Digital Therapeutics Market Size, Share, Trends, Industry Analysis Report: By Revenue Model (Subscription and Value-Based), Application, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM1908

- Base Year: 2023

- Historical Data: 2019-2022

Digital Therapeutics Market Overview

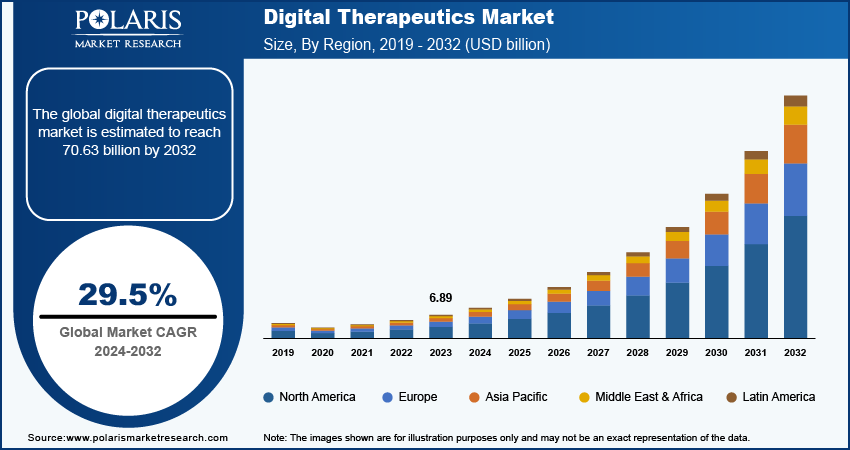

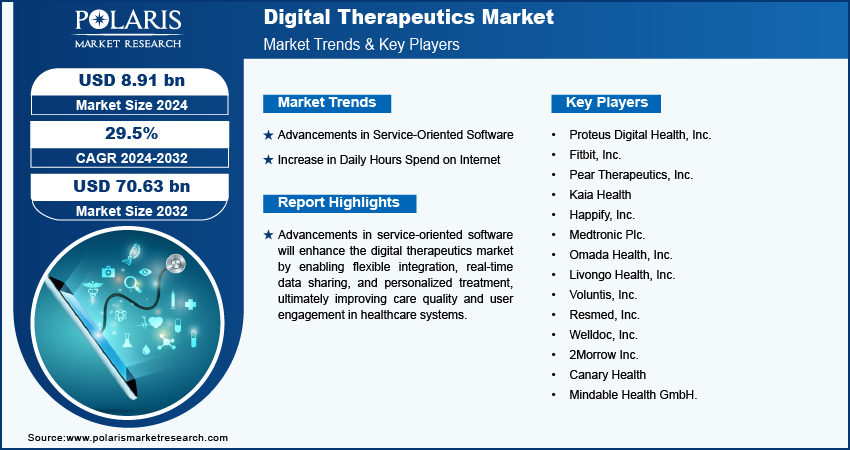

The digital therapeutics market size was valued at USD 6.89 billion in 2023. The market is projected to grow from USD 8.91 billion in 2024 to USD 70.63 billion by 2032, exhibiting a CAGR of 29.5% from 2024 to 2032.

Digital therapeutics is patient-facing software that is developed with evidence-based approaches to prevent, manage, or treat medical disorders. The market for digital therapeutics is primarily driven by an increased adaptation to the digital world and greater access to the Internet among the general population. For instance, according to Global Change Data Lab, 91% of the population share of the United States had internet access in 2022, which has risen from 64% in 2007, representing a 27% growth in 15 years. Similarly, the population share of internet users in Europe and Central Asia reached 89% in 2022, which has risen from 69% of internet users in 2005. The global average of internet users was 64% in 2021. This growth in the number of internet users is due to many factors, such as the evolution of smartphone technologies and advancements in computing software and hardware. As a result, the expansion of stable internet connection and an increase in internet users are expected to fuel the digital therapeutics market over the forecast period.

For Specific Research Requirements: Request a Free Sample Report

The increasing use of digital technology drives the digital therapeutics market. A greater share of the population now has access to smartphones and other hardware, which has accelerated the adoption of digital tools across various sectors, including healthcare. For instance, according to the World Bank, there were 8.5 billion mobile subscriptions worldwide in 2022, up from 338 million in 1981. Similarly, the number of landline internet users increased from 38 million in 2001 to 1.5 billion in 2022. Thus, the factors mentioned above are expected to propel the digital therapeutics market from 2024 to 2032.

