Digital Signature Market Size, Share, Trends, Industry Analysis Report: By Component (Solutions and Services), Level, Deployment, End User, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM1673

- Base Year: 2024

- Historical Data: 2020-2023

Digital Signature Market Overview

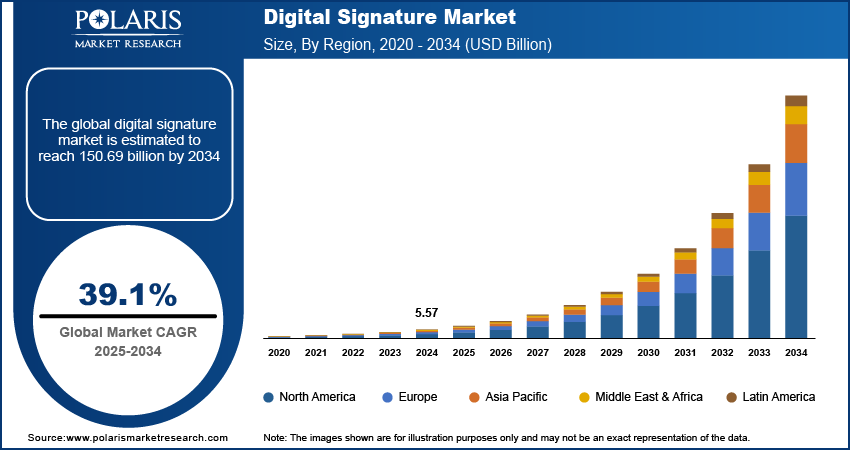

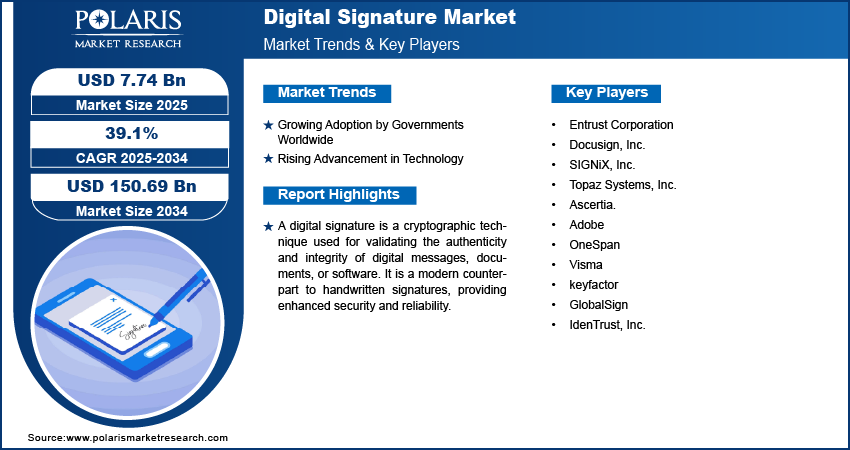

Digital signature market size was valued at USD 5.57 billion in 2024. The market is projected to grow from USD 7.74 billion in 2025 to USD 150.69 billion by 2034, exhibiting a CAGR of 39.1 % during the forecast period.

A digital signature is a cryptographic technique used to validate the authenticity and integrity of digital messages, documents, or software. It is a modern counterpart to handwritten signatures, providing enhanced security and reliability. Digital signatures are based on public key infrastructure (PKI), which utilizes asymmetric cryptography to generate a pair of keys. Their primary functions include ensuring data integrity, providing non-repudiation, and authenticating the identity of the signer.

The increasing adoption of smartphones is propelling the global digital signature market growth. State of Mobile Internet Connectivity Report 2023 shows that over half (54%) of the global population owns a smartphone. Smartphones, equipped with internet connectivity, biometric authentication, and advanced security features, provide an ideal platform for executing and verifying digital signatures. The convenience and efficiency of digital signatures have become necessary as more individuals and businesses rely on smartphones for everyday tasks such as signing contracts, authorizing payments, or submitting official documents. Furthermore, the integration of digital signature capabilities into widely used mobile applications and platforms simplifies processes, enhances trust, and meets the growing demand for secure, paperless workflows. This shift towards mobile-driven digitalization drives digital signature adoption across sectors such as banking, e-commerce, healthcare, and government services.

To Understand More About this Research: Request a Free Sample Report

The digital signature market demand is driven by the growing usage of the internet. Internet usage leads to increased online interactions, such as remote work, e-commerce, and digital payments, creating a need for secure and reliable methods to authenticate identities and validate transactions. Digital signatures provide a legally recognized and tamper-proof way to sign documents and agreements over the Internet, ensuring trust and efficiency in online processes. Moreover, as Internet usage expands to include cloud-based services, online contract management, and cross-border transactions, digital signatures become essential for streamlining workflows and maintaining compliance with global regulations. This surge in internet reliance drives the adoption of digital signature solutions across industries and countries.

