Digital Thread Market Size, Share, Trends, Industry Analysis Report: By Technology, Module, Deployment (Cloud and On-Premise), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5297

- Base Year: 2024

- Historical Data: 2020-2023

Digital Thread Market Overview

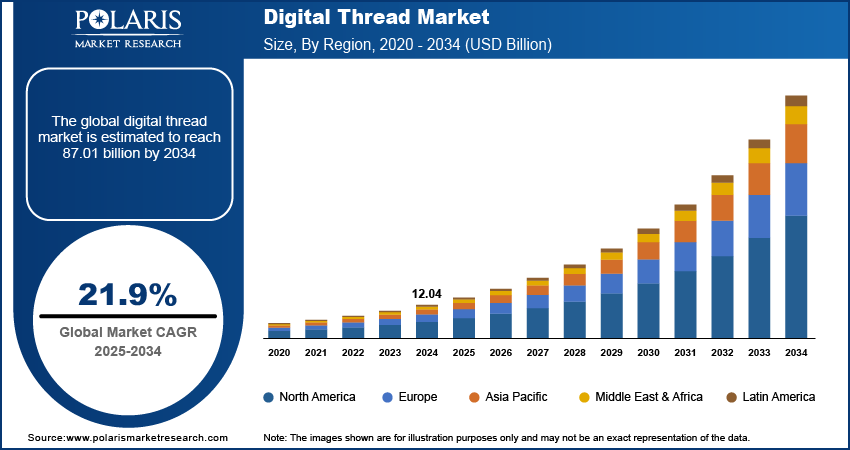

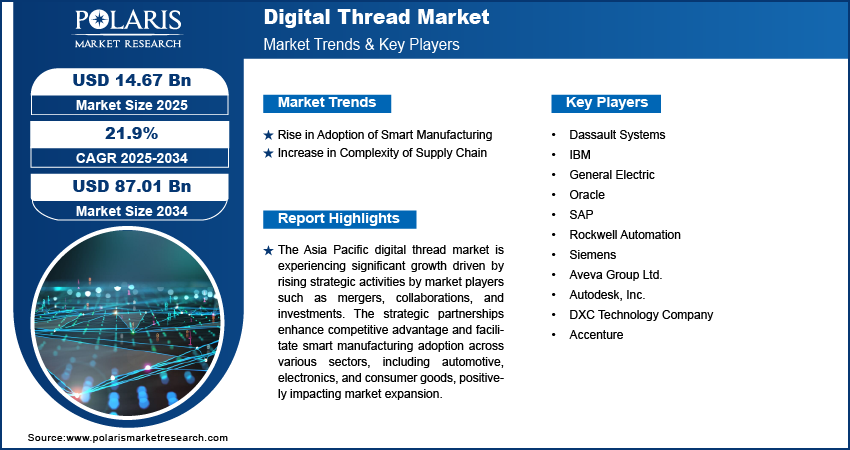

The global digital thread market size was valued at USD 12.04 billion in 2024. The market is projected to grow from USD 14.67 billion in 2025 to USD 87.01 billion by 2034, exhibiting a CAGR of 21.9% during 2025–2034.

Digital thread is a communication framework that connects traditionally siloed elements in manufacturing and product development. It enables a seamless flow of information across all stages of a product's lifecycle, from designing and engineering to production, maintenance, and end-of-life.

An increase in the adoption of Industry 4.0 drives the digital thread market growth. As manufacturers increasingly adopt smart manufacturing practices, the need for seamless data connectivity throughout the product lifecycle has grown. Digital threads enable real-time communication and collaboration between different systems, significantly improving operational efficiency and decision-making speed. According to Invest India, the adoption rate of Industry 4.0 in India is at 51%, indicating a growing recognition of the necessity for advanced digital solutions among businesses. By utilizing IoT, AI, and data analytics, digital threads offer a comprehensive view of operations, allowing manufacturers to optimize performance and enhance product quality. As the adoption of Industry 4.0 continues to increase for seamless operational processes, the demand for digital thread technologies is growing substantially.

