Digital Textile Printing Market Size, Share, Trends, Industry Analysis Report

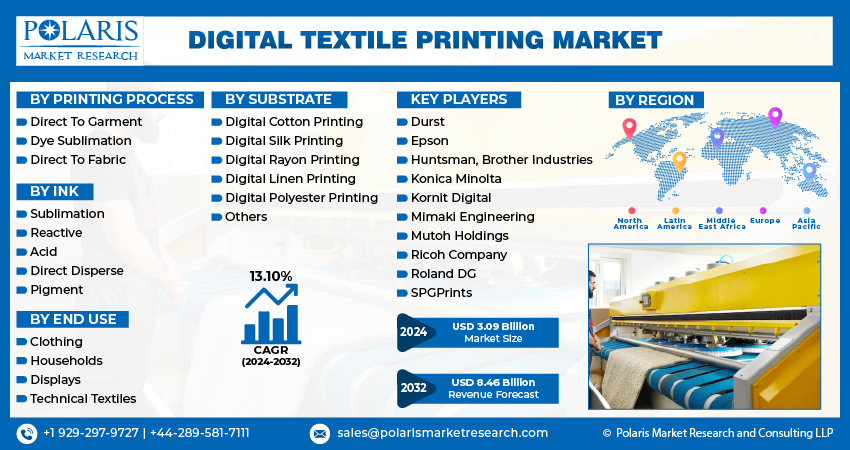

: By Printing Process, By Ink, By Substrate, By End Use (Clothing, Households, Displays, and Technical Textiles), and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM3710

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

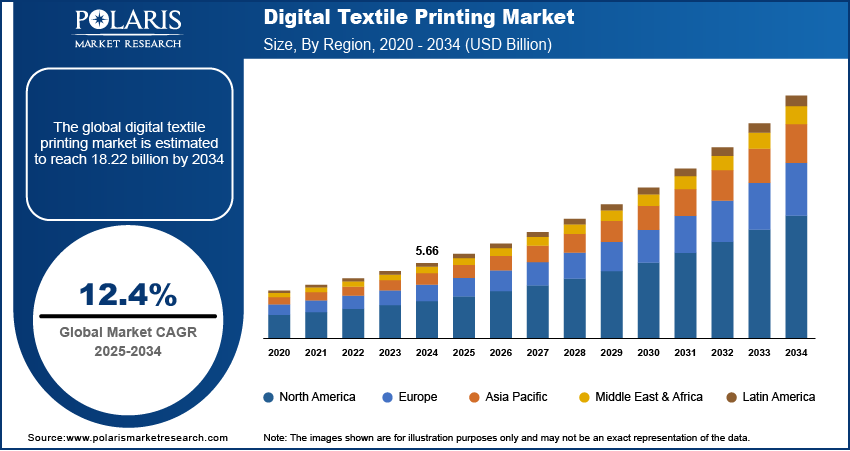

The global digital textile printing market size was valued at USD 5.66 billion in 2024. It is expected to grow from USD 6.35 billion in 2025 to USD 18.22 billion by 2034, at a CAGR of 12.4% during 2025–2034.

Digital textile printing is a process of printing colorful designs directly onto fabrics using digital inkjet technology. This innovative method is increasingly being adopted across the textile industry due to its ability to offer customization, faster turnaround times, and reduced environmental impact compared to traditional printing techniques. The digital textile printing market growth is attributed to the increasing preference for digital printing technology over conventional methods. Unlike screen printing, digital textile printing allows for on-demand production, minimal setup costs, and efficient short-run printing, which is particularly beneficial for fashion, home décor, and customized textile applications. In September 2024, ColorJet India launched the IconicFabJet Pro, a high-speed digital textile printer with a 3.2m width and 13,000 sqm/day capacity. Featuring 8-color options and Kyocera/Konica Minolta print heads, it targets large-format home textiles such as curtains and bed covers with precision. The precision, flexibility, and sustainability of digital processes align well with the dynamic demands of modern textile producers and consumers.

