DNA Sequencing Market Share, Size, Trends, Industry Analysis Report

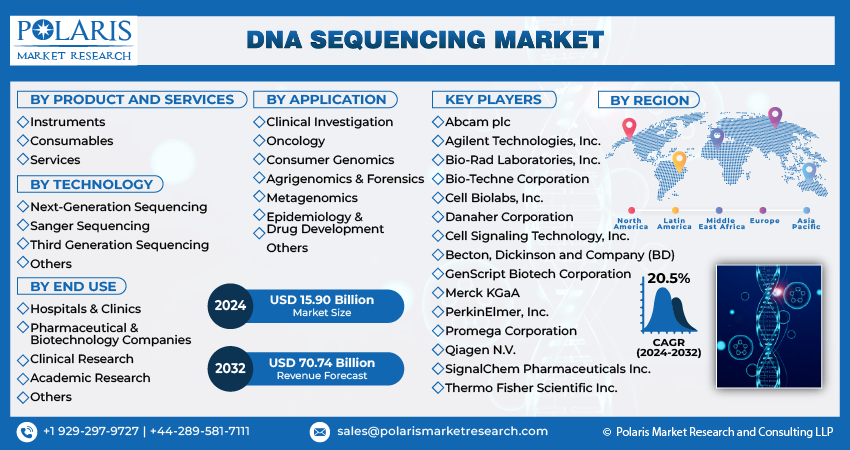

By Product and Services (Instruments, Consumables, Services); By Technology; By Application; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM4704

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

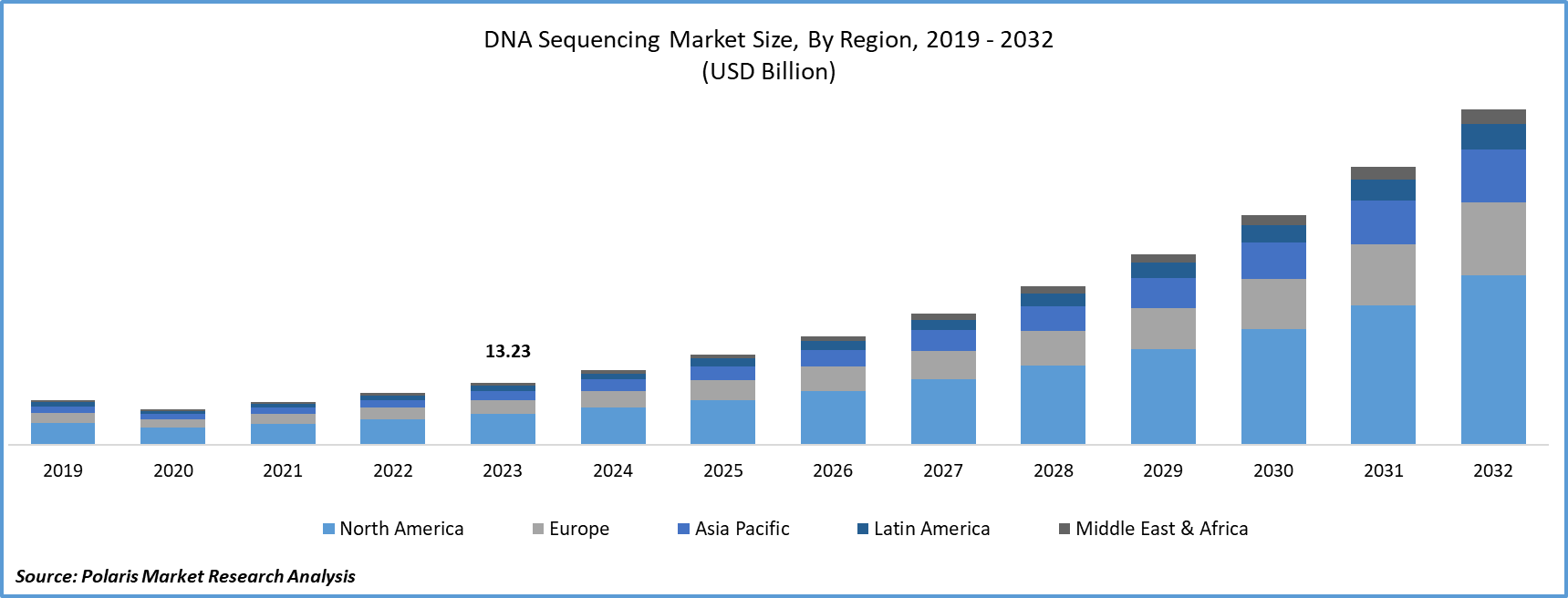

- Global DNA sequencing market size was valued at USD 13.23 billion in 2023.