Digital Therapeutics Market Trends

Advancements in Service-Oriented Software

Advancements in service-oriented software are anticipated to boost the digital therapeutics market. Service-oriented architecture (SOA) allows for the development of flexible, scalable, and integrative digital health solutions that can adapt to the needs of various users and healthcare systems. By utilizing cloud-based technologies, APIs, and modular design, service-oriented software enables seamless integration of digital therapeutics into existing healthcare infrastructures, including electronic health records (EHRs) and other health management systems. This integration facilitates real-time data sharing and personalized treatment, thus enhancing the effectiveness of digital therapeutics. Additionally, SOA supports the development of interoperable solutions that can be easily updated or expanded, allowing for continuous improvement and adaptation of therapeutic interventions based on emerging evidence and user feedback. These advancements ensure that digital therapeutics can provide high-quality, evidence-based care while maintaining user engagement through adaptive, responsive features. As a result, the efficiency and adaptability offered by service-oriented software are critical in accelerating the adoption and success of digital therapeutics in the healthcare market.

Increase in Daily Hours Spend on Internet

The digital therapeutics market is experiencing significant growth due to the increasing amount of time people spend on digital media each day. The rise in the use of new software is leading to greater acceptance of healthcare tools and software among the general population, thereby impacting the digital therapeutic market positively. For instance, according to BOND internet trends statistics, the average time spent on mobile devices by residents of the United States has increased to 4 hours per day from 0.30 hours per day in 2008. In contrast, the average time spent on laptops by residents of the United States has decreased to 2 hours per day from 2.20 hours per day in 2008. Globally, the average time spent on the Internet was 6 hours and 30 minutes in 2022, which has increased to 7 hours in 2023, a 30-minute increase. The country with the highest time spent on the Internet is South Africa, with an average total time of 9 hours and 42 minutes. Of this time, 5 hours are spent on mobile devices and 4 hours on computers. Therefore, the rapid adoption of Internet tools is expected to increase as people spend more time on the Internet in major countries, which is likely to have a positive impact on the digital therapeutics market growth during the study period.

Digital Therapeutics Market Segment Insights

Digital Therapeutics Market Breakdown by Revenue Model Insights

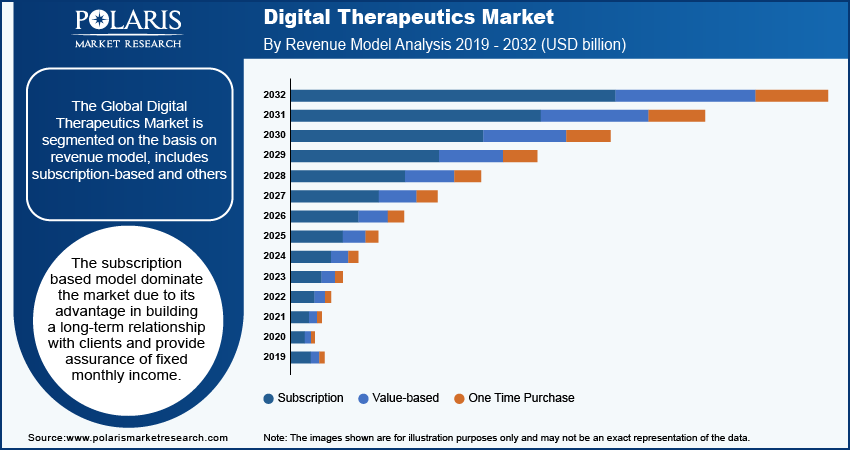

The digital therapeutics market segmentation, based on revenue model, includes subscription, value-based, and one time purchase. The subscription segment is projected to register a high CAGR in the global market, as the subscription-based model can be beneficial in many ways. For example, the model can be used to build a long-term relationship with clients and provide assurance of fixed monthly income. In digital therapeutics, the subscription-based model is primarily implemented for chronic disease management and mental health treatment.

Digital Therapeutics Market Breakdown by End Users Insights

The digital therapeutics market segmentation, based on end users, includes patients, providers, payers, employers, and others. The employer segment is expected to dominate the digital therapeutics market from 2024 to 2032. Therapies have become a type of valuable benefit offered by major employers to improve employee well-being and prevent conditions like depression or hypertension. For example, in a survey of large companies in the United States, 72% have added virtual behavioral healthcare networks or telehealth options for their workers, about 69% have added employee assistance programs, and approximately 30% have incorporated mental health plans into existing benefits. As a result, the employer segment is considered to be the major consumer in the digital therapeutics market.

