Directed Energy Weapons Market Size, Share, Trends, Industry Analysis Report

: By Lethality, Technology, Platform, Application (Defense and Homeland Security), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 125

- Format: PDF

- Report ID: PM3075

- Base Year: 2024

- Historical Data: 2020-2023

Directed Energy Weapons Market Overview

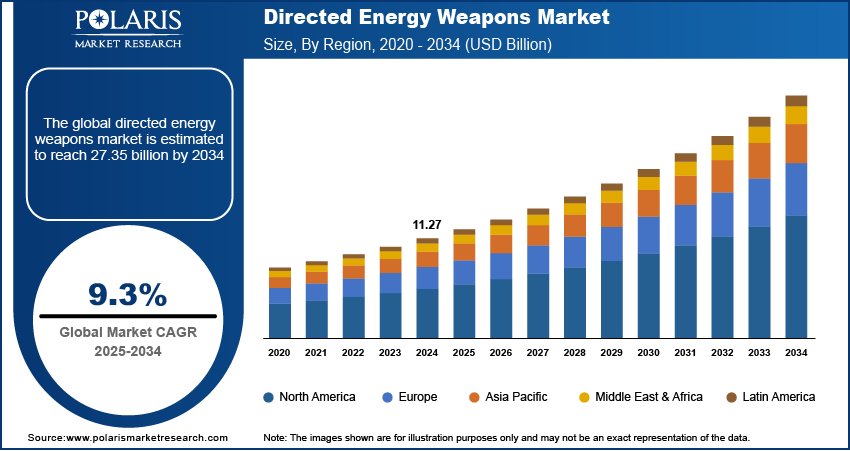

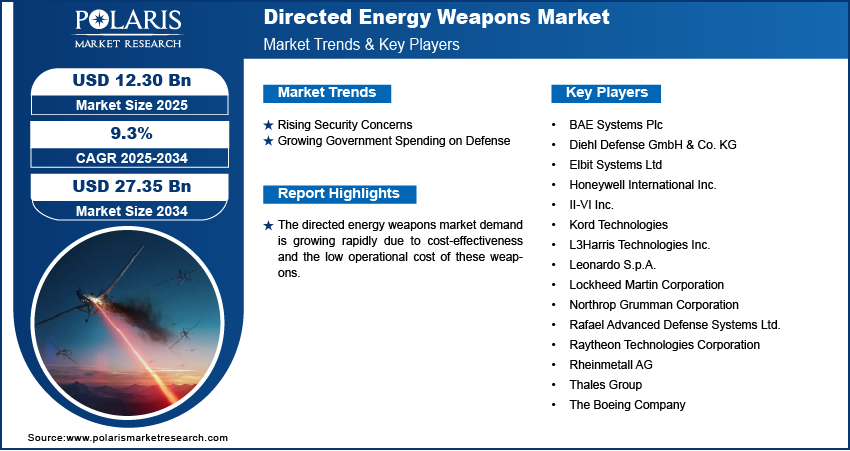

The global directed energy weapons market size was valued at USD 11.27 billion in 2024. The market is projected to grow from USD 12.30 billion in 2025 to USD 27.35 billion by 2034, exhibiting a CAGR of 9.3% from 2025 to 2034.

Directed energy weapons (DEWs) are advanced technologies that use concentrated energy, such as lasers, microwaves, or particle beams, to damage or destroy targets. These weapons can disable or destroy active electronic components, vehicles, or even personnel, offering a new approach to defense and warfare.

The directed energy weapons market growth is driven by continuous technological advancements. Over the years, innovations in laser, microwave, and particle beam technologies have improved the performance, precision, and reliability of DEWs, making them more effective in targeting and neutralizing threats with greater accuracy. As the technology matures, the overall effectiveness of DEWs increases, making them an increasingly attractive option for defense forces. Additionally, advancements in energy efficiency, power generation, and systems miniaturization are expanding the adoption of directed energy systems across various applications, contributing to the market’s continued growth.

