Disposable Endoscopes Market Size, Share, Trends, Industry Analysis Report: By Type, Application, End Use (Outpatient Facilities and Hospitals), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 116

- Format: PDF

- Report ID: PM5173

- Base Year: 2024

- Historical Data: 2020-2023

Disposable Endoscopes Market Overview

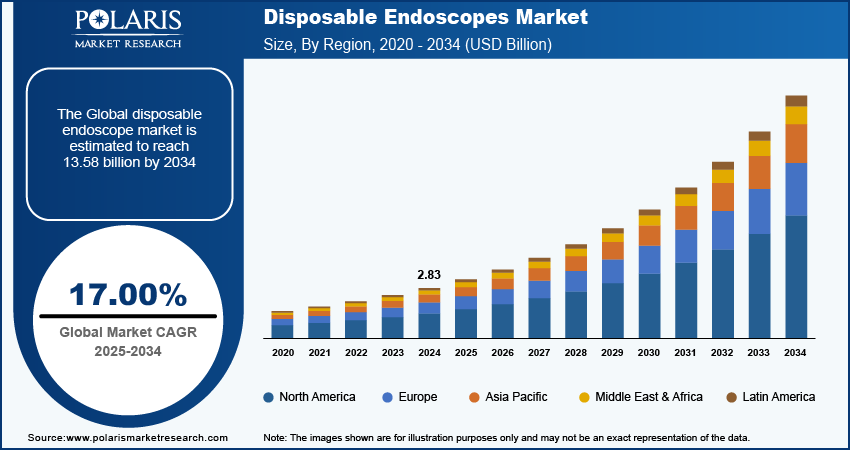

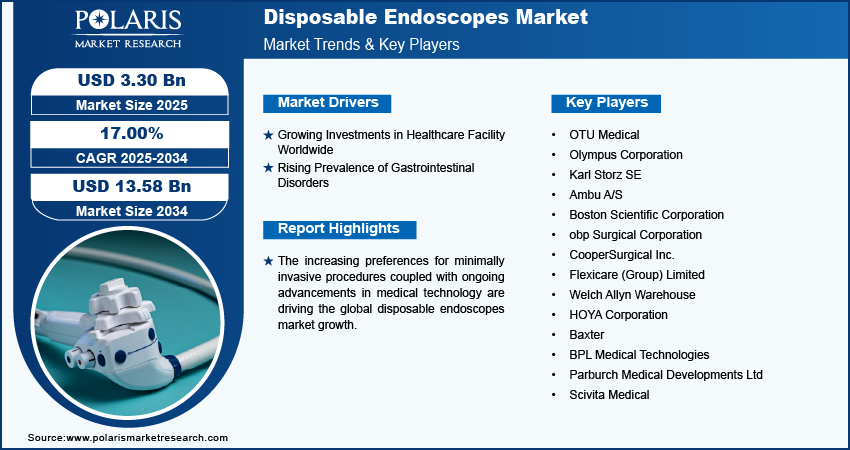

The disposable endoscopes market size was valued at USD 2.83 billion in 2024. The market is projected to grow from USD 3.30 billion in 2025 to USD 13.58 billion by 2034, exhibiting a CAGR of 17.00% during 2025–2034. Disposable endoscopes represent a significant advancement in medical technology, particularly in the field of gastrointestinal (GI) procedures. These single-use devices are designed for minimally invasive diagnostic and therapeutic applications, allowing healthcare professionals to perform procedures with enhanced safety and reduced infection risks.

The increasing preferences for minimally invasive procedures are driving the global disposable endoscopes market. Minimally invasive procedures involve smaller incisions, resulting in less pain, reduced recovery time, and a focus on patient safety. Disposable endoscopes align perfectly with this preference as they offer enhanced safety by eliminating the risk of device-related infections, a critical concern in surgical settings.

The ongoing advancements in medical technology fuel the global disposable endoscopes market. Technological innovations have led to higher-quality imaging capabilities in disposable endoscopes, which helps healthcare professionals make more accurate diagnoses and perform procedures with greater precision, thereby increasing appeal and adoption.

