Digital Shipyard Market Share, Size, Trends, Industry Analysis Report

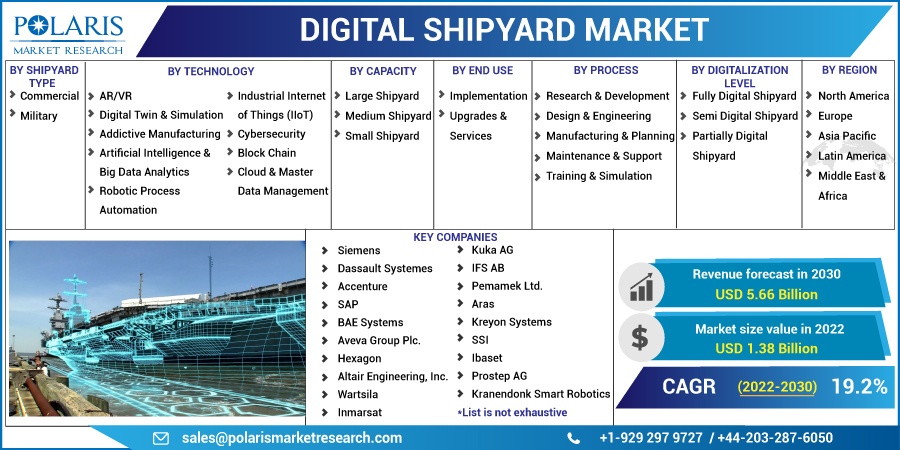

By Shipyard Type (Commercial, Military); By Technology; By Capacity; By End Use; By Process; By Digitalization Level; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 117

- Format: PDF

- Report ID: PM2759

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

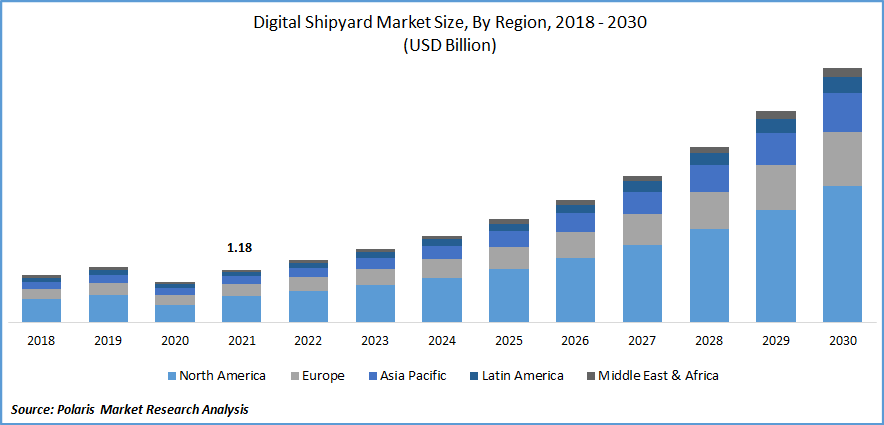

The global digital shipyard market was valued at USD 1.18 billion in 2021 and is expected to grow at a CAGR of 19.2% during the forecast period.

The marine industry's global market is driven by intelligent technology and procedures. Shipyards worldwide are undergoing a digital transition due to modernization and procurement initiatives in both commercial and military shipyards. Shipyards are also adopting digital reinvention strategies using cutting-edge technologies to promote digitalization, a greener environment, waste reduction, and faster growth to help shipbuilding companies overcome barriers posed by unprecedented change, disruption, expensive program costs, and expanding international opportunities.

Know more about this report: Request for sample pages

The key factors influencing the expansion of the global market during the forecast period include strict regulations and standards from regulatory organizations regarding harmful emissions, reductions in overall operational expenses, etc.

A shipyard, often known as a dockyard, is where ships are constructed and maintained. The automation process during the past few years has been a current priority for shipbuilding enterprises. The automation procedure reduces the amount of time required for shipbuilding. In the meantime, many businesses are trying to integrate digitization in shipbuilding.

The term "digital shipyard" refers to the use of Industry 4.0 capabilities for designing, constructing, and repairing our ships and submarines and monitoring and maintaining the related infrastructure. It uses sensors and monitoring systems set up by Cyber-Physical Systems (CPS), which can transmit massive amounts of data to a loT device, improving the ability to anticipate and schedule repairs in the future.

The COVID-19 pandemic has impacted the shipping sector. In response to the COVID-19 outbreak, the government implemented a lockdown, which required shipyards to cease all shipbuilding operations. With the travel restrictions put in place by the governments to contain the COVID-19 spread, shipyards' digitalization initiatives are placed on hold for lack of labor.

