Drill Pipe Market Size, Share, Trends, Industry Analysis Report: By Grade (API Grade and Premium Grade), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM3493

- Base Year: 2024

- Historical Data: 2020-2023

Drill Pipe Market Overview

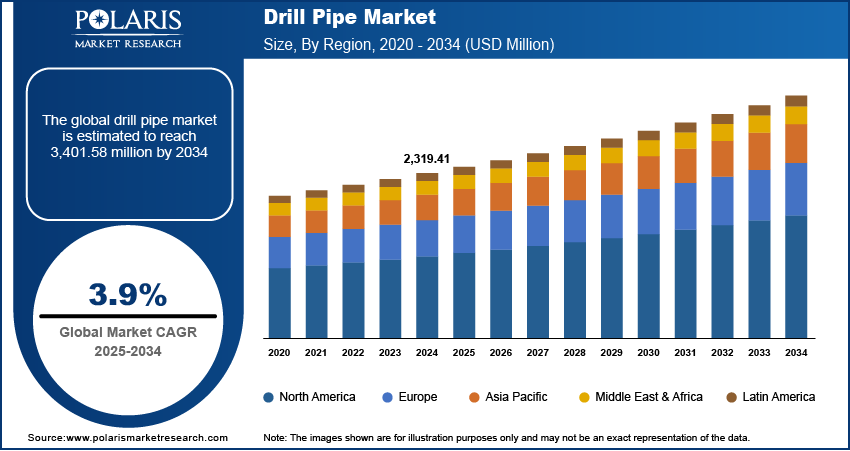

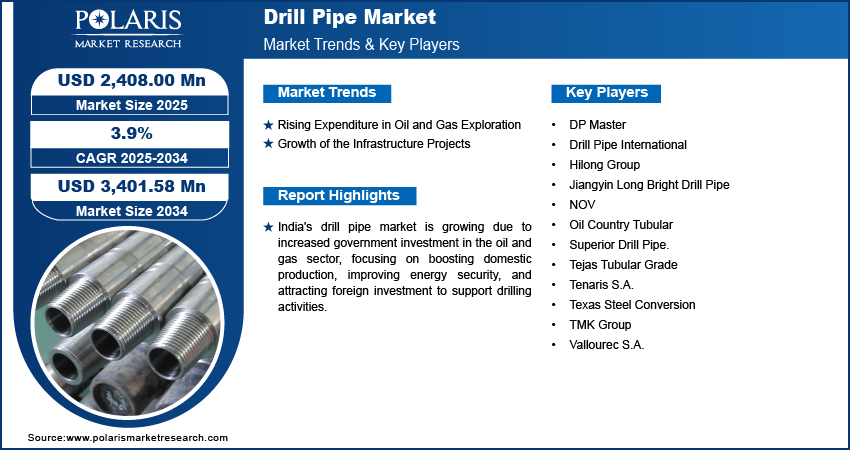

Drill pipe market size was valued at USD 2,319.41 million in 2024. The market is projected to grow from USD 2,408.00 million in 2025 to USD 3,401.58 million by 2034, exhibiting a CAGR of 3.9% during the forecast period.

Drill pipe is a long, hollow steel tube used in drilling operations to transmit drilling fluid and rotational energy to the drill bit. It connects the surface equipment to the drill bit, allowing for deep penetration into the ground during exploration or extraction activities.

The world needs more energy because more people are being born, and industries are growing. This increases the demand for oil, gas, and other natural resources, leading to more drilling to extract them. As energy use rises, drilling becomes more intense, creating a higher need for strong and durable drill pipes. These pipes are important for making drilling safer, faster, and more efficient. Because of this, the drill pipe market is growing, as companies need better equipment to keep up with the demand for energy.

Advancements in drilling technologies, such as horizontal drilling and deep-water drilling, have created the need for more advanced drill pipes. These innovations require drill pipes with improved strength, flexibility, and resistance to harsh conditions. In addition, modern drilling techniques target deeper reserves or complex geological formations, which demand pipes that withstand higher pressures and corrosive environments. This continuous evolution of technology is driving the demand for advanced, high-performance drill pipes, thereby driving the drill pipe market expansion.

To Understand More About this Research: Request a Free Sample Report

Drill Pipe Market Dynamics

Rising Expenditure in Oil and Gas Exploration

Expenditure in oil and gas exploration has been steadily rising, especially in regions with untapped reserves such as deep-water areas, shale fields, and remote locations. For instance, according to the International Energy Forum, in 2023, Oil and gas annual upstream capital expenditures rose by USD 63 billion compared to 2022, showcasing an increase in expenditure in oil and gas exploration. Companies are focusing on new opportunities to meet the growing global energy demand, which requires drilling deeper and more complex wells. The industry's ongoing allocation of funds towards exploration and production is driving the need for reliable, high-quality drill pipes, which in turn is driving the drill pipe market demand.

