Digital Signal Processor Market Share, Size, Trends, Industry Analysis Report – By Core (Single-Core DSPs and Multi-Core DSPs); Configuration; Type; Category; IC Design; Application; End Use Industry; and Region; Segment Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 116

- Format: PDF

- Report ID: PM5164

- Base Year: 2024

- Historical Data: 2020-2023

DSP Market Outlook

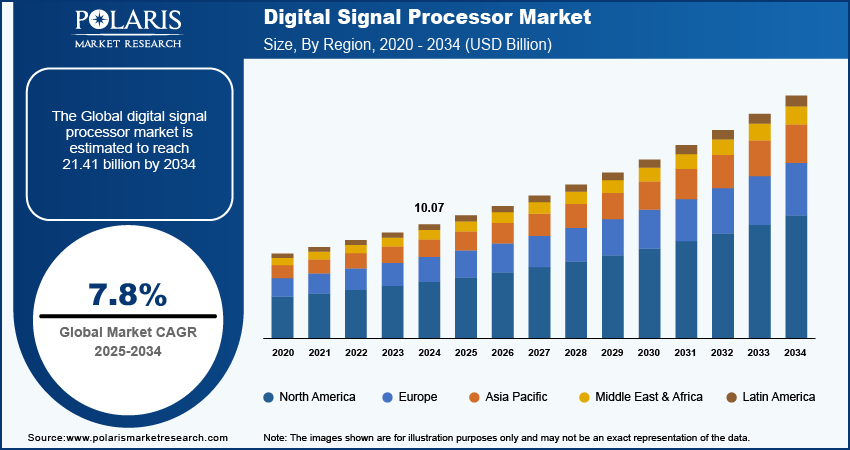

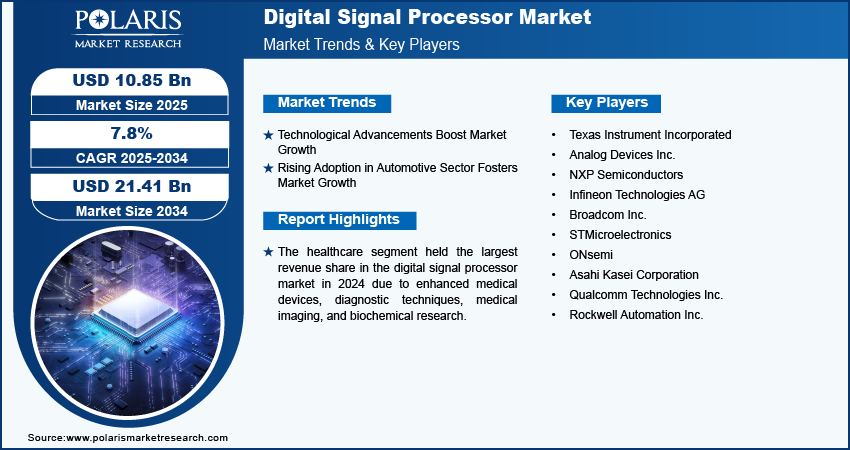

The digital signal processor (DSP) market size was valued at USD 10.07 billion in 2024. The market is anticipated to grow from USD 10.85 billion in 2025 to USD 21.41 billion by 2034, exhibiting a CAGR of 7.8% during 2025–2034.

DSP Market Overview

A digital signal processor is a specialized microprocessor designed to efficiently process digital signals, which are representations of real-world data like sound, images, or sensor inputs. The market for DSPs is being driven by increasing demand for consumer electronics, advancements in wireless communication technologies, and widespread application across various industries. The efficiency improvements and processing capabilities of DSPs have made digital signal processor essential components in smartphones, laptops, and embedded systems. Furthermore, in the defense sector, the processors are used in various technologies such as radar, system intelligence, and communication systems. For instance, in January 2024, US military researchers announced the development of sensor processing for the radar digital phased arrays in different bandwidths to develop software algorithms that replace large matrix operations in digital signal processing.

To Understand More About this Research: Request a Free Sample Report

Advanced driver assistance systems (ADAS), car connectivity, infotainment systems, and other automated solutions require the integration of high-performance digital signal processors. There are rising safety standards for vehicles, interconnected ecosystems, and advanced digital solutions in automobiles. Therefore, the growing automotive industry, one of the important end users of digital signal processors, fuels the digital signal processor market growth. For instance, in June 2024, Texas Instruments released the AM263P4. It is a four-core MCU, a powerful processor for automotive and industrial applications to meet functional safety standards.

Rising technological advancements are making DSPs more cost-effective, efficient, and accessible to a wider range of applications across multiple verticals like healthcare, aerospace & defense, and others. A notable shift toward smart grids and renewable solutions involves the use of complex digital signal processing to manage and monitor energy systems. These are increasingly used due to technologies such as artificial intelligence (AI) and machine learning (ML) for natural language processing (NPL) and critical sensor data analytics, which further boosts the digital signal processor market expansion. For instance, in March 2024, MaxLinear, Inc. announced the development of its fourth-generation 200G/lane PAM4 SERDES and DSP family named Rushmore.

