District Cooling Market Size, Share, Trends, Industry Analysis Report

: By Application (Residential, Commercial, and Industrial), Technology, Service Type, Source, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM2432

- Base Year: 2024

- Historical Data: 2020-2023

District Cooling Market Overview

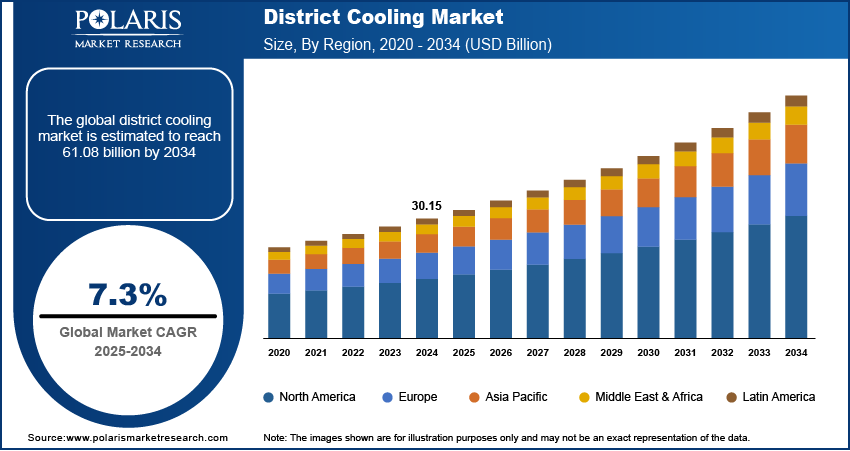

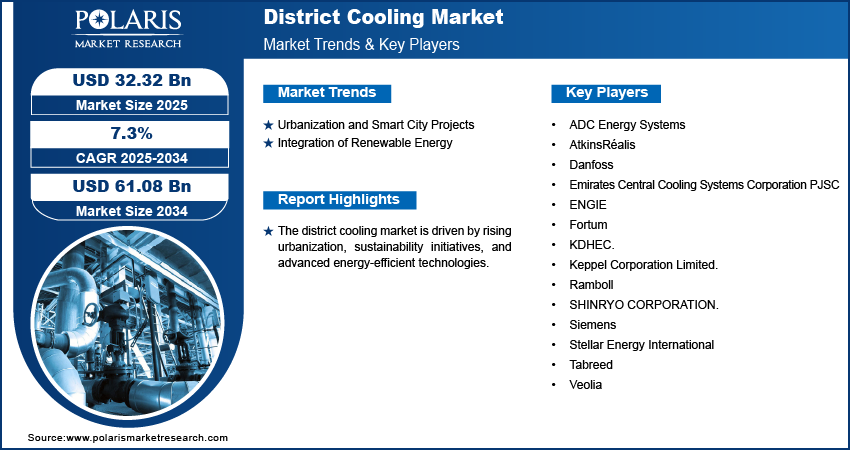

District cooling market size was valued at USD 30.15 billion in 2024. The market is projected to grow from USD 32.32 billion in 2025 to USD 61.08 billion by 2034, exhibiting a CAGR of 7.3% during the forecast period 2025-2034.

The district cooling market involves centrally producing and distributing chilled water to cool buildings such as residential, commercial, and industrial buildings. It provides energy-efficient, sustainable, and cost-effective cooling solutions by leveraging advanced technologies and centralized infrastructure. On a global front, the market is gaining traction due to urbanization, climate change concerns, and the growing demand for energy efficiency. Increasing government focus on sustainable urban development is driving the district cooling market demand. Governments across the globe are implementing green building initiatives, net-zero energy buildings, incentivizing energy-efficient systems, and promoting renewable energy integration to curb greenhouse gas emissions.

For instance, in November 2024, India’s Bureau of Energy Efficiency (BEE) mandated annual internal energy audits for industries, achieving a reduction of 31 million tonnes of CO2e per year. The BEE’s star labelling policy for household appliances also led to a cumulative savings of USD 112.8 billion in electricity bills in 2021-22, greatly reducing emissions. Additionally, district cooling aligns with smart city development projects aimed at improving urban living standards. The district cooling market expansion is further supported by advancements in thermal energy storage and intelligent distribution systems, ensuring reliable and optimized cooling solutions for modern urban needs.

