Distribution Transformer Market Size, Share, Trends, Industry Analysis Report: By Mounting (Pad, Pole, and Underground), Phase, Power Range, Insulation, End User, and Region; Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 118

- Format: PDF

- Report ID: PM5208

- Base Year: 2024

- Historical Data: 2020-2023

Distribution Transformer Market Outlook

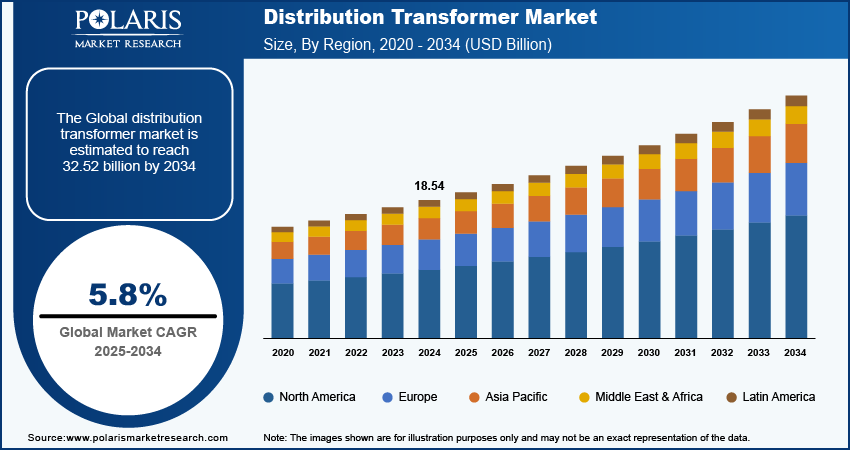

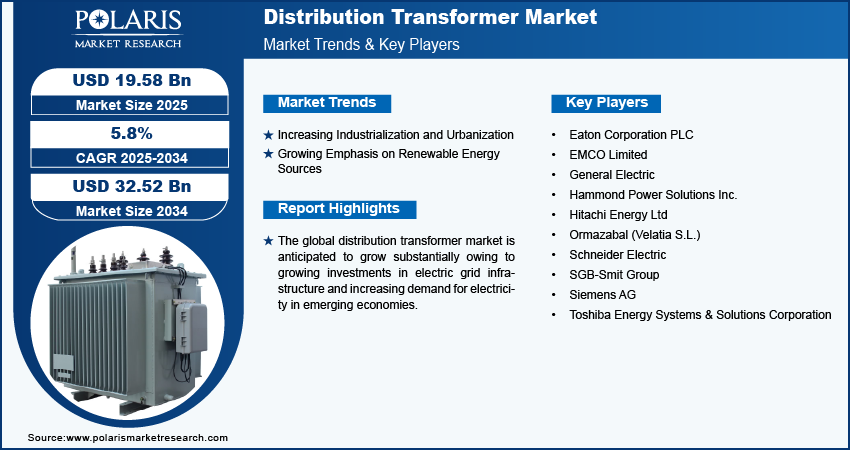

The distribution transformer market size was valued at USD 18.54 billion in 2024. The market is anticipated to grow from USD 19.58 billion in 2025 to USD 32.52 billion by 2034, exhibiting a CAGR of 5.8% during 2025–2034.

Distribution Transformer Market Overview

The global distribution transformer market is anticipated to grow substantially owing to growing investments in electric grid infrastructure and increasing demand for electricity in emerging economies.

To Understand More About this Research: Request a Free Sample Report

The shifting focus toward renewable energy sources such as wind and solar power boosts the distribution transformer market. Furthermore, the heightened emphasis on technologies has enabled the key players to incorporate advanced technologies such as IoT and AI to enhance the efficiency and reliability of transformers, thereby driving demand.

These technological advancements are enabling the predictive maintenance and real-time monitoring of distribution transformers to prevent potential failures and reduce downtime, fostering the growth of the distribution transformer market.

