Direct to Shape Printer Market Size, Share, Trends, Industry Analysis Report: By Technology (Inkjet, Laser, and Others), Ink Type, Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5534

- Base Year: 2024

- Historical Data: 2020-2023

Direct to Shape Printer Market Overview

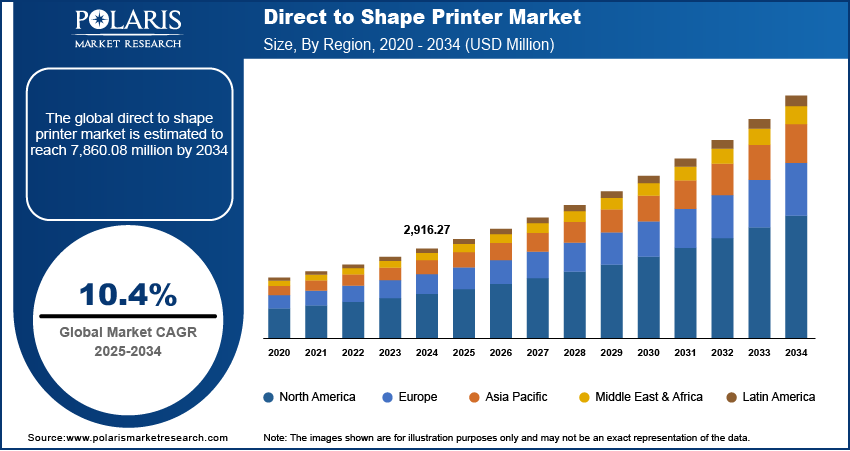

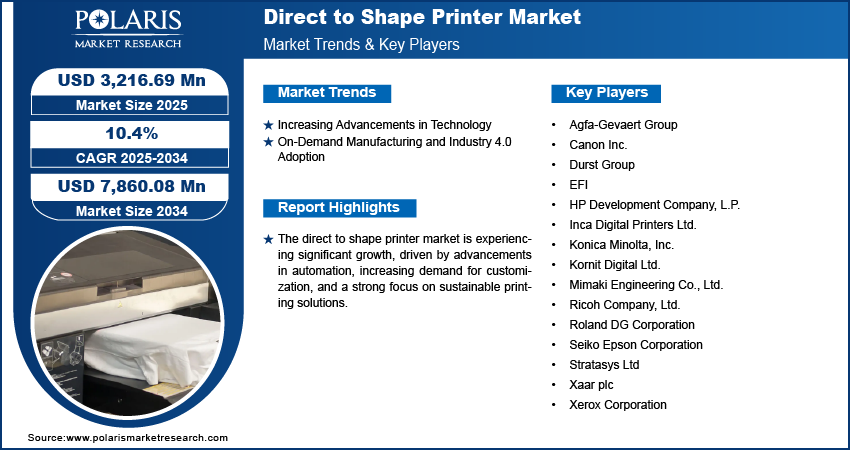

The global direct to shape printer market was valued at USD 2,916.27 million in 2024. The market is expected to grow from USD 3,216.69 million in 2025 to USD 7,860.08 million by 2034, at a CAGR of 10.4% from 2025 to 2034.

Direct to shape printing refers to the technology that enables direct printing onto three-dimensional objects without requiring labels or additional substrates. The increasing demand for customization and personalization drives the direct to shape printing market growth. Industries such as packaging, consumer goods, and healthcare are leveraging this technology to create unique, high-quality designs that enhance brand recognition and customer engagement. For instance, in January 2024, Roland DG Corporation launched the MO-240, a UV flatbed printer for 3D objects, offering higher productivity, expanded color gamut, and compatibility with various materials. It features advanced print heads, UV-LED curing, and intuitive operation for diverse applications. The ability to print directly on diverse materials such as plastic, glass, and metal allows manufacturers to cater to consumer preferences for exclusive and tailored products, reinforcing brand identity and fulfilling customer loyalty.

To Understand More About this Research: Request a Free Sample Report

Another driver shaping the direct to shape printer market development is the rising emphasis on sustainability and eco-friendliness. Direct to shape printing emerges as a feasible solution by eliminating excess packaging materials as industries seek to minimize waste and reduce reliance on traditional labeling methods. For instance, in March 2023, HP launched the color laser jet 4200/4300 and enterprise 5000/6000/X500/X600 printers, featuring sustainable toner for reduced energy use and plastic waste management. They aim to improve productivity and scalability for businesses of all sizes designed for hybrid workstyles. The technology supports sustainable manufacturing practices by reducing ink usage, energy consumption, and overall production waste. Additionally, advancements in eco-friendly ink formulations and energy-efficient printing systems align with global sustainability goals, making DTS printers an attractive option for businesses seeking to enhance their environmental responsibility.

