Drone Detection Market Size, Share, Trends, Industry Analysis Report: By Technology, Application, Range, Type (Ground-Based and Handheld), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5529

- Base Year: 2024

- Historical Data: 2020-2023

Drone Detection Market Overview

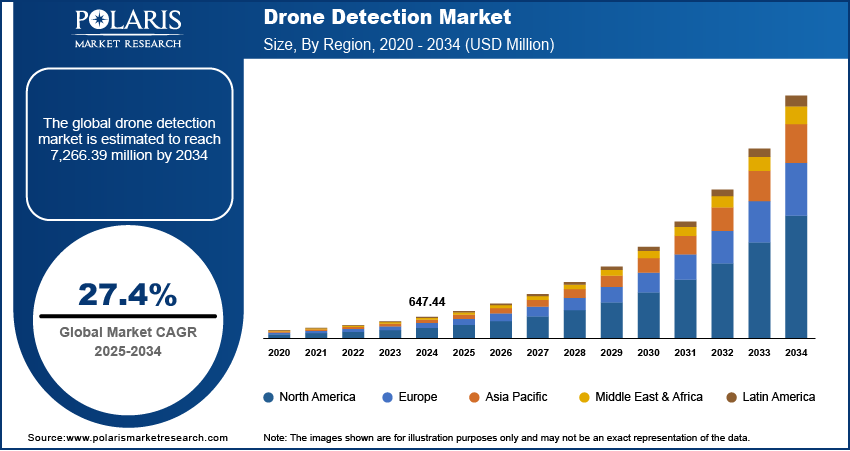

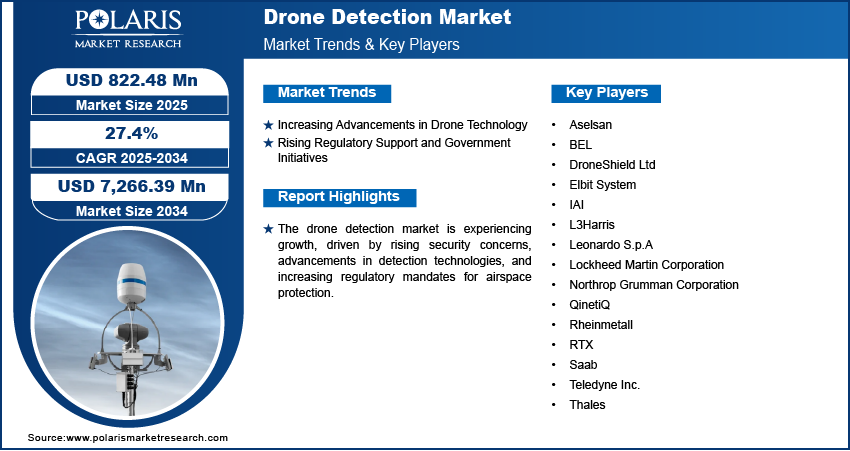

The global drone detection market size was valued at USD 647.44 million in 2024. It is expected to grow from USD 822.48 million in 2025 to USD 7,266.39 million by 2034, at a CAGR of 27.4% during the forecast period.

Drone detection refers to the use of advanced technologies to identify, track, and mitigate unauthorized drones in sensitive airspace. The drone detection market growth is driven by rising concerns over unauthorized drone activities. According to a report from January 2025 by the FAA, the organization highlights safe flying and works together with law enforcement to tackle unauthorized drone operations. There have been over 100 reports of drone sightings near airports each month, which is notably high. Operating drones near aircraft is illegal and poses substantial risks, potentially resulting in fines or jail time. The increasing accessibility and affordability of drones have led to their misuse in restricted areas, posing security threats to critical infrastructure, defense establishments, and public spaces. Governments and private organizations are investing in refined detection solutions, including radar, RF sensors, and AI-powered analytics, to counter these threats. The demand for robust drone detection systems is further reinforced by regulatory frameworks mandating the protection of high-risk zones against aerial intrusions.

To Understand More About this Research: Request a Free Sample Report

Another key factor fueling drone detection market demand is growing concerns about privacy and public safety. Unauthorized drones equipped with high-resolution cameras and other surveillance capabilities raise serious privacy issues, particularly in residential areas, corporate facilities, and public events. Additionally, the risk of drones being used for illicit activities, such as smuggling and potential attacks, has prompted authorities to implement strict counter-drone measures. A report from Insight Crime in March 2025 highlights that organized crime in Latin America is increasingly utilizing drones for various illicit activities, such as surveillance, attacks, and transporting goods. Criminal groups in countries such as Brazil, Colombia, Mexico, and Haiti are employing drones for intelligence gathering, bombings, and psychological warfare, which presents challenges for security forces and local communities. As a result, advancements in detection technologies, such as machine learning-based anomaly detection and integrated countermeasures, are gaining traction. This increasing focus on safeguarding airspace integrity is driving continuous innovation and investments in the drone detection market.

