Distributed Temperature Sensing Market Size, Share, Trends, Industry Analysis Report: By Operating Principle, Fiber (Single-Mode Fiber and Multi-Mode Fiber), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 125

- Format: PDF

- Report ID: PM5375

- Base Year: 2024

- Historical Data: 2020-2023

Distributed Temperature Sensing Market Overview

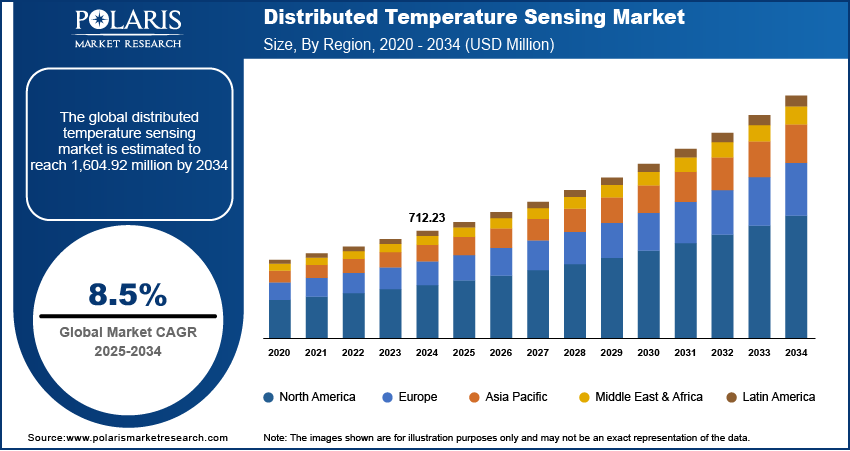

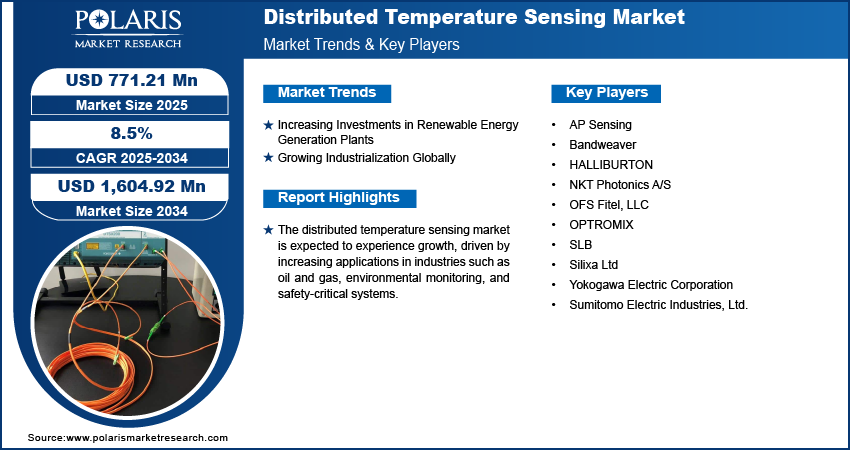

The global distributed temperature sensing market size was valued at USD 712.23 million in 2024. The market is projected to grow from USD 771.21 million in 2025 to USD 1,604.92 million by 2034, exhibiting a CAGR of 8.5% from 2025 to 2034.

Distributed temperature sensing is a technology that uses optical fibers to measure temperature along their entire length, providing real-time, continuous temperature profiles over long distances. It works by sending a laser pulse through the fiber and analyzing the scattered light to determine temperature variations at various points.

Rising safety concerns and stricter regulatory standards across industries such as oil and gas, chemicals, and power generation are driving the distributed temperature sensing market growth. Government regulations mandating enhanced monitoring of critical infrastructure to prevent accidents, reduce risks, and ensure compliance are driving the demand for distributed temperature sensing technology.

To Understand More About this Research: Request a Free Sample Report

Technological advancements in distributed temperature sensing systems are driving the distributed temperature sensing market expansion. Innovations in fiber optic sensors and signal processing have made distributed temperature sensing more accurate, reliable, and cost-effective. For instance, in February 2022, Luna launched a strain-compensated temperature sensor and ODiSI platform to provide more accurate, reliable, and repeatable distributed temperature measurements. These improvements allow distributed temperature sensing systems to monitor temperature over longer distances with higher precision and less maintenance, leading to the rising adoption of these systems.

Distributed Temperature Sensing Market Dynamics

Increasing Investments in Renewable Energy Generation Plants

Increasing investments in renewable energy generation plants allows energy generation facilities to allocate more funds towards advanced systems, such as distributed temperature sensing systems. For instance, according to the Indian Ministry of New and Renewable Energy, in 2023, the Indian government allocated USD 420 million to renewable energy power generation plants, signifying a substantial increase in capital inflow. Thus, rising investments in renewable energy are driving the distributed temperature sensing systems market revenue.

