Disinfectant Spray Market Size, Share, Trends, Industry Analysis Report: By Type (Organic and Conventional), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 125

- Format: PDF

- Report ID: PM5355

- Base Year: 2024

- Historical Data: 2020-2023

Disinfectant Spray Market Overview

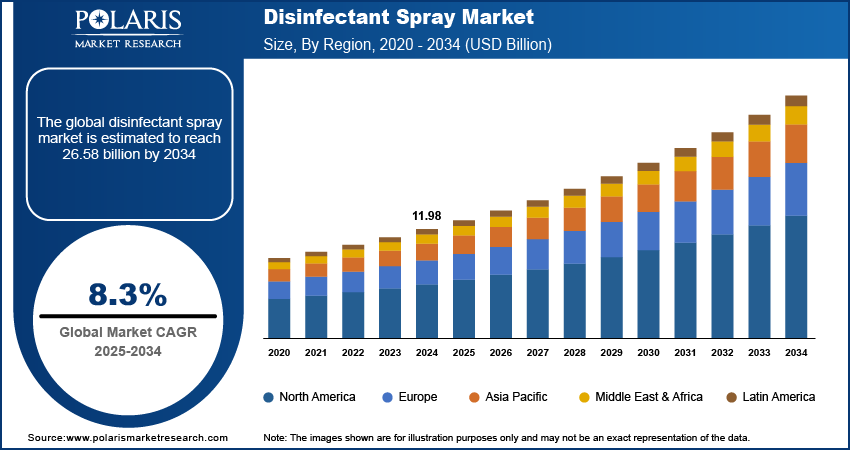

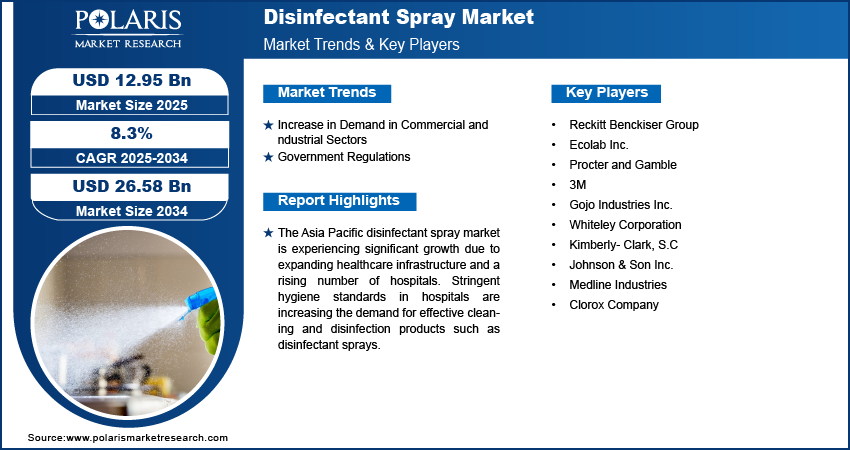

The disinfectant spray market size was valued at USD 11.98 billion in 2024. The market is projected to grow from USD 12.95 billion in 2025 to USD 26.58 billion by 2034, exhibiting a CAGR of 8.3% during 2025–2034.

A disinfectant spray is a cleaning product designed to destroy harmful germs, bacteria, and viruses on surfaces. It is typically used on hard, nonporous areas to help reduce the spread of infectious diseases and maintain a clean environment.

Consumers are becoming more aware of health and wellness, due to which they are prioritizing cleaner and safer environments. This shift in consumer behavior has led to a growing demand for products that help reduce germs, bacteria, and viruses. Disinfectant sprays are a convenient and effective solution to achieve this, whether at home, in offices, or public spaces. Additionally, the rise in cases of allergies, asthma, and other health concerns has led to an increase in the use of disinfectant sprays that help reduce allergens and harmful bacteria, further fueling the disinfectant spray market growth.

To Understand More About this Research: Request a Free Sample Report

The COVID-19 outbreak has heightened global awareness about the importance of maintaining hygiene to prevent the spread of germs and viruses, due to which people are becoming more cautious about cleanliness. These have led to an increase in demand for disinfectant sprays. The ongoing focus on health and safety has propelled a sustained interest in disinfectant products, driving the disinfectant spray market expansion.

Disinfectant Spray Market Driver Analysis

Increase in Demand in Commercial and Industrial Sectors

The demand for disinfectant sprays has increased in the commercial and industrial sectors due to the increasing need for sanitation in offices, schools, hotels, hospitals, and restaurants. Businesses are seeking to maintain a clean and safe environment for employees, customers, and patients, due to which the disinfectant sprays have become essential in their cleaning protocols. Additionally, the hospitality industry, in particular, has seen a rise in cleaning standards, with disinfectant sprays used regularly in guest rooms and common areas. Thus, the rising need for effective disinfection in high-traffic environments such as commercial and industrial spaces is driving the disinfectant spray market development.