Digital Signature Market Dynamics

Growing Adoption by Governments Worldwide

The growing adoption by governments worldwide is projected to propel the global digital signature market. The government of India is promoting the use of digital signatures in official interactions by recognizing digital signatures ('signatures) under the Information Technology Act, 2000 ('IT Act'). Governments worldwide are increasingly implementing digital signature solutions for e-governance initiatives, including online tax filing, identity verification, business registrations, and public procurement. These applications enhance operational efficiency, reduce paperwork, and ensure the authenticity and integrity of sensitive transactions.

Rising Advancement in Technology

The rising advancements in technology are estimated to fuel the global digital signature market. Innovations such as cloud-based digital signature platforms, integration with widely used software, and the incorporation of advanced security features such as blockchain technology and biometric authentication make digital signatures more reliable and appealing. Additionally, user-friendly interfaces, mobile compatibility, and the ability to integrate with emerging technologies such as AI and machine learning simplify adoption for businesses and individuals. These advancements address diverse industry needs, from streamlining workflows to improving regulatory compliance, thereby expanding the application of digital signatures across sectors such as finance, healthcare, legal, and e-commerce.

Digital Signature Market Segment Analysis

Digital Signature Market Assessment by Component

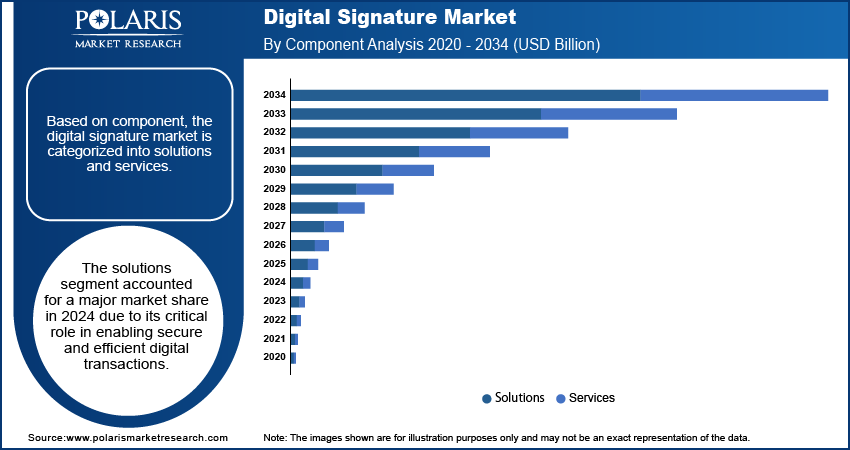

Based on component, the digital signature market is categorized into solutions and services. The solutions segment accounted for a major market share in 2024 due to its critical role in enabling secure and efficient digital transactions. Businesses across industries prioritized software-based offerings that integrate seamlessly with existing workflows, such as document management systems, email platforms, and cloud services. The increasing reliance on electronic document signing and authentication, coupled with the growing demand for compliance with global regulatory standards, contributed to the dominance of the segment. Organizations value the ease of deployment and scalability that solutions provide, allowing them to meet the rising volume of digital interactions without compromising security or operational efficiency.

Digital Signature Market Evaluation by End User

In terms of end user, the digital signature market is divided into individuals, businesses, and organizations. The business segment dominated the market share in 2024 due to the increasing shift toward digital transformation and paperless workflows. Companies across industries embraced secure signing solutions to streamline processes such as contract management, vendor agreements, and customer onboarding. The need to enhance operational efficiency, reduce costs associated with physical documentation, and meet compliance requirements fueled adoption in the segment. Businesses prioritized solutions that integrate with their existing infrastructure and scale with their operations, making these tools a core component of their digital strategies.