Growing Industrialization Globally

Industries such as manufacturing, chemicals, and energy are expanding, creating a rising need for advanced monitoring solutions to ensure efficiency, safety, and process optimization. For instance, according to the Indian Ministry of Commerce and Industry, the Indian Manufacturing sector grew by 11.8% in 2022. This surge in industrial activity across developing and developed economies is fueling the demand for distributed temperature sensing systems, leading to the distributed temperature sensing market development.

Distributed Temperature Sensing Market Segment Insights

Distributed Temperature Sensing Market Evaluation by Fiber Outlook

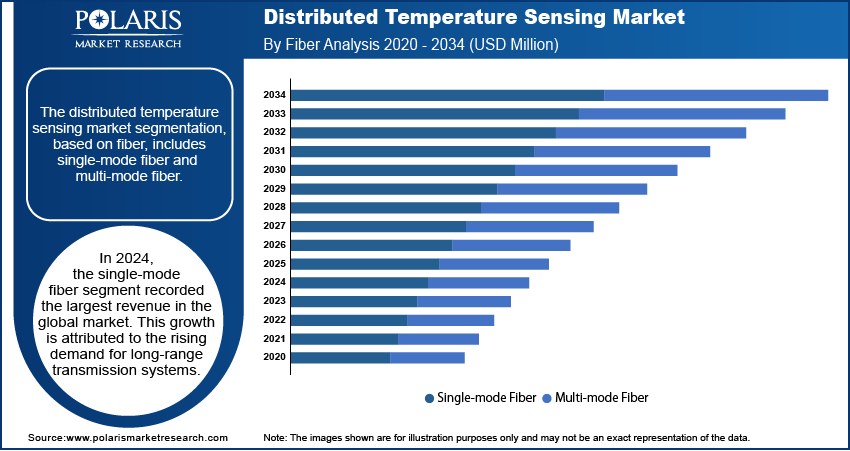

The distributed temperature sensing market segmentation, based on fiber, includes single-mode fiber and multi-mode fiber. In 2024, the single-mode fiber segment recorded the largest revenue in the global market. This growth is attributed to the rising demand for long-range transmission systems, which require superior performance and low attenuation properties of single-mode fibers. These fibers are ideal for applications where long-distance temperature monitoring is essential, such as in oil and gas pipelines or large infrastructure projects.

Distributed Temperature Sensing Market Assessment by Application Outlook

The distributed temperature sensing market segmentation, based on application, includes oil and gas, power cable monitoring, fire detection, process & pipeline monitoring, environmental monitoring, and others. The oil and gas segment dominated the market in 2024 due to the increasing need for temperature monitoring systems in the oil and gas industry. Oil and gas operations are carried out in challenging environments, which drives the demand for accurate, real-time temperature data to ensure safety, optimize operations, and prevent equipment failure.

Distributed Temperature Sensing Market Regional Analysis

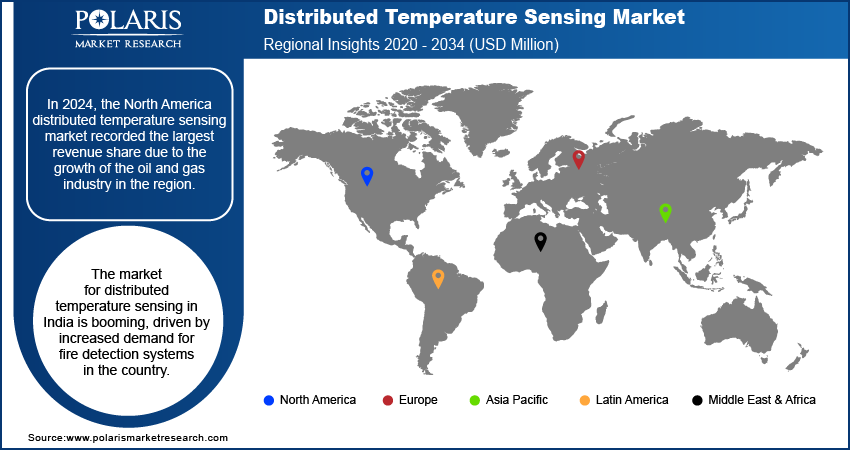

By region, the study provides the distributed temperature sensing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America had the largest revenue share of the global market in 2024, driven by the robust growth of the oil and gas industry in the region. Major players operating in the oil and gas industry are expanding their production facilities, which is driving the demand for accurate and reliable temperature monitoring systems. For instance, according to the US Energy Information Administration, in 2023, the US produced 13.3 million barrels per day, showcasing the growth of the industry in North America. Additionally, stringent regulatory guidelines on temperature monitoring during oil and gas production processes are propelling the demand for distributed temperature sensing systems, thereby driving regional market growth.

The Asia Pacific distributed temperature sensing market is experiencing significant growth due to an increase in strategic mergers and acquisitions between manufacturers. These partnerships have enabled companies to expand their market reach, improve production capabilities, and foster technological innovations. As a result, the region is witnessing stronger competition and a more efficient supply chain, leading to greater demand for temperature sensors in the power generation and oil and gas industries.