The demand for digital textile printing is rising due to the rapid expansion of e-commerce and direct-to-consumer (DTC) channels. An October 2024 IOSR report noted that global retail e-commerce sales reached 19% of total retail sales in 2023. Projections indicate a 39% growth in the coming years, with sales expected to exceed USD 8 trillion by 2027. Brands are increasingly leveraging digital textile printing to cater to diverse and fast-changing consumer preferences as more consumers shift to online platforms for home furnishing purchases, apparel and footwear. The ability to quickly adapt to trends and produce unique, personalized designs in low volumes is critical for success in the digital marketplace. Digital textile printing enables brands and manufacturers to offer a wider variety of designs with shorter lead times, aligning perfectly with the expectations of digitally native consumers. This synergy between digital printing capabilities and the evolving retail landscape is fostering greater adoption and market expansion.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Advancements in Printing Equipment, Ink Formulations, and Digital Textile Design Software

Advancements in printing equipment, ink formulations, and digital textile design software are accelerating the adoption of digital textile printing. These technological innovations have greatly enhanced the quality, speed, and versatility of digital textile production. For instance, in December 2022, ColorJet Group launched the Metro NXT at India ITME 2022, an industrial digital textile printer featuring 32 Kyocera print heads and 8-color options. The printer delivers high-speed output of up to 9,000 sqm/day while maintaining print quality. These modern printers support higher resolution and faster print speeds, while improved ink chemistries offer greater durability, color vibrancy, and fabric compatibility. Additionally, the evolution of design software has empowered designers with greater creative flexibility, enabling the development of complex and intricate patterns with ease. Together, these advancements reduce production costs, minimize waste, and streamline workflows, making digital printing a more efficient and attractive solution for manufacturers.

Rising Demand for Customized and Personalized Textile Products

The rising demand for customized and personalized textile products is boosting the adoption of digital textile printing. Consumers are increasingly seeking unique and tailored designs that reflect their tastes and preferences. In April 2024, Stratasys launched a Direct-to-Garment (D2G) solution for its J850 TechStyle printer, enabling full-color 3D printing on assembled garments (denim, cotton, polyester, and linen). The technology supports the customization of designs, sizes, and styles for fashion brands. Digital textile printing meets this demand by enabling on-demand production, allowing manufacturers and brands to offer a wide range of custom options without the constraints of minimum order quantities for commercial printing. This level of flexibility improves customer satisfaction and also allows businesses to respond swiftly to trends and seasonal changes. Digital textile printing stands out as a critical enabler of agile and consumer-centric textile manufacturing as the market continues to shift toward personalization.

Segment Insights

Market Assessment by Ink

The global market segmentation, based on ink, includes sublimation, reactive, acid, direct disperse, and pigment. The sublimation segment held the largest digital textile printing market share in 2024. Sublimation inks are widely preferred due to their high compatibility with polyester-based fabrics, which dominate sportswear, fashion, and home décor applications. These inks provide excellent color vibrancy, wash resistance, and durability, making them ideal for high-performance textiles. Additionally, the sublimation process allows for continuous tone printing and is environmentally favorable, as it eliminates water usage and minimizes waste. The widespread adoption of polyester textiles across various end-use industries has especially contributed to the dominance of sublimation inks in the market.

Market Evaluation by Printing Process

The global market segmentation, based on printing process, includes direct to garment (D2G), dye sublimation, and direct to fabric (D2F). The dye sublimation segment is expected to witness the fastest growth during the forecast period, driven by the increasing demand for high-quality, lightweight, and wrinkle-resistant polyester fabrics in fashion, sports apparel, and signage applications. Dye sublimation offers superior color reproduction, edge definition, and durability, which are essential in producing vibrant and lasting prints. Moreover, it supports quick production cycles and customization, which aligns well with the growing demand for fast fashion and personalized products. The process’s minimal environmental impact and adaptability to both small-scale and industrial production further support its accelerating adoption.