Drone Detection Market Dynamics

Increasing Advancements in Drone Technology

Modern drones are becoming more refined, featuring improved autonomy, extended flight ranges, and advanced payloads, making them harder to detect and neutralize as evolving drone capabilities pose greater challenges to security and surveillance. In September 2024, YellowScan and Delair integrated the YellowScan Voyager LiDAR into Delair’s DT46 drone, enabling long-range inspections and precise digital twin creation. The DT46 offers up to 300 km range, quick deployment, and high-precision data capture for demanding applications. This rapid technological progress necessitates the development of equally advanced detection systems capable of identifying, tracking, and mitigating next-generation drone threats. Organizations and security agencies are investing in AI-driven analytics, multi-sensor fusion, and high-precision tracking solutions to keep pace with these advancements. As drones continue to evolve, the demand for innovative detection technologies will remain crucial in ensuring airspace security. Thus, increasing advancements in drone technology boost the drone detection market development.

Rising Regulatory Support and Government Initiatives

Governments are implementing policies mandating the deployment of drone detection solutions in critical infrastructure, airports, and public spaces to mitigate potential threats as authorities worldwide recognize the need for strict airspace security measures. For instance, a December 2022 report from the Ministry of Civil Aviation highlighted advancements in India’s drone industry, driven by simplified regulations, a production-linked incentive (PLI) scheme, and a ban on imports. Drones are increasingly used in logistics, agriculture, and mapping, with the industry expected to grow from USD 8.1 million in 2021 to USD 121.5 million by 2024–25. This growth highlights the importance of integrating robust detection systems to address emerging security challenges. Additionally, increasing investments in research and development, along with collaborations between public and private entities, are fostering technological innovation in this field. Regulatory frameworks are also driving the adoption of standardized detection and counter-drone systems, ensuring a more coordinated approach to addressing unauthorized drone activities. This growing regulatory push is accelerating the deployment and advancement of drone detection solutions across various sectors.

Drone Detection Market Segment Insights

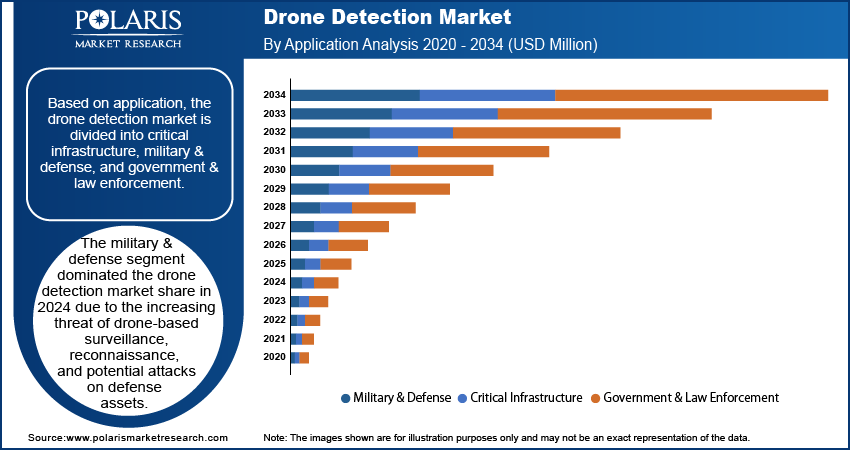

Drone Detection Market Assessment by Application Outlook

The global drone detection market segmentation, based on application, includes critical infrastructure, military & defense, and government & law enforcement. The military & defense segment dominated the drone detection market share in 2024 due to the increasing threat of drone-based surveillance, reconnaissance, and potential attacks on defense assets. Armed forces worldwide are prioritizing the deployment of advanced detection and counter-drone systems to safeguard military installations, airbases, and battlefield operations. Defense agencies are investing in radar-based tracking, electronic warfare systems, and AI-driven threat analysis, with drones being utilized for intelligence gathering and asymmetric warfare. Additionally, the integration of drone detection with existing defense networks improves situational awareness and response capabilities, further driving adoption in this sector.