Digital Therapeutics Market Breakdown by Regional Insights

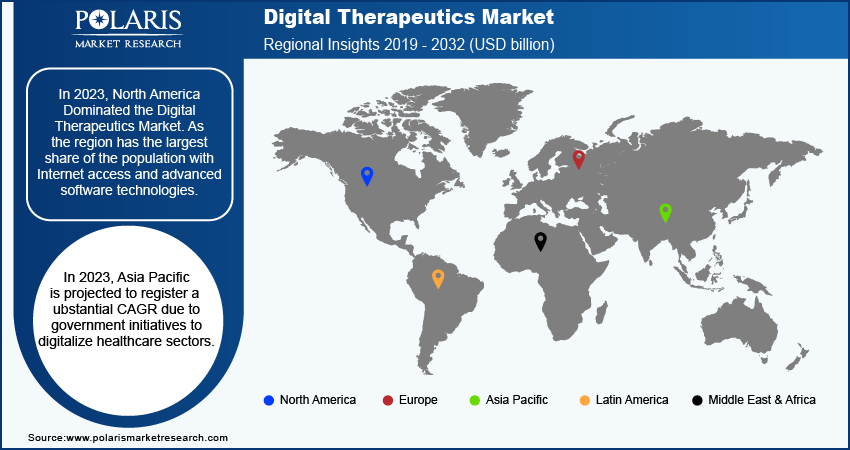

By region, the study provides digital therapeutics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, North America accounted for the largest revenue share in the digital therapeutics market, as the region has the largest share of the population with Internet access and advanced software technologies. For instance, according to the World Bank, North America has the largest share of the population with Internet access; 92% of North Americans had Internet access in 2021, a significant increase from 44% in 2000. Within North America, 93% of Canadians and 92% of residents of the United States had an internet connection in 2021. Additionally, increased awareness about chronic disorders and changing lifestyle dynamics to maintain mental well-being is also anticipated to fuel the digital therapeutics market growth in the study time. For instance, according to the Centers for Disease Control (CDC), in a sample of every five adult individuals, one individual lives with mental illness. Furthermore, one in every 25 adult individuals lives with serious mental illness, such as bipolar disorder or major depression. Therefore, the increasing number of internet users and stable internet connectivity are expected to boost the digital therapeutic market growth during the study period.

Asia Pacific is projected to register a substantial CAGR from 2024 to 2032 due to government initiatives to digitalize healthcare sectors. Increasing government funding in the sub-regions and the lack of medical professionals and institutions are anticipated to boost the digital therapeutics market in the forecast years. For instance, according to statistics, China’s spending on healthcare has significantly increased in the last decade from 4 trillion to 7.6 trillion RMB in 2021. The majority of funds were directed toward new healthcare technologies, healthcare digitalization, and institutions. China spent 6.5% of the total GDP in the healthcare sector in 2023. Therefore, the increasing government funding in the healthcare sector and upcoming opportunities in the digital ecosystem are expected to fuel the digital therapeutic market growth in the forecast years.

The digital therapeutics market in India is poised for significant growth due to government initiatives aimed at digital transformation in the healthcare sector. For instance, according to the Indian Government National Portal, four years after the launch of the Ayushman Bharat Digital Mission (ABDM), the government started the digitalization of healthcare services in the majority of states. In April 2024, the Ayushman Bharat Digital Mission was rooted in six union territories in one year, including Daman & Diu, Ladakh, Lakshadweep, and another union territory. This increasing effort by the government for the expansion of internet connectivity and digital transformation in a major sector of the country is anticipated to boost the digital therapeutics market growth in the forecast years.

Digital Therapeutics Market – Key Players & Competitive Insights

The digital therapeutics market is constantly changing, with various companies working to innovate and stand out. Big global firms lead the market by utilizing extensive research and development capabilities, advanced software technologies, and large capital to stay ahead. These companies engage in strategic initiatives like mergers, acquisitions, partnerships, and collaborations to improve their product offerings and reach new markets.

New companies are impacting the market by introducing innovative digital therapeutics and meeting the needs of specific market sectors. This competitive environment is amplified by continuous progress in product offerings, greater emphasis on sustainability, and the rising requirement for tailor-made therapeutic products in diverse industries. Major players in the digital therapeutics market include Proteus Digital Health, Inc.; Fitbit, Inc.; Pear Therapeutics, Inc.; Kaia Health; Happify, Inc.; Medtronic Plc.; Omada Health, Inc.; Livongo Health, Inc.; Voluntis Inc.; Resmed, Inc.; Welldoc, Inc.; 2Morrow Inc.; Canary Health; and Mindable Health GmbH.