Direct to Shape Printer Market Dynamics

Increasing Advancements in Technology

Continuous innovations in print head technology, high-resolution imaging, and improved ink formulations have enhanced the efficiency, precision, and versatility of direct to shape printing solutions. For instance, in September 2024, HP launched HP Print AI, an intelligent printing solution to simplify and improve printing experiences. Its first feature, Perfect Output, optimizes web content for printing, eliminating ads and unnecessary elements, saving time, paper, and ink while ensuring high-quality results. These advancements allow high-speed printing on complex surfaces with superior adhesion and durability, expanding the applicability of direct to shape printers across various industries, such as packaging, automotive, and healthcare. Additionally, the integration of artificial intelligence (AI) and automation in DTS printing systems has streamlined operations, reduced production errors, and improved cost efficiency, making it a preferred choice for manufacturers seeking advanced printing solutions. Thus, rising technological advancements are driving the direct to shape printer market expansion.

On-Demand Manufacturing and Industry 4.0 Adoption

The shift toward digitalized production processes and just-in-time manufacturing has increased the demand for flexible and efficient printing solutions. Direct to shape printers align with Industry 4.0 principles by offering seamless integration with smart manufacturing ecosystems, allowing real-time customization, data-driven production, and reduced inventory costs. For instance, in June 2024, Roland DGA launched the VersaOBJECT CO-i Series UV-LED flatbed printers, offering direct printing on substrates and 3D objects up to 9.5 inches tall. Featuring advanced ink options, ergonomic design, and cloud-based tools, they enhance versatility, precision, and workflow efficiency. The ability to print directly on various substrates without pre-treatment or additional processing enhances production agility, allowing manufacturers to respond quickly to changing consumer demands while optimizing supply chain efficiency. As a result, the growing popularity of on-demand manufacturing and rising Industry 4.0 adoption is propelling the direct to shape printer market development.

Direct to Shape Printer Market Segment Insights

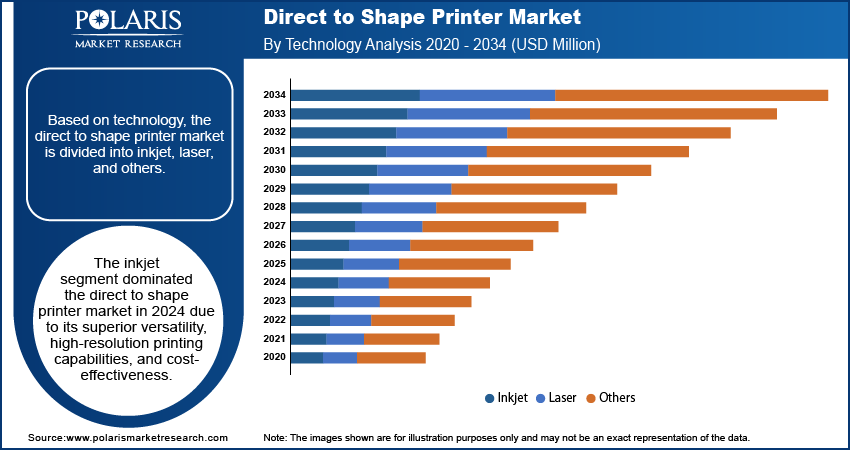

Direct to Shape Printer Market Assessment by Technology Outlook

The global direct to shape printer market assessment, based on technology, includes inkjet, laser, and others. The inkjet segment dominated the market in 2024 due to its superior versatility, high-resolution printing capabilities, and cost-effectiveness. Inkjet technology allows precise and efficient printing on a wide range of materials, such as plastic, glass, and metal, making it the preferred choice for industries such as packaging, consumer goods, and electronics. Advancements in ink formulations, including UV-curable and water-based inks, have improved durability, adhesion, and eco-friendliness, further driving its adoption. The ability to support high-speed, on-demand production while maintaining print quality has solidified inkjet technology as the dominant segment in the market.

Direct to Shape Printer Market Evaluation by End Use Outlook

The direct to shape printer market evaluation, based on end use, includes cosmetics & personal care, automotive, electronics, food & beverage, toys & sporting goods, and others. The toys & sporting goods segment is expected to witness substantial growth during the forecast period due to the increasing demand for product customization and brand differentiation. Manufacturers in this sector are leveraging DTS printing to create vibrant, high-quality designs directly on toys, sports equipment, and collectibles, enhancing aesthetic appeal and consumer engagement. The growing preference for sustainable and label-free printing solutions further supports the adoption of direct to shape printers, as they minimize material waste while ensuring durability. Additionally, advancements in digital printing technology have allowed cost-effective, short-run production, allowing brands to introduce limited-edition and personalized products efficiently.

