Digital X-Ray Market Share, Size, Trends, Industry Analysis Report – By Type (Analog X-ray Systems and Digital X-ray Systems), Technology, Portability, Systems, Price Range, Application, End user, and Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) - Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 118

- Format: PDF

- Report ID: PM5165

- Base Year: 2024

- Historical Data: 2020-2023

Digital X-Ray Market Outlook

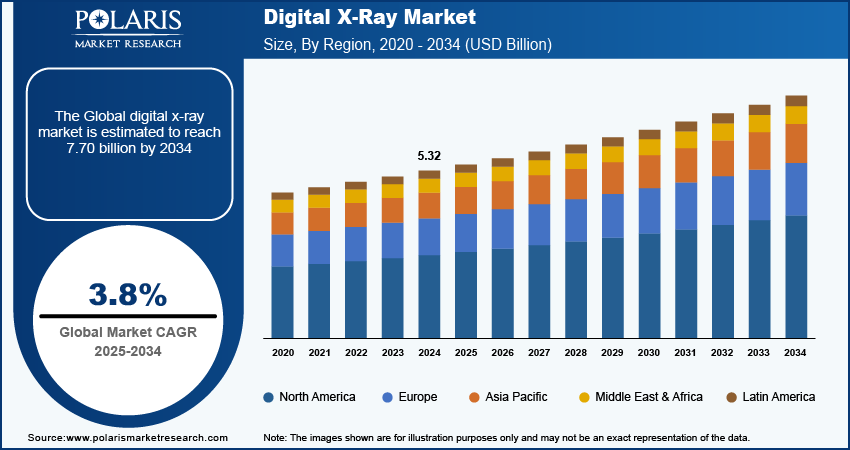

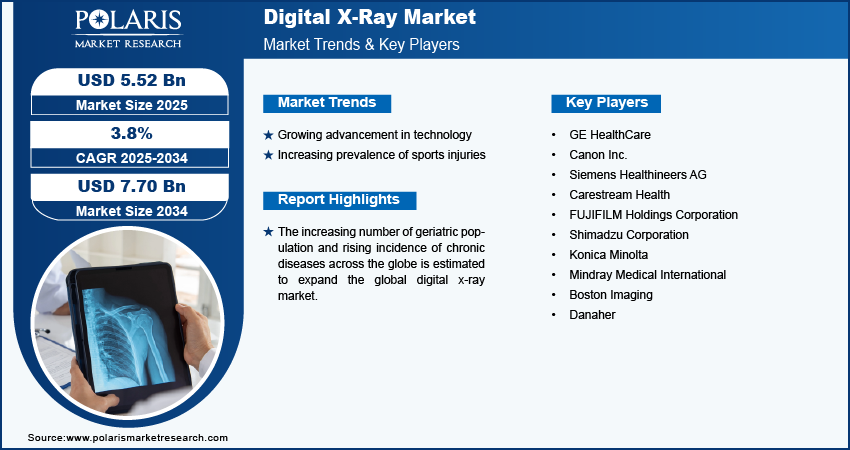

The digital x-ray market size was valued at USD 5.32 billion in 2024. The market is anticipated to grow from USD 5.52 billion in 2025 to USD 7.70 billion by 2034, exhibiting a CAGR of 3.8% during 2025–2034.

Market Overview

The global digital x-ray market has witnessed substantial growth in recent years, largely due to the rapid pace of technological advancements. These advancements have led to the development of more efficient and accurate imaging solutions, such as advanced digital x-ray systems, thereby meeting the increasing demand for such services. The rising prevalence of chronic diseases worldwide has further bolstered the need for efficient diagnostic imaging services, including digital x-ray.

To Understand More About this Research: Request a Free Sample Report

The burden of chronic diseases is increasing globally, with the World Health Organization (WHO) estimating that chronic diseases are responsible for 61% of all deaths and is expected to increase to 70% by 2030.

The shift toward digitalization in the healthcare industry with the growing adoption of PACS (picture archiving and communication systems) contributes to the growth of the digital x-ray market. Moreover, the rising investments in healthcare infrastructure in emerging countries and the growing geriatric population boost the market. For instance,

According to a report published by the United Nations, the number of people aged 65 years or older worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion in 2050.

Growth Drivers

Increased Prevalence of Cancer Expand Market Growth

The increasing prevalence of cancer drives the demand for digital x-ray systems. Early detection is crucial for effective cancer treatment and improved survival rates. Digital X-ray systems offer high-resolution imaging that helps in detecting abnormalities at an early stage. Therefore, as cancer cases rise, the demand for technologies such as digital x-ray also increases. For instance,

As per a report published by the World Health Organization (WHO), over 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022.

