Drilling Fluids and Chemicals Market Share, Size, Trends, Industry Analysis Report: By Product (Oil-Based, Synthetic-Based, Water-Based, and Others), Additive Type, Well Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 117

- Format: PDF

- Report ID: PM1485

- Base Year: 2023

- Historical Data: 2019-2022

Drilling Fluids and Chemicals Market Overview

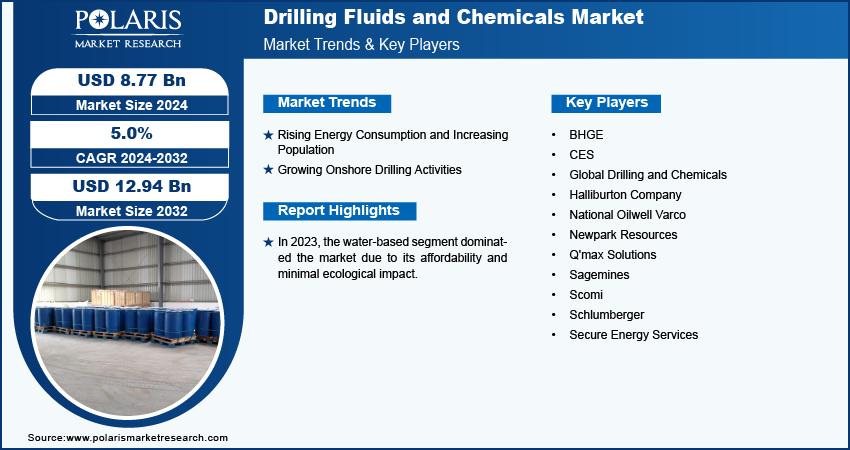

The global drilling fluids and chemicals market size was valued at USD 8.35 billion in 2023. The market is projected to grow from USD 8.77 billion in 2024 to USD 12.94 billion by 2032, exhibiting a CAGR of 5.0% during 2024–2032.

The drilling fluids and chemicals market involves the production and supply of various fluids and chemical additives used in drilling operations. These products enhance drilling efficiency, stabilize wellbore conditions, and minimize environmental impact, playing a crucial role in the oil and gas industry.

The drilling fluids and chemicals market is experiencing strong growth, driven by increasing urbanization and a growing demand for power to support business operations. Rising population and higher income levels worldwide are leading to greater vehicle usage, including two-wheelers and four-wheelers, due to the convenience of transportation and the accessibility of fuel stations. These trends are expected to boost drilling activities, positively impacting the drilling fluids and chemicals market.

To Understand More About this Research: Request a Free Sample Report

Additionally, the expansion of the oil and gas sector contributes to market growth. Technological advancements in extraction techniques and increased exploration of unconventional resources are key factors driving this development. Innovations such as the use of nanotubes or graphene in drilling fluids have enhanced offshore drilling capabilities. Furthermore, regulatory pressures for environmentally friendly practices are encouraging the creation of sustainable fluid formulations, further supporting the growth of the drilling fluids and chemicals market.

Drilling Fluids and Chemical Market Trends

Rising Energy Consumption and Increasing Population

The drilling fluids and chemicals market is expected to grow due to increasing energy consumption and a growing global population. For instance, according to the International Energy Agency, energy consumption is projected to grow by 4% in 2024, leading to increased demand for oil and gas resources. This growth highlights the need for advanced drilling technologies and efficient fluid solutions to improve extraction processes. Furthermore, the demand for reliable energy sources to support urbanization and industrialization is driving the demand for drilling fluids and chemicals. Thus, rising energy consumption and increasing population are expected to drive the drilling fluids and chemicals market growth.

Growing Onshore Drilling Activities

The drilling fluids and chemicals market is experiencing significant growth due to the increasing onshore drilling activities. For instance, according to the African Energy Chamber, in 2022, African drilling levels saw an 11% increase over 2021, with a total of 910 wells drilled, of which 80% were onshore. This growth in number shows increased exploration and production efforts driven by rising energy demands and favorable regulatory environments. Onshore drilling comes with lower costs and faster project timelines and requires advanced drilling fluids and chemicals to enhance efficiency and performance. As more operators invest in onshore projects, the demand for specialized drilling solutions is expected to rise substantially, positively impacting the growth of the drilling fluids and chemicals market.

The rising awareness of the negative impacts of natural resource extraction and the increasing waste generation during drilling operations is driving the adoption of drilling fluids and chemicals. These substances help minimize ecological degradation, leading to growth in the drilling fluids and chemicals market.