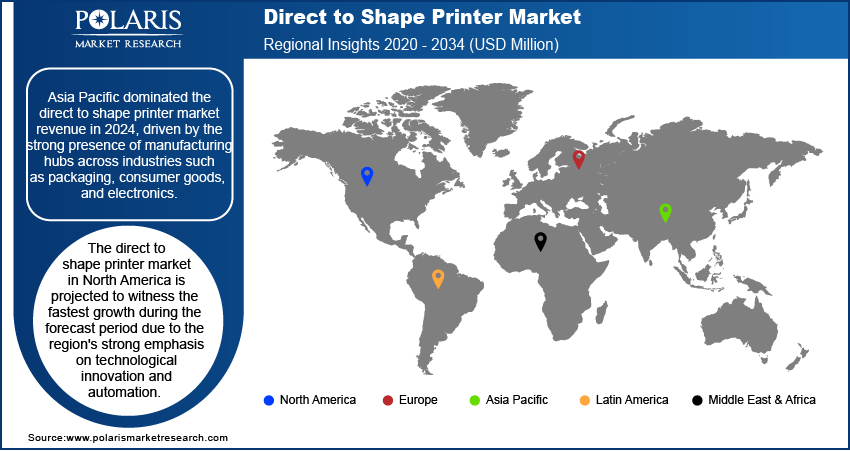

Direct to Shape Printer Market Regional Analysis

By region, the report provides the direct to shape printer market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the direct to shape printer market in 2024, driven by the strong presence of manufacturing hubs across industries such as packaging, consumer goods, and electronics. The region's rapid industrialization, coupled with increasing investments in advanced printing technologies, has fueled the adoption of direct to shape printers. For instance, in October 2024, FUJIFILM India collaborated with Sri Lanka’s Advance Digital Graphics to improve the digital printing landscape. The collaboration integrates Fujifilm’s advanced printing technology to deliver superior quality, productivity, and sustainable solutions across commercial, packaging, and photo sectors. Additionally, the rising demand for sustainable and customized printing solutions among manufacturers in countries such as China, Japan, and India has contributed to growth opportunities. The availability of cost-effective production facilities and the presence of key market players have also played a significant role in establishing Asia Pacific as the leading region in the DTS printer market.

The direct to shape printer market size in North America is projected to witness the fastest growth during the forecast period due to the region's strong emphasis on technological innovation and automation. The growing adoption of Industry 4.0 principles, such as smart manufacturing and digitalized production processes, has driven demand for direct to shape printing solutions across various industries. Additionally, the rising preference for sustainable and eco-friendly printing technologies, coupled with increasing investments in on-demand and mass customization, has accelerated expansion opportunities. For instance, in March 2022, Kodak collaborated with GDM to integrate Kodak’s high-speed inkjet technology into disposable hygiene production lines. This collaboration enables GDM to offer digital printing solutions for decorative designs and instructions, enhancing efficiency and quality in disposable hygiene product manufacturing. The presence of major industry players and the growing demand for high-quality, precision-based printing solutions further support the rapid growth of the direct to shape printer market in North America.

Direct to Shape Printer Market – Key Players and Competitive Insights

The competitive landscape features global leaders and regional players competing for direct to shape printer market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Direct to shape printer market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions.

The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with direct to shape printer market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the direct to shape printer industry's growth is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, assuring sustained growth in a hypercompetitive global market. A few key major players are Agfa-Gevaert Group; Canon Inc.; Durst Group; EFI; HP Development Company, L.P.; Inca Digital Printers Ltd.; Konica Minolta, Inc.; Kornit Digital Ltd.; Mimaki Engineering Co., Ltd.; Ricoh Company, Ltd.; Roland DG Corporation; Seiko Epson Corporation; Stratasys Ltd; Xaar plc; and Xerox Corporation.

