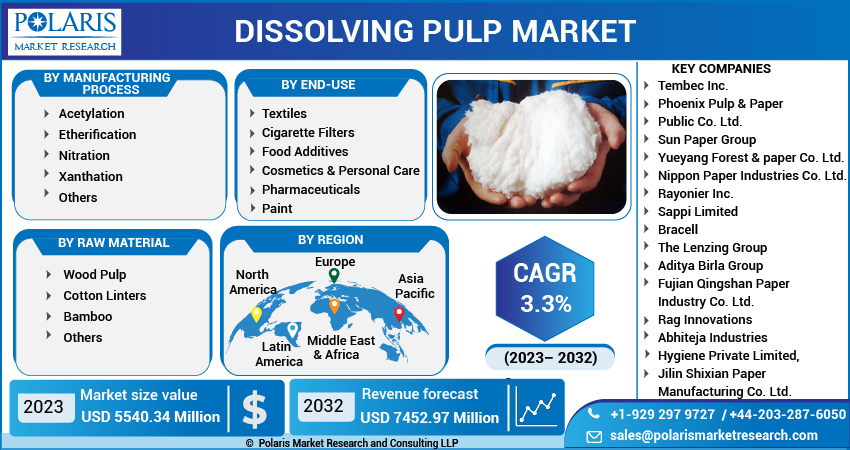

Dissolving Pulp Market Share, Size, Trends, Industry Analysis Report, By Manufacturing Process (Acetylation, Etherification, Nitration, Xanthation, and Others); By Raw Material; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3550

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

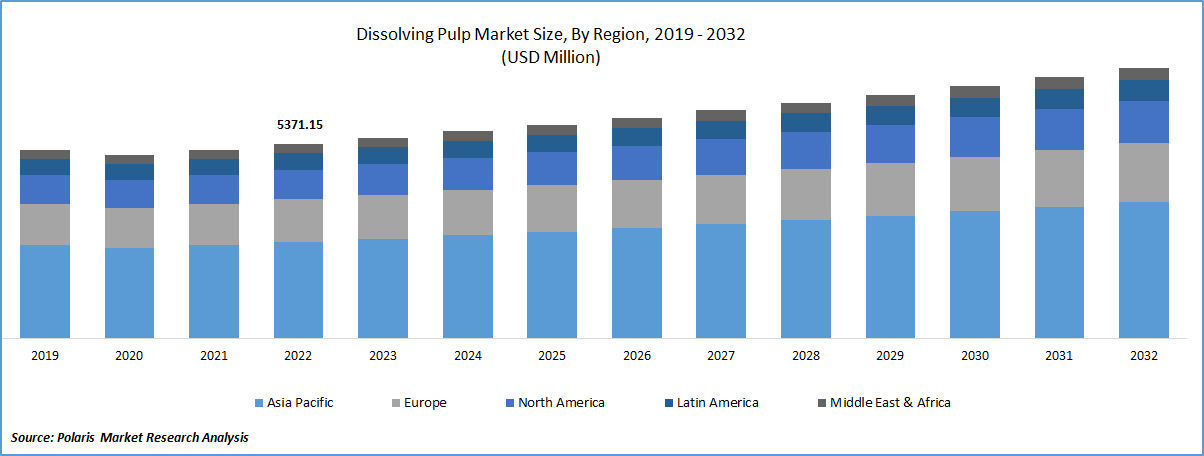

The global dissolving pulp market was valued at USD 5371.15 million in 2022 and is expected to grow at a CAGR of 3.3% during the forecast period. Increasing focus of both consumers and producers regarding the environment sustainability and surging number of manufacturers paying attention towards including natural substitutes in place of synthetic options coupled with the presence of high degree of polymerization and low hemicellulose content, that makes its acceptable for wider range of applications, are among the primary factors fueling the market growth.

To Understand More About this Research: Request a Free Sample Report

In addition, the expanding cigarette industry and growing product use as a filter in cigarettes along with the rising demand for the product from several end-use industries, that has been encouraging manufacturers to expand their production capacities, will also boost the market in the coming years. For instance, in March 2022, ANDRITZ, new manufacturing plant for the Bracell’s named “STAR” project, in Brazil. For this project, the company used A-ConFlex continuous kraft & dissolving pulping technology.

Moreover, various new advanced bleaching technologies have been developed in the recent years to improve the brightness and whiteness of dissolving pulp, as these technologies use less chlorine and other harsh chemicals and are more environmentally friendly than traditional bleaching methods, leading to higher adoption as a sustainable method for producing dissolving pulp worldwide.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the dissolving pulp market. The rapid spread of the pandemic has declined the demand for dissolving pulp due to the closure of textile mills and paper mills, which are the major product consumers. And, the global lockdowns and several restrictions on travel and trade activities also disrupted supply chains and caused delays in the delivery of raw materials and finished products, that also had negative impact on the market.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rapid increase in the product demand and adoption as a viscose-pulp, which is widely used to produce viscose-pulp, hi-alpha, and specialty pulp, that are being used in wide array of significantly high valued products like acetate low for the cigarette fibers, cellulosic fibers, and also nitrocellulose coupled with the growing investments in developing new dissolving pulp production facilities mainly by the Chinese producers, are the key factors driving the global market growth at rapid pace.

