DNA Synthesis Market Size, Share, Trends, Industry Analysis Report

By Type (Oligonucleotide Synthesis and Gene Synthesis), By Application, By End-User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM2944

- Base Year: 2024

- Historical Data: 2020-2023

Overview

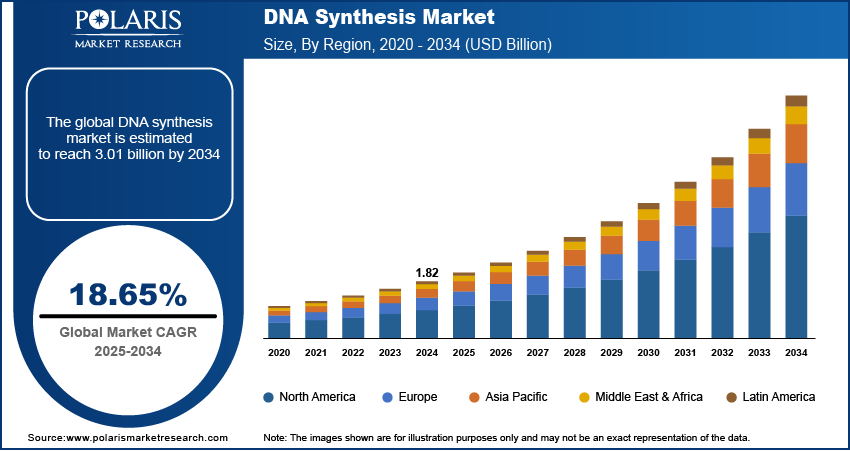

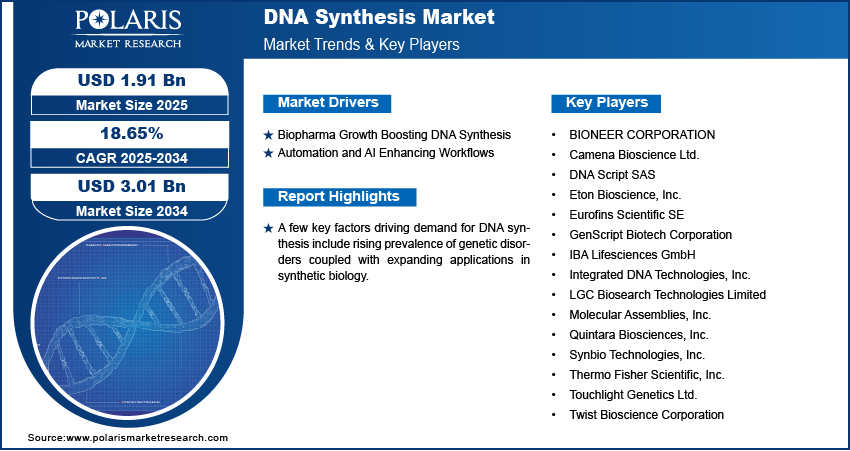

The global DNA synthesis market size was valued at USD 3.66 billion in 2024, growing at a CAGR of 16.85% from 2025 to 2034. DNA synthesis demand is fuelled by biopharma expansion and increased utilization of AI and automation in workflows.

Key Insights

- Material for oligonucleotide synthesis dominated the market in 2024.

- Therapeutics segment to grow rapidly, fueled by need for gene therapy, biologics, and precision medicine.

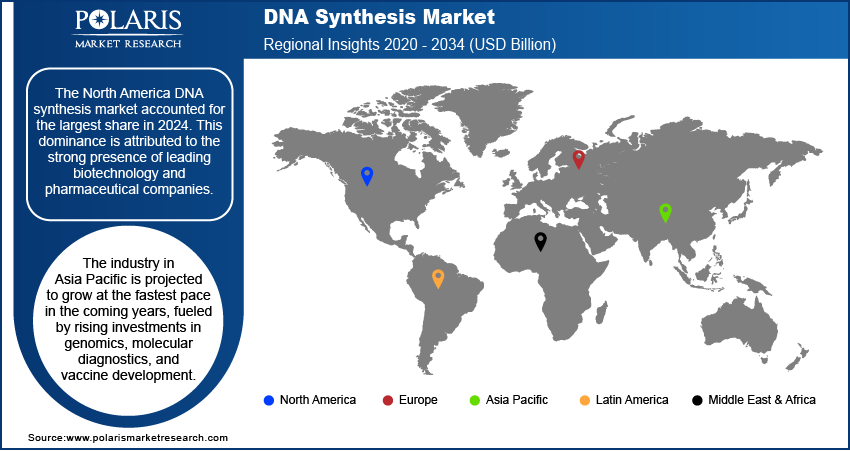

- North America dominated worldwide DNA synthesis market share in 2024.

