Dried Blood Spot Collection Cards Market Share, Size, Trends, Industry Analysis Report, By Type (Whatman 903, Ahlstrom 226, FTA, Others); By Application (Newborn Screening, Infectious Disease Testing, Therapeutic Drug Monitoring, Forensics, Others); By Regions; Segment Forecast, 2020 - 2027

- Published Date:Jan-2021

- Pages: 108

- Format: PDF

- Report ID: PM1784

- Base Year: 2019

- Historical Data: 2016 - 2018

Report Outlook

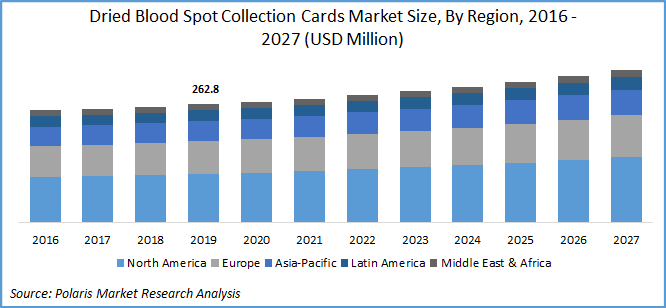

The global dried blood spot collection cards market was valued at USD 262.8 million in 2019 and is expected to grow at a CAGR of 3.4% during the forecast period. Dried blood spot testing (DBS) is a minimally invasive blood sample gathering procedure on specifically designed filter paper. These DBS samples could be easily shipped to any lab to detect any hereditary, rare disease, or blood-related disorder.

The key factors responsible for the market growth of dried blood spot collection cards include compulsory newborn screening programs in developed economies, innovations in the diagnosis time and effectiveness, and the rising prevalence of hereditary disorders across the globe. In November 2019, the Virginia Department of General Services tested 7,868 infants for approximately 31 genetic and metabolic disorders. As per the estimates of the National Institutes of Health (NIH), more than 30 million people in the U.S. are suffering from around 7,000 hereditary diseases which are driving the demand for dried blood spot collection cards.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The dried blood spot collection method is vital in newborn screening to diagnose congenital diseases in infants. For instance, in November 2018, the state government of Pennsylvania introduced newborn screening (NBS) programs for the mandatory tests of serious hereditary disorders such as maple syrup urine disease (MSUD), adrenal hyperplasia, Pompe’s disease, X-linked Adreno-leukodystrophy, galactosemia, and mucopolysaccharidosis type 1.

The usage of DBS for the serological diagnosis of infectious and autoimmune diseases also driving the market. According to the World Health Organization (WHO), in 2018, there were around 37.9 million people diagnosed with HIV. In the same year, around 770,000 people were died from HIV, across the globe.

Know more about this report: request for sample pages

Moreover, the use of DBS offers early and effective diagnosis, facilitating easy gathering and storage of samples and it is highly effective in plasma-based testing in low resource laboratory settings. Several counties in the U.S. have implemented DBS HIV testing, for instance, New South Wales (NSW) health ministry, in 2016, introduced DBS based HIV testing project, to improve penetration of HIV testing. This project aimed to eliminate HIV, by 2022, with increased adoption of DBS based diagnosis techniques.

Dried Blood Spot Collection Cards Market Report Scope

The dried blood spot collection cards industry report is primarily segmented on the basis of type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based on card type, the global dried blood spot collection cards market is categorized into Whatman 903, Ahlstrom 226, FTA, and others. Whatman 903 dried blood spot collection cards industry segment accounted for the largest market share globally, in 2019. These are a safe and efficient method for sampling, gathering, and transport. Several firms, including, Eastern Business Forms Inc., is a U.S.-based manufacturer of newborn screening devices, is a renowned provider of “903 Five Spot Blood Card” across the globe. It is ready to use the product, which saves time and cost.

FTA dried blood spot collection cards industry segment is projected to register a lucrative growth rate over the forecast period. This is the new market entrant that allows rapid analysis and is usually combined with DNA preservation at room temperature, which facilitates the user with multiple copies from a single sample. Qiagen is the dried blood spot collection cards industry leader in the production of FTA Classic Card with varied applications such as drug discovery, molecular biology, forensics, plasmid screening, and STR analysis.

Insight by Application

Based on application, the dried blood spot collection cards market is segmented into forensics, therapeutic drug monitoring, newborn screening, infectious disease testing, and other applications. The newborn screening market segment for dried blood spot collection cards industry holds the majority of share during the assessment period, owing to its numerous benefits such as low cost, reproducibility, easy storage and gathering, short diagnosis period, and its high precision, in comparison to other collection techniques.

Moreover, the growing incidence of HIV is getting the attention of major dried blood spot collection cards industry players for easy and time-bound analysis of HIV. For instance, Roche Diagnostics offers a COBAS plasma separation product, which offers a collection device for HIV plasma and its storage. The therapeutic drug monitoring segment of the dried blood spot collection cards industry is anticipated to register a lucrative growth rate over the dried blood spot collection cards industry study period. DBS tags offer home or remote sampling, which is well suited for several drug classes such as anti-depressants, analgesics, antimalarials, anticonvulsants, antiretrovirals, and antibiotics.

Geographic Overview

North American dried blood spot collection cards industry accounted for the largest market share and is likely to maintain its dominance over the market study period. This high share is due to compulsory newborn screening (NBS) in both the U.S. and Canada. As per the statistics published by the National Institute of Children’s Health Quality, in 2016, NBS was performed in more than 4 million newborns in the U.S. alone, with a participation rate of higher than 99.99 percent. Center for Disease and Control (CDC) reported that each year around 12,500 infants were diagnosed with at least one chronic hereditary disease.

Moreover, several collaborations are being taken by the U.S. government to speed up newborn screenings. For instance, in 2016, the National Institute for Children's Health Quality developed the NewSTEPs 360 program, which undertook initiatives to improve testing in 20 states of the U.S. in collaboration with the Association of Public Health Laboratories and the Colorado School of Public Health. The project received funding of USD 5.4 million from the Health Resources and Services Administration (HRSA).

The growth in the European dried blood spot collection cards industry is expected to increase with rising cases of hepatitis B in the market. According to the Center for Disease, Prevention, and Control, in 2017, there were around 26,907 individuals diagnosed with the concerned disease, with a prevalence rate of 6.7 cases per 100,000. DBS is considered an important tool in the diagnosis of hepatitis B, as compared to conventional collection methods and it is easier to transport samples. Thus, a rise in hepatitis B cases will enable higher adoption of DBS driving the market demand for dried blood spot collection cards industry.

Competitive Insight

Some of the major players operating in the dried blood spot collection cards industry include Qiagen, PerkinElmer, Roche Diagnostics, Shimadzu (Novilytic Labs), Ahlstrom-Munksjö, Pall Corporation, Eastern Business Forms, Inc., ARCHIMEDlife, and Centogene AG. The dried blood spot collection cards industry players in the market are introducing new products and services to remain competitive. For instance, in June 2019, Ahlstrom and GenTegra introduced the DBS collection card, which protects the DNA collected for around 20 years, without any contamination or damage.