Drilling Waste Management Market Size, Share, Trends, Industry Analysis Report: By Application (Offshore and Onshore), Service, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 116

- Format: PDF

- Report ID: PM5182

- Base Year: 2024

- Historical Data: 2020-2023

Drilling Waste Management Market Overview

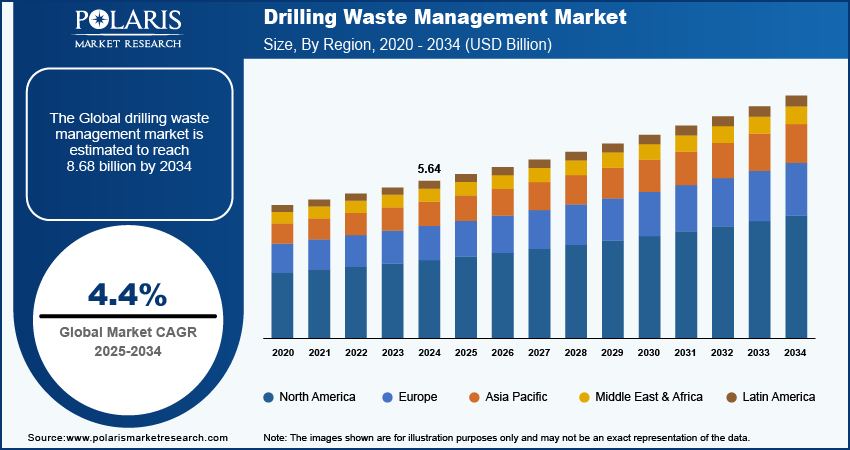

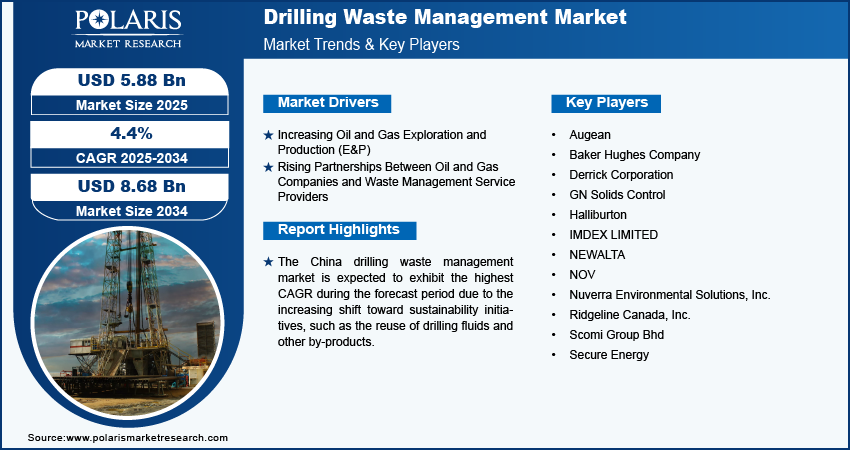

The drilling waste management market size was valued at USD 5.64 billion in 2024. The market is projected to grow from USD 5.88 billion in 2025 to USD 8.68 billion by 2034, exhibiting a CAGR of 4.4% during 2025–2034.

Drilling waste management refers to the collection, treatment, and disposal of waste generated during drilling operations by the industry. Governments and regulatory bodies are imposing strict guidelines on waste disposal and emissions to protect ecosystems, especially for onshore and offshore drilling activities, which drives the demand for drilling waste management. Furthermore, the rising need to maintain environmental compliance in sensitive marine ecosystems has driven demand for advanced waste management techniques such as cuttings reinjection (CRI) and thermal desorption units (TDU). Thus, the growing environmental compliance is driving the drilling waste management market growth.

To Understand More About this Research: Request a Free Sample Report

The expansion of shale gas, coalbed methane (CBM), and tight oil drilling activities generates a higher volume of waste due to the use of horizontal drilling and hydraulic fracturing techniques. The growing amount of waste in the drilling processes is driving demand for drilling waste management systems. Moreover, mining companies involved in mineral and geothermal energy exploration generate drill cuttings and wastewater. The crossover of technologies between the mining and oil & gas sectors contributes to the adoption of drilling waste management solutions, contributing to the market growth.

Drilling Waste Management Market Driver Analysis

Increasing Oil and Gas Exploration and Production (E&P)

The rise in energy demand is driving exploration and production (E&P) activities across onshore and offshore fields, resulting in increased drilling waste and the need for advanced management solutions. According to the US Energy Information Administration, in May 2022, the US oil production accounted for 11,742 barrels per day, while the oil production reached 13,201 barrels per day in May 2024. Thus, the growing oil production is driving the drilling waste management market growth.

