Dog Vaccine Market Share, Size, Trends, Industry Analysis Report, By Vaccine Type, By Disease Type, By Route of Administration, By Duration of Immunity, By Component, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4185

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

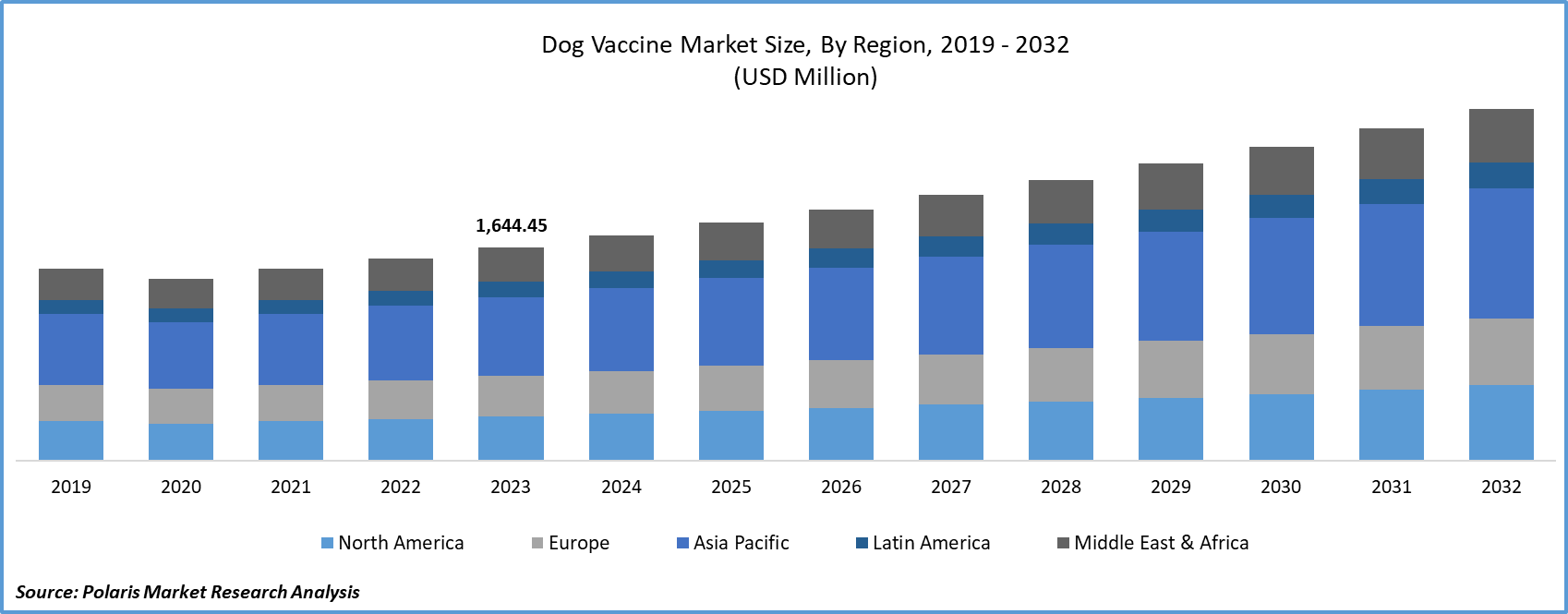

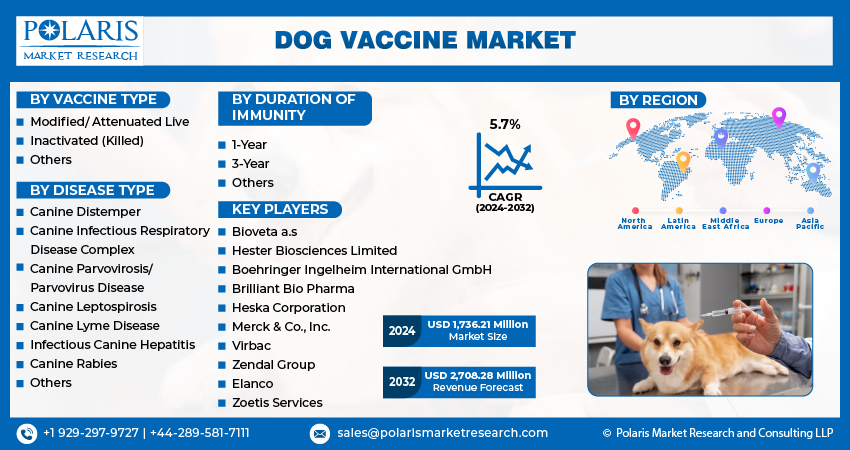

The global dog vaccine market was valued at USD 1,644.45 million in 2023 and is expected to grow at a CAGR of 5.7% during the forecast period.