To Understand More About this Research: Request a Free Sample Report

District Cooling Market Dynamics

Urbanization and Smart City Projects

Urbanization and the rapid development of smart cities is driving the district cooling market expansion. There is a growing demand for efficient cooling solutions to maintain comfort in residential, commercial, and industrial buildings as cities become more densely populated. District cooling systems, which centralize cooling production and distribution, are ideal for large urban areas. They offer notable energy savings, reducing the need for individual air conditioning units. Furthermore, smart city projects prioritize sustainability and energy efficiency, making district cooling an essential component.

For instance, a report by the Energy Market Authority highlighted that in October 2021, a new invention boosted energy efficiency in district cooling systems, tripling capacity and saving over 10% in costs. The trial was conducted at Keppel Infrastructure's plant in Changi Business Park, Singapore. District cooling systems align perfectly with these goals, making them increasingly popular in urban development initiatives globally as governments focus on reducing energy consumption and carbon emissions.

Integration of Renewable Energy

The integration of renewable energy significantly improves district cooling systems market development by linking sustainable power generation with efficient cooling solutions. These systems effectively harness renewable sources, especially solar power, to run chillers and pumps, thereby lowering operational costs and carbon emissions. Thermal energy storage allows excess renewable energy to be stored as chilled water for later use, creating a more resilient urban cooling infrastructure aligned with decarbonization goals. District cooling offers a large-scale application for clean energy, particularly in high cooling demand areas as renewable energy capacity grows.

For instance, a report from the United Arab Emirates indicates that the UAE has already channeled more than $50 billion into renewable energy initiatives spanning 70 countries. Building on this significant investment, the nation has outlined plans to match this amount with an additional $50 billion in renewable energy funding by 2035. This synergy also improves the economic viability of both technologies, with renewable energy having a stable consumer and district cooling benefiting from reduced energy costs.

For instance, a report from the United Arab Emirates indicates that the UAE has already channeled more than $50 billion into renewable energy initiatives spanning 70 countries. Building on this significant investment, the nation has outlined plans to match this amount with an additional $50 billion in renewable energy funding by 2035. This synergy also improves the economic viability of both technologies, with renewable energy having a stable consumer and district cooling benefiting from reduced energy costs.

District Cooling Market Segment Assessment

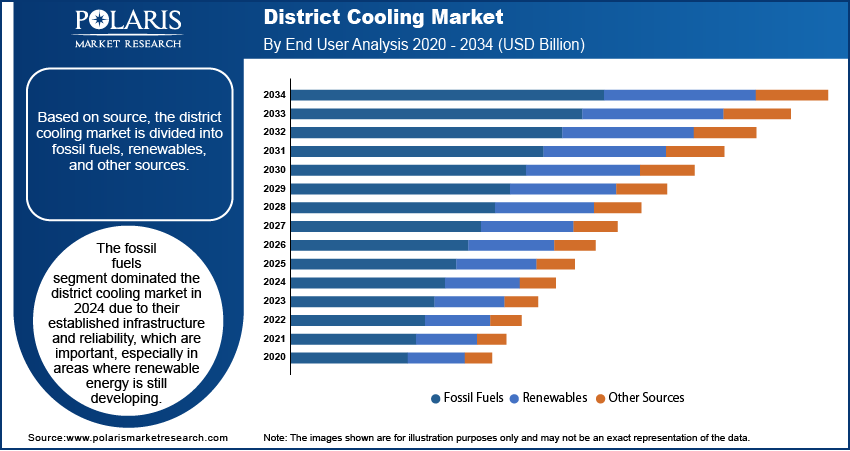

District Cooling Market Assessment by Source Outlook

The global district cooling market assessment, based on source, includes fossil fuels, renewables, and other sources. The fossil fuels segment dominated the market in 2024 due to their established infrastructure and reliability, which are important, especially in areas where renewable energy is still developing. Lower initial capital costs and existing expertise in fossil fuel systems make them a preferred choice for large-scale projects. Gas-fired absorption chillers are cost-effective and efficient in regions with plenty of natural gas. Additionally, fossil fuel systems provide consistent cooling services, crucial for critical applications such as healthcare and data centers, despite the global shift towards renewable energy.