Rising Partnerships Between Oil and Gas Companies and Waste Management Service Providers

Strategic partnerships between oil and gas companies and waste management service providers are increasingly prevalent as both sectors recognize the need for more effective and sustainable drilling waste management solutions. The collaborations enable the exchange of best practices and advanced technologies, allowing for a more integrated approach to waste handling. Oil and gas companies often bring extensive operational experience and insights into the unique challenges they face during drilling activities, while waste management providers contribute specialized knowledge in waste treatment, recycling, and disposal techniques. For instance, in September 2024, SLB partnered with ADNOC Drilling Company and Patterson-UTI to form Turnwell Industries LLC OPC. This joint venture will focus on integrating AI, optimizing smart drilling techniques, and enhancing completion engineering and production solutions for greater operational efficiency. Thus, by working together, the companies develop tailored strategies that optimize waste management processes, reduce environmental impact, and ensure compliance with regulatory requirements.

Drilling Waste Management Market Segment Analysis

Drilling Waste Management Market Breakdown by Application Outlook

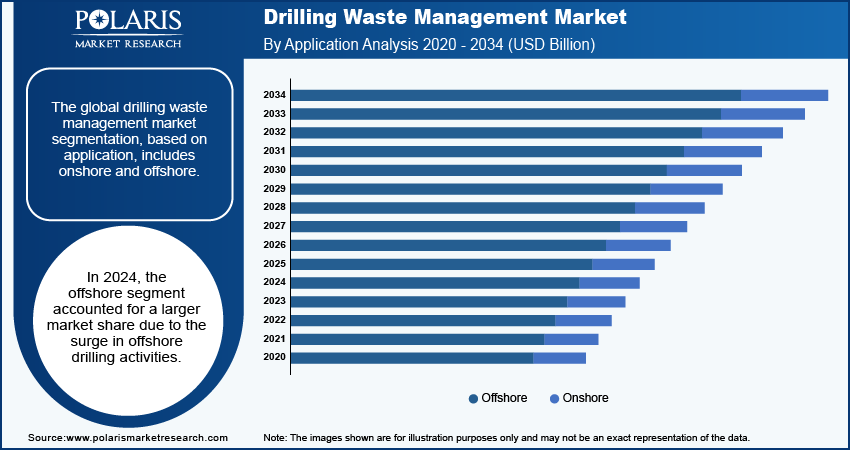

The global drilling waste management market segmentation, based on application, includes onshore and offshore. In 2024, the offshore segment accounted for a larger market share due to the surge in offshore drilling activities, particularly in resource-rich regions such as the Gulf of Mexico, the North Sea, and Brazil. Rising offshore drilling activities have led to significant increases in the volume of waste generated during exploration and production (E&P) operations. Offshore drilling presents unique challenges, including the management of large quantities of cuttings, spent drilling fluids, and other waste materials that require specialized treatment and disposal methods. Furthermore, stringent environmental regulations governing offshore operations have heightened the demand for advanced waste management solutions, compelling companies to invest in technologies such as cuttings reinjection (CRI) and thermal desorption units (TDU) to ensure compliance while minimizing environmental impact.

Drilling Waste Management Market Breakdown by Service Outlook

The global drilling waste management market segmentation, based on service, includes containment & handling, solid control, and treatment & disposal. The containment & handling segment is expected to register the highest CAGR during the forecast period. The increasing volume of drilling waste generated from onshore and offshore operations necessitates more efficient containment and handling solutions to prevent environmental contamination and ensure regulatory compliance. Companies are facing stricter environmental regulations, which are driving demand for advanced containment technologies, such as spill containment systems and engineered waste storage solutions. Additionally, innovations in handling equipment and methods, including automated systems for waste collection and transportation, are enhancing operational efficiency and reducing risks associated with waste management.

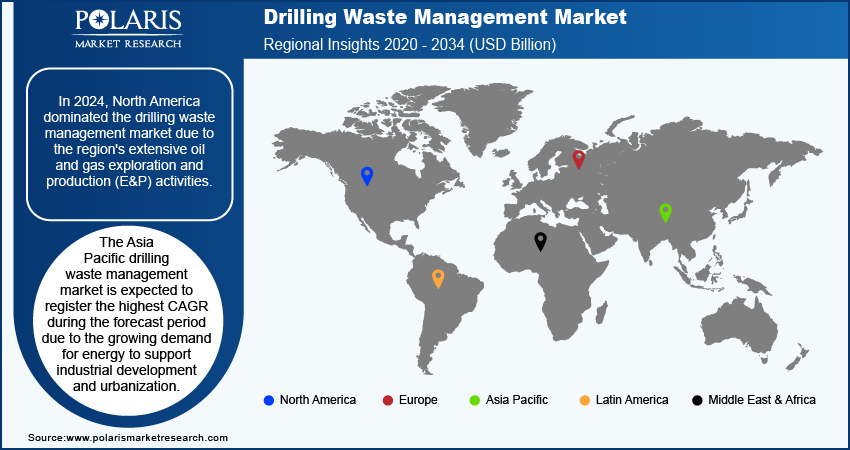

Drilling Waste Management Market Breakdown, by Regional Outlook

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the drilling waste management market share due to the region's extensive oil and gas exploration and production (E&P) activities, particularly in the US and Canada, which have significantly contributed to the high demand for effective waste management solutions. Unconventional drilling techniques, such as hydraulic fracturing and horizontal drilling in shale plays like the Permian Basin and Bakken Formation, generate substantial volumes of drilling waste, including cuttings and contaminated fluids, necessitating advanced waste treatment technologies. Furthermore, North America has stringent environmental regulations enforced by organizations such as the Environmental Protection Agency (EPA) and provincial authorities in Canada, compelling companies to adopt efficient waste management practices to ensure compliance.