The expansion of the market is fueled by the increasing trend of pet ownership and the growing phenomenon of pet humanization. This trend emphasizes treating pets as integral members of the family, leading to a greater focus on their well-being and comfort. As reported by My Golden Retriever Puppies in August 2023, dogs and cats stand out as the most beloved and widely adopted pets globally, with the U.S. alone boasting approximately 89.7 Mn pet dogs.

To Understand More About this Research: Request a Free Sample Report

The manufacturing of effective bivalent viral vector-based vaccines targeting both rabies and canine distemper holds promise for controlling both diseases with a single vaccine candidate, particularly in developing nations. Additionally, future vaccine development efforts should prioritize the establishment of a multivalent vaccine offering broad-spectrum protection efficacy, encompassing other members of the Lyssavirus. This approach could be highly effective in mitigating this deadly disease. Further exploration of rabies vaccines employing small interfering RNA (siRNA) in the natural host or the development of bi-specific antibody (BsAb)-based therapies for the rabies virus presents more promising options in the therapeutic aspects of rabies.

Moreover, the market for dog vaccines is anticipated to be positively influenced by the increasing pet ownership trends among millennials, who prioritize preventive healthcare for their canine companions. As indicated by the National Pet Owners Survey conducted by the American Pet Products Association, Inc. for 2023-2024, millennials accounted for the largest share of pet ownership at 33%. A May 2023 article published by Women's Health (Hearst UK) highlighted survey findings revealing that 63% of millennials were spending more on their dogs than on themselves. This trend is expected to contribute further to the industry's growth in the future.

The research report offers a quantitative and qualitative analysis of the dog vaccines market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

The global dog vaccine market experienced challenges during the COVID-19 pandemic due to disruptions in the global supply chain and concerns about infection transmission. However, the same period also witnessed a surge in pet adoption rates and increased health consciousness among people. This shift in behavior is expected to contribute to the growth of the global market. As reported by Health for Animals, the United Kingdom saw a notable increase in pet adoptions during the pandemic, with more than two million people in the country choosing to adopt a pet. The heightened awareness of health and companionship during the pandemic likely influenced this trend, impacting the demand for products related to pet care, including vaccines.

Growth Drivers

Increasing Pet Adoption Rates

The dog vaccine market has witnessed significant growth in recent years, which can be attributed to several factors. One of the primary drivers behind this expansion is the increasing rate of pet adoption worldwide. As more people adopt dogs, there is a corresponding rise in demand for preventative healthcare measures, including vaccinations. Pet owners are becoming more aware of the importance of vaccines in safeguarding the health and well-being of their furry companions, which is driving the market forward.

Additionally, the growing prevalence of infectious diseases among dogs has underscored the necessity of vaccination as a vital preventive strategy. Diseases such as parvovirus, distemper, and rabies pose significant threats to canine populations, making vaccinations an essential aspect of responsible pet ownership. Veterinary professionals and animal health organizations have been instrumental in promoting the importance of regular vaccinations, further fueling market growth.

Moreover, technological advancements in vaccine development have also contributed to the expansion of the dog vaccine market. Innovations in vaccine formulations, delivery systems, and manufacturing processes have led to the development of safer, more effective vaccines that offer longer-lasting protection against a broader range of diseases. These advancements have not only improved the efficacy of vaccines but have also enhanced their convenience and accessibility for both veterinarians and pet owners.

Furthermore, favorable government initiatives and regulations mandating the vaccination of dogs in many regions have further boosted market growth. Such policies reinforce the significance of vaccination and ensure compliance among pet owners, thereby creating a conducive environment for market expansion.

Report Segmentation

The market is primarily segmented based on vaccine type, disease type, duration of immunity, and region.

|

By Vaccine Type |

By Disease Type |

By Duration of Immunity |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Vaccine Type Analysis

Attenuated live Segment Held the Largest Share in 2023

The attenuated live segment held the largest share in 2023. This is primarily due to the efficacy of attenuated live vaccines in providing protection against diseases and infections, offering long-term immunity. Specifically, vaccines for canine adenovirus-2 and parvoviruses, including canine adenovirus type 2 (CAV-2), fall into the category of attenuated live vaccines. Notably, the CAV-2 vaccine plays a crucial role in safeguarding against infectious hepatitis.

Other segments are projected to grow at the fastest rate. Advancements in dog vaccine technology have resulted in the creation of novel and more efficient canine vaccines, including recombinant vaccines. These vaccines involve the integration of a pathogen gene into the virus, along with additional antigens. For instance, Recombitek, a recombinant vaccine developed by the Boehringer Ingelheim. This vaccine is designed to protect against distemper, leptospirosis, and canine diseases.