Growth Drivers

Technological Advancements Boost Market Growth

Enhanced processing power and efficiency, improved algorithms and software systems, and integration of DSPs with multicore systems in wider applications propel the demand for digital signal processors. Real-time larger dataset processing, parallel processing, and the capability of handling the complex modulations and demodulation tasks required in advanced communication standards are further fueling the market growth.

In March 2024, MediaTek introduced the first Dimensity Auto Cockpit SoCs in partnership with NVIDIA, featuring Arm V9-A CPU cores, a multi-audio DSP, an HDR image signal processor (ISP), support for multiple cameras and AI processing capabilities.

Rising Adoption in Automotive Sector Fosters Market Growth

The rising installation of infotainment systems, connected ecosystems, and autonomous driving facilities and growing customization trends for enhanced user experience in the automotive sector boost the requirement for digital signal processors. The automotive industry is increasingly focusing on telematics systems to track and monitor vehicle performance, where real-time data processing based on DSPs plays a crucial role, which further drives the demand for digital signal processors.

In March 2024, Cadence developed two new vision DSPs plus a radar accelerator with a focus on automotive sensor-fusion applications.

Restraining Factors

High Development Cost and Complex Integration Restrain Market Growth

The substantial investments required to develop advanced DSPs, complexity involved in integrating it with concerned applications, and compatibility issues with existing systems hinder the digital signal processor market growth. Furthermore, the evolving landscape of analog-to-digital convertors (ADCs) restrains the market.

Digital Signal Processor Market Segment Insights

By Core Analysis

In 2024, Multi-Core DSPs Segment Held the Largest Market Share

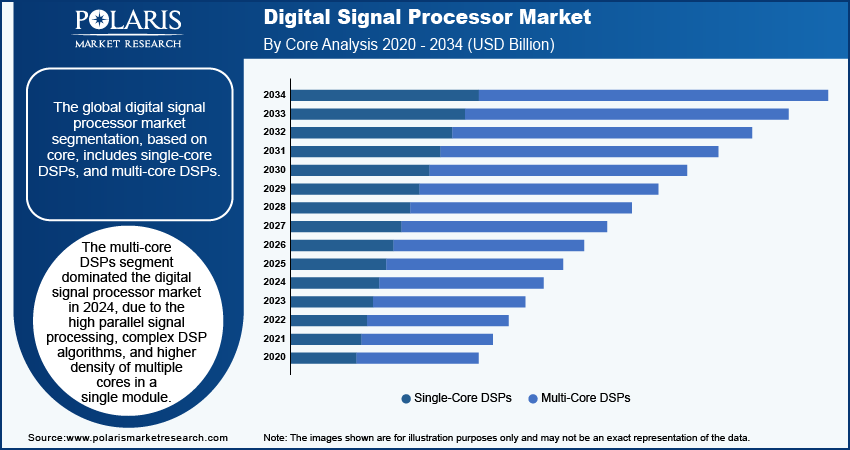

The multi-core DSPs segment dominated the digital signal processor market in 2024, due to the high parallel signal processing, complex DSP algorithms, and higher density of multiple cores in a single module. These cores can function independently and in collaborations as well. Depending on the programming models, utilization of multi-cores is done to execute numerous tasks and larger data into smaller and manageable sections.

In January 2024, Andes Technology & Spacetouch Technology announced the AndesCore D25F, a multi-core processor to provide additional flexibility through customized special-purpose instructions.

By Application Analysis

Audio Signal Processing Segment Witnessed Significant Growth

The digital signal processor market for the audio signal processing segment is expected to witness rapid growth during the forecast period. This is primarily due to the rising demand for consumer electronics, increasing adoption of voice recognition and AI assistants, and the growing popularity of wireless audio devices. Ongoing advancements in audio technologies, voice cancellation algorithms, and sound localization techniques are further propelling the segment growth.

In March 2024, Nevion announced the extension of its software, Virtuoso, with a new audio interface and additional up/down/cross conversion (UDC) functionality.

By End-Use Industry Analysis

Healthcare Segment Accounted for Significant Revenue Share In 2024

The healthcare segment held the largest revenue share in the digital signal processor market in 2024 due to enhanced medical devices, diagnostic techniques, medical imaging, and biochemical research. MRIs and CT scanners are increasingly using advanced DSPs to process raw data from these imaging machines. It offers noise filtration, detailed image reconstruction, and signal processing for diagnostics, which notably boosts the growth of the segment.

In April 2024, VeriSilicon introduced the health monitoring platform “VeriHealthi” based on the ZSP Digital Signal Processor & BLE Ips.