The distributed temperature sensing market in India is experiencing substantial growth due to an increase in demand for fire detection systems. The expansion of new residential and commercial infrastructure projects is propelling this demand. For instance, according to the Indian Department of Economics Affairs, in 2024, India recorded USD 818.67 billion worth of new infrastructure projects through public-private partnerships. More builders are integrating fire detection systems into their projects, leading to increased demand for distributed temperature sensing solutions across the country.

Distributed Temperature Sensing Market – Key Players and Competitive Insights

The distributed temperature sensing market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the distributed temperature sensing market include AP Sensing; Bandweaver; HALLIBURTON; NKT Photonics A/S; OFS Fitel, LLC; OPTROMIX; SLB; Silixa Ltd; Yokogawa Electric Corporation; and Sumitomo Electric Industries, Ltd.

Schlumberger Limited, now branded as SLB, is an American oilfield services company headquartered in Houston, Texas. Established in 1926, SLB provides technology for reservoir characterization, drilling, production, and processing within the global energy sector. The company has operations in over 120 countries. SLB offers a range of products and services for the oil and gas industry. Its key offerings include reservoir characterization technologies that analyze and interpret geological formations, drilling services, and production solutions for hydrocarbon recovery through artificial lift and well-completion techniques. Additionally, SLB provides processing technologies for refining and processing hydrocarbons alongside integrated project management services that cover the entire lifecycle of oilfield operations from exploration to production.

Yokogawa Electric Corporation, founded in 1915 and headquartered in Tokyo, Japan, specializes in the field of industrial automation and control systems. The company specializes in measurement, control, and information technologies with a global workforce exceeding 19,000 employees and operations in over 60 countries. Yokogawa is well-known for its innovative products, such as distributed control systems (DCS), process analyzers, and various measurement instruments as pressure transmitters and flow meters. The company has made contributions to the development of distributed temperature sensing (DTS) technology, which allows for continuous temperature monitoring along a fiber optic cable. This technology is crucial in various industries, such as oil and gas, energy, and environmental monitoring. Yokogawa enhances operational efficiency and safety for its clients by integrating DTS with its existing automation solutions. In recent years, Yokogawa has focused on digital transformation initiatives and industrial IoT applications, further solidifying its position as a comprehensive solutions provider. The company's commitment to sustainability and innovation continues to drive its growth in the competitive industrial automation market.

List of Key Companies in Distributed Temperature Sensing Market

- AP Sensing

- Bandweaver

- HALLIBURTON

- NKT Photonics A/S

- OFS Fitel, LLC

- OPTROMIX

- SLB

- Silixa Ltd

- Yokogawa Electric Corporation

- Sumitomo Electric Industries, Ltd.

Distributed Temperature Sensing Industry Developments

November 2022: Precise Downhole Solutions and AP Sensing launched the FBG Barcode distributed temperature sensing (DTS) technology, designed for extreme oil and gas environments. The innovation, revealed at the Society of Petroleum Engineers' Symposium, aims to improve reservoir performance and integrity.

March 2020: Sumitomo Electric Industries, Ltd. launched the OPTHERMO FTS3500 fiber-optic distributed temperature sensing system. The FTS3500, featuring improved sampling interval performance, inherits the compact design of its predecessor, FTR3000, and offers improved temperature monitoring capabilities.

Distributed Temperature Sensing Market Segmentation

By Operating Principle Outlook (Revenue – USD Million, 2020–2034)

- Optical Time Domain Reflectometry (OTDR)

- Optical Frequency Domain Reflectometry (OFDR)

By Fiber Outlook (Revenue – USD Million, 2020–2034)

- Single-Mode Fiber

- Multi-Mode Fiber

By Application Outlook (Revenue – USD Million, 2020–2034)

- Oil and Gas

- Power Cable Monitoring

- Fire Detection

- Process & Pipeline Monitoring

- Environmental Monitoring

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Distributed Temperature Sensing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 712.23 million |

|

Market Size Value in 2025 |

USD 771.21 million |

|

Revenue Forecast by 2034 |

USD 1,604.92 million |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The distributed temperature sensing market size was valued at USD 712.23 million in 2024 and is projected to grow to USD 1,604.92 million by 2034.

• The global market is projected to register a CAGR of 8.5% from 2025 to 2034.

• North America had the largest share of the global market in 2024.

• A few of the key players in the market are AP Sensing; Bandweaver; HALLIBURTON; NKT Photonics A/S; OFS Fitel, LLC; OPTROMIX; SLB; Silixa Ltd; Yokogawa Electric Corporation; and Sumitomo Electric Industries, Ltd.

• The single-mode fiber segment recorded the largest revenue in 2024, driven by the rising demand for long-range transmission systems.

• The oil and gas segment dominated the market in 2024 due to the increasing need for temperature monitoring systems in the oil and gas industry