To Understand More About this Research: Request a Free Sample Report

The rising demand for real-time data and analytics across industries propels the digital thread market expansion. Organizations have started adopting real-time data analytics software due to the increasing need for operational efficiency and informed decisions. Digital thread technologies facilitate this demand by integrating data from various sources, providing a comprehensive view of processes and product performance. According to IBM, a recent survey revealed that 72% of organizations consider real-time analytics critical for their competitive advantage. This focus on timely insights allows companies to quickly identify issues, optimize production, and respond to market changes. Thus, an increase in demand for real-time data analytics is expected to fuel the digital thread market development during the forecast period.

Digital Thread Market Drivers

Rise in Government Initiatives for Adoption of Smart Manufacturing

Government initiatives aimed at training workers and providing funding for improved production output increase the adoption of smart manufacturing practices. The Ministry of Heavy Industry of India has launched the CEFC (Center of Excellence for Smart Manufacturing) initiative to assist startups in adopting smart manufacturing practices. This center is designed as a versatile facility with interconnected smart machinery that simulates a comprehensive production system. The National CEFC provides demonstrations, skill development, and integrated solutions for smart technology-enabled manufacturing. As part of this initiative, a Cyber-Physical Lab for Smart Manufacturing Research has been set up at IIT Delhi’s Hauz Khas campus, along with a fully equipped Cyber-Physical Factory at the Sonipat campus. These facilities aim to promote innovation and research in smart manufacturing, thereby driving the adoption of digital threads that seamlessly connect data and processes. Consequently, the adoption of smart manufacturing is increasing, supported by government initiatives. Therefore, the rising government initiatives for the adoption of smart manufacturing fuel the digital thread market demand.

Increase in Complexity of Supply Chain

As global supply chains become more interconnected and multifaceted, manufacturers need enhanced visibility and traceability to manage dependencies and risks effectively. According to Goedis, 70% of the global supply chain is extremely complex due to a lack of traceability caused by the large volume of goods to be supplied. Unilever, for instance, sources raw materials from 53,000 farmers, highlighting the extensive volume of goods transported. This complexity in supply chain operations is expected to drive the demand for digital thread. Digital threads offer a unified framework for integrating data from various sources, enabling real-time monitoring of supply chain processes. This connectivity helps identify bottlenecks, streamline operations, and improve responsiveness to disruptions. Therefore, an increase in the complexities of the supply chain fuels the digital thread market growth.

Digital Thread Market Segment Insights

Digital Thread Market Outlook – by Technology Insights

The digital thread market segmentation, based on technology, includes product lifestyle management, computer aided manufacturing, application lifestyle management, enterprise resource planning, material requirement planning, and other technology. The product lifestyle management segment is expected to experience significant growth at the highest CAGR in the global market during the forecast period. This growth is attributed to the increasing need for integrated solutions that streamline design, development, and manufacturing processes. PLM enables seamless collaboration across groups, enhances data visibility, and optimizes product quality throughout the lifecycle.

Digital Thread Market Outlook – by Deployment Insights

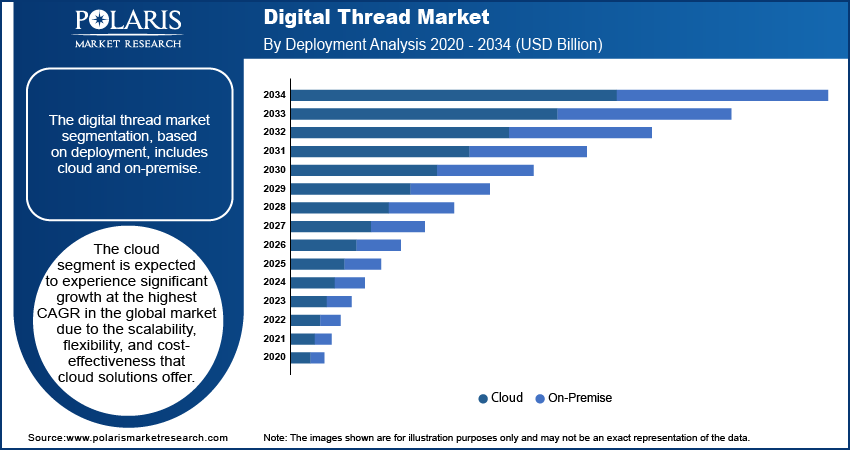

The digital thread market segmentation, based on deployment, includes cloud and on-premise. The cloud segment is expected to dominate the market during the forecast period due to the scalability, flexibility, and cost-effectiveness that cloud solutions offer. Cloud deployment enables real-time data access and collaboration across distributed teams, enabling seamless integration of information throughout the product lifecycle.