Xaar plc is a global manufacturer of industrial inkjet printheads specializing in piezo-based drop-on-demand technologies. Founded in 1990 in Cambridge, UK, Xaar has been at the forefront of transforming industries through digital inkjet solutions. The company's printheads are renowned for their precision and reliability, making them a preferred choice for various manufacturing applications, including direct-to-shape printing. This technology allows for the precise application of inks and fluids onto complex shapes, improving efficiency and productivity in sectors such as packaging, product decoration, and advanced manufacturing. Xaar's business model is centered around designing, manufacturing, and marketing its printheads to Original Equipment Manufacturers (OEMs) and User Developer Integrators (UDIs). The company's commitment to innovation is evident in its substantial R&D investments, with a substantial portion of its revenue dedicated to research and development. Xaar's technology has been instrumental in converting traditional analog printing methods to digital, offering benefits such as increased efficiency, cost-effectiveness, and versatility. Xaar continues to drive innovation and growth in the direct-to-shape printing sector through its cutting-edge printhead technologies and strategic partnerships with a strong presence in multiple markets, including graphics, labeling, and ceramic tile decoration.

Seiko Epson Corporation manufactures high-tech information-related equipment, such as printers, scanners, and industrial robots. Founded in 1942, Epson has a diverse portfolio that contains inkjet printers, large-format printers, and related supplies. Epson is renowned for its inkjet technologies, particularly in textile printing. Epson's expertise in inkjet technology is well-adapted for direct-to-shape applications due to the overlap in printing technologies. Epson's innovations in textile printing, such as its direct-to-garment and direct-to-film printers, demonstrate its capability to develop advanced printing solutions. The company's commitment to sustainability and quality is apparent in its textile printing technologies, which aim to transform the textile industry by offering eco-friendly alternatives to traditional analog printing methods. Epson's technological advancements in inkjet printing could be leveraged to explore opportunities in the direct to shape printer market.

List of Key Companies in Direct to Shape Printer Market

- Agfa-Gevaert Group

- Canon Inc.

- Durst Group

- EFI

- HP Development Company, L.P.

- Inca Digital Printers Ltd.

- Konica Minolta, Inc.

- Kornit Digital Ltd.

- Mimaki Engineering Co., Ltd.

- Ricoh Company, Ltd.

- Roland DG Corporation

- Seiko Epson Corporation

- Stratasys Ltd

- Xaar plc

- Xerox Corporation

Direct to Shape Printer Industry Developments

March 2025: Epson launched the EcoTank L3250, an A4 Wi-Fi all-in-one ink tank printer for home use. It offers high print yields, borderless photo printing, wireless connectivity, and energy-efficient Heat-Free Technology, with spill-free refilling and mobile app management.

February 2025: Epson launched its first Direct-to-Film (DTFilm) printer, the SC-G6000, targeting the textile printing market. Featuring automated maintenance, PrecisionCore technology, and UltraChrome DF ink, it offers high-quality, versatile transfers with minimal manual intervention, supported by user-friendly Edge Print Pro software.

May 2024: ColorJet launched the Polo Earth, a 3.2-meter eco-solvent printer, and partnered with Kromodyne Digital Solutions to introduce sustainable polyethylene substrate. This initiative promotes eco-friendly large-format printing, combining high performance with environmental responsibility for indoor and outdoor applications.

Direct to Shape Printer Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Inkjet

- Laser

- Others

By Ink Type Outlook (Revenue, USD Million, 2020–2034)

- UV-Based

- Solvent-Based

- Aqueous-Based

By Type Outlook (Revenue, USD Million, 2020–2034)

- Single Pass

- Multi Pass

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Cosmetics & Personal Care

- Automotive

- Electronics

- Food & Beverage

- Toys & Sporting Goods

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Direct to shape printer Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,916.27 million |

|

Market Size Value in 2025 |

USD 3,216.69 million |

|

Revenue Forecast by 2034 |

USD 7,860.08 million |

|

CAGR |

10.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global direct to shape printer market size was valued at USD 2,916.27 million in 2024 and is projected to grow to USD 7,860.08 million by 2034.

The global market is projected to register a CAGR of 10.4% during the forecast period.

Asia Pacific dominated the market in 2024.

Some of the key players in the market are Agfa-Gevaert Group; Canon Inc.; Durst Group; EFI; HP Development Company, L.P.; Inca Digital Printers Ltd.; Konica Minolta, Inc.; Kornit Digital Ltd.; Mimaki Engineering Co., Ltd.; Ricoh Company, Ltd.; Roland DG Corporation; Seiko Epson Corporation; Stratasys Ltd; Xaar plc; and Xerox Corporation.

The inkjet segment dominated the direct to shape printer market expansion in 2024 due to its superior versatility and high-resolution printing capabilities.

The toys & sporting goods segment is expected to witness substantial growth during the forecast period due to the increasing demand for product customization and brand differentiation.