Growth of Infrastructure Projects

The rapid growth of infrastructure projects, particularly in energy, mining, and oil and gas sectors, has led to increased demand for drill pipes. These sectors require drilling operations for resource extraction, foundation work, and pipeline installation. Countries and industries investing in large-scale infrastructure projects to support economic growth have made drill pipes essential for these infrastructure developments. For instance, according to the International Energy Agency, in 2023, the US alone invested USD 21.3 billion for grid improvement and installments. The ongoing development of new pipelines, energy plants, and resource extraction facilities is boosting the demand for drill pipes, thereby driving the growth of the drill pipe market.

Drill Pipe Market Segment Analysis

Drill Pipe Market Assessment by Grade

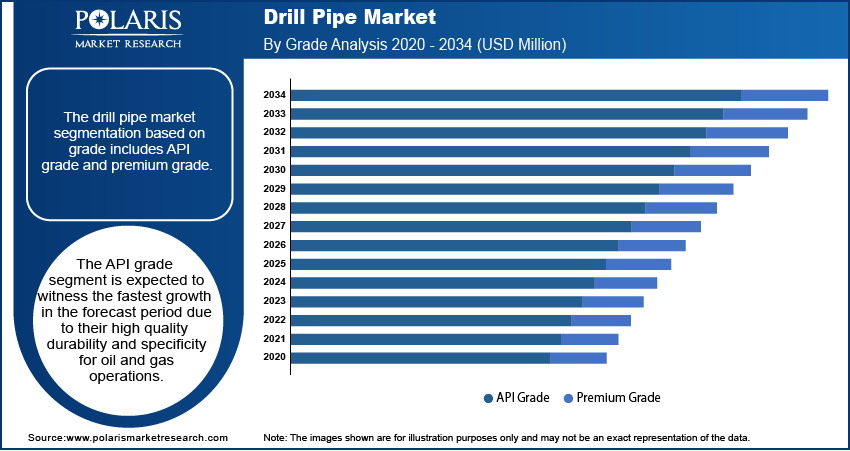

The drill pipe market segmentation, based on grade, includes API grade and premium grade. The API grade segment is expected to witness the fastest growth during the forecast period. American Petroleum Institute (API) grades are renowned for their high quality and durability, specifically designed for oil and gas drilling operations. These drill pipes adhere to strict industry standards, ensuring reliability under extreme conditions such as deep drilling and high-pressure environments. Additionally, the increasing demand for energy is boosting oil and gas exploration activities, especially in challenging locations, which is driving the demand for API grade drill pipes, thereby driving the segmental growth.

Drill Pipe Market Evaluation by Application

The drill pipe market segmentation, based on application, includes onshore and offshore. The onshore segment dominated the market in 2024 due to the high volume of drilling activities in energy infrastructure and mining. This segment includes exploration and production activities in fields that are located on land, where drilling is more accessible and efficient. Onshore drilling operations are less complex and more cost-effective compared to offshore projects, making them more attractive to oil and gas companies. The demand for drill pipes in onshore operations is rising as energy companies are focusing on boosting domestic production and meeting the growing energy needs, thereby driving segmental growth.

Drill Pipe Market Share by Regional Insights

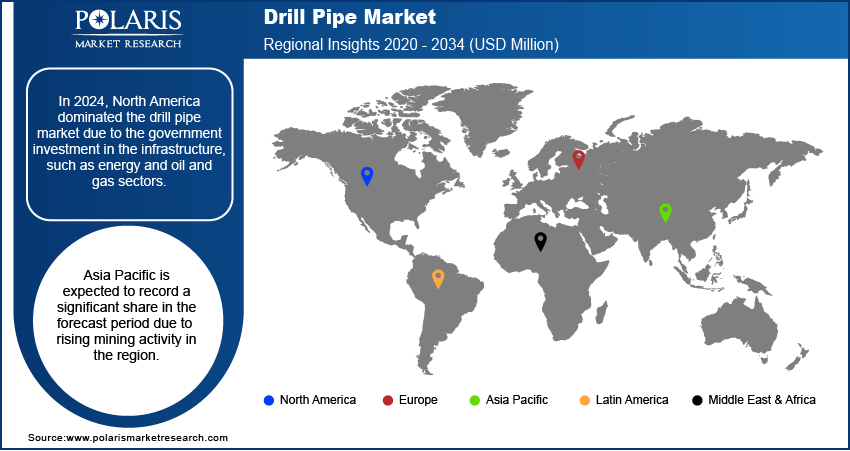

By region, the study provides the drill pipe market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to government investment in infrastructure, especially within the energy and oil and gas sectors. Significant funds are being allocated to improve energy production, pipeline development, and resource extraction. This surge in investment is directly increasing the demand for drilling operations, thereby raising the need for durable, high-quality drill pipes. Additionally, expanding energy infrastructure, including new drilling projects and pipeline installations, is further fueling the demand for drill pipes, thereby driving the drill pipe market in North America.