Distribution Transformer Market Drivers

Increasing Industrialization and Urbanization

Increasing industrialization and urbanization in developing countries are leading to a greater need for electricity for businesses, power homes, and industries. The electricity demand is surging continuously as more people are moving from rural to urban centers, which demand drives the distribution transformer market. For instance, according to the United Nations, 55% of the world's population lives in urban areas, and is expected to increase to 68% by 2050

Growing Emphasis on Renewable Energy Sources

There is a strong interest in renewable energy sources such as wind and solar power, which drives demand for distribution transformers that efficiently handle the integration of renewable energy into the power grid. Furthermore, the rise in solar installations across the world is driving the need for distribution transformers that accommodate fluctuations in power generation from solar panels.

Distribution Transformer Market Restraining Factors

Fluctuating Prices

Fluctuating prices of raw materials hamper the market growth as it directly impacts the overall production cost. For instance, the price of copper (one of the key components in manufacturing) has been volatile in recent times due to various factors such as geopolitical tensions and disruptions in the supply chain, which have forced the manufacturers to absorb the costs or to get affected by the profit margins.

Distribution Transformer Market Segment Analysis

By Mounting Analysis

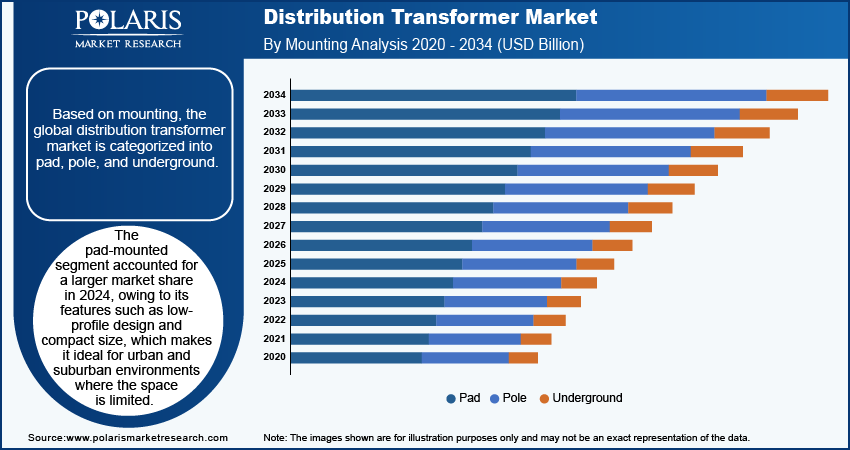

Pad Segment Held Significant Market Revenue Share Distribution Transformer

The pad-mounted segment accounted for a larger market share in 2024, owing to its features such as low-profile design and compact size, which makes it ideal for urban and suburban environments where the space is limited. Additionally, these transformers are highly demanded for their convenience such as reduced visibility and esthetic appeal, which blends well with the surrounding infrastructure. Furthermore, pad-mounted transformers offer enhanced safety features such as tamper-resistant enclosures and underground connectivity, which makes them safer in public areas. The ongoing modernization and urbanization of electrical infrastructure further propel the adoption of pad-mounted transformers.

By Phase Analysis

Three-Phase Segment Accounted for Major Market Share in 2024

In 2024, the segment that held the largest share of the market was the three-phase transformer segment. This dominance resulted from several key factors, such as industries increasingly relying on three-phase systems for their efficiency in transmitting power. These transformers handle larger loads and provide a more balanced power supply, making them ideal for commercial and industrial applications. Additionally, the ongoing expansion of renewable energy projects necessitates robust three-phase systems for integrating generated power into the grid. The growth of smart grid technologies also bolsters the demand for these transformers, as they support better load management and energy distribution, enhancing overall grid stability and efficiency.