Regional Analysis

By region, the report provides the digital textile printing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024, driven by the region's strong technological infrastructure and advanced manufacturing capabilities. The presence of established players, coupled with high investments in research and development, has fostered the early adoption of digital textile technologies. Additionally, consumer demand for high-quality, customized apparel and home textiles is quite high in this region, encouraging manufacturers to adopt flexible and efficient digital printing methods. North America also benefits from a mature e-commerce ecosystem, which further enhances the demand for short-run, on-demand printing solutions that digital textile printing readily provides.

The Asia Pacific digital textile printing market is projected to witness the fastest growth during the forecast period due to the region's expanding textile manufacturing base, rising disposable incomes, and growing consumer demand for fashion and customized products. Additionally, the rising penetration of e-commerce and rapid urbanization are further fueling demand for versatile, cost-effective printing solutions. A 2022-23 Ministry of Textiles report indicated that the USA, EU-27, and the UK collectively accounted for nearly 50% of India's textiles and apparel exports, highlighting the importance of maintaining competitive production capabilities to serve these lucrative markets. Countries such as China, India, and Bangladesh are increasingly shifting toward digitized production methods to improve efficiency, reduce environmental impact, and meet global quality standards.

Key Players and Competitive Analysis Report

The digital textile printing market expansion is driven by technological advancements in print head technologies, ink formulations, and automation systems. Market analysis reveals that market leaders such as HP, Epson, and Kornit Digital maintain competitive advantages through vertically integrated business models and robust partner & customer ecosystem development spanning fashion, home décor, and technical textile segments. These established players face mounting pressure from emerging Asian manufacturers offering price-competitive alternatives specifically targeting small and medium-sized businesses. Sustainability strategy and transformation have emerged as a critical differentiator, with water-based and eco-solvent solutions gaining substantial traction amid heightened environmental regulations. Future development strategies increasingly focus on single-pass printing capabilities that address throughput limitations while maintaining quality standards. The competitive landscape is being reshaped through strategic alliances and capability-driven acquisitions, particularly in software integration and color management technologies. Latent demand and opportunities exist in previously underserved regions where the digitalization of traditional textile manufacturing is accelerating. Competitive intelligence indicates that successful market participants are prioritizing end-to-end workflow solutions rather than standalone equipment offerings. A few key major players are Durst, Epson, Huntsman, Brother Industries, Konica Minolta, Kornit Digital, Mimaki Engineering, Mutoh Holdings, Ricoh Company, Roland DG, SPGPrints, Aeoon Technologies, MS Printing Solutions, EFI Reggiani, and Zimmer Austria.

Huntsman International LLC, through its Huntsman Textile Effects division, specializes in the development of innovative and sustainable solutions for the textile industry, with a strong focus on digital textile printing. The company offers a comprehensive suite of high-performance digital ink ranges designed for all major textile substrates, such as cellulosic, polyester, polyamide, wool, silk, and their blends. Huntsman’s digital inks, such as the NOVACRON ADVANCE reactive inks for cellulosic and ERIOFAST VISTA for polyester/cotton blends, are engineered to deliver outstanding color depth, brilliancy, and a broad color gamut, meeting the demands of the latest industrial digital printing machines. These inks are recognized for their superior wash-fastness, stability, tunability, and reproducibility, ensuring consistent, high-quality results across fashion, apparel, home textiles, and technical applications. Huntsman’s digital printing solutions are also notable for their environmental benefits, enabling urea-free processes that significantly reduce energy consumption, water usage, machine maintenance, and carbon dioxide emissions. The company’s innovation-driven approach helps mills and brands meet strict industry standards and growing consumer demand for eco-friendly textile products, positioning Huntsman as a key partner in the transition to more sustainable and efficient digital textile printing worldwide.