- The U.S. market on the rise with robust public investment in genomics and molecular biology.

- Asia Pacific market poised for high growth between 2025–2034 underpinned by genomics and vaccine spending.

- India market growing with growth in pharma and more robust R&D foundation.

Industry Dynamics

- Biopharma development spurring use of DNA synthesis in drug development, biologics, and vaccines.

- Automation and artificial intelligence increasing efficiency, accuracy, and scalability in operations.

- Enzymatic DNA synthesis opening new avenues with scalable and faster production of long-sequences.

- Huge R&D spending constrains growth, making it difficult for smaller companies to operate smoothly.

Market Statistics

- 2024 Market Size: USD 3.66 Billion

- 2034 Projected Market Size: USD 17.36 Billion

- CAGR (2025–2034): 16.85%

- North America: Largest Market Share

AI Impact on DNA Synthesis Market

- AI maximizes DNA synthesis based on analysis of protocols, sequence complexity, and reagent interactions.

- AI facilitates adaptive synthesis, real-time temperature, timing, and reagent flow adjustments

- AI analysis identifies synthesis failures, reagent degradation, and contamination, minimizing waste.

- AI assists automated sequence design and workflow optimization, accelerating R&D and throughput.

The DNA synthesis market provides advanced platforms to construct DNA sequences with high accuracy, flexibility, and efficiency. It finds application in the field of pharmaceuticals, biotech, diagnostics, agriculture, and research, facilitating gene editing, synthetic biology, and the creation of new biomolecules. Chemical and enzymatic synthesis, automation, and quality control improvements are driving speed, reliability, and scalability, underpinning innovation across genomics, drug discovery, and bioengineering.

Increased genetic disorders are fueling investment in DNA synthesis for gene therapy, diagnostics, and tailored treatments. WHO estimates 10 per 1,000 individuals are afflicted, amounting to 70–80 million worldwide. Increased use of high-fidelity sequence in oncology, rare disease, and regenerative medicine is further boosting market growth.

Applications in synthetic biology are increasing gene circuits, designed microbes, and metabolic pathway design for industrial biotechnology and therapeutics. New methods in DNA synthesis, automation, and error correction permit longer, more precise sequences. Integration into research enhances development of enzymes, biomolecules, and designed biological systems in pharmaceuticals, agriculture, and bio-based industries.

Drivers & Opportunities

Strong Growth in the Biopharmaceutical Industry Driving Utilization of DNA Synthesis in Drug Discovery, Biologics, and Vaccine Development: Global biopharma expansion is accelerating demand for DNA synthesis of gene constructs, antibody libraries, and synthetic vaccines. India's biopharma industry expanded from USD 10 billion in 2014 to USD 165.7 billion in 2024, likely to reach more than USD 300 billion by 2030. Increased investment in genomics and next-generation therapeutics brings DNA synthesis into focus as essential for speeding up pharmaceutical and healthcare development.

Increasing Integration of Automation and AI in DNA Synthesis Workflows: Integration of automation and AI is fueling market expansion through optimized design, accuracy, and production scale-up. AI platforms identify errors, confirm sequences, and facilitate high-throughput synthesis, cutting cost and time. In October 2024, CODA platform designed synthetic DNA components with high accuracy, showcasing the role of AI in revolutionizing research, therapeutics, and synthetic biology.