The US dominated the North America drilling waste management market in 2024 due to its leading technological innovation and the presence of a robust network of service providers and vendors, offering solutions such as mobile treatment units, zero-discharge systems, and recycling services. The growing focus of the US operators on sustainability and resource recovery has increased the adoption of drilling waste management tools and equipments.

The Asia Pacific drilling waste management market is expected to register the highest CAGR during the forecast period due to the growing demand for energy to support industrial development and urbanization. This rising demand has led to increased onshore and offshore drilling operations across the region, resulting in higher volumes of drilling waste. Thus, the regional market is expected to witness rapid growth during the forecast period.

The China drilling waste management market is expected to record the highest CAGR during the forecast period due to the increasing shift toward sustainability initiatives, such as the reuse of drilling fluids and other by-products, which aligns with the government’s push for green development policies.

Drilling Waste Management Market – Key Players and Competitive Insights

The competitive landscape of the drilling waste management market is characterized by the presence of a mix of global players, regional service providers, and specialized vendors offering diverse waste management solutions. Key companies are focusing on strategic partnerships, mergers, and acquisitions to expand their market presence and enhance their technological capabilities. Innovation plays a crucial role, with firms investing in advanced technologies such as thermal desorption units (TDU), cuttings reinjection (CRI), and mobile treatment units to meet regulatory requirements and improve efficiency. Moreover, companies are increasingly offering customized waste management services to cater to the varying needs of onshore and offshore operations, with a growing focus on sustainability by promoting recycling and reuse initiatives. The market is also witnessing increased competition from regional players who leverage their knowledge of local regulations and operational environments to gain a competitive edge. A few key market players are Augean; Baker Hughes Company; Derrick Corporation; GN Solids Control; Halliburton; IMDEX LIMITED; NEWALTA; NOV; Nuverra Environmental Solutions, Inc.; Ridgeline Canada, Inc.; Scomi Group Bhd; and Secure Energy.

Baker Hughes Company is a multinational technology-based company headquartered in Texas, US. Founded in 1908, the company provides products and services for industrial solutions. Its portfolio of products includes subsea production systems, drilling equipment, pipe systems, compressors, energy recovery and storage systems, electricity generators, control systems, regulators, valves, pumps, and process control technologies. In addition, Baker Hughes offers digital solutions such as sensor-based process measurement, plant controls, non-destructive testing and inspection, and pipeline integrity solutions. The key focus of the company is to provide services to other businesses, including state and national-owned oil companies and autonomous oil and natural gas companies. In June 2024, Baker Hughes signed a 10-year service framework agreement with Woodside Energy to optimize the performance of its LNG operations in Australia, leveraging advanced technologies and expertise for enhanced efficiency.

Halliburton Company delivers comprehensive products and services tailored for the global energy sector, operating through two primary segments: completion and production and drilling and evaluation. The completion and production segment focuses on enhancing hydrocarbon extraction efficiency through specialized stimulation and sand control services. Additionally, it provides advanced cementing solutions, encompassing wellbore bonding, casing operations, and essential casing equipment. The segment also includes a range of sophisticated completion tools that deliver innovative downhole solutions, including intelligent, well completions, service tools, liner hangers, sand control mechanisms, and multilateral systems designed for complex reservoir access and management.

Key Companies in the Drilling Waste Management Market

- Augean

- Baker Hughes Company

- Derrick Corporation

- GN Solids Control

- Halliburton

- IMDEX LIMITED

- NEWALTA

- NOV

- Nuverra Environmental Solutions, Inc.

- Ridgeline Canada, Inc.

- Scomi Group Bhd

- Secure Energy

Drilling Waste Management Market Segmentation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Onshore

- Offshore

By Service Outlook (Revenue, USD Billion, 2020–2034)

- Containment & Handling

- Solid Control

- Treatment & Disposal

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Drilling Waste Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.64 billion |

|

Market Size Value in 2025 |

USD 5.88 billion |

|

Revenue Forecast by 2034 |

USD 8.68 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global drilling waste management market size was valued at USD 5.64 billion in 2024 and is projected to grow to USD 8.68 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

In 2024, North America dominated the market due to the region's extensive oil and gas exploration and production (E&P) activities.

A few key players in the market are Augean; Baker Hughes Company; Derrick Corporation; GN Solids Control; Halliburton; IMDEX LIMITED; NEWALTA; NOV; Nuverra Environmental Solutions, Inc.; Ridgeline Canada, Inc.; Scomi Group Bhd; and Secure Energy.

In 2024, the offshore segment dominated the market due to the surge in offshore drilling activities.

Treatment & disposal segment is expected to register the highest CAGR during the forecast period.