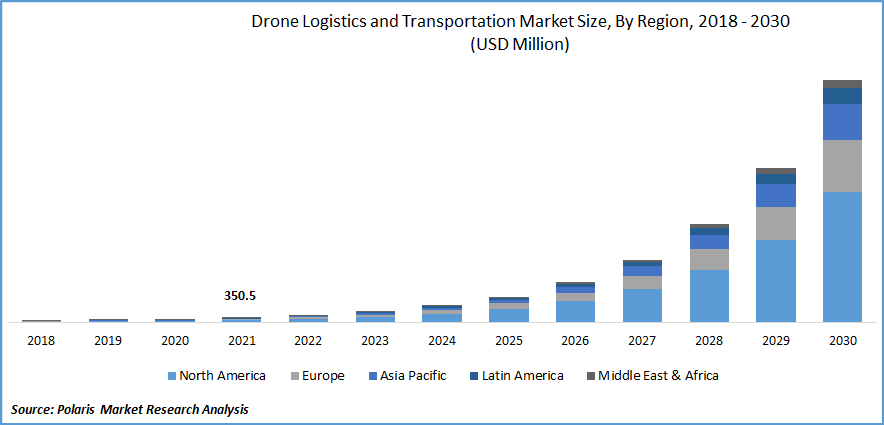

The global drone logistics and transportation market was valued at USD 350.5 million in 2021 and is expected to grow at a CAGR of 55.20% during the forecast period.

Faster delivery of goods and services at remote and isolated places, investment opportunities in the market, and favorable government initiatives are key drivers for the expansion of the global market. One of the most significant factors expected to drive the growth of the market is the increasing use of drones for military and commercial uses. Bandwidth concerns, battery life concerns, delivery verification, cybersecurity concerns, and restrictions on commercial drone usage are all impeding the market.

Know more about this report: Request for sample pages

Drone logistics and transportation respond to the use of drones to deliver a package, cargo, and/or commuters. Freight drones can produce various types of cargo, whereas transportation drones can transmit to patients and passengers. Some of the major operating systems include route planning and optimization software, fleet management software, and computer vision software. In contrast, the infrastructure improvements required for the deployment of drone transportation and logistics include ground station stations, charging points, and landing pads.

With the rapid advancement of technology, drones are now widely used in logistics management and transportation to their destinations. Drones are being used by a growing number of businesses around the world to manage their supply chain management systems. Drones are also employed in mining operations, land surveying, agricultural land, crop examinations, and many other applications.

Further, customers are prepared to pay extra to have packages delivered on the same day, implying an increase in consumption for quicker and more effective delivery at low costs, particularly in the e-commerce sector. This demand will almost certainly increase the use and acknowledgment of drones in the logistics and transportation markets.

Drones for logistics and transportation are being extensively tested around the world for the postal delivery, health insurance, and pharmaceutics packages such as medications, blood, and organ and machinery transport, and retail & food packages such as e-commerce, delivery services, and food delivery. This means that drone distribution is expected to be 60% less expensive. A fleet of drones is also easier to manage than ground-based vehicles.

Expanding the e-commerce and logistic support industries creates an opportunity for time-efficient delivery solutions for the global transportation of critical goods. For example, ANA Holdings Inc. and Wingcopter announced a partnership in April 2021 to accelerate the development of critical pharmaceuticals and other consumer goods drone delivery infrastructure. The collaboration aims to establish a drone delivery infrastructure throughout Japan.

The spread of COVID-19 has been a boon to the drone industry. The most important factor in controlling this outbreak is to promote social distancing, and drones assisted in managing many actions that helped in restricting physical connection among people, such as verifying the temperature at facilities available, delivering medical supplies, and numerous others. One of the primary characteristics that have aided in the development of the Drone Logistics and Transportation Market is the flexibility that the drones carry out their operational processes.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising zero-emission initiatives by the private and public players are driving market growth over the forecast period. In August 2022, SEINO HOLDINGS CO., LTD., and NEXT DELIVERY Co. announced a drone delivery prototype experiment in Tsuruga City's Kanegasaki Green and Higashiura areas to develop a new smart logistics system that will contribute to resolving regional issues. They reached an extensive collaboration agreement to address regional issues like aging and depopulation by implementing decarbonization initiatives like hydrogen, renewable energy, and zero-emission logistic support, which Tsuruga City aims for. They collaborate to develop a new logistics business model based on next-generation modern techniques.

One of the primary causes of the increased number of greenhouse gases in the Earth's atmosphere, causing global warming, is growth in disposable income combined with decreasing automobile costs. Rising air pollution in large cities hurts the urban population, forcing governments to adopt strict action to combat it.

Further, recent technological advancements in this field point to a bright future, with cities embracing unmanned structures for next-generation transportation. For example, Toray Advanced Composites announced in December 2020 that it had accomplished a supply agreement with Joby Aviation. Toray's carbon fiber composite materials will be used by Joby Aviation to develop fast, low-cost, zero-emission aerial transportation for global communities.