Government Regulations

Governments worldwide have implemented stricter health and sanitation regulations to combat the spread of infectious diseases. These regulations, especially in healthcare, food service, and public spaces, have increased the demand for disinfectant sprays. Health policies requiring frequent cleaning and sanitization have prompted businesses and institutions to adopt disinfectant sprays as a regular part of their cleaning protocols. For instance, the US Congress the US government passed the H.R. 5545 Bill on sanitation in public places and healthcare facilities, showcasing the government regulations for sanitization. Additionally, the increased focus on hygiene in government buildings has created a large and ongoing demand for disinfectant products, thereby fueling the disinfectant spray market demand.

Disinfectant Spray Market Segment Analysis

Disinfectant Spray Market Assessment by Type Outlook

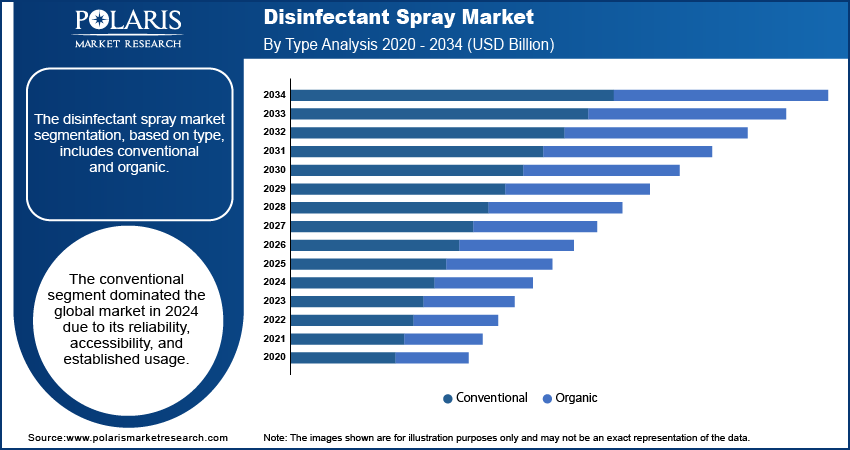

The disinfectant spray market segmentation, based on type, includes organic and conventional. The conventional segment dominated the global market in 2024. Conventional disinfectant sprays are widely used due to their effectiveness in destroying germs and viruses on various surfaces. These products typically contain chemicals such as alcohol, bleach, or hydrogen peroxide, which have long been trusted for their strong disinfecting properties. The reliability, accessibility, and established usage of conventional disinfectant sprays make them a preferred choice for households and commercial spaces, driving their dominance in the disinfectant spray market.

Disinfectant Spray Market Evaluation by End Use Outlook

The disinfectant spray market segmentation, based on end use, includes hospitals, nursing homes, medical laboratories, and others. The hospitals segment is expected to experience a significant CAGR in the global market during the forecast period. Hospitals require strict hygiene standards to prevent the spread of infections, making disinfectant sprays an essential part of their cleaning protocols. These increasing health concerns and the need for regular disinfection of high-touch areas have led to an increase in demand for effective disinfectant sprays in healthcare settings.

Disinfectant Spray Market Regional Analysis

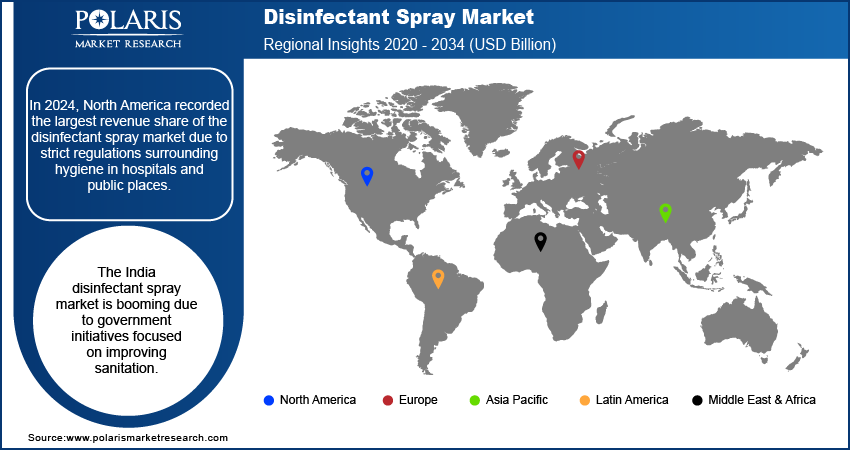

By region, the study provides the disinfectant spray market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share of the market due to strict regulations for surrounding hygiene in hospitals and public places. Governments and health organizations have imposed stringent sanitation standards to prevent the spread of infections, especially in healthcare settings and public spaces such as schools, offices, and airports. This has led to the disinfectant spray market growth in the region.