- The market is anticipated to grow from USD 15.9 billion in 2024 to USD 70.74 billion by 2032, exhibiting the CAGR of 20.5% during the forecast period.

Market Introduction

The DNA sequencing market share is expanding due to the growing incidence of genetic disorders and chronic diseases worldwide. Genetic disorders, such as cystic fibrosis and sickle cell anemia, require accurate diagnosis and understanding of genetic causes, driving demand for DNA sequencing technologies. Chronic diseases such as cancer and cardiovascular diseases also have significant genetic components, necessitating targeted therapies and personalized treatments. Aging populations and lifestyle changes contribute to the rise in chronic diseases, further boosting demand for DNA sequencing. Advancements in technology and decreasing sequencing costs allow for integration into clinical practice, enhancing healthcare outcomes through early detection and personalized treatment strategies, ensuring sustained growth in the market.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

- For instance, in September 2022, Illumina, Inc revealed the introduction of the NovaSeq X Series, a new line of production-scale sequencers designed to deliver quicker, more robust, and environmentally-friendly sequencing capabilities.

To Understand More About this Research: Request a Free Sample Report

Advancements in technology, heightened competition among service providers, and economies of scale have significantly reduced sequencing expenses. This accessibility has democratized genomic research and personalized medicine, expanding applications in oncology, rare genetic disorders, and pharmacogenomics. Emerging technologies like nanopore sequencing offer faster turnaround times and higher throughput at lower costs, further propelling market expansion. Moreover, the affordability of DNA sequencing has spurred its adoption in clinical settings for diagnostics, disease monitoring, and treatment selection, creating opportunities for service providers and diagnostic companies to broaden their offerings and reach a wider customer base.

Industry Growth Drivers

Growing demand for personalized medicine is projected to spur the product demand

The DNA sequencing market size is propelled by the rising demand for personalized medicine. This approach tailors medical treatment based on an individual's genetic makeup, enabled by comprehensive genetic analysis through DNA sequencing. Advancements in sequencing technologies have improved speed, accuracy, and cost-effectiveness, making personalized medicine more accessible. Healthcare professionals can identify genetic variations influencing disease predisposition or treatment response. Moreover, DNA sequencing is increasingly utilized for disease prevention, early detection, and targeted therapy. Its adoption spans various medical fields such as oncology, pharmacogenomics, and rare genetic disorders. Additionally, DNA sequencing finds applications in research, drug development, and agriculture, driving market expansion.

Advancement in Next-Generation Sequencing (NGS) technologies is expected to drive DNA sequencing market growth

Advancements in NGS technologies are propelling growth in the DNA sequencing market share. These innovations offer faster, more accurate, and cost-effective DNA sequencing solutions compared to traditional methods. Continuous improvements in NGS platforms enhance sequencing speed, throughput, and accuracy, empowering researchers to tackle complex genomic projects. Innovative sequencing chemistries and bioinformatics tools expand analytical capabilities, providing deeper insights into genomic data. The decreasing cost of NGS democratizes genomic sequencing, fostering advancements in precision medicine, cancer genomics, and agricultural biotechnology.

Industry Challenges

High cost of sequencing technologies is likely to impede the market growth

High costs associated with sequencing technologies hinder the market growth. Despite technological advancements improving accuracy and speed, expenses remain prohibitive for many researchers and healthcare providers. Initial equipment investments and ongoing consumable expenses pose financial challenges, limiting accessibility. Consequently, access is primarily restricted to well-funded institutions, impeding democratization of genomic research and personalized medicine.

Report Segmentation

The DNA sequencing market analysis is primarily segmented based on product and services, technology, application, end use, and region.

|

By Product and Services |

By Technology |

By Application |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product and Services Analysis

Consumables segment held significant market revenue share in 2023

The consumables segment held significant revenue share in 2023. Essential for every sequencing run, consumables like reagents and sequencing kits ensure a consistent demand regardless of machine usage frequency. Their finite lifespan necessitates regular repurchasing, providing a steady revenue stream. Moreover, technological advancements drive the adoption of updated or specialized consumables, fueling market growth. With extensive genomic research worldwide, research institutions and biotech firms require consumables for various sequencing projects, further boosting demand. While sequencing instruments involve high initial costs, consumables usually have lower upfront expenses but yield ongoing revenue through repeated purchases, making them a vital contributor to market revenue.