DSP Market Regional Insights

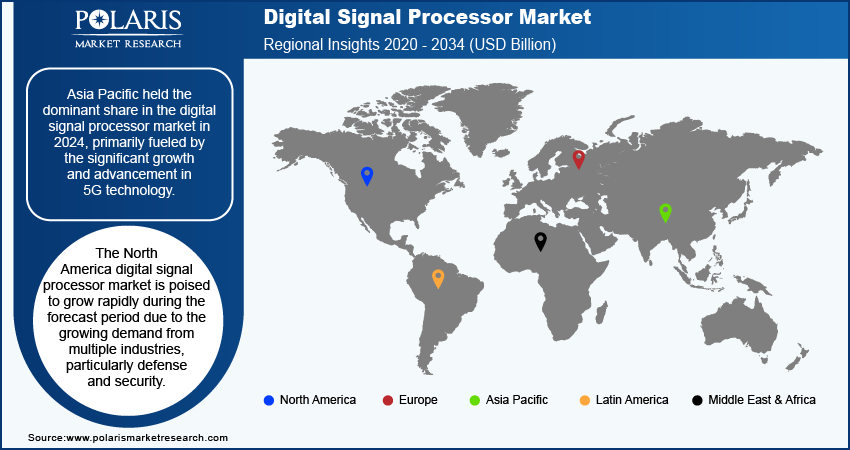

Asia Pacific Accounted for the Largest Market Share in 2024

Asia Pacific held the dominant share in the digital signal processor market in 2024, primarily fueled by the significant growth and advancement in 5G technology. The presence of emerging markets that are leading in the telecom sector and demanding advanced network infrastructure further boosts the Asia Pacific digital signal processor market growth.

In April 2024, Apple announced its plan to assemble and manufacture components of its camera modules in India, including infrared filters, image sensors, digital signal processing, and soft board or PCB.

The North America digital signal processor market is poised to grow rapidly during the forecast period due to the growing demand from multiple industries, particularly defense and security. The processor is used in radar and sonar systems for surveillance, target detection, navigation, and communication, driving the demand for advanced DSPs.

Key Market Players and Competitive Insights

New Product Offering Drives Market Dynamics

The digital signal processor market is fragmented. Growing investments in new product development and technical advancement positively impact the market dynamics. The ongoing demand for digital signal processors due to their distinct functionality and wider application pushes companies to come up with new offerings. In July 2023, Asahi Kasei Microdevices introduced a new multi-core DSP, the AK7709VQ, which is conceived for the in-vehicle sound design.

Major Players Operating in Global Digital Signal Processor Market:

- Texas Instrument Incorporated

- Analog Devices Inc.

- NXP Semiconductors

- Infineon Technologies AG

- Broadcom Inc.

- STMicroelectronics

- ONsemi

- Asahi Kasei Corporation

- Qualcomm Technologies Inc.

- Rockwell Automation Inc.

Recent Developments in Industry

- In January 2024, HARMAN International introduced several products such as BSS Audio’s Soundweb OMNI Open Architecture Digital Signal Processors by making a significant investment to modernize its portfolio.

- In September 2024, Mercury Systems has expanded its Direct RF digital signal processing products using Altera Agilex FPGAs to detect and process emissions across the electromagnetic spectrum.

Report Coverage

The digital signal processor market report emphasizes key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction across the world. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, core, application, end-user industry, and their futuristic growth opportunities.

Digital Signal Processor Market Segmentation

By Core Outlook (Revenue - USD Billion, 2020 - 2034)

- Single-Core DSPs

- Multi-Core DSPs

By Configuration Outlook (Revenue - USD Billion, 2020 - 2034)

- Low-end DSP

- Mid-range DSP

- High-end DSP

By Type Outlook (Revenue - USD Billion, 2020 - 2034)

- General-purpose DSPs

- Application-specific DSPs

- Programmable DSP

By Category Outlook (Revenue - USD Billion, 2020 - 2034)

- Fixed Point

- Floating Point

By IC Design Outlook (Revenue - USD Billion, 2020 - 2034)

- Standard

- Embedded

By Application Outlook (Revenue - USD Billion, 2020 - 2034)

- Audio processing

- Video Processing

- Image Processing

- Speech Processing & Recognition

- Radar Systems

- Communication Systems

- Others

By End-use Industry Outlook (Revenue - USD Billion, 2020 - 2034)

- Consumer Electronics

- Automotive

- Industrial Automation

- Communication & Networking

- Healthcare

- Aerospace & Defense

- Others

By Regional Outlook (Revenue - USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Signal Processor Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2025 |

USD 10.85 billion |

|

Revenue Forecast in 2034 |

USD 21.41 billion |

|

CAGR |

7.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global digital signal processor market size was valued at USD 10.07 billion in 2024 and is projected to grow to USD 21.41 billion by 2034.

The global market is projected to grow at a CAGR of 7.8% during the forecast period.

Asia Pacific had the largest share in the global market in 2024 due to significant growth and advancement in 5G technology.

The key players in the market Texas Instrument Incorporated, Analog Devices Inc., NXP Semiconductors, Infineon Technologies AG, Broadcom Inc., STMicroelectronics, ONsemi, Asahi Kasei Corporation, Qualcomm Technologies Inc., Rockwell Automation Inc.

The multi-core DSPs segment category dominated the market in 2024 due to the high parallel signal processing.

The healthcare category is expected to grow significantly over the forecast period due to enhanced medical devices, diagnostic techniques, medical imaging, and biochemical research.