Segmental Insights

By Type

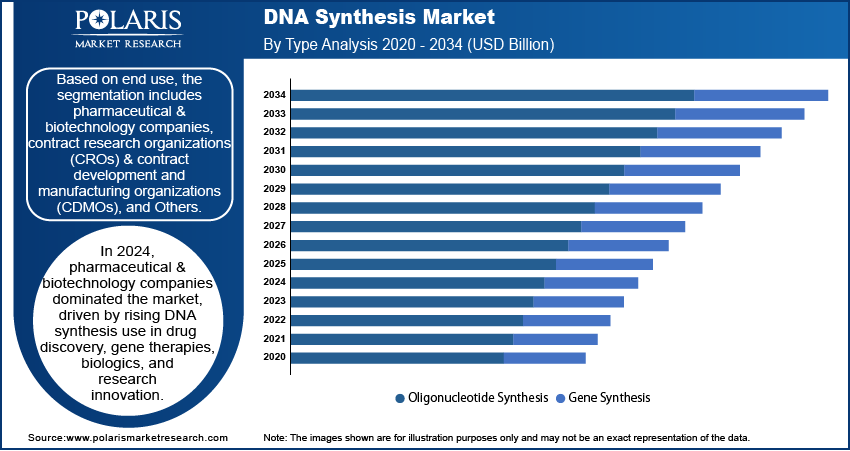

On the basis of type, the market is segmented into oligonucleotide synthesis and gene synthesis. The oligonucleotide synthesis segment accounted for the largest market share in 2024, owing to its extensive use in PCR assays, next-generation sequencing, molecular diagnostics, and targeted therapeutic research. Its significant application in facilitating high-throughput genetic analysis and diagnostic assays for infectious diseases, oncology, and personalized medicine made it the most used type of DNA synthesis.

The gene synthesis segment expected to growth at the highest growth rate in the forecast period, driven by its expanding use in synthetic biology, genetic engineering, vaccine development, and large-scale DNA assembly for cutting-edge therapeutics and biotechnological innovations. The segment is expanding on account of the growing need for sophisticated DNA constructs and engineered organisms that facilitate innovations in metabolic engineering, bio-based materials, and next-generation drug development.

By Application

On the basis of application, the market is divided into diagnostics, therapeutics, and research & development. The diagnostics segment led the market in 2024 due to the growing use of DNA-based assays, biomarker discovery, and infectious disease detection in healthcare, research, and clinical applications. Uses in early disease detection, personalized diagnosis, and precision medicine is driving up demand for high-quality synthetic DNA for precise and fast testing solutions.

The therapeutics market is projected to advance at the rapid pace over the forecast period, driven by increasing demand for gene therapies, personalized medicine, biologics, and precision therapeutics that involve the need for accurate and scalable DNA constructs. Growing emphasis on rare disease, oncology drugs, and advanced molecular therapeutics is driving adoption of DNA synthesis technologies that enables large-scale production, high-fidelity sequences, and fast turnaround times.

By End-User

On the basis of end-user, the industry is divided into pharmaceutical & biotechnology firms, contract research organizations (CROs) & contract development and manufacturing organizations (CDMOs), and others. In 2024, the pharmaceutical & biotechnology firms segment had the largest share, owing to increasing use of DNA synthesis in drug discovery, gene therapy development, biologics, and research-based innovation. These businesses depend heavily on artificial DNA for the development, testing, and production of advanced therapeutic products, creating steady demand for high-quality materials.

The CROs and CDMOs segment attain the fastest growth, boosted by the worldwide trend of outsourcing DNA synthesis operations to cut costs, increase scalability, and speed up the research timeline. Growing acceptance of third-party vendors providing automated processes, precision synthesis, and tailored DNA constructs is helping small organizations, startups, and research institutions avail of advanced solutions, leading to heavy market expansion.

Regional Analysis

North America dominated the DNA synthesis market in 2024, with top biotech and pharma organizations requiring personalized DNA constructs. Expansion in gene therapy, synthetic biology, and CRISPR research is fueling uptake. Government investment, private venture, and academia-industry collaborations drive innovation and commercialization.

U.S. DNA Synthesis Market Analysis

The U.S. dominated North America as a result of increasing public funding in genomics and molecular biology. In September 2024, NIH granted USD 5.4 million to integrate genomics into learning health systems. Robust federal support is placing increasing demand on DNA synthesis in research and therapeutics.

Asia Pacific DNA Synthesis Market Insights

Asia Pacific expected to grow at the fastest rate, powered by investment in genomics, molecular diagnostics, and vaccine sectors. India, China, Japan, and South Korea's growth of research institutions and biotechnology innovation are propelling the take-up of next-generation DNA synthesis technologies.