Medtronic Plc is a medical device company with significant capital investment and advanced research facilities. The company offers a wide range of medical devices for advanced surgeries, cardiac rhythm, cardiovascular diseases, diabetes, digestive and gastrointestinal diseases, and other common and rare conditions. Medtronic is present globally, including major countries such as the United States, Canada, Australia, India, Japan, Germany and other Asian and European regions. In November 2021, Medtronic joined hands with Nvidia Technologies, the world’s largest provider of graphics and software, to integrate artificial intelligence into endoscopy to improve patient care outcomes. This collaboration involved integeating Nvidia’s healthcare and edge AI technologies into Medtronic’s GI Genus intelligent endoscopy module, manufactured by Irish manufacturer Cosmo Pharmaceuticals. Medtronic also developed its own digital platform, GI, which can accumulate endoscopy modules and can be used for future developments.

Omada Health, Inc. partnered with Physera Physical Therapy Group, PC provides evidence-based digital therapeutics. The company offers therapeutic programs for prediabetes, diabetes, hypertension, and musculoskeletal (MSK) related disorders. Established in 2011, Omada Health has gained global recognition and currently operates in major regions, including North America, Europe, and Asia Pacific. In 2023, Omada Health became the first digital healthcare provider to receive the prestigious URAC telehealth accreditation for musculoskeletal (MSK) care-related services. In 2021, Omada Health’s Type 2 Diabetes and Type 2 Diabetes + Hypertension programs earned the National Committee for Quality Assurance’s (NCQA) Population Health Program (PHP) Accreditation.

List of Key Companies in Digital Therapeutics Market

- Proteus Digital Health, Inc.

- Fitbit, Inc.

- Pear Therapeutics, Inc.

- Kaia Health

- Happify, Inc.

- Medtronic Plc.

- Omada Health, Inc.

- Livongo Health, Inc.

- Voluntis, Inc.

- Resmed, Inc.

- Welldoc, Inc.

- 2Morrow Inc.

- Canary Health

- Mindable Health GmbH.

Digital Therapeutics Market Developments

May 2024: Otsuka Pharmaceutical launched a new subsidiary to commercialize its digital therapeutic, Rejoyn, and expand into digital therapeutics and connected health products. In April 2024, Rejoyn earned FDA clearance as the first prescription digital therapeutic for major depressive disorder. Developed in partnership with Click Therapeutics, the app facilitate behavioral change through interactive lessons and exercises, marking a significant milestone in digital mental health treatment. The subsidiary will focus on advancing Rejoyn and other innovative digital health solutions.

June 2024: The Digital Therapeutics Alliance (DTA) revealed its plans to launch an accreditation program for digital therapeutics through a new partnership with DirectTrust. Announced at the DTA conference, the program aims to bolster industry confidence by establishing rigorous criteria for evaluating product efficacy, privacy, and interoperability. DirectTrust will apply its existing standards and expand its accreditation suite to include clinical evaluations. Accredited products will receive digital badges valid for two years.

November 2023: Virtual contract research organization Curavit Clinical Research has introduced a Health Economics and Outcomes Research (HEOR) service for clinical trials. This new service aims to provide medicine manufacturers with insights into product value and market potential. Curavit will particularly focus on the economic value of digital therapeutics, assessing their impact at both individual and population levels. HEOR will be integrated into trials and analyzed at study close-out to evaluate financial impact.

Digital Therapeutics Market Segmentation

By Revenue Model Outlook

- Subscription

- Value-based

- One Time Purchase

By Application Outlook

- Diabetes

- Obesity

- CVD

- CNS Disease

- Respiratory Diseases

- Smoking Cessation

- Lifestyle Management

- Preventive Applications

- Others

By End Users Outlook

- Patients

- Providers

- Payers

- Employers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 6.89 billion |

|

Market Size Value in 2024 |

USD 8.91 billion |

|

Revenue Forecast in 2032 |

USD 70.63 billion |

|

CAGR |

29.5% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The digital therapeutics market size was valued at USD 6.89 billion in 2023 and is projected to grow to USD 70.63 billion by 2032

The market is projected to grow at a CAGR of 29.5% from 2024 to 2032.

North America had the largest share of the market.

The key players in the market are Proteus Digital Health, Inc.; Fitbit, Inc.; Pear Therapeutics, Inc.; Kaia Health; Happify, Inc.; Medtronic Plc.; Omada Health, Inc.; Livongo Health, Inc.; Voluntis Inc.; Resmed, Inc.; Welldoc, Inc.; 2Morrow Inc.; Canary Health; and Mindable Health GmbH.

The Subscription-based segment is anticipated to experience substantial growth with a significant CAGR in the market. This growth is attributed to its advantage in building a long-term relationship with clients and provide assurance of fixed monthly income.

The Employer segment accounted for the largest revenue share of the market in 2023 as Therepies have become a type of valuable benefit offered by major employers to improve employee well-being and prevent conditions .