Furthermore, due to the global financial crisis and the COVID-19 scenario, countries are also experiencing delays in procuring cutting-edge technology and components necessary for manufacturing navy ships like submarines and destroyers. Consequently, the orders for new ships have been canceled due to a decline in the need for sea transportation and trade. The most lucrative area of shipbuilding in European nations is cruise ships.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The size of the global market is anticipated to increase greatly in the next years due to increased global trade and tourism activities conducted by ships. In this direction, in April 2022, Wartsila unveiled its augmented simulation services for scalable training experiences, using the most recent augmented reality (AR) and virtual reality (VR) technologies. The system builds authentic, immersive settings that simulate the tasks carried out aboard any ship, and the lifelike scenarios boost learning retention, job performance, and teamwork. As a result of a surge in process automation, the global market for digital shipyards is rapidly growing.

The growing usage of digital twin technology and the increase in environmental concerns about reducing the carbon footprint created by the shipping industry both contribute to the expansion of the global market. These factors also increase the demand for cargo ships due to increased maritime trade.

However, it is projected that the high cost of digitization, the complexity of the systems, and the high training expenses will obstruct the growth of the digital shipbuilding sector. Additionally, the industrial internet of things (loT) and increased robot technology use in the shipbuilding sector is anticipated to offer a wealth of chances to the major players in the global market.

Report Segmentation

The market is primarily segmented based on shipyard type, technology, capacity, end-use, process, digitalization level, and region.

|

By Shipyard Type |

By Technology |

By Capacity |

By End Use |

By Process |

By Digitalization Level |

By Region |

|

|

|

|

|

|

|

Know more about this report: Request for sample pages

Commercial segment is expected to witness the fastest growth in 2021

The global market's commercial segment is estimated to witness fastest growth throughout the projection period. Commercial ship owners and operators have benefited from lower lifetime costs, the pursuit of capital enhancements, streamlined construction, increased operational availability, and decreased overhead costs associated with operating ships due to the digitization of commercial shipyards.

The military category is anticipated to grow significantly over the forecast period. The military digital shipyard market is driven by increased demand for shipyard upgrades. In terms of ship size and complexity, the acquisition process, design and construction, personnel, client engagement, and business strategies, these shipyards vary. The countries' increased military spending and naval fleets due to the escalating tensions may help the market flourish.

Artificial Intelligence & Big Data Analytics accounted for the largest market share in 2021

In 2021, artificial intelligence and big data analytics dominated the market. One of the digital transformation technologies in the shipbuilding sector that are most enabling is artificial intelligence (AI). In shipbuilding applications like resource management, predictive maintenance, design, and manufacturing, combining IoT, blockchain, big data, robotic process automation, and AI and ML provides several advantages.

In the global market, it is anticipated that the robotic process automation segment will rise more quickly over the forecast period. In the shipbuilding sector, robotic process automation is frequently employed for manufacturing, design, engineering, and planning. Diverse system integrators and shipbuilders are implementing the technology to cut operating costs and time while boosting the effectiveness and dependability of goods and services.

The AR/VR category is expected to grow significantly over the forecast period. Digital shipbuilding can become more productive and efficient with the help of AR/VR. A high-quality immersion experience is provided by AR/VR headsets, which also have the advantage of being largely hands-free. With a screen directed towards the concerned worker, AR/VR headsets can access important information, such as the level of a worker's alertness, measured by a fatigue index.

Large Shipyards sector is expected to hold the significant revenue share

Large shipyards optimize their business models with different solutions by outsourcing or sharing particular jobs or entire business processes, which expands the market for numerous large shipyards, system integrators, software & solution providers, etc. The medium shipyards segment has dominated the market which is expected to expand in volume more quickly. Ferries, passenger ships, cruise ships, and naval ships are all included in the medium sector. The marine industry is anticipated to adopt smart solutions at an increasing rate, fueling the segment's expansion.

Implementation accounted for the largest market share in 2021

In 2021, the market was led by the implementation category. The procurement strategies of the navies encourage the adoption of innovative technology in shipyards. The main factors anticipated to propel the market in the upcoming years include the adoption of disruptive technologies and the modernization and procurement strategies of various shipyards. The Upgrades & Services category is expected to increase rapidly over the forecast period. Segment expansion is being driven by the need to modernize existing technology. Demand for digital shipyards is predicted to rise rapidly as more people become aware of the importance of intelligent technology in the marine sector.