To Understand More About this Research: Request a Free Sample Report

The growing incidence of cross-contamination diseases, such as COVID-19, drives the disposable endoscopes market growth. Disposable endoscopes reduce the risk of cross-contamination between patients, which is a concern during outbreaks of infectious diseases. This encourages healthcare facilities to use single-use devices to minimize transmission risks.

Disposable Endoscopes Market Driver Analysis

Growing Investments in Healthcare Facility Worldwide

Increased healthcare funding leads to the development and upgradation of healthcare facilities, which increases the capacity to treat more patients. The higher patient volume drives the need for reliable, easy-to-use medical instruments, such as disposable endoscopes, that facilitate quicker procedures. Therefore, the rising investments in healthcare facilities worldwide propel the global disposable endoscopes market growth.

Rising Prevalence of Gastrointestinal Disorders

The prevalence of gastrointestinal disorders, such as colorectal cancer and inflammatory bowel disease, is growing across the world. As per a large-scale study conducted by the Gastroenterology Organization, 40% of people worldwide have functional gastrointestinal disorders (FGIDs). Disposable endoscopes offer a safe and effective option for procedures such as colonoscopies, which are crucial for diagnosing gastrointestinal conditions such as colorectal cancer. Furthermore, the rise in gastrointestinal disorders results in the need for various endoscopic interventions, such as biopsies, polyp removal, and therapeutic procedures. Thus, the increasing prevalence of gastrointestinal disorders propels the adoption of disposable endoscopes.

Disposable Endoscopes Market Segment Insights

Disposable Endoscopes Market Breakdown by Type Insights

Based on type, the disposable endoscopes market is segmented into laparoscopes, arthroscopes, ureteroscopes, cystoscopes, gynecology endoscopes, neuroendoscopes, bronchoscopes, hysteroscopes, laryngoscopes, otoscopes, sigmoidoscopes, duodenoscopes, nasopharyngoscopes, rhinoscopes, and colonoscopes. The colonoscopes segment accounted for a major share of the market in 2024 due to the increasing prevalence of colorectal cancer and a growing emphasis on preventive healthcare. Colonoscopes allow for the early detection of abnormalities, which is crucial for the successful treatment of colorectal cancer. The convenience and safety offered by single-use instruments significantly appeal to patients and healthcare providers, as they effectively reduce the risk of infection and cross-contamination. Additionally, innovations in imaging technology have improved the accuracy and efficacy of these procedures, further contributing to the dominant position of the colonoscope segment in the market.

The laparoscopes segment is estimated to grow at a robust pace in the coming years owing to the widespread adoption of minimally invasive surgical techniques, which provide numerous benefits such as reduced recovery times and lower postoperative complications. The development of advanced features, such as high-definition imaging and enhanced maneuverability, makes laparoscopes increasingly attractive for surgeons and patients during minimally invasive surgical techniques. Furthermore, ongoing research focuses on expanding the capabilities of these instruments, including integrating robotic assistance, which is expected to drive their adoption.