Drilling Fluids and Chemicals Market Segment Insights

Drilling Fluids and Chemicals Market Breakdown – Product Insights

The global drilling fluids and chemicals market, based on product, is segmented into oil-based, synthetic-based, water-based, and others. In 2023, the water-based segment dominated the market due to its affordability and minimal ecological impact. Water-based drilling fluids are cost-effective, making them a preferred choice for many operators, particularly in onshore drilling applications. Their formulation facilitates easy availability and handling, which helps to reduce overall operational costs. Additionally, these fluids are environmentally friendly and pose lower risks of contamination compared to oil-based alternatives. The demand for water-based drilling fluids is expected to rise as regulations increasingly favor sustainable practices. Therefore, due to the factors mentioned above, the water-based segment dominated in 2023.

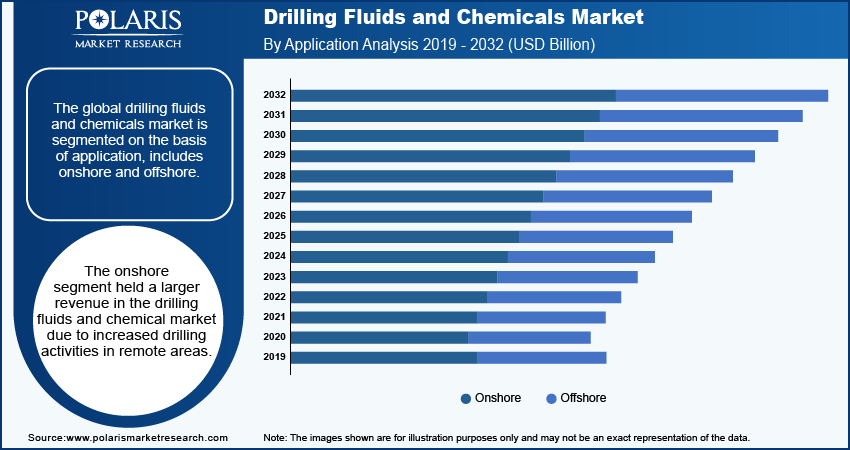

Drilling Fluids and Chemicals Market Breakdown – Application Insights

The global drilling fluids and chemicals market, based on application, is bifurcated into onshore and offshore. The onshore segment held a larger revenue share in 2023 driven by increased drilling activities in remote areas. Further, the increase in domestic energy production and exploration of unconventional reserves has boosted the demand for onshore drilling, positively impacting market segmental growth.

Drilling Fluids and Chemicals Market Breakdown – Regional Insights

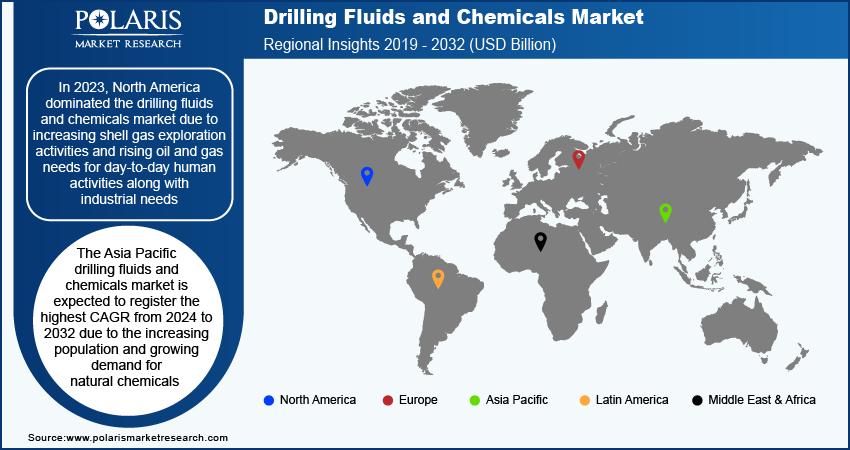

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the drilling fluids and chemicals market due to the increasing shell gas exploration activities and rising oil and gas needs for day-to-day human activities along with industrial needs. In addition, the presence of major companies such as National Oilwell Varco, BHGE, Newpark Resources, Q'max Solutions, Secure Energy Services, and CES offering their services in the region boosts the market growth in North America.

Major market players are adopting various strategies such as acquisition, collaboration to strengthen their market presence and enhance their service outreach in North America, further driving the drilling fluids and chemicals market growth in the region.

The Asia Pacific drilling fluids and chemicals market is expected to register the highest CAGR from 2024 to 2032. This is attributable to the increasing population and growing demand for natural chemicals, leading to their higher extraction. The increasing population has led to a growth in energy consumption, positively impacting the demand for drilling fluids and chemicals in the region.

