Door and Window Automation Market Share, Size, Trends, Industry Analysis Report

By Control Systems (Fully Automatic, Push and Go, Power Assist, and Low Energy); By Component; By Product; By Application; By Region; Segment Forecast, 2023-2032

- Published Date:Dec-2022

- Pages: 115

- Format: PDF

- Report ID: PM2958

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

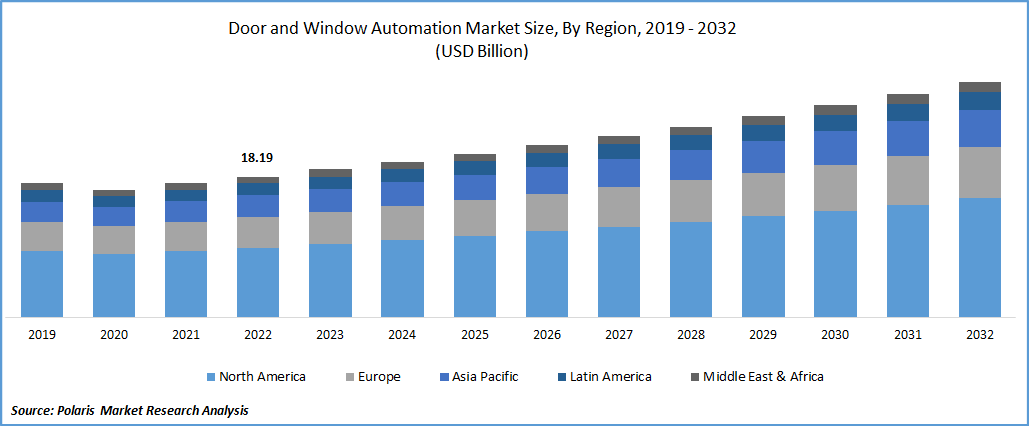

The global door and window automation market was valued at USD 18.19 billion in 2022 and is expected to grow at a CAGR of 5.3% during the forecast period.

Automated doors are available in a variety of designs and can swing or slide. To detect approaching persons, they can feature motion sensors above the doors or weight sensors embedded in the ground near the entry. Among other materials, these can be made of glass, metal, wood, or plastic. The automated door has a sensor that determines when the door requires to be opened. When it detects a trigger, the sensor sends a signal to the door's operating system. When the machine gets the signal, it opens the door.

Know more about this report: Request for sample pages

Motion-detecting sensors are now present on a large percentage of automated doors. Most motion detectors use passive infrared (PIR) or microwave vibrations to detect movement. The timing of the automatic door's opening can also be determined by the access control. The access control system sends a signal to the door, which opens as opposed to being triggered by motion or pressure. Such signal can be sent by the key-card, a fob, a smart-phone, any device configured with this system.

Windows and doors in smart homes are controlled by electronics. The comfort, security, and convenience of a living room are all increased by automated door and window systems. A further significant factor is increasing real estate investment. The installation and maintenance of door and window control systems require the use of highly skilled personnel and are prohibitively expensive. High prices are therefore anticipated to be a barrier for the door and window automation sector.

The COVID-19 epidemic had a detrimental impact on the door and window automation industry since it forced the closure of numerous facilities and created supply chain constraints and trade barriers. Early in 2020, several business units reduced their manufacturing capacity as a result of the worsening door sensor shortages and declining market potential for door and window automation. However, the simplicity of lockdown measures around the world in Q3 of 2020 gave the door and window automation industry momentum, which would fuel market growth in the ensuing years.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising product launches as well as collaborations among players are boosting the demand for door and window automation market growth. Due to an increase in consumers of consumer electronics, demand for door and window control systems is anticipated to increase during the forecast period.

Further, in smart houses, doors and windows may be locked and unlocked using electronic devices, providing security and comfort. In August 2021, With the ability to be installed on any robot and CNC machine in less than an hour, Made4CNC created what it claims to be the first fully automatic door-opening solutions for robotic equipment tending in the world. Only a small portion of the CNC machines in the sector is presently continuously fed materials.

Additionally, space is saved by the use of automatic interior and window systems. With the aid of cutting-edge technology, doors and windows are closed and opened for the ideal number of cycles, allowing for energy savings. Saving electricity eventually results in cost savings, and throughout the projected period, this is expected to open up opportunities for sector growth.

Report Segmentation

The market is primarily segmented based on control systems, components, applications, products, and regions.

|

By Control Systems |

By Component |

By Product |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Access Control Systems Segment is Expected to Witness the Fastest Growth

Access control systems and automated door systems can be coupled to boost security. The stop-and-go functionality of the access control system makes it simple to enter and exit the building while keeping out authorized people. The fastest growth rate of access control systems during the forecast period is mostly due to the increasing deployment of these systems in commercial buildings.