Report Segmentation

The market is primarily segmented based on application, range, user, and region.

|

By Application |

By Range |

By User |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Defense Segment is Expected to Witness the Fastest Growth

Drones are progressively being used on the battlefield for various purposes, including intelligence, surveillance, reconnaissance (ISR), and battle damage management. Defense logistics can be a dangerous task, so defense organizations are attempting to reduce the number of employees needed for logistics by implementing autonomous drones. Militaries also investigate the use of drones for logistics purposes, such as supplying soldiers with food, ordnance, fuel, and spare parts.

According to Navy statistics, 90% of aircraft and ships that were taken out of purpose status when implemented lack simple components such as electronics or wiring fittings, 90% of which evaluate less than 50 pounds and can be supplied using drones instead of manned aircraft. In August 2021, the US Navy evidenced that small drones could replace crewed platforms in providing needed spare parts and food reserves between ships at sea.

Close Range Segment Industry Accounted for the Highest Market Share in 2021

The demand for immediate delivery of goods and packages such as medications and food is increasing. The increased demand for same-day package delivery is expected to fuel the market for close-range delivery drones. Longer-range delivery drones contribute to lower overall operational costs for delivering packages. Close-location delivery drones are employed for close and nearby places. These drones, which can travel up to 50 kms on a single charge, allow immediate package delivery following online orders.

The Demand in North America is Expected to Witness Significant Growth

The largest share belongs to North America, which is expected to continue during the projected period because of the use of drones for delivering packages by companies such as Amazon, DHL, and UPS. The quantity of deliveries in logistics, particularly in the e-commerce sector, is increasing rapidly in North America, boosting the region's market. The growing use of drones for military and commercial purposes is boosting the North American market. Drones have been used in commercial and military applications such as tracking, food delivery, medical supply delivery, border surveillance, delivery service, and so on, boosting the region's market.

The Asia-Pacific continent is also anticipated to expand rapidly during the forecast period due to growing infrastructure investment in drone technological development and a growing preference for the delivery of drone services. Drones are increasingly being used in military combat operations, which has had a significant effect on the growth. Globalization is propelling the Asia Pacific market's expansion in developing countries. UAVs are increasingly used for inspection and testing in the real estate and agriculture industries.

Competitive Insight

Some of the major players operating in the global market include Airbus SE, Amazon.com, , CANA Advisors, DHL Group, DroneScan, Drone Delivery Canada, FedEx Corp, Flytrex, Hardis Group, Infinium Robotics, Maternity, PINC Solutions, SZ DJI Technology, United Parcel Service of America, Wing Aviation, Workhorse Group, and Zipline International.

Recent Developments

- In April 2022, Toyota Tsusho Corp. and Zipline launched an automatic vehicle, for medical products across Japan's Got Islands, with the Tsusho’s using Zipline's instant logistics operations for the commercial remotest delivery drones.

- In February 2022, Volocopter and Aviation Capital Group LLC (ACG) announced an agreement to establish financing solutions to support the selling of the Volocopter's battery-operated (electric) vertical take-off and landing (eVTOL) aircraft ranging upto USD 1 Bn.

Drone Logistics and Transportation Market Report Scope

|

Report Attributes |

Details |

|

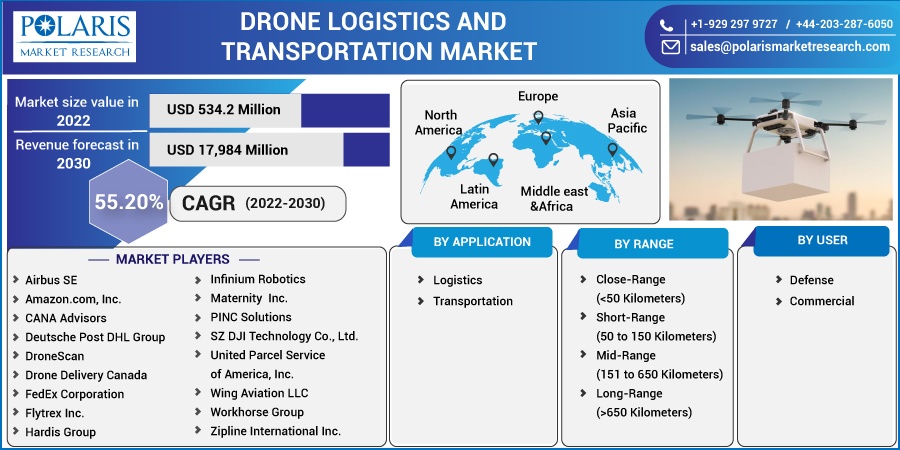

Market size value in 2022 |

USD 534.2 million |

|

Revenue forecast in 2030 |

USD 17,984 million |

|

CAGR |

55.20% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Application, By User By Range, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Airbus SE, Amazon.com, Inc., CANA Advisors, Deutsche Post DHL Group, DroneScan, Drone Delivery Canada, FedEx Corporation, Flytrex Inc., Hardis Group, Infinium Robotics, Maternity Inc., PINC Solutions, SZ DJI Technology Co., Ltd., United Parcel Service of America, Inc., Wing Aviation LLC, Workhorse Group, and Zipline International Inc. |