Disposable Endoscopes Market Breakdown by End Use Insights

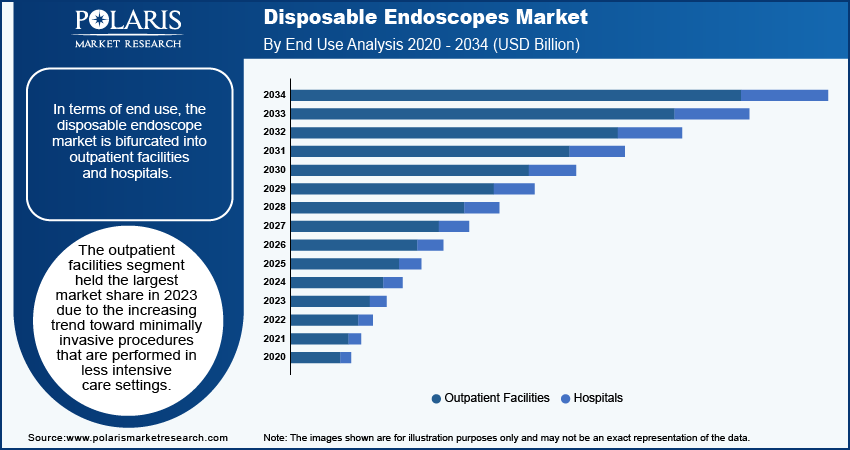

In terms of end use, the disposable endoscope market is bifurcated into outpatient facilities and hospitals. The outpatient facilities segment held a larger market share in 2024 due to the increasing trend toward minimally invasive procedures. These facilities have gained popularity as healthcare providers seek to improve patient convenience and reduce costs associated with hospital stays. The efficiency and quick turnaround associated with disposable endoscopes align well with the operational goals of outpatient settings, allowing for faster patient flow and shorter recovery times. Additionally, patients often prefer outpatient procedures due to their lower costs and the ability to return home the same day, contributing to the growing demand for outpatient facilities.

The hospitals segment is projected to grow at a rapid pace during the forecast period owing to the rising prevalence of chronic diseases, such as gastrointestinal disorders and cancers. Owing to the rising incidence of these diseases, hospitals adopt more sophisticated diagnostic and therapeutic solutions, such as disposable endoscopes, to treat these diseases effectively and efficiently. Furthermore, the emphasis on infection control within hospitals has led to a higher adoption of disposable endoscopes, as they effectively minimize the risk of cross-contamination.

Disposable Endoscopes Market Regional Insights

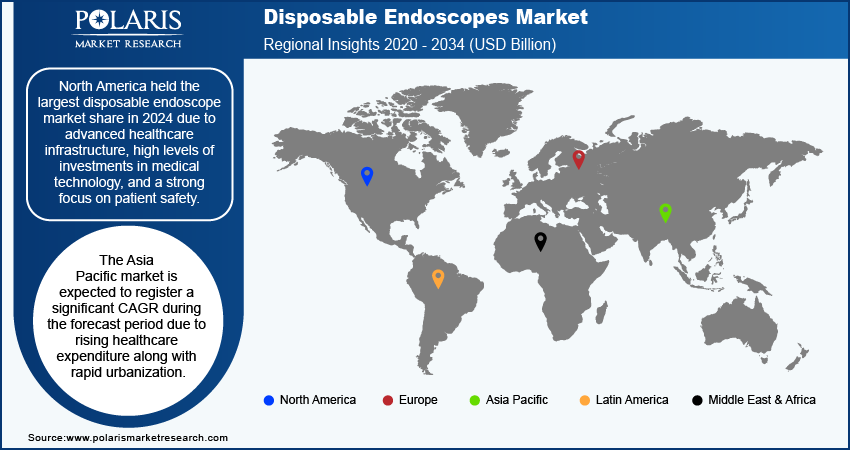

By region, the study provides the disposable endoscopes market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to advanced healthcare infrastructure, high levels of investments in medical technology, and a strong focus on patient safety. The US, in particular, dominated the regional market due to its well-established healthcare system and the increasing prevalence of chronic diseases that require regular diagnostic procedures. The emphasis on infection control in hospitals and outpatient facilities has led to a growing adoption of disposable endoscopes, as these tools significantly reduce the risk of cross-contamination. Furthermore, the ongoing innovation in medical devices, coupled with the strong presence of key manufacturers in the US, has fueled the market growth in the region.

The Asia Pacific disposable endoscopes market is expected to record a significant CAGR during the forecast period due to rising healthcare expenditure, rapid urbanization, and increasing awareness of advanced medical technologies across countries such as China and India. These countries are witnessing a surge in the incidence of chronic diseases, leading to a higher demand for effective diagnostic and therapeutic solutions such as disposable endoscopes. Additionally, the growing middle-class population in these countries is pushing for improved access to quality healthcare, further driving the adoption of single-use instruments.