By Technology Analysis

Next-generation sequencing segment held significant market revenue share in 2023

The next-generation sequencing segment held significant revenue share in 2023. NGS technologies offer enhanced throughput, allowing simultaneous analysis of multiple samples, boosting productivity. Despite high initial investments, NGS platforms offer lower per-base sequencing costs, enhancing cost-effectiveness. Their versatility in performing various sequencing applications caters to diverse research and diagnostic needs. Rapid technological advancements ensure continuous improvements in speed, accuracy, and cost-effectiveness, maintaining their relevance. Furthermore, NGS's expanding applications in clinical settings, such as cancer genomics and infectious disease diagnostics, bolster its significant revenue share by providing comprehensive genetic information quickly and accurately.

By Application Analysis

Oncology segment held significant market revenue share in 2023

The oncology segment held significant revenue share in 2023 due to its role in precision medicine, comprehensive tumor profiling, and early cancer detection. DNA sequencing identifies cancer-related genetic mutations, facilitating personalized treatment strategies. It offers insights into tumor heterogeneity and drug resistance mechanisms, crucial for treatment decisions. Moreover, DNA sequencing aids in early cancer detection by identifying malignancy-indicative genetic alterations. Additionally, it monitors treatment response over time, assessing efficacy and detecting drug resistance. Furthermore, its contribution to cancer research, drug development, and clinical trials further supports growth.

By End Use Analysis

Academic research segment held significant revenue share in 2023

The academic research segment held significant revenue share in 2023. Academic institutions benefit from substantial research funding, allowing them to invest in sequencing technologies and consumables. With diverse genomic studies across biology, medicine, and environmental science, these institutions necessitate frequent use of sequencing technologies. Additionally, as training grounds for future scientists, academic institutions require cutting-edge sequencing technologies for educational purposes, further driving demand. Collaborative projects among researchers and publication requirements for reputable journals also contribute to the segment's revenue share.

Regional Insights

North America region accounted for a significant market share in 2023

In 2023, North America region accounted for a significant market share. The region is a key research and development hub in the life sciences, hosting leading academic institutions and biotech companies driving innovation. Additionally, the region's advanced healthcare infrastructure encourages widespread adoption of DNA sequencing technologies for clinical diagnostics and research. Substantial government funding for genomic research and precision medicine initiatives further supports market growth. Moreover, the region's high prevalence of genetic disorders drives demand for DNA sequencing in genetic testing and personalized medicine.

Asia-Pacific is expected to experience significant growth during the forecast period due to rising healthcare expenditure and the rapid expansion of the biotechnology and pharmaceutical industries. Additionally, the presence of numerous research institutions focusing on genomics and increasing prevalence of genetic diseases and cancers in the region drive demand for DNA sequencing. Supportive government initiatives and funding for genomics research further fuel adoption. Moreover, technological advancements and cost reductions make DNA sequencing more accessible.

Key Market Players & Competitive Insights

The DNA sequencing market players includes a diverse range of participants, and the expected entry of new players is poised to intensify competitive dynamics. Leading market players continually innovate their technologies to maintain a competitive advantage, emphasizing efficiency, reliability, and safety. These companies prioritize strategic actions such as forming partnerships, improving product offerings, and participating in collaborative projects. Their primary goal is to outperform competitors within the industry, securing significant DNA sequencing market share.

Some of the major players operating in the global market include:

- Abcam plc

- Agilent Technologies, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Cell Biolabs, Inc.

- Cell Signaling Technology, Inc.

- Danaher Corporation

- GenScript Biotech Corporation

- Merck KGaA

- PerkinElmer, Inc.

- Promega Corporation

- Qiagen N.V.

- SignalChem Pharmaceuticals Inc.

- Thermo Fisher Scientific Inc.

Recent Developments

- In January 2024, Ultima Genomics revealed plans to introduce a series of high-capacity devices capable of sequencing a human genome for a mere $100. This sequencer, named the UG 100, has the capacity to sequence up to 20,000 human genomes annually.

- In November 2023, Oxford Nanopore Technologies plc and Fabric Genomics unveiled a partnership to create an adaptable software solution for the comprehensive analysis and clinical reporting of extensive genomic data.

- In February 2023, Complete Genomics introduced its most efficient sequencer, the DNBSeq-T20x2. This platform utilizes Complete Genomics' unique DNA nanoball sequencing technology, and is designed for large-scale population genomics initiatives.

Report Coverage

The DNA sequencing market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products and services, technologies, applications, end uses, and their futuristic growth opportunities.

DNA Sequencing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15.90 billion |

|

Revenue forecast in 2032 |

USD 70.74 billion |

|

CAGR |

20.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global DNA Sequencing market size is expected to reach USD 70.74 billion by 2032

Key players in the market are Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Bio-Techne Corporation, Cell Signaling Technology, Inc

North America contribute notably towards the global DNA Sequencing Market

DNA Sequencing Market exhibiting the CAGR of 20.5% during the forecast period.

The DNA Sequencing Market report covering key segments are product and services, technology, application, end use, and region.