Asia Pacific is experiencing significant growth in the global market due to the increasing number of hospitals. The healthcare infrastructure in the region is expanding to meet the needs of growing populations, due to which the demand for effective cleaning and disinfection products, including disinfectant sprays, is increasing. According to the National Institute of Health, China alone boasts 36,570 hospitals, showcasing an increase in hospital count. Hospitals in the region require stringent hygiene standards to prevent infections, driving the adoption of disinfectant sprays. Thus, an increase in the number of hospitals is driving the Asia Pacific disinfectant spray market expansion.

The disinfectant spray market in India is experiencing substantial growth driven by government initiatives focused on improving sanitation. Programs such as the Swachh Bharat Abhiyan (Clean India Mission) have raised awareness about cleanliness and hygiene, particularly in public spaces and healthcare facilities. These government efforts have led to increased adoption of disinfectant products, including sprays, which has led to an increase in demand for disinfectant sprays for cleanliness in both residential and commercial sectors, thereby driving the disinfectant spray market demand in the country.

Disinfectant Spray Market – Key Players and Competitive Analysis

The disinfectant spray market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to fulfill the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. A few major disinfectant spray market players are Reckitt Benckiser Group, Ecolab Inc., Procter and Gamble, 3M, Gojo Industries Inc., Whiteley Corporation, Kimberly-Clark, S.C. Johnson & Son Inc., Medline Industries, and Clorox Company.

3M Company, originally founded in 1902 as Minnesota Mining and Manufacturing Company, is a diversified technology and science corporation headquartered in St. Paul, Minnesota. The company has operations in over 70 countries and sales in ∼200 countries. 3M business operates in various industries, including industrial, safety, healthcare, and consumer markets. The company’s portfolio features more than 60,000 products categorized into key business segments. The safety & industrial segment offers personal protective equipment, adhesives, abrasives, and tapes for industries such as automotive and construction. In the transportation & electronics segment, 3M provides solutions for automotive OEMs and electronic components. The healthcare segment focuses on medical supplies, dental products, and health information systems for hospitals and clinics. Meanwhile, the consumer segment includes home improvement items, office supplies, and consumer health products. 3M operates manufacturing facilities across various regions, including North America, and significant operations in Asia Pacific, particularly in India and China. The company also maintains a robust presence across Europe.

Reckitt Benckiser Group PLC, commonly known as Reckitt, is a British-Dutch consumer goods company with headquarters in Slough, UK, and Hoofddorp, Netherlands. Formed in 1999 through the merger of Reckitt & Colman plc and Benckiser N.V., Reckitt specializes in health, hygiene, and nutrition products. The company boasts a diverse portfolio of well-known brands, such as Dettol, Lysol, Nurofen, Durex, and Enfamil. Reckitt organizes its products into three primary segments—hygiene, health, and nutrition. The hygiene segment focuses on cleaning and hygiene products, featuring brands such as Lysol, Finish, Harpic, and Air Wick. The health segment offers a range of over-the-counter medications and personal care items, with notable brands such as Nurofen, Strepsils, Mucinex, and Gaviscon. Meanwhile, the nutrition segment is dedicated to infant and child nutrition as well as adult nutritional products, including Enfamil and Nutramigen. The company has operations in ∼68 countries and products sold in nearly 200 countries worldwide.

List of Key Companies in Disinfectant Spray Market

- Reckitt Benckiser Group

- Ecolab Inc.

- Procter and Gamble

- 3M

- Gojo Industries Inc.

- Whiteley Corporation

- Kimberly- Clark, S.C

- Johnson & Son Inc.

- Medline Industries

- Clorox Company

Disinfectant Spray Market Development

In May 2023, SC Johnson launched Family Guard, a new lineup of disinfectant sprays for the porous and nonporous surfaces. The spray is launched as children and pet friendly. The company claims that the spray destroys COVID-19-causing virus.

In June 2023, Lysol announced the launch of its new Lysol Air Sanitizer in the US, the first air sanitizing spray approved by the EPA. The product was introduced to destroy airborne viruses and bacteria while eliminating odors and was introduced as a breakthrough in creating sanitized home environments and reducing illness-causing pathogens.

Disinfectant Spray Market Segmentation

By Type Outlook (Revenue USD Billion, 2020–2034)

- Organic

- Conventional

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Hospitals

- Nursing Homes

- Medical Laboratories

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Disinfectant Spray Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.98 billion |

|

Market Size Value in 2025 |

USD 12.95 billion |

|

Revenue Forecast by 2034 |

USD 26.58 billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The disinfectant spray market size was valued at USD 11.98 billion in 2024 and is projected to grow to USD 26.58 billion by 2034.

The global market is projected to register a significant CAGR of 8.3% during 2025–2034.

North America accounted for the largest global market share in 2024.

A few key players in the market are Reckitt Benckiser Group, Ecolab Inc., Procter and Gamble, 3M, Gojo Industries Inc., Whiteley Corporation, Kimberly- Clark, S.C. Johnson & Son Inc., Medline Industries, and Clorox Company.

The conventional segment dominated the global market in 2024 due to its reliability, accessibility, and established usage.

The hospitals segment is expected to experience significant CAGR in the global market due to strict regulations on hygiene standards.