Konica Minolta specializes in digital textile printing, renowned for its integrated approach to developing industrial inkjet printheads, inks, and textile printers for commercial and industrial markets. The company’s flagship Nassenger Series, including models such as the Nassenger SP-1e, Nassenger 10e, Nassenger 8, and Nassenger PRO 120, caters to a wide spectrum of textile printing needs, from high-speed, large-volume production to sample and small-lot printing. Konica Minolta’s digital textile printers are distinguished by their in-house development of three core technologies: the printer, the inkjet head, and the ink, enabling seamless integration, superior performance, and simplified customer support. These systems deliver vibrant color reproduction, high image quality, and exceptional productivity, with multi-nozzle printheads and proprietary disperse and reactive dye inks that meet stringent standards such as the Global Organic Textile Standard (GOTS). Major features include intuitive touch-panel interfaces, multiple printing modes for precision or speed, advanced maintenance functions, and robust reliability, minimizing downtime and ensuring consistent output. Konica Minolta’s digital textile printing solutions are trusted worldwide for their ability to meet the fast-evolving demands of the fashion and home textiles industries, providing customers with high-quality, eco-friendly, and efficient printing technologies.

List of Key Companies in Digital Textile Printing Market

- Aeoon Technologies GmbH

- Brother Industries, Ltd.

- Electronics for Imaging, Inc.

- Huntsman International LLC

- Konica Minolta, Inc.

- Kornit Digital Ltd.

- Mimaki Engineering Co., Ltd.

- MS Printing Solutions S.r.l.

- MUTOH HOLDINGS CO., LTD.

- Ricoh Company, Ltd.

- Roland DG Corporation

- Seiko Epson Corporation

- SPGPrints B.V.

- The Durst Organization Inc.

- Zimmer Maschinenbau GmbH

Digital Textile Printing Industry Development

September 2024: ColorJet India launched the IconicFabJet Pro, a high-capacity digital textile printer with a 3.2m width and daily output of 13,000 sqm. Featuring 32–48 print heads, it combines speed, precision, and color accuracy for industrial-scale fabric printing.

June 2023: Roland DG, a prominent global manufacturer of wide-format inkjet printers and printer/cutters, introduced the Roland DG Connect subscription service. This cloud-based connected service aims to enhance value and facilitate business growth for users.

June 2023: Mimaki Engineering, known for its expertise in industrial inkjet printers, cutting plotters, and 3D printers, is set to unveil the innovative "Neo-Chromato Process." This technology focuses on the sustainable reuse of colored polyester textiles by removing the dye-sublimation ink.

Digital Textile Printing Market Segmentation

By Printing Process Outlook (Revenue, USD Billion, 2020–2034)

- Direct to Garment (D2G)

- Dye Sublimation

- Direct to Fabric (D2F)

By Ink Outlook (Revenue, USD Billion, 2020–2034)

- Sublimation

- Reactive

- Acid

- Direct Disperse

- Pigment

By Substrate Outlook (Revenue, USD Billion, 2020–2034)

- Digital Cotton Printing

- Digital Silk Printing

- Digital Rayon Printing

- Digital Linen Printing

- Digital Polyester Printing

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Clothing

- Households

- Displays

- Technical Textiles

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Textile Printing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.66 billion |

|

Market Size Value in 2025 |

USD 6.35 billion |

|

Revenue Forecast by 2034 |

USD 18.22 billion |

|

CAGR |

12.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.66 billion in 2024 and is projected to grow to USD 18.22 billion by 2034.

The global market is projected to register a CAGR of 12.4% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Durst, Epson, Huntsman, Brother Industries, Konica Minolta, Kornit Digital, Mimaki Engineering, Mutoh Holdings, Ricoh Company, Roland DG, SPGPrints, Aeoon Technologies, MS Printing Solutions, EFI Reggiani, and Zimmer Austria.

The sublimation ink segment held the largest market share in 2024.

The dye sublimation segment is expected to witness the fastest growth during the forecast period.