District Cooling Market Evaluation by Technology Outlook

The global district cooling market evaluation, based on technology, includes electric chillers, absorption chillers, free cooling, and thermal energy storage. The thermal energy storage segment is expected to witness the fastest growth during the forecast period. This is due to its crucial ability to optimize energy consumption by storing excess cooling capacity during off-peak hours for use during peak demand periods. This advanced energy storage systems technology reduces operational costs and improves system efficiency by allowing cooling plants to operate at optimal capacity levels throughout the day. The integration of thermal storage systems also complements renewable energy sources, addressing intermittency challenges while providing grid stability and reducing the overall carbon footprint of district cooling operations. Moreover, the growing adoption of ice thermal storage systems, particularly in commercial and industrial applications, offers substantial cost savings through reduced peak electricity demand and better load management capabilities, making it increasingly attractive for new district cooling installations.

District Cooling Market Regional Insights

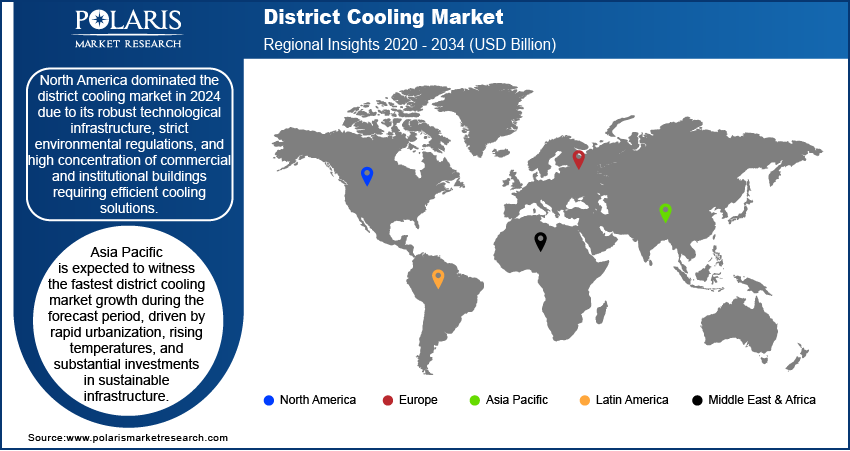

By region, the report provides the district cooling market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024 due to its robust technological infrastructure, strict environmental regulations, and high concentration of commercial and institutional buildings requiring efficient cooling solutions. The region's leadership position is further strengthened by investments in smart city projects, particularly in the US, coupled with increasing adoption of sustainable cooling solutions in urban centers. For instance, in October 2024, the Canadian government allocated $713,900 in funding to the Canadian Association of Heritage Professionals to assess how existing buildings align with the construction standards outlined in the National Building Code and the National Energy Code of Canada for Buildings. The presence of established district cooling networks in major cities, combined with supportive government policies promoting energy efficiency and carbon reduction, has accelerated market growth. Additionally, the region's advanced research and development capabilities, along with the presence of major district cooling system providers, contribute to continuous innovation and market expansion.

Asia Pacific is expected to witness the fastest district cooling market growth during the forecast period, driven by rapid urbanization, rising temperatures, and substantial investments in sustainable infrastructure. For instance, in December 2024, SP Group received a $16.7 million contract to operate a cooling and heating system for AMATC, reducing electricity use by 17.5% and natural gas by 40%, cutting carbon emissions by 880 tonnes annually. District cooling systems offer an efficient and eco-friendly solution as densely populated cities in countries such as India and China face increasing energy demands. Governments in the region are prioritizing energy-efficient buildings development, including district cooling, to address climate change and reduce greenhouse gas emissions. Additionally, advancements in renewable energy integration further improve the adoption of district cooling systems, making them a cornerstone of sustainable urban development in the region.