In 2023, China held the largest market share for drilling fluids and chemicals in the Asia Pacific region. This dominance was driven by several factors, including a significant oil and gas consumer base primarily focused on transportation and the use of heavy machinery in the manufacturing industry. As drilling companies engage in deeper fossil fuel extraction, there is an increasing demand for fluids and chemicals to meet regulatory requirements and ensure effective operations. Consequently, China's robust industrial activity is expected to continue fueling growth in the drilling fluids and chemicals market.

Drilling Fluids and Chemicals Market – Key Players and Competitive Insights

Leading market players are showing significant interest in investing heavily in research and development to offer specialized chemicals and fluids to mitigate drilling complexities, which is driving the growth of the drilling fluids and chemicals market. Market participants are also constantly equipping advanced technologies and focusing on strategic planning to enhance their brand presence and a variety of strategic activities to expand their global footprint with important market developments, including new product launches, collaborations, contractual agreements, mergers, and acquisitions with other organizations. To expand and survive in a more competitive and rising market landscape, the market players must offer affordable and highly functional products to end users.

Key players in the global market are frequently working to minimize input costs, which is becoming a major business tactic as it enables the global drilling fluids and chemicals industry to provide products with reasonable costs and utilize resources optimally. In recent years, the industry has offered various technological advancements such as remotely operated vehicles (ROVs) for drilling in deep water, which is expected to expand the drilling fluids and chemicals market reach in the coming years.

Major players in the drilling fluids and chemicals market are BHGE, CES, Global Drilling and Chemicals, Halliburton Company, National Oilwell Varco, Newpark Resources, Q'max Solutions, Sagemines, Scomi, Schlumberger, and Secure Energy Services.

Cinco Mud Solutions, a company recently acquired by Paragon ISG, is a provider of drilling fluids and solids separation services. The company offers LG-100, an eco-friendly shale inhibitor and hydration suppressant specifically designed for water-based drilling fluid systems. Cinco Mud Solutions operates primarily in two segments: drilling fluids for both conventional and unconventional drilling operations, and environmental services. Their product portfolio includes LG-100 for traditional oil-based muds, as well as dewatering and desludging services.

ADNOC Drilling Company, a subsidiary of the Abu Dhabi National Oil Company (ADNOC), is a drilling firm in the Middle East that specializes in both onshore and offshore operations. Formerly known as the National Drilling Company, the firm operates in the UAE, particularly in Abu Dhabi, and has a fleet of 105 rigs, including 28 offshore jack-up units. The company provides drilling and well construction services, focusing on both conventional and unconventional oil and gas resources.

- BHGE

- CES

- Global Drilling and Chemicals

- Halliburton Company

- National Oilwell Varco

- Newpark Resources

- Q'max Solutions

- Sagemines

- Scomi

- Schlumberger

- Secure Energy Services

Drilling Fluids and Chemicals Industry Developments

June 2024: ADNOC Drilling, a drilling company, received 10-year contracts worth USD 2 billion for jack-up rigs to hold up ADNOC Offshore’s drilling operations. This initiative is part of its fast-track rig expansion project to boost production potential with a view to meeting increasing energy demand.

December 2023: Fineotex Chemical Ltd. announced that it had acquired land worth approximately USD 4.2 million to construct an additional factory. This expansion aims to enhance the supply of home care, hygiene, and drilling specialty chemicals.

Drilling Fluids and Chemicals Market Segmentation

By Product Outlook (USD Billion, 2019–2032)

- Oil-Based

- Synthetic-Based

- Water-Based

- Others

By Additive Type Outlook (USD Billion, 2019–2032)

- Polymer Viscosifiers

- Barite

- Bentonite

- Lost Circulation Materials

- Shale Inhibitors

- Others

By Well Type Outlook (USD Billion, 2019–2032)

- HPHT

- Conventional

By Application Outlook (USD Billion, 2019–2032)

- Onshore

- Offshore

By Regional Outlook (USD Billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Drilling Fluids and Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 8.35 billion |

|

Market Size Value in 2024 |

USD 8.77 billion |

|

Revenue Forecast by 2032 |

USD 12.94 billion |

|

CAGR |

5.0% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global drilling fluids and chemicals market size was valued at USD 8.35 billion in 2023 and is projected to grow to USD 12.94 billion by 2032.

The global market is projected to register a CAGR of 5.0% during the forecast period.

North America accounted for the largest share of the global market during 2024–2032.

ADAMA Agricultural Solutions Ltd.; Syngenta; Arrow Exterminators, Inc.; BHGE; CES; Global Drilling and Chemicals; Halliburton Company; National Oilwell Varco; Newpark Resources; Q'max Solutions; Sagemines; Scomi; Schlumberger; and Secure Energy Services are among the key players in the market.

The water-based category dominated the market in 2023.

The onshore segment accounted for a larger share of the global market in 2023