Digital Signature Market Regional Insights

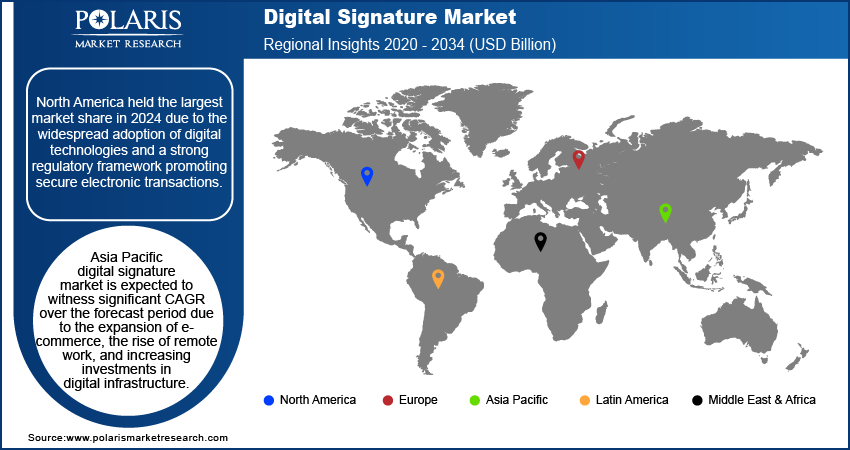

By region, the study provides the digital signature market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to the widespread adoption of digital technologies and a strong regulatory framework promoting secure electronic transactions. Businesses and organizations across the US and Canada prioritized solutions that enhanced operational efficiency and reduced dependency on paper-based processes. They ensured compliance with laws such as the ESIGN Act and UETA in the US and PIPEDA in Canada. The region's well-established IT infrastructure and high internet penetration further facilitated the adoption of secure signing tools such as digital signatures, thereby contributing to digital signature market expansion.

Asia Pacific digital signature market is expected to witness significant CAGR over the forecast period due to the expansion of e-commerce, the rise of remote work, and increasing investments in digital infrastructure. Governments in countries such as India, China, and Japan are implementing initiatives to digitize public services and promote secure online transactions, creating significant opportunities for digital signatures. China, with its rapid technological advancements and large-scale adoption of digital solutions across sectors, is leading the region's growth. The presence of a vast consumer base, increasing awareness of secure transaction tools, and supportive government policies position Asia Pacific as a key region in the market.

Digital Signature Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the digital signature market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The digital signature industry is fragmented, with the presence of numerous global and regional market players. Major players in the market include Entrust Corporation; Docusign, Inc.; SIGNiX, Inc.; Topaz Systems, Inc.; Ascertia.; Adobe; OneSpan; Visma; keyfactor; GlobalSign; and IdenTrust, Inc.

Entrust Corporation is a prominent player in identity-centric security solutions, specializing in digital signatures, secure payments, and data protection. Founded in 1994 and headquartered in Shakopee, Minnesota, Entrust has evolved significantly over the years, particularly after its rebranding in 2020 to emphasize its focus on secure identities and transactions. The company serves clients in more than 150 countries, making it a key provider of digital security solutions globally. In November 2023, Entrust launched e-signature software with ID verification for high-value transactions.

Docusign, Inc. is a major US-based software company headquartered in San Francisco, California, specializing in electronic signature solutions and digital transaction management. Founded in 2003 by Court Lorenzini, Tom Gonser, and Eric Ranft, DocuSign has transformed how organizations manage electronic agreements, providing a platform that enables users to sign documents securely from virtually any device. The company operates in 180 countries, processing billions of electronic signatures that comply with global regulations such as the US ESIGN Act and the European Union's eIDAS regulation.

Key Companies in Digital Signature Market

- Entrust Corporation

- Docusign, Inc.

- SIGNiX, Inc.

- Topaz Systems, Inc.

- Ascertia.

- Adobe

- OneSpan

- Visma

- keyfactor

- GlobalSign

- IdenTrust, Inc.

Digital Signature Market Developments

October 2023: APS Bank plc, a retail bank in Malta, introduced an innovative digital signatures solution. This solution allows customers to sign selected documents remotely without the need to visit a branch.

December 2023: TruStage, a company that offers insurance, investments, and technology solutions, collaborated with SIGNiX, a major provider of digital signature solutions, to modernize and enhance the signing experience for customers and members across the country through advanced digital signature capabilities.

February 2021: Entrust, an identity security company, announced that it has partnered with Sysmosoft, a provider of secure solutions for digital processes, to provide a comprehensive solution for digital signature management.

Digital Signature Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020 - 2034)

- Solutions

- Services

By Level Outlook (Revenue, USD Billion, 2020 - 2034)

- Advanced Electronic Signatures (AES)

- Qualified Electronic Signatures (QES)

By Deployment Outlook (Revenue, USD Billion, 2020 - 2034)

- Cloud

- On-premise

By End User Outlook (Revenue, USD Billion, 2020 - 2034)

- Individuals

- Businesses

- Organizations

By Industry Vertical Outlook (Revenue, USD Billion, 2020 – 2034)

- BFSI

- Health Care & Life Science

- IT & Telecom

- Government

- Retail

- Others

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Signature Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.57 billion |

|

Market Size Value in 2025 |

USD 7.74 billion |

|

Revenue Forecast in 2034 |

USD 150.69 billion |

|

CAGR |

39.1 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global digital signature market size was valued at USD 5.57 billion in 2024 and is projected to grow to USD 150.69 billion by 2034.

The global market is projected to grow at a CAGR of 39.1% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Entrust Corporation; Docusign, Inc.; SIGNiX, Inc.; Topaz Systems, Inc.; Ascertia.; Adobe; OneSpan; Visma; keyfactor; GlobalSign; and IdenTrust, Inc.

The business segment held the largest market share in the global market in 2024.

The solution segment dominated the digital signature market in 2024.