District Cooling Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the district cooling industry grow even more. The district cooling market features a mix of global leaders and regional players such as Empower, Tabreed, Veolia, and Engie, who are focusing on technological innovation and sustainable solutions to enhance energy efficiency. The market is growing, driven by urbanization, smart city investments, and strict energy efficiency regulations. Notably, Asia Pacific is expected to experience the fastest growth due to increasing urban population and rising temperatures. Key competitive strategies include partnerships with government entities, infrastructure investments, and innovative technologies such as thermal energy storage and hybrid cooling systems, emphasizing sustainability and technological advancements.

Danfoss, a Danish multinational company founded in 1933 by Mads Clausen, has evolved into a leader in energy-efficient solutions and innovative technologies. Initially starting with a single product, an expansion valve for refrigeration, Danfoss has expanded its portfolio to include heating, cooling, and power electronics. The company operates across various sectors, including climate solutions, drives, and power solutions, focusing on sustainability and decarbonization efforts aligned with global climate goals, with over 41,928 employees globally. Danfoss emphasizes quality, reliability, and innovation as core tenets of its business strategy. The company is committed to developing technologies that enhance productivity while reducing emissions and energy consumption, thereby contributing significantly to the green transition and a sustainable future.

Siemens AG specializes in electrification, automation, and digitalization and operates in a diverse range of industries, such as energy, healthcare, financing, building technology, transportation, and manufacturing. The company provides a comprehensive range of products and services, including power generation systems, turbines, medical imaging equipment, trains, and automation software, as well as building technologies and smart grid solutions. Siemens is organized into several business units, with Siemens Energy, Siemens Healthineers, and Siemens Mobility being the most prominent. Siemens Energy is primarily focused on developing and producing sustainable power generation and distribution technologies. It offers solutions in gas and power, renewable energy, and oil and gas. Siemens Healthineers is focused on providing medical technology and services to healthcare providers worldwide, with products and services that include medical imaging, laboratory diagnostics, and healthcare IT. In addition, Siemens Mobility offers intelligent mobility solutions to improve the efficiency and sustainability of transportation systems. Its products and services include rail automation, road traffic management, and intermodal solutions.

Key Companies in District Cooling Market

- AtkinsRéalis

- Danfoss

- Emirates Central Cooling Systems Corporation PJSC

- ENGIE

- Fortum

- KDHEC.

- Keppel Corporation Limited.

- Ramboll

- SHINRYO CORPORATION.

- Siemens

- Stellar Energy International

- Tabreed

- Veolia

- ADC Energy Systems

District Cooling Market Developments

October 2024: Mitsubishi Heavy Industries Thermal Systems, Ltd., a part of Mitsubishi Heavy Industries (MHI) Group, signed a new agreement with Emirates Central Cooling Systems Corporation to supply large-scale centrifugal chillers to empower district cooling plants in Dubai, UAE.

March 2024: Tabreed, the world's major district cooling company, signed a Memorandum of Understanding (MoU) with Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) to drive the adoption of energy-efficient district cooling systems and thermal storage solutions in India.

February 2022: National Central Cooling Company, The Egyptian Company for Energy and Cooling projects, and Marakez for Real Estate Investment Company signed a partnership agreement to provide district cooling services to the new D5M mall in New Katameya, east Cairo.

District Cooling Market Segmentation

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Residential

- Commercial

- Industrial

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Electric Chillers

- Absorption Chillers

- Free Cooling

- Thermal Energy Storage

By Service Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Generation

- Distribution

- Energy Optimization

By Source Outlook (Revenue, USD Billion, 2020 - 2034)

- Fossil Fuels

- Renewables

- Other Sources

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

District Cooling Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 30.15 billion |

|

Market Size Value in 2025 |

USD 32.32 billion |

|

Revenue Forecast in 2034 |

USD 61.08 billion |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global district cooling market size was valued at USD 30.15 billion in 2024 and is projected to grow to USD 61.08 billion by 2034.

The global market is projected to grow at a CAGR of 7.3% during the forecast period.

North America dominated the district cooling market revenue in 2024.

Some of the key players in the market are Emirates Central Cooling Systems Corporation PJSC, Tabreed, ENGIE, Veolia, Danfoss, Siemens, Fortum, KDHEC, AtkinsRéalis, Ramboll, and SHINRYO CORPORATION.

The fossil fuels segment dominated the district cooling market revenue in 2024.