Manufacturing & planning sector is expected to hold the significant revenue share

In 2021, the market was largely dominated by the research & development category. The market for digital shipyards is likely to have increased R&D activity, which will fuel the segment's expansion. To meet the need for high-quality systems, many players are now making investments in improvements to manufacturing techniques. Increasing R&D expenditures to create lightweight components are also advancing technology.

In the global market, the manufacturing & planning segment is anticipated to experience faster growth. The execution of the idea of a digital shipyard involves the crucial phases of design and engineering. The procedure uses various cognitive technologies, including blockchain, cloud computing, robotic process automation, and additive manufacturing.

The market was led by the maintenance and support category, and this trend is expected to continue over the projection period. The category is anticipated to rise due to the increasing usage of cutting-edge technologies in shipyard maintenance and the high cost of building new shipyards.

The fully digital shipyard sector is expected to hold the significant revenue share

The market's dominance in 2021 was attributable to the growing purchase of advanced vessels by the navy of nations like China, India, and the US. The dominance might be attributed to shipbuilding companies' increasing realization of the necessity of modernizing their production methods. The fully digital shipyard is anticipated to experience the quickest growth rate throughout the projection period due to the rising usage of IIOT, augmented reality, digital twins, and other advanced technologies for constructing marine vessels.

Due to increased shipyard modernization plans, the industry will likely overgrow during the projection period. The growing use of the industrial internet of things (IIoT) and robot technologies in shipbuilding are expected to drive the expansion of this industry.

The market is anticipated to increase significantly throughout the projected period. The segment's expansion is anticipated to be fueled by the development of linked and autonomous ships that support digital technology. The global digital shipbuilding market is expanding quickly due to a spike in process automation.

The demand in North America is expected to witness significant growth

In 2021, North America accounted for a key share of the global market and was presumed to witness significant growth in the coming years. The United States is a significant player in automation and digitalization. It is backed financially and has the necessary infrastructure. This is expected to strengthen the market in North America shortly. Countries in the North American region are investing in, developing, and modernizing a range of capabilities related to the digital transformation of shipyards, which presents a sizable opportunity for system integrators and maritime technology suppliers. One of the elements promoting the market's expansion is an increase in demand for the purchase of contemporary, complex, and technologically advanced marine vessels from military shipyards.

The growth of the digital shipyard will also be aided by the presence of significant solution suppliers in the area. The area has been at the forefront of implementing cutting-edge digital shipyard upgrades and fusing cutting-edge technology for various levels of digitalization. The United States is a significant nation in terms of automation and digitalization. It has the required economic backing and infrastructure. In the near future, this will probably help North America's market.

The Asia Pacific is expected to be the fastest-growing global market over the forecast period. Through years of significant economic growth, maritime trade has increased in the region. The desire for process improvements, quick delivery, lower costs, stringent regulations, etc., is likely to expand throughout the forecast period, fueling the expansion of the global market in developing nations like India and China. These nations' governments are likewise modernizing and fostering the growth of shipyards.

Competitive Insight

Some of the major players operating in the global market include Siemens, Dassault Systemes, Accenture, BAE Systems, Aveva Group., Hexagon, Altair Engineering, Wartsila, Inmarsat, Kuka AG, IFS AB, Pemamek, Aras, Kreyon Systems, Prostep, Kranendonk Smart Robotics, Damen Shipyards, Thyssenkrupp Marine Systems, Navantia, Bureau Veritas, Cadmatic and Inrotech.

Recent Developments

- In June 2022, BAE Systems worked with Dematec Automation to create a digital platform capability demonstration that connects robots, hardware subsystems, welding machines, devices, and sensors across common shipyard operations. Workers, equipment, robotic plants, and possibly the Hunter class frigates are all linked via Industry 4.0 technologies.

- In February 2020, the ProProS research project was introduced by the Lurssen shipyard, RWTH Aachen University's Machine Tool Laboratory (WZL), and PROSTEP.

Digital Shipyard Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1.38 billion |

|

Revenue forecast in 2030 |

USD 5.66 billion |

|

CAGR |

19.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Shipyard Type, By Technology, By Capacity, By End Use, By Process, By Digitalization Level, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Siemens, Dassault Systemes, Accenture, SAP, BAE Systems, Aveva Group Plc., Hexagon, Altair Engineering, Inc., Wartsila, Inmarsat, Kuka AG, IFS AB, Pemamek Ltd., Aras, Kreyon Systems, SSI, Ibaset, Prostep AG, Kranendonk Smart Robotics, Damen Shipyards Group, Thyssenkrupp Marine Systems, Navantia, Bureau Veritas, Cadmatic and Inrotech. |