Disposable Endoscopes Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development to expand their offerings, which will help the disposable endoscopes market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The disposable endoscopes market is fragmented, with the presence of numerous global and regional market players. A few major players in the disposable endoscopes market are OTU Medical; Olympus Corporation; Karl Storz SE; Ambu A/S; Boston Scientific Corporation; obp Surgical Corporation; CooperSurgical Inc.; Flexicare (Group) Limited; Welch Allyn Warehouse; HOYA Corporation; Baxter; BPL Medical Technologies; Parburch Medical Developments Ltd; OMNIVISION; and Shenzhen HugeMed Medical Technical Development Co., Ltd.

HOYA Corporation is a prominent player in the medical device industry and has made significant growth in the development and commercialization of disposable endoscopes, particularly through its PENTAX Medical division. HOYA leverages its expertise in high image quality and innovative design to produce flexible endoscopes used for examining various medical conditions, including those affecting the digestive system, respiratory organs, and ENT (ear, nose, and throat) areas. The company's commitment to advancing medical technology is evident in its focus on disposable endoscopes, which have gained traction due to their potential to enhance patient safety and streamline procedural efficiency. In May 2021, HOYA's first disposable bronchoscope, “PENTAX Medical ONE Pulmo,” obtained CE mark certification in Europe.

Olympus Corporation, a global medical technology company, has made significant advancements in the field of disposable endoscopes, particularly through its introduction of the H-SteriScope single-use bronchoscope line. This innovative product portfolio represents a strategic response to the growing demand for safer and more efficient medical procedures, especially in the context of infection control and patient safety. The H-SteriScope series includes five premium single-use bronchoscopes designed for advanced diagnostic and therapeutic applications in respiratory care. These devices combine high-definition imaging capabilities with user-friendly features that enhance procedural efficiency, making them suitable for a variety of clinical settings.

Key Companies in Disposable Endoscopes Market

- OTU Medical

- Olympus Corporation

- Karl Storz SE

- Ambu A/S

- Boston Scientific Corporation

- obp Surgical Corporation

- CooperSurgical Inc.

- Flexicare (Group) Limited

- Welch Allyn Warehouse

- HOYA Corporation

- Baxter

- BPL Medical Technologies

- Parburch Medical Developments Ltd

- Scivita Medical

- Shenzhen HugeMed Medical Technical Development Co., Ltd.

Disposable Endoscopes Industry Developments

November 2023: OMNIVISION, a global developer of semiconductor solutions such as advanced digital imaging, analog, and touch & display technology, announced the new OVMed OH0131 image signal processor (ISP), an easy-to-implement solution for reusable and disposable endoscopes.

October 2023: Olympus Corporation, a global medical technology company, announced the market launch of its next-generation EVIS X1 endoscopy system.

September 2023: Scivita Medical announced the launch of the Single Broncho Videoscope Solution at the European Respiratory Society (ERS) International Congress 2023, designed for single use and an endoscopic image processor featuring full HD visualization.

Disposable Endoscopes Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Otoscopes

- Sigmoidoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

By Application Outlook (Revenue, USD Billion, 2020–2034)

- GI Endoscopy

- ENT Endoscopy

- Bronchoscopy

- Urology

- Obstetrics/Gynecology

- Other

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Outpatient Facilities

- Hospitals

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Disposable Endoscopes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.83 Billion |

|

Market Size Value in 2025 |

USD 3.30 Billion |

|

Revenue Forecast by 2034 |

USD 13.58 Billion |

|

CAGR |

17.00% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global disposable endoscopes market size was valued at USD 2.83 billion in 2024 and is projected to grow to USD 13.58 billion by 2034.

The global market is projected to register a CAGR of 17.00% during the forecast period.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are OTU Medical; Olympus Corporation; Karl Storz SE; Ambu A/S; Boston Scientific Corporation; obp Surgical Corporation; CooperSurgical Inc.; Flexicare (Group) Limited; Welch Allyn Warehouse; HOYA Corporation; Baxter; BPL Medical Technologies; Parburch Medical Developments Ltd; OMNIVISION; and Shenzhen HugeMed Medical Technical Development Co., Ltd.

The laparoscopes segment is projected for significant growth in the global market during the forecast period.

The outpatient facilities segment dominated the disposable endoscopes market in 2024.