Digital Thread Market Regional Insights

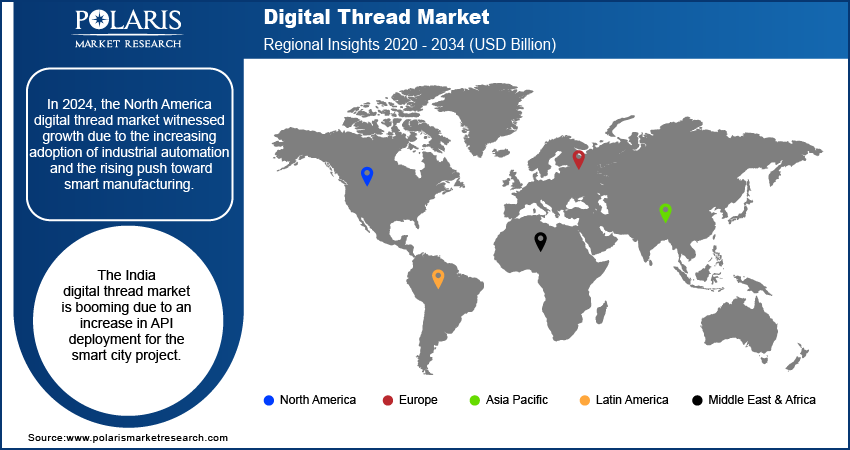

By region, the study provides the digital thread market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share of the market. The region's advanced manufacturing sector is rapidly adopting automated solutions to enhance productivity. Due to the increase in companies integrating smart technologies, such as IoT, AI, and machine learning, the demand for seamless data connectivity across the product lifecycle is increasing. Digital threads enable this integration, allowing real-time monitoring and optimization of manufacturing processes. Moreover, North America benefits from a robust technological infrastructure and a skilled workforce, fostering innovation and the implementation of digital thread solutions. Industry leaders across sectors, including aerospace, automotive, and consumer goods, are applying digital threads to streamline operations and respond effectively to market demands. Consequently, the demand for digital threads is increasing due to rising industrial automation, propelling the digital thread market growth in the region.

The digital thread market in Asia Pacific is growing significantly due to a rise in strategies adopted by market players such as mergers and acquisitions, collaborations, and investments. Companies are forming strategic partnerships to use digital thread technologies, enhancing their competitive advantage and expanding their networks. These collaborations enable organizations to integrate advanced solutions, streamline operations, and improve data visibility. Furthermore, increased investments in smart manufacturing initiatives boost the adoption of digital threads across various industries, including automotive, electronics, and consumer goods, positively impacting the digital thread market expansion in Asia Pacific.

The digital thread market in India is witnessing significant growth, driven by the increase in the deployment of Application Programming Interface (APIs) for smart city projects. With the government focusing on urban development and technological integration, the adoption of APIs has become crucial for creating interconnected urban infrastructures. The Ministry of Housing and Urban Affairs, India, has deployed 242 APIs across 100 cities, and this number is expected to rise in the coming years. These APIs enable seamless data exchange between various systems, improving connectivity and urban management. Digital threads play a necessary role in this ecosystem by enabling real-time data integration and analytics, improving decision-making for city planners and administrators.

Digital Thread Market – Key Players and Competitive Insights

The digital thread market is always evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced software technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their technology offerings and expand into new markets.

New companies are impacting the industry by introducing new medical devices and meeting the needs of specific sectors. This competitive environment is amplified by continuous progress in technology offerings and new modules, greater emphasis on sustainability, and the rising requirement for tailor-made single-use technology in diverse industries. A few major players in the digital thread market are Dassault Systems; IBM; General Electric; Oracle; SAP; Rockwell Automation; Siemens; Aveva Group Ltd.; Autodesk, Inc.; DXC Technology Company; Accenture.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. It is the largest technology firm in the world and the second most valuable worldwide brand. The company mainly sells software, which generates 29% of its revenue. Infrastructure services hold 37%, the hardware segment has 8%, and IT services hold 23%. The organization has an extensive network of 80,000 business associates who help it handle 5,200 clients, including 95% of the Fortune 500. Although IBM is a B2B firm, it has a significant external influence. For instance, the company is responsible for 50% of all wireless and 90% of all credit card transactions. Recently, Siemens and IBM announced a renewed collaboration focused on integrating product lifecycle management (PLM), model-based systems engineering (MBSE), service lifecycle management (SLM), and asset lifecycle management (ALM) capabilities. The partnership was reaffirmed to enhance initiatives related to IoT, data analytics, AI, and Industry 4.0. Through this collaboration, advanced solutions were developed to streamline processes and improve operational efficiency across various industries. This strategic alliance aimed to leverage each company's strengths, driving innovation and providing enhanced value to their customers.

