Drone Inspection and Monitoring Market Share, Size, Trends, Industry Analysis Report, By Application (Construction & Infrastructure, Agriculture, Utilities, Oil & Gas, Mining, Others); By Solution; By Type; By Mode of Operation; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 113

- Format: PDF

- Report ID: PM2226

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

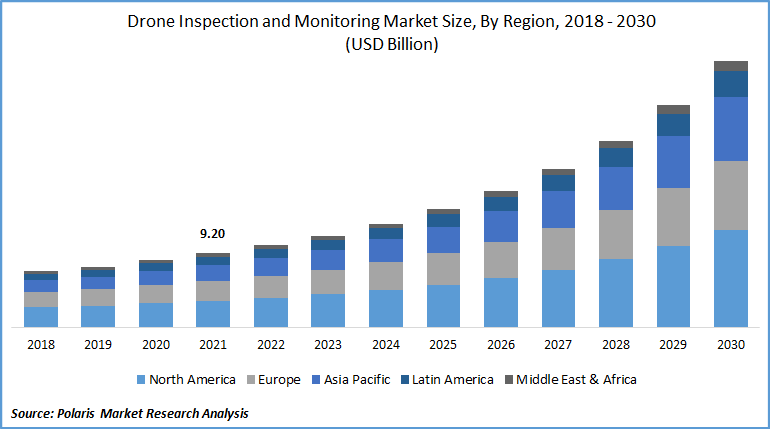

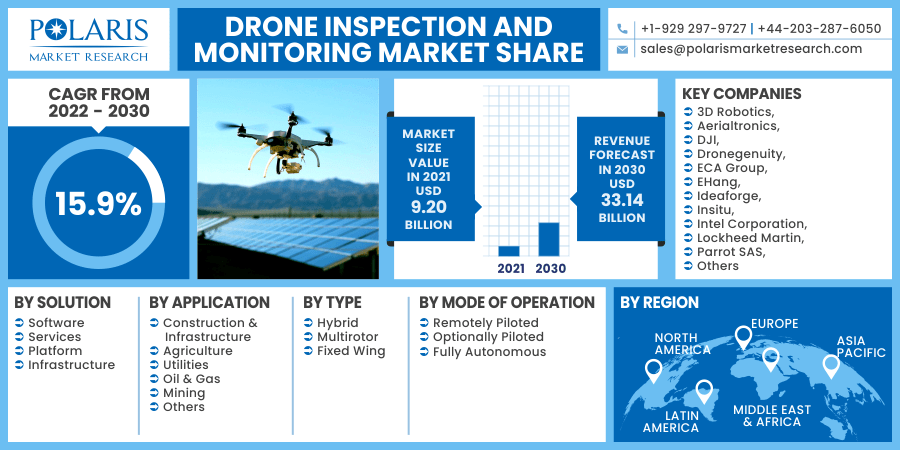

The global drone inspection and monitoring market was valued at USD 9.20 billion in 2021 and is expected to grow at a CAGR of 15.9% during the forecast period. Almost all industries that require a visual assessment of facilities as part of their maintenance operations use drones for inspection and monitoring. Visual inspection and monitoring are necessary to verify that a company's resources are properly maintained.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

During inspection and monitoring applications, drone cameras often perform the functions of the human eye. Inspectors can avoid unsafe areas such as scaffolding or tall, lean structures by using drone-based inspection and monitoring. The major factor supporting the drone inspection and monitoring market growth includes its increasing use in critical infrastructure applications as a Remote Visual Inspection (RVI) tool.

They are also being used for internet provision in rural areas, aerial photography and video recording, animal surveying, documentation, and public service missions. Several businesses use this technology for agricultural, aerial images, and data gathering applications. Home deliveries using the equipment are becoming a reality due to the efforts of transportation and retail corporations like Amazon and UPS to roll out the technology.

Further, advanced technology adoption, such as installing artificial intelligence by the major players, augment the drone inspection and monitoring market growth during the forecast period. Artificial intelligence in drones has improved their capabilities while allowing them to do the takeoff, data capture, data transfer, navigation, and data analysis without human interaction.