Drone Detection Market Evaluation by Type Outlook

The global drone detection market segmentation, based on type, includes ground-based and handheld. The handheld segment is expected to witness the fastest growth during the forecast period due to its portability, ease of deployment, and growing demand for on-the-go security solutions. Law enforcement agencies, border security forces, and private security firms are increasingly adopting handheld drone detection devices for real-time threat identification in dynamic environments. These systems provide rapid response capabilities, making them ideal for securing events, patrolling restricted areas, and conducting field operations. Advancements in miniaturized sensors and AI-powered detection further improve their effectiveness, driving widespread adoption in various security applications.

Drone Detection Market Regional Analysis

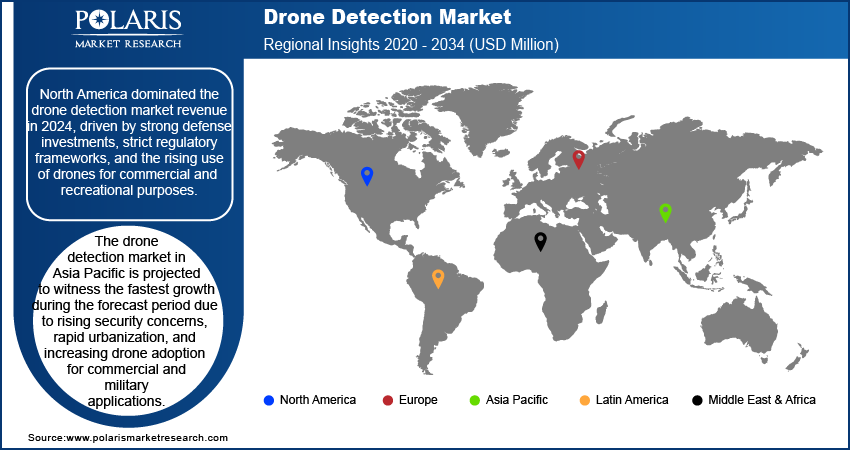

By region, the report provides the drone detection market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the drone detection market revenue in 2024, driven by strong defense investments, strict regulatory frameworks, and the rising use of drones for commercial and recreational purposes. In March 2024, the US government proposed a USD 849.8 billion FY 2025 defense budget, aligning with the Financial Responsibility Act. It focuses on defending the US, supporting personnel, and fostering teamwork through strategic investments and capabilities. The region has a well-established security infrastructure, with government agencies and private organizations prioritizing drone detection technologies to protect critical assets. Additionally, increasing concerns over unauthorized drone activities near airports, military bases, and urban areas have led to higher adoption rates. Ongoing research and innovation in counter-drone solutions, supported by major technology firms and defense contractors, have further strengthened North America's market leadership.

The Asia Pacific drone detection market is projected to witness the fastest growth during the forecast period due to rising security concerns, rapid urbanization, and increasing drone adoption for commercial and military applications. Governments across the region are implementing stricter airspace regulations and investing in advanced detection systems to mitigate potential threats. Additionally, the expanding defense budgets of key economies are driving large-scale deployment of counter-drone solutions in military and border security operations. The growing presence of domestic technology firms developing cost-effective detection systems further supports Asia Pacific drone detection market expansion.

Drone Detection Market – Key Players & Competitive Analysis Report

The competitive landscape in the drone detection market features global leaders and regional players competing for market share through innovation, strategic alliances, and regional expansion. Global players leverage strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, addressing the growing demand for disruptive technologies and integrated security systems. Drone detection market trends highlight rising demand for emerging technologies, digitalization, and operational transformation driven by increasing security threats, geopolitical shifts, and evolving regulatory frameworks. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position and expand their product portfolios. Post-merger integration and strategic alliances are key strategies to enhance competitive positioning and extend regional footprints. Regional companies, on the other hand, cater to localized needs by offering cost-effective solutions and leveraging regional economic and regulatory landscapes. Competitive benchmarking in the drone detection market includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative and future-ready solutions. The market is experiencing rapid technological advancements, such as AI-driven detection systems, radar technologies, and RF-based solutions, which are reshaping industry ecosystems. Companies are investing in advanced supply chain management, procurement strategies, and sustainability transformations to align with market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability in this dynamic market. The drone detection market grows through innovation and regional investments as key players focus on strategic developments to address security challenges. A few key major players are Aselsan, BEL, DroneShield Ltd, Elbit System, IAI, L3Harris, Leonardo S.p.A, Lockheed Martin Corporation, Northrop Grumman Corporation, QinetiQ, Rheinmetall, RTX, Saab, Teledyne Inc., and Thales.