Furthermore, the growing incorporation of enzymatic technologies in the product process of high-quality dissolving pulp because of their green, mild conditions, higher specificity and efficiency along with the rising prevalence of using cellulase due to their ability to improve the product quality in several ways including reactivity, accessibility, and controlling the intrinsic viscosity, thereby propelling the demand and growth of the growth.

Report Segmentation

The market is primarily segmented based on manufacturing process, raw material, end-use, and region.

|

By Manufacturing Process |

By Raw Material |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Acetylation segment accounted for the largest market share in 2022

Acetylation segment garnered largest share with considerable growth rate in 2022, it is mainly attributable to high efficiency in the disruption of hydrogen bonding and continuous surge in the usage of acetylated dissolving pulp in variety of non-traditional applications such as production of cellophane and several other specialty products.

In addition, with the increasing awareness among the key market players towards the cost-effectiveness of acetylation method for producing dissolving pulp, as it requires less energy and fewer chemicals compared to the traditional methods, and resulting in higher adoption of acetylated dissolving pulp as a more attractive option among the companies looking to reduce their production costs, thereby propelling the market growth.

Wood pulp segment held the significant market revenue share in 2022

The wood pulp segment held the significant market share in terms of revenue in 2022, which is highly attributable to growing adoption as an effective renewable source that could be sustainably harvested and produces fewer greenhouse emissions compared to other synthetic fibers, making them highly acceptable and popular among eco-friendly or conscious customers across the world.

Advances in technology that have made it easier and more cost-effective to produce high-quality dissolving pulp from wood pulp like new pulp bleaching methods and the use of enzymes in the production process, which have helped to improve the quality and consistency of dissolving pulp, and creating new revenue opportunities for the players by incorporating these technologies in their operations.

The cotton linters segment is expected to gain substantial growth rate over the next coming years, mainly due to its wider availability in significant large quantities, that led to increased adoption as a source of raw material for dissolving pulp production, mainly as the demand and prevalence for sustainable and renewable materials continues to grow globally.

Textiles segment is expected to witness highest growth over the forecast period

The textiles segment is projected to grow at fastest growth rate during the projected period, on account of increasing product utilization to produce textiles such as rayon modal, and lyocell, which are considered eco-friendly and sustainable than synthetic fabrics and with the growing awareness about the impact of textile production on the environment, the demand for sustainable textiles is increasing.

Moreover, the exponential growth in the fashion and apparel industry, due to numerous factors like changing consumer preferences, increasing disposable income, and the rise of e-commerce channels especially in the emerging economies including China, India, Malaysia, and South Korea, is likely to drive the demand for textiles, which in turn will boost the demand for dissolving pulp as well in the near future.

Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market in terms of volume and value in 2022, which is largely accelerated to drastic increase in the demand for viscose fiber across the region, which requires dissolving pulp as a major raw material and change in consumer clothing styles that led to higher demand from the textile industry. Additionally, growing environmental concerns and awareness regarding the impact of traditional pulp on environment has been encouraging consumers as well as producers to opt for sustainable options, which is likely to create new growth potential for the market over the coming years.

The North America region is likely to emerge as fastest growing region with a healthy CAGR during the projected period, owing to continuous expansion of the textile industry and surge in the number of consumers demanding bio-based products. The growing penetration among government towards promoting the use of renewable resources including wood, which is the primary raw material used to produce dissolving pulp with the help of favorable policies and initiatives, are also creating a positive business environment for the key players operating in the market.

Competitive Insight

Some of the major players operating in the global market include Tembec, Phoenix Pulp, Sun Paper, Yueyang Forest, Nippon Paper Industries, Rayonier, Sappi Limited, Bracell, Lenzing Group, Aditya Birla, Fujian Qingshan Paper, Rag Innovations, Abhiteja Industries, Hygiene Private, and Jilin Shixian Paper.

Recent Developments

In August 2022, Bracell, announced that the company has raised around USD 1.8 billion through the syndicated loans, for the development of world’s largest and greenest pulp mill. The new pulp is integrated with the latest and best available technology for the sector and designed with several key innovations like biorefinery controlling the materials input to maximize recycling and minimize waste.

In June 2021, Renewcell, collaborated with the Citec, with an aim to design a plant to produce recycled textiles in Sweden. The company is highly focused to bring an industrial revolution to sustainable world with the production of high-quality materials for the recycled textiles including dissolving pulp.

Dissolving Pulp Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 5540.34 million |

|

Revenue forecast in 2032 |

USD 7452.97 million |

|

CAGR |

3.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Manufacturing Process, By Raw Material, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Tembec Inc., Phoenix Pulp & Paper Public Co. Ltd., Sun Paper Group, Yueyang Forest & paper Co. Ltd., Nippon Paper Industries Co. Ltd., Rayonier Inc., Sappi Limited, Bracell, The Lenzing Group, Aditya Birla Group, Fujian Qingshan Paper Industry Co. Ltd., Rag Innovations, Abhiteja Industries, Hygiene Private Limited, and Jilin Shixian Paper Manufacturing Co. Ltd. |

FAQ's

The global dissolving pulp market size is expected to reach USD 7452.97 million by 2032.

Top market players in the Dissolving Pulp Market are Tembec, Phoenix Pulp, Sun Paper, Yueyang Forest, Nippon Paper Industries, Rayonier, Sappi Limited.

Asia Pacific contribute notably towards the global Dissolving Pulp Market.

The global dissolving pulp market expected to grow at a CAGR of 3.3% during the forecast period.

The Dissolving Pulp Market report covering key are manufacturing process, raw material, end-use, and region.