However, the market's growth would be hindered by low flight duration and payload capacity over the forecast period. They can now only fly for 15 to 30 minutes before needing to be replaced or recharged. It is available with payloads of nearly twenty pounds, but those weighing five pounds or less are more popular. Payload weight and flight endurance to make matters even more complicated: as payload increases, flying time decreases. This means, in demanding tasks, such as inspection and monitoring bridges and major catastrophes, there are frequent intervals. Due to this limitation, they are unable to perform larger tasks.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Over the last few decades, the drone inspection and monitoring market has observed extensive developments supported by several factors such as the increased cost-saving and human safety and the emergence of advanced technology for various applications. Organizations now benefit from previously inaccessible levels of visibility and acceptable cost by deploying this equipment for inspection and monitoring reasons rather than traditional human, airplane, or helicopter techniques. They are used to increase worker safety and offer access to asset information in various dynamic and complex sectors.

Inspections and monitoring will, on average, identify no problem that has to be fixed 80% of the time, as has been seen. When a human inspector is dispatched to begin the work, this makes inspections and monitoring a waste of time. Inspectors benefit from drone inspections and monitoring because they put themselves in dangerous situations. They can help companies save money on liability insurance by lowering the length of time employees are exposed to hazardous situations.

Further, in recent years, the successful design of small remote-controlled aircraft has become the most popular commercial industry. The market is a major contributor to the economic development of several countries. Their payloads and software systems have become less expensive as a result of these improvements. As a result, it's been successful in a variety of industries, including surveying, aerial mapping, aerial photos, and precision farming. The need for real-time data analysis on the ground to determine the true potential of projects that would help the industry expand.

Report Segmentation

The market is primarily segmented based on solution, application, type, mode of operation, and region.

|

By Solution |

By Application |

By Type |

By Mode of Operation |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based on the type segment, the hybrid segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. This segment is growing due to hybrid drones' increased payload and endurance capabilities over fixed-wing and multirotor drones.

Geographic Overview

In terms of geography, North America had the largest revenue share. The market for the North American region is anticipated to grow significantly as a result of the presence of major players and increased demand for the market in various industries. For instance, in May 2021, FLIR Systems, Inc. has been received USD 15.4 Mn contract to supply FLIR Black 3 Personal Reconnaissance Systems. Within the Army's Soldier Borne Sensor (SBS) program, advanced nano-unmanned aerial vehicles (UAVs) are used for small-level surveillance, inspection, and monitoring capabilities. Thus, the major players focus on the funding for the drone supply to boost the region's growth.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2021. The increased demand for the market in developing economies like China and India, where the equipment is frequently used for inspection and monitoring jobs in the agriculture and utility sectors, can be credited to the rise of this regional market. According to the IBEF, drones are increasingly being used in India for non-commercial purposes such as aerial cinematography, mining activities, disaster management, and mapping of the national highways and railway routes.

The market has witnessed popularity over the last few years due to its diverse capabilities, ranging from simple photography to surveillance, road, and railway line monitoring, and even delivering essentials/food items to clients. Drones also performed a critical part in various tasks across the country, from surveillance and sanitization to temperature checks and public broadcasting, even during the current COVID-19 outbreak. This reduced the chance of viral spread and helped authorities protect medical and law enforcement workers.

Competitive Insight

Some of the major players operating in the global market include 3D Robotics, Aerialtronics, DJI, Dronegenuity, ECA Group, EHang, Ideaforge, Insitu, Intel Corporation, Lockheed Martin, Northrop Grumman Corporation, Parrot SAS, Sensefly Ltd., Skydio, Teledyne Flir LLC, and Yunnec.

Drone Inspection and Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 9.20 billion |

|

Revenue forecast in 2030 |

USD 33.14 billion |

|

CAGR |

15.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Solution, By Application, By Type, By Mode of Operation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

3D Robotics, Aerialtronics, DJI, Dronegenuity, ECA Group, EHang, Ideaforge, Insitu, Intel Corporation, Lockheed Martin, Northrop Grumman Corporation, Parrot SAS, Sensefly Ltd., Skydio, Teledyne Flir LLC, and Yunnec. |