To Understand More About this Research: Request a Free Sample Report

The directed energy weapons market demand is growing rapidly due to cost-effectiveness and the low operational cost of these weapons. Unlike traditional weapons that rely on expensive ammunition, DEWs operate with lower operational costs. Once the system is set up, the cost of using a directed energy weapon is relatively low, especially since it doesn't require a continuous supply of ammunition. This cost-effectiveness makes DEWs an attractive option for military organizations, which face budget constraints and are looking for sustainable, long-term defense solutions. The reduced cost per shot, coupled with the lower risk of collateral damage, further fuels the demand for DEWs, driving market growth.

Directed Energy Weapons Market Dynamics

Rising Security Concerns

Rising global security threats, including terrorism and geopolitical tensions, have led nations to focus more on enhancing their defense capabilities. For instance, according to the US Department of State, India alone faced 153 terrorist attacks in 2021, resulting in the loss of 274 lives. This growing security threat has driven the demand for lethal and non-lethal weapons. DEWs offer unique advantages, such as non-lethal options and the ability to disable or destroy targets with minimal collateral damage. These benefits are especially valuable in high-stakes environments where precision and control are essential. As security concerns continue to escalate, military forces are increasingly turning to advanced technologies like DEWs to counter new and evolving threats, thereby driving directed energy weapons market expansion.

Growing Government Spending on Defense

Governments worldwide, particularly in defense-focused nations, are increasing their military budgets to modernize their defense infrastructure. For instance, according to the US House Appropriations Committee, the US government allocated USD 824.3 billion to the military and defense sectors in 2024, an increase of USD 26.8 billion from 2023. This surge in government spending is driving the demand for advanced weapons like DEWs. Nations seeking to maintain military superiority are increasingly turning to innovative systems like DEWs. Thus, growing investments in research and development, coupled with ongoing modernization programs, are fueling the adoption of DEWs, thereby driving the directed energy weapons market development.

Directed Energy Weapons Market Segment Insights

Directed Energy Weapons Market Assessment by Lethality Insights

The directed energy weapons market segmentation, based on lethality, includes non-lethal and lethal. The lethal segment is expected to witness the fastest growth during the forecast period, driven by the increasing demand for more effective military solutions to counter advanced threats such as missiles, drones, and other high-tech weaponry. Lethal DEWs are designed to neutralize or destroy targets with high precision, making them highly valuable in modern defense strategies. Their ability to quickly and accurately eliminate threats while minimizing collateral damage makes them a preferred choice for military forces. Additionally, rising global security challenges are driving the demand for lethal DEWs, fueling segmental growth in the global market.

Directed Energy Weapons Market Evaluation by Application Insights

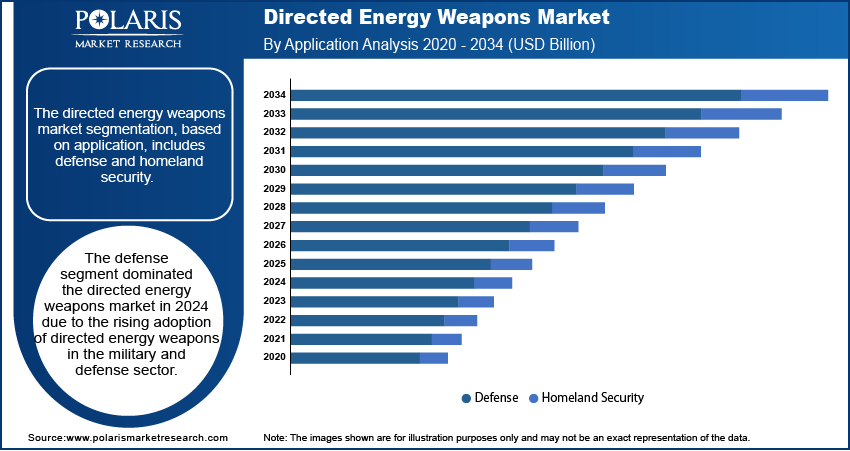

The directed energy weapons market segmentation, based on application, includes defense and homeland security. The defense segment dominated the directed energy weapons market in 2024. Military forces worldwide are increasingly adopting DEWs for their precision, cost-effectiveness, and ability to neutralize threats without causing extensive collateral damage. These weapons are particularly valuable in defense applications, where they can target and disable advanced threats such as drones, missiles, and aircraft. The ability to quickly engage multiple targets with minimal resources makes DEWs an attractive option for defense agencies, fueling their adoption in the sector.