Northrop Grumman Corporation specializes in the drone detection and counter-drone market. The company offers a range of advanced solutions designed to address the growing threat of unmanned aerial systems (UAS). Its capabilities include integrated, layered defenses that combine sensing, tracking, and interception technologies. Notable systems include the Forward Area Air Defense (FAAD), which the US Department of Defense has adopted for counter-small UAS operations. FAAD integrates sensors, radars, and both kinetic and non-kinetic effectors to create a comprehensive defense network. Northrop Grumman has also developed innovative tools such as the Mobile Application for UAS Identification (MAUI), which uses mobile devices to detect and identify small drones acoustically. Another key system is DRAKE, a radio-frequency negation technology designed to neutralize drones selectively. Additionally, the company’s Cannon-Based Air Defense (CBAD) system employs guided ammunition to counter drone swarms effectively and affordably. Northrop Grumman remains at the forefront of counter-drone technology with advancements such as artificial intelligence integration into its FAAD system for streamlined decision-making and interoperability with allied forces.

RTX, formerly known as Raytheon Technologies, is a major aerospace and defense company that plays a substantial role in the drone detection and counter-UAS market. Through its various business units, such as Collins Aerospace and Raytheon Intelligence & Space, RTX offers a wide array of technologies designed to detect, track, and neutralize unmanned aerial threats. These solutions range from advanced radar systems capable of detecting small drones at considerable distances to electronic warfare systems that can disrupt drone operations. RTX's counter-UAS capabilities often integrate multiple sensors, such as radar, electro-optical/infrared (EO/IR) cameras, and acoustic sensors, to provide a comprehensive situational awareness picture. The company also develops sophisticated command and control systems that allow operators to analyze threat data and deploy appropriate countermeasures. Specific technologies include advanced radars such as the Air Missile Defense Radar (AMDR) and electronic warfare systems that can jam or spoof drone signals. RTX's holistic approach to counter-UAS emphasizes layered defense, combining different technologies to provide robust protection against diverse drone threats.

List of Key Companies in Drone Detection Market

- Aselsan

- BEL

- DroneShield Ltd

- Elbit System

- IAI

- L3Harris

- Leonardo S.p.A

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- QinetiQ

- Rheinmetall

- RTX

- Saab

- Teledyne Inc.

- Thales

Drone Detection Industry Developments

March 2025: AeroDefense launched AirWarden Essentials, a cost-effective drone detection system using Remote ID broadcasts. It provides real-time alerts, regional monitoring, and flight pattern analysis via a cloud-based console, enhancing situational awareness and coordination for organizations addressing unauthorized drone activity.

January 2025: L3Harris Technologies launched a drone detection and defeat capability for its T7 robot system at Vanguard 24. The integration of counter-UAS technology and electronic warfare tools showcased the T7’s potential for multi-mission roles, including remote sensing and spectrum operations.

October 2024: Rohde & Schwarz launched ARDRONIS Detect, a cost-effective counter-drone solution for detecting and identifying drones. Part of the ARDRONIS CUAS system, it uses signals such as FHSS and video for detection, integrating with ARDRONIS Control Center for user-friendly operation and advanced capabilities.

Drone Detection Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Radar System

- RF Scanner

- Optical System

By Application Outlook (Revenue, USD Million, 2020–2034)

- Critical Infrastructure

- Military & Defense

- Government & Law Enforcement

By Range Outlook (Revenue, USD Million, 2020–2034)

- < 5 Km

- 5–10 Km

- > 10 Km

By Type Outlook (Revenue, USD Million, 2020–2034)

- Ground-Based

- Handheld

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Drone Detection Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 647.44 million |

|

Market Size Value in 2025 |

USD 822.48 million |

|

Revenue Forecast in 2034 |

USD 7,266.39 million |

|

CAGR |

27.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global drone detection market size was valued at USD 647.44 million in 2024 and is projected to grow to USD 7,266.39 million by 2034.

The global market is projected to register a CAGR of 27.4% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Aselsan, BEL, DroneShield Ltd, Elbit System, IAI, L3Harris; Leonardo S.p.A, Lockheed Martin Corporation, Northrop Grumman Corporation, QinetiQ, Rheinmetall, RTX, Saab, Teledyne Inc., and Thales.

The military & defense segment dominated the market in 2024.

The handheld segment is expected to witness the fastest market growth during the forecast period.