By Disease Type Analysis

Canine Infectious Respiratory Disease Complex (CIRDC) Segment Registered the Largest Market Share in 2023

The CIRDC segment accounted for the largest share in 2023. This is due to the presence of various causal agents for the CIRDC, prompting the continuous development of new vaccines. The complex nature of CIRDC, involving multiple pathogens such as viruses and bacteria, necessitates diverse vaccine formulations to address the spectrum of infectious agents contributing to respiratory diseases in dogs.

The canine rabies segment will grow rapidly. This growth is primarily driven by the widespread prevalence of canine rabies and the significant zoonotic potential associated with this infectious disease. Canine rabies poses a direct threat to both animal and human populations, emphasizing the urgency to address and prevent its transmission. Public and private entities are actively engaged in awareness campaigns, vaccination programs, and other preventive measures to curb the incidence of canine rabies.

By Duration of Immunity Analysis

One Year Segment Held the Significant Market Revenue Share in 2023

During the year 2023, the one-year segment held the highest market revenue. Vaccines that offer protection against common diseases for a year are more convenient for dog owners, as they eliminate the need for frequent booster shots. This convenience is expected to contribute to the continued growth of the market.

In addition to one-year vaccines, other segments are also expected to grow at a substantial pace. These vaccines have an extended duration of immunity, which reduces the need for frequent visits to veterinary clinics. A study published in the National Library of Medicine in April 2020 suggests that some vaccines, such as the rabies vaccine, can provide immunity for more than three years, eliminating the need for frequent re-vaccination.

Regional Insights

North America Region Held the Largest Share of the Global Market in 2023

The North America region dominated the market in 2023. The growing awareness of preventive healthcare for pets and the increasing rates of pet ownership are significant contributors to market growth. A notable example is the collaborative efforts of Merck, Petco Love, and an NGO, which resulted in the distribution of 1 million free pet vaccines by around October 2022.

The Asia Pacific region is projected to grow at a rapid pace. The anticipated growth in income levels, shifting demographics, and improvements in the standard of living are poised to drive market expansion in this geographical area. As reported by CNBC in October 2022, India is expected to witness a significant increase of 4.6% in real wages, while China is projected to experience a growth of 3.6%. This rise in income levels is likely to stimulate increased spending on pets.

South Asia accounts for approximately 40% of global human rabies fatalities. The economic burden of rabies is estimated at USD 583.5 Mn annually, with Asia and Africa experiencing livestock losses of about USD 12.3 million. Canine rabies is prevalent in 87 countries and plays a central role in instances of human rabies.

Key Market Players & Competitive Insights

Major players in this market are implementing strategies like introducing new products, conducting trials, engaging in mergers and acquisitions, and forming partnerships and collaborations to enhance their market shares.

Some of the major players operating in the global market include:

- Bioveta a.s

- Hester Biosciences Limited

- Boehringer Ingelheim International GmbH

- Brilliant Bio Pharma

- Heska Corporation

- Merck & Co., Inc.

- Virbac

- Zendal Group

- Elanco

- Zoetis Services

Recent Developments

- In June 2023, Boehringer Ingelheim partnered with MebGenesis to collaborate on the development of monoclonal antibodies for the canines.

- In June 2022, Zoetis Services acquired Basepaws, enhancing its capabilities in precision animal health solutions.

- In September 2022, Merck Animal Health introduced the initial oral vaccine targeting two canine respiratory pathogens, para-influenza virus, & Bordetella bronchiseptica.

- In March 2021, MSD Animal Health released the new Nobivac (r) Respira Bb, an injectable vaccine designed to safeguard against Bordetella bronchiseptica. The vaccine, administered in a single dose, protects for seven months following the primary course and 12 months after the booster dose.

Dog Vaccine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,736.21 million |

|

Revenue forecast in 2032 |

USD 2,708.28 million |

|

CAGR |

5.7% from 2023 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Material, Product Type, By Straw Length, Diameter, Sales Channel, End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

The analysis of dog vaccines market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis. report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

FAQ's

key companies in dog vaccine market are Bioveta, Hester Biosciences, Boehringer Ingelheim, Brilliant Bio Pharma

The global dog vaccine market is expected to grow at a CAGR of 5.7% during the forecast period.

The dog vaccine market report covering key segments are vaccine type, disease type, duration of immunity, route of administration, and region.

key driving factors in dog vaccine market are Increasing Pet Adoption Rates

The global dog vaccine market size is expected to reach USD 2,708.28 million by 2032