Directed Energy Weapons Market Regional Analysis

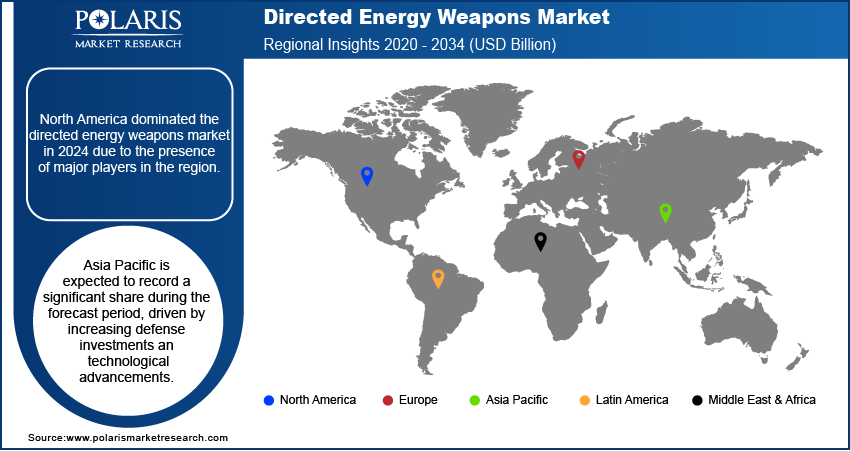

By region, the study provides directed energy weapons market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024 due to the presence of major players in the region. The US, in particular, is home to key defense contractors and government agencies that are heavily investing in directed energy weapons technologies for military and security purposes. These companies are driving innovation, research, and development, advancing more effective and reliable directed energy systems. Additionally, the US military’s focus on modernizing defense capabilities and countering emerging threats boosts demand for DEWs in the region.

The Asia Pacific directed energy weapons market is expected to record a significant share during the forecast period, driven by increasing defense investments and technological advancements. Countries like China and Japan are focusing heavily on modernizing their military forces and enhancing defense capabilities. Additionally, growing tensions in the region have led to a higher demand for advanced, cost-effective solutions to counter emerging threats such as missiles and drones. DEWs offer a promising solution, providing high precision and reduced operational costs. Ongoing military modernization programs across several Asia Pacific nations are accelerating the adoption of these systems, further propelling market growth in the region.

The India directed energy weapons market is growing rapidly, driven by the government’s increased focus on defense spending and military modernization. To address evolving security challenges, India is making significant investments in advanced defense technologies. In 2023, the Indian Ministry of Defense allocated USD 75 billion to strengthen the country’s military capabilities, highlighting its commitment to national security. Additionally, the push for greater private sector participation in defense is accelerating innovation and technological advancements. This shift is enhancing the development and deployment of directed energy weapons, further propelling market growth in India.

Directed Energy Weapons Market – Key Players and Competitive Insights

The directed energy weapons market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the directed energy weapons market include Elbit Systems Ltd; Diehl Defense GmbH & Co. KG; Honeywell International Inc.; BAE Systems Plc; II-VI Inc.; Kord Technologies; Leonardo S.p.A.; L3Harris Technologies Inc.; Northrop Grumman Corporation; Lockheed Martin Corporation; Rafael Advanced Defense Systems Ltd.; Rheinmetall AG; Raytheon Technologies Corporation; The Boeing Company; and Thales Group.

Lockheed Martin Corporation, based in Bethesda, Maryland, is a prominent aerospace and defense manufacturer. Established in 1995 through the merger of Lockheed Corporation and Martin Marietta, the company serves both the US government and international clients. Lockheed Martin operates through four primary business segments: aeronautics, missiles and fire control, rotary and mission systems, and space. The aeronautics segment focuses on military aircraft, including the F-35 Lightning II. The missiles and fire control segment develops missile systems and precision strike weapons. The rotary and mission systems segment is involved in manufacturing helicopter simulatorv, such as those produced by Sikorsky, as well as various mission systems for defense applications. The space segment encompasses satellite systems and technologies related to space exploration. Lockheed Martin has operations in various regions, including the Americas, Europe, Asia Pacific, Africa, and the Middle East. A substantial portion of its revenue is derived from contracts with the US Department of Defense. Lockheed Martin offers laser weapon systems, including HELIOS, ATHENA, and LLNL, for defense applications like rockets and missiles defense and drone neutralization.