India DNA Synthesis Market Analysis

India maintained a strong Asia Pacific share, driven by fast pharma growth and growing R&D. India was the third-largest volume producer of drugs in 2023 with a 20% global generic export market share. The USD 50 billion industry targets USD 450 billion by 2047, increasing DNA synthesis demand for genomics and drug discovery.

Europe DNA Synthesis Market Assessment

Europe held substantial market share in 2024, supported by state funding for genomics, biobanking, and synthetic biology. EU endeavors such as Horizon Europe and high CRISPR adoption facilitate big genomics, agricultural biotech, and bioeconomy initiatives, fueling the adoption of precise DNA synthesis.

Key Players & Competitive Analysis

The market worldwide is competitive, dominated by Twist Bioscience, DNA Script, and Molecular Assemblies. Twist increases synthetic DNA portfolios, DNA Script provides benchtop platforms for on-demand oligonucleotides, and Molecular Assemblies creates faster, more precise, and reagent-scarce DNA synthesis techniques. AI-optimized integrated platforms and high-throughput workflows decrease costs.

Major players in the market for DNA synthesis are BIONEER CORPORATION, Camena Bioscience Ltd., DNA Script SAS, Eton Bioscience, Inc., Eurofins Scientific SE, GenScript Biotech Corporation, IBA Lifesciences GmbH, Integrated DNA Technologies, Inc., LGC Biosearch Technologies Limited, Molecular Assemblies, Inc., Quintara Biosciences, Inc., Synbio Technologies, Inc., Thermo Fisher Scientific, Inc., Touchlight Genetics Ltd., and Twist Bioscience Corporation.

Key Players

- BIONEER CORPORATION

- Camena Bioscience Ltd.

- DNA Script SAS

- Eton Bioscience, Inc.

- Eurofins Scientific SE

- GenScript Biotech Corporation

- IBA Lifesciences GmbH

- Integrated DNA Technologies, Inc.

- LGC Biosearch Technologies Limited

- Molecular Assemblies, Inc.

- Quintara Biosciences, Inc.

- Synbio Technologies, Inc.

- Thermo Fisher Scientific, Inc.

- Touchlight Genetics Ltd.

- Twist Bioscience Corporation

DNA Synthesis Industry Developments

In May 2025: Ginkgo Bioworks and Twist Bioscience prolonged their partnership to three years when Ginkgo prepaid for DNA products and Twist acquired long DNA technology licenses.

In March 2025: Integrated DNA Technologies (IDT) entered into a partnership with Elegen to offer early access to ENFINIA Plasmid DNA service for genes that are complex-sized between 5–15 kb.

DNA Synthesis Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Oligonucleotide Synthesis

- Gene Synthesis

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Diagnostics

- Infectious Diseases

- Cancer

- Others

- Therapeutics

- Gene Therapy

- Preventive Medicine

- Others

- Research & Development

- Cloning and Gene Editing

- Drug Discovery & Development

- Others

By End-User Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs) & Contract Development and Manufacturing Organizations (CDMOs)

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

DNA Synthesis Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.82 Billion |

|

Market Size in 2025 |

USD 1.91 Billion |

|

Revenue Forecast by 2034 |

USD 3.01 Billion |

|

CAGR |

5.20% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.82 billion in 2024 and is projected to grow to USD 3.01 billion by 2034.

The global market is projected to register a CAGR of 18.65%% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are BIONEER CORPORATION, Camena Bioscience Ltd., DNA Script SAS, Eton Bioscience, Inc., Eurofins Scientific SE, GenScript Biotech Corporation, IBA Lifesciences GmbH, Integrated DNA Technologies, Inc., LGC Biosearch Technologies Limited, Molecular Assemblies, Inc., Quintara Biosciences, Inc., Synbio Technologies, Inc., Thermo Fisher Scientific, Inc., Touchlight Genetics Ltd., and Twist Bioscience Corporation.

The oligonucleotide synthesis segment dominated the market revenue share in 2024, due to its widespread application in PCR assays, next-generation sequencing, molecular diagnostics, and targeted therapeutic research.

The therapeutics segment is projected to witness the fastest growth during the forecast period, fueled by rising demand for gene therapies, personalized medicine, biologics, and precision therapeutics that require precise and scalable DNA constructs.