Siemens AG specializes in electrification, automation, and digitalization and operates in a diverse range of industries, such as energy, healthcare, financing, building technology, transportation, and manufacturing. The company provides a comprehensive range of products and services, including power generation systems, turbines, medical imaging equipment, trains, and automation software, as well as building technologies and smart grid solutions. Recently, Siemens announced its participation in IMTS 2024, showcasing a revolutionary approach to manufacturing high-performance EV components through an end-to-end digital thread. The focus will be on the optimized design of the eRod’s transmission housing, enhancing structural integrity while reducing weight, noise, and vibration. Utilizing the Siemens Xcelerator software portfolio, the integration of data into a single CAD model streamlines the design process for additive manufacturing. Siemens aims to redefine digital manufacturing standards, highlighting innovative solutions that outperform conventional components.

Key Companies in Digital Thread Market

- Dassault Systems

- IBM

- General Electric

- Oracle

- SAP

- Rockwell Automation

- Siemens

- Aveva Group Ltd.

- Autodesk, Inc.

- DXC Technology Company

- Accenture

Digital Thread Industry Developments

February 2024: EIZO, a player in visual technology, implemented Aras Innovator to create a digital thread between development and manufacturing. This integration streamlined EIZO's processes, enabling efficient tracking of products and digital assets throughout the entire product lifecycle. The transition to Aras was completed seamlessly, with no disruption to operations. EIZO’s approach, supported by Aras Innovator, provided consolidated workflows and enhanced data connectivity, laying the groundwork for future advancements in mass customization and product development.

December 2023: Autodesk announced the launch of Autodesk Informed Design, a cloud-based solution designed based on the bidirectional digital thread to connect design and manufacturing workflows in the architecture, engineering, construction, and operations (AECO) industry. This innovative tool streamlined the building design and construction process, allowing architects to utilize customizable, pre-defined building products. By embedding industrialized construction principles, Informed Design aimed to enhance sustainability and efficiency. The solution was made available globally as a free add-in for Autodesk's Revit and Inventor, transforming how design and manufacturing teams collaborate on projects.

Digital Thread Market Segmentation

By Technology Outlook (USD Billion, 2020–2034)

- Product Lifestyle Management

- Computer Aided Manufacturing

- Application Lifestyle Management

- Enterprise Resource Planning

- Material Requirement Planning

- Other Technology

By Module Outlook (USD Billion, 2020–2034)

- Data Collection

- Data Analysis and Visualization

- Data Management and Integration

- Others

By Deployment Outlook (USD Billion, 2020–2034)

- Cloud

- On-Premise

By End User Outlook (USD Billion, 2020–2034)

- Automotive

- Aerospace

- Energy and Power

- Pharmaceutical

- Oil and Gas

- Consumer Goods

- Others

By Regional Outlook (USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Thread Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.04 billion |

|

Market Size Value in 2025 |

USD 14.67 billion |

|

Revenue Forecast by 2034 |

USD 87.01 billion |

|

CAGR |

21.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Deployment |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The digital thread market size was valued at USD 12.04 billion in 2024 and is projected to grow to USD 87.01 billion by 2034.

The global market is projected to register a CAGR of 21.9% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are Dassault Systems; IBM; General Electric; Oracle; SAP; Rockwell Automation; Siemens; Aveva Group Ltd.; Autodesk, Inc.; DXC Technology Company; Accenture.

The product lifestyle management segment is anticipated to experience substantial growth at a significant CAGR in the global market during the forecast period due to the increasing demand for integrated solutions that streamline design, development, and manufacturing processes.

The cloud segment accounted for a larger revenue share of the market in 2024 due to the scalability, flexibility, and cost-effectiveness that cloud solutions offer.