Further, extensive innovation and product development are creating growth opportunities for the market. The growing adoption of smart devices such as smartphones, the rise of IoT-based security solutions, growing home monitoring from a remote location, and an increase in consumer awareness regarding security systems are the factors driving the growth of the market.

Besides, the adoption of access control systems in residential and commercial sectors owing to security features such as biometric authorization, auto locking, and remote password setting, among others provided by them are creating huge demands for such types of systems, which in turn, drive the market growth.

The rise in urbanization, advancement in wireless and IoT-based security technologies, and growing demands for home automation are further anticipated to boost the market growth. There is strong growth in Mobile Access Solutions which allow hotel guests to open their doors with their smartphones.

Operators Segment Industry Accounted for the Highest Market Share in 2021

An operator can easily open and close the door at a steady pace. Any commercial building, retail establishment, or industrial setting uses it extensively. Additionally, access control tools like smart cards, biometric readers, and video surveillance systems are being employed more and more to meet the demand for security and safety in a variety of businesses, banks, and other financial organizations, among others. As a result, it is anticipated that there will be a large increase in demand for operators based access control equipment.

The Commercial Buildings Segment is Expected to Hold the Significant Revenue Share

Commercial building automation demand is anticipated to dominate the market during the time of the projection. In the commercial sector, which includes, among many other things, governmental structures, banks and other financial organizations, office buildings, commercial complexes, and shopping malls, automatic doors and windows are frequently employed. In commercial buildings, pedestrian moving doors are generally preferred.

To prevent unwanted air dispersion, these doors optimize the opening and closing times based on the transit direction. This keeps abrupt temperature swings from occurring in the building and close to doors, which lowers energy costs. The elderly and physically challenged greatly benefit from automated doors. The control systems for these windows and doors are interconnected and react to fire signals. Automated doors and windows are becoming more popular in business buildings due to the increased security they offer.

The Demand in Asia-Pacific is Expected to Witness Significant Growth

The market is anticipated to expand quickly in the coming years as a result of an increase in construction activities, rising sales of the door and window motors and actuators in the region, and a thriving home automation industry in developing nations like China and India. The latest advancements in door and window automation systems for residential applications have also been made possible by the rising purchasing power of the local populace. One of the main factors propelling the market's expansion is the increasing use of automated door and window systems in workplaces and healthcare institutions.

Additionally, in the upcoming years, leading producers of door and window control panels in the Asia Pacific region are anticipated to benefit financially from expanding infrastructure. With rising disposable income, expenditure on infrastructure projects has surged. Additionally, China is spending more money on its infrastructure.

The market is expanding due to the availability of market-relevant service and software suppliers, the dominance of industry leaders, and the growing demand for the residential applications. The recent trend of automated doors & windows in the Germany & Canada are supporting demand growth for automated doors and windows in these nations.

Competitive Insight

Some of the major players operating in the global market include ABB Group, Allegion Plc, Assa Abloy, Came S.p.A, Dormakaba International, GEZE GmbH, Gira Giersiepen, Honeywell International, INSTEON, Nabtesco Corporation, Royal Boon Edam, Schneider Electric, Siemens, and Stanley Black & Decker.

Recent Developments

- In September 2022, ASSA ABLOY and VHS Plastik Metal ("VHS"), a well-known Turkish producer of window and door hardware systems, entered into a purchase contract.

- In August 2022, J Newton Enterprises Inc., a top distributor and service provider of pedestrian doors in Florida, USA, was acquired by ASSA ABLOY. This acquisition carries out the company's objective to strengthen its present entry automation product.

Door and Window Automation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 19.12 billion |

|

Revenue forecast in 2032 |

USD 30.48 billion |

|

CAGR |

5.3% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Control Systems, By Component, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

ABB Group, Allegion Plc, Assa Abloy AB, Came S.p.A, Dormakaba International Holding AG, GEZE GmbH, Gira Giersiepen GmbH & Co. KG, Honeywell International Inc., INSTEON, Nabtesco Corporation, Royal Boon Edam International B.V, Schneider Electric SE, Siemens AG, and Stanley Black & Decker Inc., |

FAQ's

key companies in door and window automation market are ABB Group, Allegion Plc, Assa Abloy, Came S.p.A, Dormakaba International, GEZE GmbH, Gira Giersiepen, Honeywell International, INSTEON, Nabtesco Corporation.

The global door and window automation market expected to grow at a CAGR of 5.3% during the forecast period.

The door and window automation market report covering key segments are control systems, components, applications, products, and regions.

key driving factors in door and window automation market are rising demand for energy-efficient automated systems and rising adoption of door and window automation in hospitality sector

The global door and window automation market size are expected to reach USD 30.48 billion by 2032.