Honeywell International Inc. is an American multinational conglomerate based in Charlotte, North Carolina. The company was formed in 1999 through the merger of Honeywell Inc. and AlliedSignal. It operates across four primary business segments: aerospace, building technologies, performance materials and technologies, and safety and productivity solutions. In the aerospace segment, Honeywell provides products such as avionics, aircraft engines, and flight management systems for commercial aviation, defense, and space industries. The building technologies segment focuses on energy management, building automation, fire safety systems, and security solutions. These offerings are designed to improve operational efficiency and safety in both commercial and residential buildings. The performance materials and technologies division specializes in high-performance materials and process technologies for the oil & gas sector, along with automation solutions for various industrial applications. The safety and productivity solutions segment includes personal protective equipment (PPE)v, industrial safety products, and software aimed at enhancing productivity across sectors like logistics, healthcare, and manufacturing. Honeywell operates globally with a significant presence in North America, Europe, Asia Pacific, and other regions. Its diverse portfolio serves industries such as aerospace, refining, petrochemicals, manufacturing, utilities, and building management. The company is also involved in digital transformation initiatives through its Honeywell Forge platform, which connects assets to optimize performance. Honeywell International Inc. provides advanced power and cooling solutions for directed energy weapons, ensuring efficiency, reliability, and enhanced battlefield performance.

List of Key Companies in Directed Energy Weapons Market

- BAE Systems Plc

- Diehl Defense GmbH & Co. KG

- Elbit Systems Ltd

- Honeywell International Inc.

- II-VI Inc.

- Kord Technologies

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Rheinmetall AG

- Thales Group.

- The Boeing Company

Directed Energy Weapons Industry Developments

In May 2024: The US Army Space and Missile Defense Command awarded BlueHalo a $95.4 million contract under the LARDO program to enhance directed energy solutions for aerial drones, focusing on automation and ruggedization.

In December 2023: Raytheon (RTX division) was selected by the Air Force and Navy for the DEFEND program, focusing on high-power microwave systems that disable electronic components via energy blasts.

Directed Energy Weapons Market Segmentation

By Lethality Outlook (Revenue, USD Billion, 2020–2034)

- Non-Lethal

- Lethal

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- High Power Microwave Technology

- High Energy Laser Technology

- Plasma Weapons

- Particle Beam Weapons

- Sonic Weapons

By Platform Outlook (Revenue, USD Billion, 2020–2034)

- Ship-Based

- Land-Based

- Airborne-Based

- Space-Based

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Defense

- Homeland Security

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Directed Energy Weapons Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 11.27 billion |

|

Market size value in 2025 |

USD 12.30 billion |

|

Revenue Forecast by 2034 |

USD 27.35 billion |

|

CAGR |

9.3% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The directed energy weapons market size was valued at USD 11.27 billion in 2024 and is projected to grow to USD 27.35 billion by 2034.

The global market is projected to register a CAGR of 9.3% during the forecast period, 2025–2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Elbit Systems Ltd; Diehl Defense GmbH & Co. KG; Honeywell International Inc.; BAE Systems Plc; II-VI Inc.; Kord Technologies; Leonardo S.p.A.; L3Harris Technologies Inc.; Northrop Grumman Corporation; Lockheed Martin Corporation; Rafael Advanced Defense Systems Ltd.; Rheinmetall AG; Raytheon Technologies Corporation; The Boeing Company; and Thales Group.

The defense segment dominated the market in 2024 due to the rising adoption of directed energy weapons in the military and defense sector.

The lethal segment is expected to witness the fastest growth during the forecast period due to increasing demand for more effective military solutions to counter advanced threats such as missiles, drones, and other high-tech weaponry.