Regional Insights

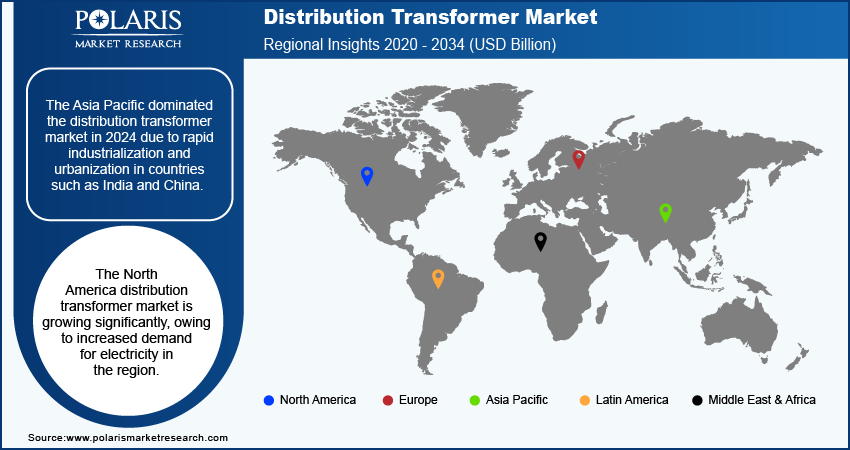

Asia Pacific Accounted for Largest Share in 2024

The Asia Pacific dominated the distribution transformer market in 2024 due to rapid industrialization and urbanization in countries such as India and China. These countries are consistently engaged in infrastructure development, which is driving demand for electricity, ultimately propelling the requirement for distribution transformers. Moreover, key companies in the region are expanding their manufacturing capacity of distribution transformers, which is fueling the market. In January 2023, CG Power & Industrial Solutions Limited expanded its manufacturing capacity of power transformers and distribution transformer units.

The North America distribution transformer market is growing significantly, owing to increased demand for electricity in the region. Additionally, the rise in residential developments, commercial establishments, and industries is propelling the demand for distribution transformers to ensure a reliable power supply.

Key Market Players and Competitive Insights

Prominent market players are investing heavily in research and development in order to expand their offerings, which will help the distribution transformer market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the distribution transformer industry must offer innovative solutions.

The distribution transformer market is fragmented, with the presence of numerous global and regional market players. Major players in the distribution transformer market include Eaton Corporation; EMCO Limited; General Electric; Hammond Power Solutions Inc.; Hitachi Energy Ltd; Ormazabal (Velatia S.L.); Schneider Electric; SGB-Smit Group; Siemens AG; and Toshiba Energy Systems & Solutions Corporation.

Major Players Operating in the Global Distribution Transformer Market

- Eaton Corporation

- EMCO Limited

- General Electric

- Hammond Power Solutions Inc.

- Hitachi Energy Ltd

- Ormazabal (Velatia S.L.)

- Schneider Electric

- SGB-Smit Group

- Siemens AG

- Toshiba Energy Systems & Solutions Corporation

Distribution Transformer Market Recent Developments in Industry

- In February 2024, Eaton expanded and established a new plant in Santiago, in the Dominican Republic, to meet growing customer demand for its fuses. It will provide safety functionality in electric vehicles (EVs), renewable and energy storage projects, data centers, and other industrial applications.

- In November 2023, Hitachi Energy introduced liquid-filled transformers to protect distribution transformers from the transient voltage.

Distribution Transformer Market Report Coverage

The distribution transformer, as a market report, emphasizes key regions across the globe to provide a better understanding of the product to the users. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects, such as competitive analysis, mounting, phase, power range, insulation, end user.

Distribution Transformer Market Report Segmentation

By Mounting Outlook (Revenue, USD Billion, 2020 - 2034)

- Pad

- Pole

- Underground

By Phase Outlook (Revenue, USD Billion, 2020 - 2034)

- Three

- Single

By Power Range Outlook (Revenue, USD Billion, 2020 - 2034)

- Up to 0.5 MVA

- 0.5-2.5 MVA

- 2.5-10 MVA

- Above 10 MVA

By Insulation Outlook (Revenue, USD Billion, 2020 - 2034)

- Oil Immersed

- Dry

By End User Outlook (Revenue, USD Billion, 2020 - 2034)

- Power Utilities

- Residential & Commercial

- Industrial

By Region Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Distribution Transformer Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2025 |

USD 19.58 billion |

|

Revenue Forecast in 2034 |

USD 32.52 billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Distribution Transformer Industry Trends Analysis (2023) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global distribution transformer market size was valued at USD 18.54 billion in 2024 and is projected to grow to USD 32.52 billion by 2034.

The global market is projected to grow at a CAGR of 5.8% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

The key players in the market are Eaton Corporation; EMCO Limited; General Electric; Hammond Power Solutions Inc.; Hitachi Energy Ltd; Ormazabal (Velatia S.L.); Schneider Electric; SGB-Smit Group; Siemens AG; and Toshiba Energy Systems & Solutions Corporation

The pad-mounting segment dominated the distribution transformer market in 2024.