Increasing Number of Sports Injury Cases Propels Market Growth

The rising number of sports injuries is estimated to fuel the digital x-ray market. Sports injuries often require quick and accurate imaging to diagnose fractures, dislocations, and other musculoskeletal injuries. Digital X-rays provide high-resolution images almost instantly, which allows for faster diagnosis and treatment decisions. Thus, the increasing incidence of sports injuries is propelling the market. For instance,

According to the National Safety Council (NSC), Sports and recreational injuries increase 2% in 2023.

Restraining Factors

High Costs Associated with Digital X-ray Systems Hamper Market Growth

Digital X-ray systems require a significant upfront investment, which can be a barrier for smaller medical facilities, clinics, and sports medicine practices to adopt these systems, leading to fewer sales. Thus, premium costs associated with digital x-ray systems obstruct the growth of the market.

Digital X-ray Market Segment Insights

By Type Analysis

Digital X-ray Segment Held Larger Market Share in 2024

The digital x-ray segment accounted for a larger market share of the market in 2024 owing to its advanced imaging capabilities and efficiency. Digital systems provide high-resolution images with greater detail and clarity compared to traditional analog X-ray machines. This superior image quality enhances diagnostic accuracy, enabling early detection and better management of conditions such as cancer and musculoskeletal injuries. Furthermore, digital systems offer immediate image acquisition and review, streamlining workflows in busy clinical settings. The reduction in radiation exposure and the elimination of film processing also contribute to the growing adoption of digital x-ray systems.

By Technology Analysis

Direct Radiography Segment Accounted for Major Market Share in 2024

The direct radiography segment accounted for a major market share in 2024 due to its superior image quality, faster image acquisition, and reduced patient radiation dose. DR systems enable immediate image viewing and analysis, which enhances diagnostic efficiency and workflow in medical facilities. The growing demand for rapid and accurate imaging, particularly in emergency settings and high-throughput environments, has driven the widespread adoption of DR technology. Additionally, the ability of DR systems to integrate seamlessly with electronic health records (EHR) and other digital tools further contributes to their dominance in the market.

By End-user Analysis

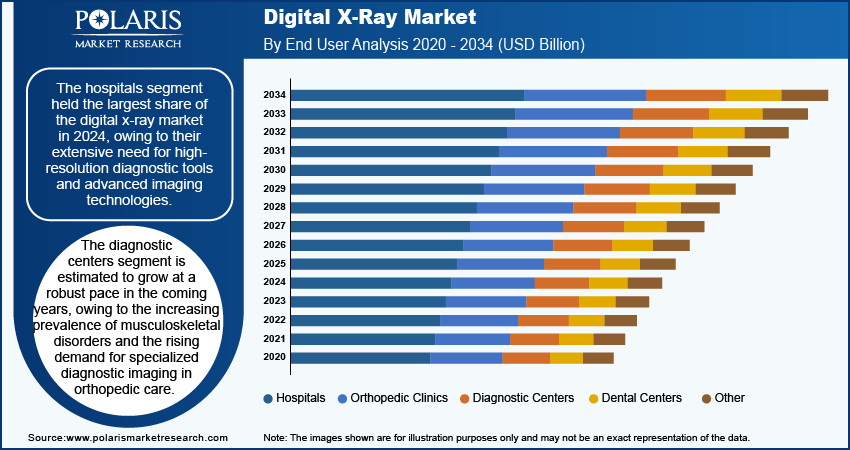

Hospitals Held Significant Market Revenue Share in 2024

The hospitals segment held the largest share of the digital x-ray market in 2024, owing to their extensive need for high-resolution diagnostic tools and advanced imaging technologies. Hospitals offer a broad range of medical services, requiring a variety of imaging modalities to support comprehensive patient care. The adoption of digital radiography in hospitals is also propelled by the increasing demand for early disease detection and the need to improve patient outcomes. Moreover, hospitals benefit from the economies of scale, making the investment in advanced imaging technology more feasible compared to smaller medical facilities.