Asia Pacific is expected to record a significant drill pipe market share during the forecast period, driven by rising mining activities, especially in countries such as China, Japan, and Australia. For instance, according to the World Gold Council, in 2023, China recorded a gold mine production of 378.2 tons, which was the largest globally. Drilling activities are essential in accessing these resources, and high-quality drill pipes are needed to ensure efficiency and safety in these operations. The increasing demand for raw materials to support infrastructure development and industrial growth is driving the demand for reliable drill pipes, boosting the market in Asia Pacific.

The drill pipe market in India is experiencing substantial growth due to rising government investment in the oil and gas sector. The Indian government has been focusing on boosting domestic oil production and improving energy security, leading to significant investments in exploration and drilling activities. Consequently, demand for high-quality drill pipes, essential for drilling operations, is increasing. Additionally, the government's emphasis on improving energy infrastructure and attracting international investments in the oil and gas sector is further supporting the market growth in India. For instance, according to the India Brand Equity Foundation, the government has allowed 100% foreign direct investment (FDI) in upstream and private sector refining projects, showcasing the government's efforts to attract foreign investment.

Drill Pipe Market Key Players & Competitive Analysis Report

The drill pipe market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the drill pipe industry include Hilong Group; NOV; Tenaris S.A.; Vallourec S.A.; TMK Group; Oil Country Tubular; Tejas Tubular Grade; Texas Steel Conversion; DP Master; Jiangyin Long Bright Drill Pipe; Drill Pipe International; and Superior Drill Pipe.

NOV Inc., formerly known as National Oilwell Varco, is a multinational corporation based in Houston, Texas, that provides technology, equipment, and services primarily for the oil and gas industry. The company operates through two main segments which include energy equipment and energy products and services. Its product offerings include rig systems, wellbore technologies, and completion solutions, serving a variety of clients such as drilling contractors, rig fabricators, and independent oil and gas companies. A significant aspect of NOV's operations is its grant prideco division, which specializes in the production of drill pipe. The drill pipes are designed for durability and performance, incorporating advanced rotary-shouldered connection technologies that aim to enhance operational efficiency. The company uses high-strength material grades to ensure reliability during drilling operations and offers custom solutions to address specific drilling requirements. NOV operates on a global scale with facilities in the Americas, Europe, Asia Pacific, the Middle East, and Africa.

Texas Steel Conversion, Inc. (TSC) is a manufacturer of oil country tubular goods (OCTG) and drill pipes, established in 1975 and based in Houston, Texas. The company operates five facilities in Southeast Texas, focusing on the production of various OCTG products, including drill pipes, pup joints, and API casing and tubing. TSC's drill pipe division produces a significant volume of drill pipes designed to meet the requirements of drilling operations. The company manufactures over 12,000 joints per month, with products that comply with API specifications to ensure they can withstand the demands of different drilling environments. TSC offers drill pipes in sizes ranging from 2-7/8 inches to 6-5/8 inches in diameter and adheres to multiple API grades such as E-75, X-95, G-105, and S-135. The manufacturing process includes stringent quality control measures, and TSC holds ISO9001:2008 certification along with compliance with API-Q1 standards. The company’s operations are primarily located in Southeast Texas, which facilitates efficient distribution to clients across North America and other regions.

Key Companies in Drill Pipe Market

- DP Master

- Drill Pipe International

- Hilong Group

- Jiangyin Long Bright Drill Pipe

- NOV

- Oil Country Tubular

- Superior Drill Pipe.

- Tejas Tubular Grade

- Tenaris S.A.

- Texas Steel Conversion

- TMK Group

- Vallourec S.A.

Drill Pipe Market Developments

December 2023: The DPM-OPTiMA was launched by DP-Master Manufacturing, featuring a premium connection designed for optimal performance, efficiency, and cost savings, approved with Fearnley Group NS-1 Design for 2024 drilling conditions.

February 2021: NOV launched its sour service drill stem product line. This line is designed to address challenges in harsh environments and is paired with MSI's pipe protection products to ensure efficient and safe drilling operations.

Drill Pipe Market Segmentation

By Grade Outlook (Revenue USD Million, 2020–2034)

- API Grade

- Premium Grade

By Application Outlook (Revenue USD Million, 2020–2034)

- Onshore

- Offshore

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Drill Pipe Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,319.41 million |

|

Market Size Value in 2025 |

USD 2,408.00 million |

|

Revenue Forecast in 2034 |

USD 3,401.58 million |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The drill pipe market size was valued at USD 2,319.41 million in 2024 and is projected to grow to USD 3,401.58 million by 2034.

The global market is projected to register a CAGR of 3.9% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Hilong Group; NOV; Tenaris S.A.; Vallourec S.A.; TMK Group; Oil Country Tubular; Tejas Tubular Grade; Texas Steel Conversion; DP Master; Jiangyin Long Bright Drill Pipe; Drill Pipe International; and Superior Drill Pipe.

The onshore segment dominated the drill pipe market in 2024 due to the rising volume of drilling activity for mining and energy infrastructure.

The API grade segment is expected to witness the fastest growth in the forecast period due to their high quality durability and specificity for oil and gas operations.