Disaster Preparedness Systems Market Share, Size, Trends, Industry Analysis Report, By Type; By Solution (Geospatial Solutions, Disaster Recovery Solutions, Situational Awareness Solutions); By Communication Technology; By End-Use; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 115

- Format: PDF

- Report ID: PM2062

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

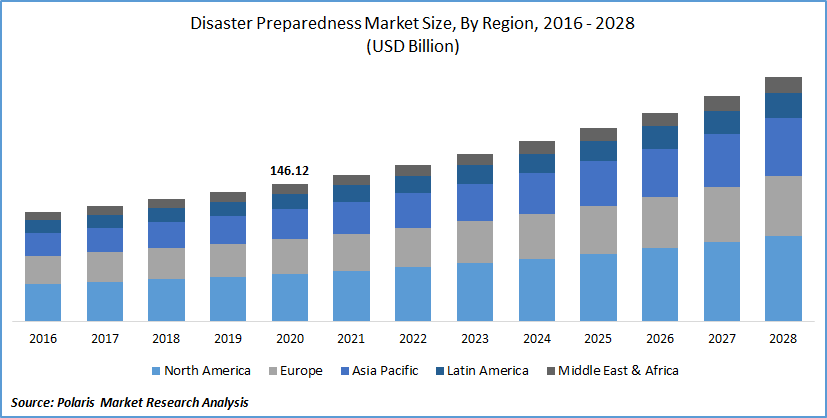

The global disaster preparedness systems market was valued at USD 146.12 billion in 2020 and is expected to grow at a CAGR of 7.6% during the forecast period. The growing number of natural calamities is leading to the increasing adoption of disaster preparedness systems. In addition, rising regulatory policies for population safety tied with the escalating incidences of criminal and terrorist attacks are attributed to the market growth. Furthermore, increasing needs for emergency preparedness & management and the growing adoption of technologically advanced systems and services further boost the disaster preparedness systems market demand across the globe.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The outbreak of COVID-19 witnessed a positive impact on the preparedness systems market owing to the increasing penetration of cloud-based solutions by organizations for protecting their critical data. In the COVID-19 scenario, a tragedy preparedness system is opted for epidemiological contact tracing growing support, vaccinating planning, asset delivery services, and others.

Additionally, numerous companies are focusing on offering tragedy response solutions for COVID-19. For instance, Tetra Tech, Inc. offered emergency management facilities during this pandemic. Therefore, the rapid market development of disaster preparedness systems has been encouraged during this period, which is expected to show an upsurge in the global market of disaster preparedness methods market demand.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing market losses caused by the natural tragedies such as cyclone and floods is propelling the tragedy preparedness systems market demand across the globe. The overall world has witnessed disaster for centuries, and its occurrence causes a huge loss of life and assets.

For instance, in 2018, Indonesia suffered from the highest number of fatalities because of the tsunami and earthquakes. Likewise, in 2018, United States faced most of the deaths due to natural calamities such as heat, wildfire, drought, and tropical cyclones. In between 2010-2019, North American Hurricane Katrina was recorded as four out of five expensive natural disasters. Furthermore, the rising number of government policies regarding emergency preparedness and safety measures also act as a catalyzing factor for the adoption of preparedness systems.

The growing occurrence of natural calamities creates massive economic losses; consequently, several governments enforce the deployment of disaster preparedness systems, further driving the disaster preparedness systems market demand in the upcoming years.

Report Segmentation

The market is primarily segmented on the basis of type, solution, communication technology, end-use, and region.

|

By Type |

By Solution |

By Communication Technology |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Communication Technology

The emergency response radars segment is exhibited with the highest shares and leading the global tragedy preparedness systems market in 2020. These systems are opting for tracing the victims caught in the disaster. It offers data that enables decision-makers and responders to better select and facilitates the emergency response team to locate obscured victims by tracking their heartbeats. As a result, the increasing number of natural tragedies creates the growing need for emergency response radars, leading to segment dominance.

The satellite phones preparedness segment is projected to show the highest CAGR in the foreseen years. Satellite mobile phones are majorly adopted for organizing response and recovery efforts in regions where natural disasters damage the network. This phone facilitates communication with a landline, cellular, and other satellite phones globally. Wireless solution providers are working on linking regular mobile phones with the satellites directly, which is paving the way for segment growth in the near future. For instance, a wireless solution provider- Lynk, declared that the company could link a satellite with a standard mobile phone in March 2020. Thus, these factors lead to segment growth in the estimated year.

Geographic Overview

Geographically, North America is leading the market with the highest number of shares in 2020. Factors such as the government's growing focus on developing and opting for intelligent emergency management and improvement plans for decreasing the response time and lessening the damages of disasters. The presence of numerous vendors coupled with the rising adoption of advanced services and solutions further contributes to the market development in North America. For instance, According to the National Centers for Environmental Information (NCEI), in 2019, 14 climatic and weather disasters occurred, which caused a loss of about USD 1 billion each in the United States.

Asia Pacific is projected to show a significant CAGR in the forecasting years. The increasing amount of government spending for emergency and disaster management systems to protect the population across the region is fuelling the market of preparedness systems growth. Besides, several disaster preparedness systems are implemented in disaster-prone areas, mainly in countries like China and India. For instance, in September 2017, IIT-Roorkee planned to deploy around 84 sensors across the seismic gap areas in North India. Therefore, these factors foster the market growth of the preparedness systems market in the Asia Pacific in the upcoming scenario.

Competitive Insight

Major market players operating in the global preparedness systems include Alertus Technologies LLC, Honeywell International Inc., IBM, Juvare, LLC, Lockheed Martin Corporation, Motorola Solutions, Inc., NEC Corporation, OnSolve, Siemens, and Singlewire Software, LLC.

Disaster Preparedness Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 146.12 billion |

|

Revenue forecast in 2028 |

USD 259.71 billion |

|

CAGR |

7.6% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By Solution, By Communication Technology, By End-Use By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Alertus Technologies LLC, Honeywell International Inc., IBM, Juvare, LLC, Lockheed Martin Corporation, Motorola Solutions, Inc., NEC Corporation, OnSolve, Siemens, and Singlewire Software, LLC. |