Digital X-Ray Market Regional Insights

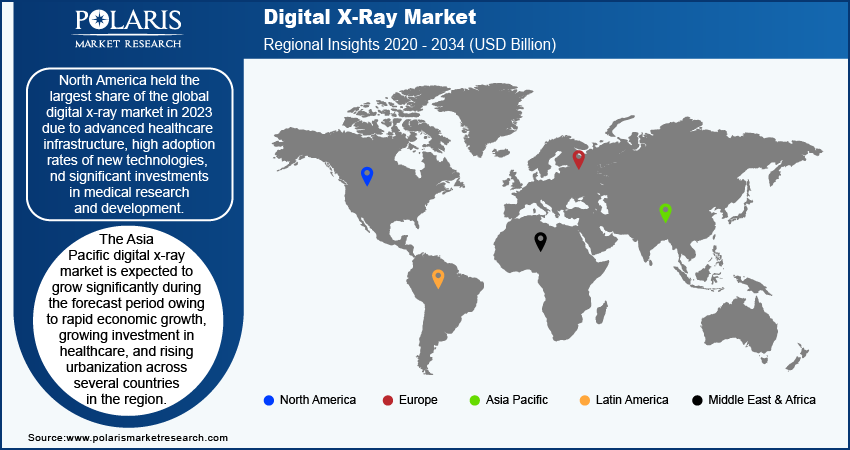

North America Accounted for Largest Market Share in 2024

North America held the largest share of the global digital x-ray market in 2024 due to advanced healthcare infrastructure, high adoption rates of new technologies, and significant investments in medical research and development. The region's extensive network of well-funded hospitals and diagnostic centers contributes to a robust demand for cutting-edge imaging solutions. Additionally, North America benefits from a high prevalence of chronic diseases and an aging population, which further fuels the need for accurate and efficient diagnostic tools such as digital x-ray. For instance,

According to a report published by the American Hospital Association, an estimated 133 million Americans, nearly half the population, suffer from at least one chronic illness.

The Asia Pacific digital x-ray market is expected to grow significantly during the forecast period owing to rapid economic growth and urbanization across several countries in the region, which significantly expanded healthcare infrastructure and increased access to advanced medical technologies. Emerging economies such as China and India are investing heavily in modernizing their healthcare systems, including the integration of imaging solutions. The growing population, rising awareness of health issues, and increasing healthcare expenditures in these countries contribute to the rising demand for high-quality diagnostic imaging. Additionally, government initiatives aimed at improving healthcare access and upgrading medical facilities are expected to further drive the digital x-ray market in Asia Pacific.

Key Market Players and Competitive Insights

Prominent market players are investing heavily in research and development in order to expand their offerings, which will help the digital x-ray market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. Major players in the digital x-ray market include GE HealthCare; Canon Inc.; Siemens Healthineers AG; Carestream Health; FUJIFILM Holdings Corporation; Shimadzu Corporation.

List of Key Companies in Digital X-ray Market

- GE HealthCare

- Canon Inc.

- Siemens Healthineers AG

- Carestream Health

- FUJIFILM Holdings Corporation

- Shimadzu Corporation

- Konica Minolta

- Mindray Medical International

- Boston Imaging

- Danaher

Recent Developments in Industry

- In January 2024, Carestream Health, a global company that provides medical imaging systems, IT solutions, and other services, introduced a new DRX-Excel Plus X-ray system, enhancing productivity, image quality, and patient experience.

- In July 2023, Canon Inc., a Japan-based multinational corporation that specializes in imaging, optical, and industrial products, announced the launch of a highly versatile Digital X-ray RF System, "Zexira i9," with high image quality and low dose, designed to enhance clinical efficiency and patient care.

Report Coverage

The digital x-ray market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the world. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, technology, portability, systems, price range, application, end user, and their futuristic growth opportunities.

Report Segmentation

The digital x-ray market is primarily segmented on the basis of type, technology, portability, systems, price range, application, end user, and region.

By Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Analog X-ray System

- Digital X-ray System

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Direct Radiography

- Computed Radiography

By Portability Outlook (Revenue, USD Billion, 2020 - 2034)

- Fixed Digital X-ray System

- Portable Digital X-ray System

By System Outlook (Revenue, USD Billion, 2020 - 2034)

- Retrofit Digital X-ray System

- New Digital X-ray System

By Price Range Outlook (Revenue, USD Billion, 2020 - 2034)

- Low-range

- Mid-range

- High-range

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Chest Imaging

- Orthopedic

- Cardiovascular Imaging

- Pediatric Imaging

- Dental

- Cancer

- Other

By End user Outlook (Revenue, USD Billion, 2020 - 2034)

- Hospitals

- Orthopedic Clinics

- Diagnostic Centers

- Dental Centers

- Other

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital X-Ray Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2025 |

USD 5.52 billion |

|

Revenue Forecast in 2034 |

USD 7.70 billion |

|

CAGR |

3.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Digital X-Ray Industry Trends Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global digital x-ray market size was valued at USD 5.32 billion in 2024 and is projected to grow to USD 7.70 billion by 2034

The global market is projected to grow at a CAGR of 3.8% during the forecast period.

North America had the largest share of the global market.

The key players in the market are GE HealthCare; Canon Inc.; Siemens Healthineers AG; Carestream Health; FUJIFILM Holdings Corporation; Shimadzu Corporation; Konica Minolta; Mindray Medical International; Boston Imaging; and Danaher.

The digital x-ray type segment is projected for significant growth in the global market.

The hospital segment dominated the digital x-ray market in 2024.